Options trading can be a complex and intimidating topic for many investors, but with the right tools, it can also be a lucrative way to manage risk and generate profits. One of the most powerful tools in an options trader's arsenal is an Excel calculator, which can help calculate option profits with ease and accuracy.

In this article, we will explore the world of options trading and demonstrate how to use an Excel calculator to calculate option profits. We will also provide examples and practical tips to help you get started with options trading.

What are Options?

Options are financial derivatives that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a certain date (expiration date). Options can be used to speculate on price movements, manage risk, or generate income.

There are two main types of options: calls and puts. Call options give the holder the right to buy an underlying asset, while put options give the holder the right to sell an underlying asset.

How Do Options Work?

Options work by allowing the holder to profit from price movements in the underlying asset without actually owning the asset. When an option is exercised, the holder buys or sells the underlying asset at the strike price, which can result in a profit or loss.

For example, let's say you buy a call option to buy 100 shares of Apple stock at $100 per share. If the price of Apple stock rises to $120 per share, you can exercise your option and buy the stock at $100 per share, then sell it at the market price of $120 per share, making a profit of $20 per share.

Calculating Option Profits with Excel

Calculating option profits can be complex, but with an Excel calculator, it's easy. Here are the basic steps:

- Determine the type of option (call or put) and the underlying asset.

- Enter the strike price, expiration date, and current price of the underlying asset.

- Enter the number of contracts (options) you want to buy or sell.

- Use Excel formulas to calculate the profit or loss.

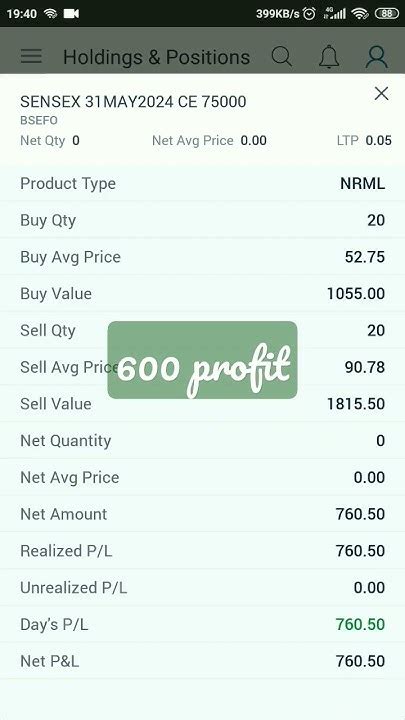

Here is an example of an Excel calculator for options trading:

| A | B | C | D | |

|---|---|---|---|---|

| 1 | Strike Price | $100 | ||

| 2 | Expiration Date | 2023-03-17 | ||

| 3 | Current Price | $120 | ||

| 4 | Number of Contracts | 10 | ||

| 5 | Profit/Loss | =IF(C2>B2, (C2-B2)*D2, 0) |

In this example, the Excel formula calculates the profit or loss based on the current price of the underlying asset and the strike price. If the current price is higher than the strike price, the formula calculates the profit as the difference between the two prices multiplied by the number of contracts.

Using Excel Formulas to Calculate Option Profits

Excel formulas can be used to calculate option profits in various ways, depending on the type of option and the underlying asset. Here are some common formulas:

- Call Option Profit: =IF(Current Price>Strike Price, (Current Price-Strike Price)*Number of Contracts, 0)

- Put Option Profit: =IF(Current Price<Strike Price, (Strike Price-Current Price)*Number of Contracts, 0)

These formulas can be modified to include other variables, such as time decay and volatility.

Benefits of Using an Excel Calculator for Options Trading

Using an Excel calculator for options trading has several benefits:

- Accuracy: Excel calculators can provide accurate calculations of option profits and losses, reducing the risk of errors.

- Speed: Excel calculators can perform calculations quickly, allowing you to make faster trading decisions.

- Flexibility: Excel calculators can be modified to include various scenarios and variables, making it easy to test different trading strategies.

Common Mistakes to Avoid When Using an Excel Calculator for Options Trading

When using an Excel calculator for options trading, there are several common mistakes to avoid:

- Incorrect Formulas: Using incorrect formulas can result in inaccurate calculations and poor trading decisions.

- Insufficient Data: Failing to include sufficient data, such as time decay and volatility, can result in incomplete calculations.

- Lack of Testing: Failing to test different scenarios and variables can result in poor trading decisions.

Conclusion

Options trading can be a complex and intimidating topic, but with the right tools, it can also be a lucrative way to manage risk and generate profits. An Excel calculator can be a powerful tool for calculating option profits and losses, providing accurate and fast calculations.

By following the steps outlined in this article and avoiding common mistakes, you can use an Excel calculator to improve your options trading skills and make more informed trading decisions.

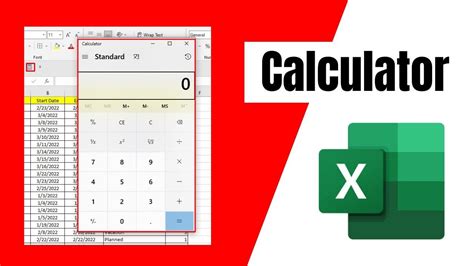

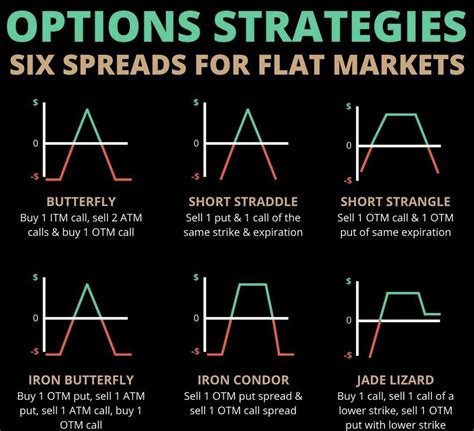

Gallery of Options Trading

Options Trading Image Gallery

We hope this article has provided you with a comprehensive understanding of options trading and how to use an Excel calculator to calculate option profits. Whether you're a seasoned trader or just starting out, options trading can be a lucrative way to manage risk and generate profits.