Intro

Discover how to calculate payback in Excel with ease. Learn 5 simple methods to determine the return on investment for your projects, including the payback period, net present value, and internal rate of return. Master Excel formulas and functions, such as XNPV, IRR, and PMT, to make informed financial decisions.

In today's fast-paced business world, understanding the financial implications of any investment or project is crucial for making informed decisions. One essential metric that helps businesses evaluate the viability of a project is the payback period, which is the time it takes for the investment to generate returns equal to its initial cost. Calculating payback in Excel is a straightforward process that can be accomplished in several ways. In this article, we will explore five methods to calculate payback in Excel, along with practical examples and step-by-step instructions.

Why is Payback Period Important?

Before diving into the calculations, it's essential to understand why the payback period is a critical metric for businesses. The payback period helps organizations evaluate the risk associated with a project, determine the liquidity of an investment, and compare different projects to prioritize the ones with the shortest payback period. A shorter payback period generally indicates a lower risk and a more attractive investment opportunity.

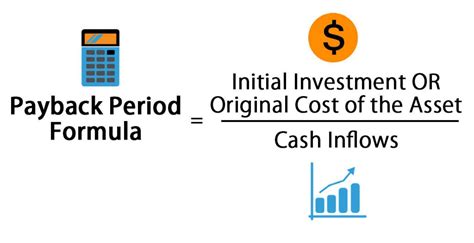

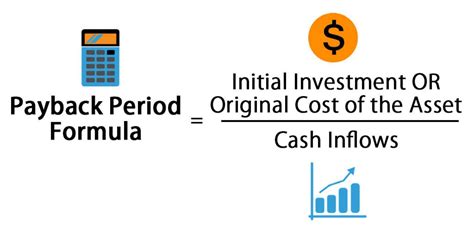

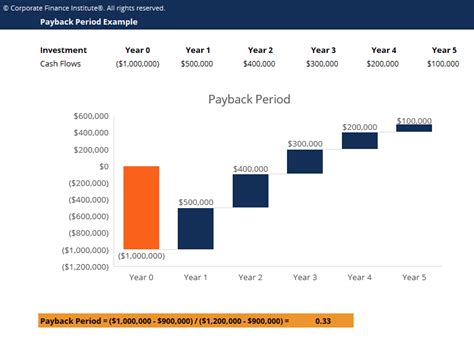

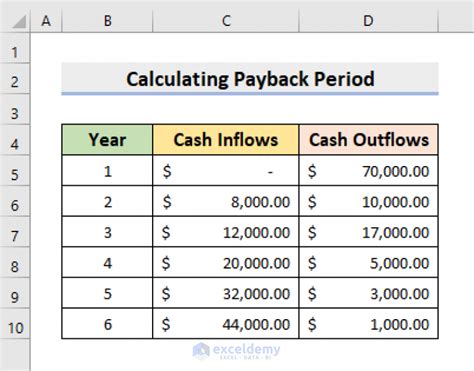

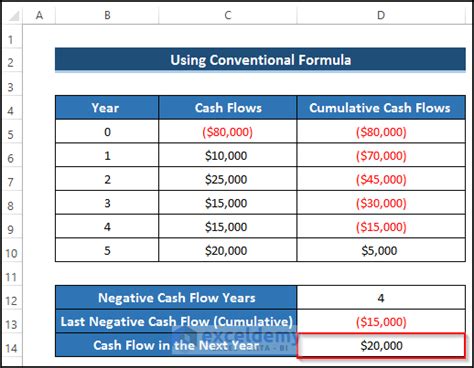

Method 1: Using the Payback Period Formula

The most straightforward way to calculate payback in Excel is by using the payback period formula. The formula is:

Payback Period = Total Investment / Annual Cash Flow

Where:

- Total Investment is the initial cost of the project

- Annual Cash Flow is the net income generated by the project each year

For example, suppose you invested $100,000 in a project that generates an annual cash flow of $25,000. To calculate the payback period, you would use the following formula:

=100,000/25,000

This would return a payback period of 4 years.

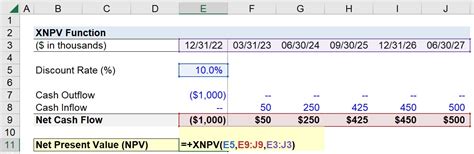

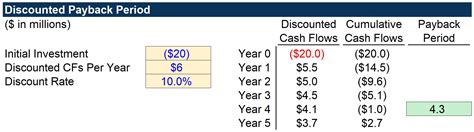

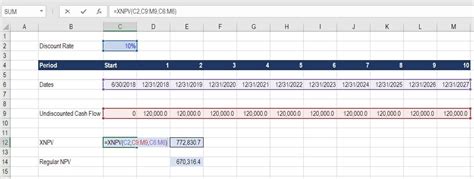

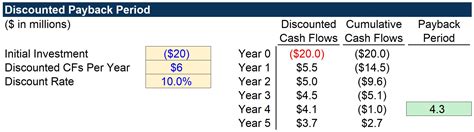

Method 2: Using the XNPV Function

The XNPV function in Excel is a more advanced way to calculate payback, especially when dealing with irregular cash flows. The XNPV function calculates the present value of a series of cash flows at specific dates.

The syntax for the XNPV function is:

XNPV(rate, dates, cash flows)

Where:

- rate is the discount rate

- dates is a range of dates for the cash flows

- cash flows is a range of cash flows

For example, suppose you have a project with the following cash flows:

| Date | Cash Flow |

|---|---|

| 1/1/2022 | -$100,000 |

| 12/31/2022 | $25,000 |

| 12/31/2023 | $25,000 |

| 12/31/2024 | $25,000 |

| 12/31/2025 | $25,000 |

To calculate the payback period using the XNPV function, you would use the following formula:

=XNPV(0.1,A2:A6,B2:B6)

Assuming the discount rate is 10%, this formula would return the payback period in years.

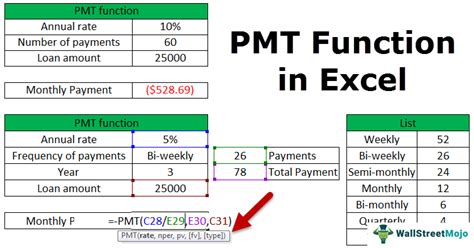

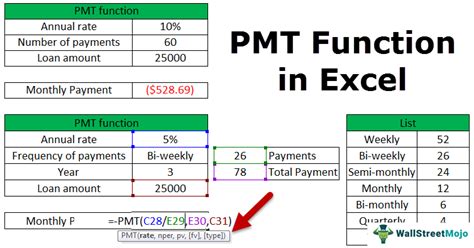

Method 3: Using the PMT Function

The PMT function in Excel calculates the payment amount for a loan or an investment based on a fixed interest rate and a specified number of periods.

The syntax for the PMT function is:

PMT(rate, nper, pv, [fv], [type])

Where:

- rate is the interest rate per period

- nper is the total number of payment periods

- pv is the present value (the initial investment)

- [fv] is the future value (optional)

- [type] is the type of payment (optional)

For example, suppose you invested $100,000 in a project with an annual interest rate of 10% and a project life of 5 years. To calculate the payback period using the PMT function, you would use the following formula:

=PMT(0.1,5,-100,000)

This formula would return the annual payment amount, which can be used to calculate the payback period.

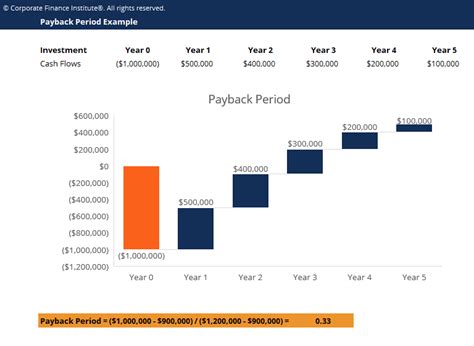

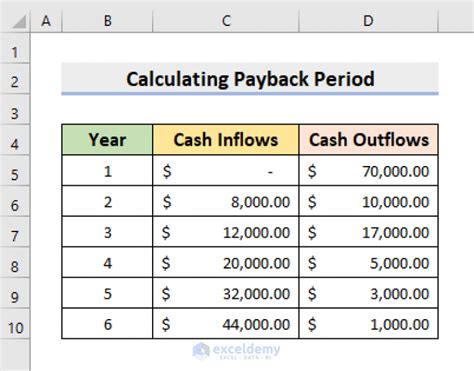

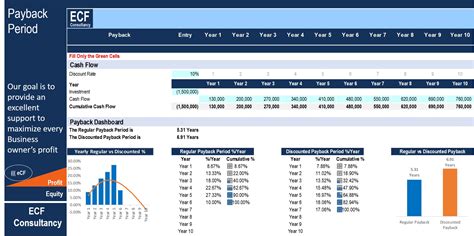

Method 4: Using a Payback Period Template

If you need to calculate payback periods frequently, you can create a template in Excel to simplify the process. A payback period template typically includes the following columns:

- Investment

- Annual Cash Flow

- Payback Period

You can create a formula to calculate the payback period based on the investment and annual cash flow.

For example, suppose you have the following template:

| Investment | Annual Cash Flow | Payback Period |

|---|---|---|

| 100,000 | 25,000 | =A2/B2 |

You can simply enter the investment and annual cash flow values, and the payback period will be calculated automatically.

Method 5: Using a Payback Period Calculator Add-in

If you need to calculate payback periods frequently and want a more user-friendly interface, you can use a payback period calculator add-in in Excel. These add-ins provide a pre-built template with formulas and formatting to calculate payback periods.

For example, you can use the Payback Period Calculator add-in from Excel Is Fun, which provides a simple and intuitive interface to calculate payback periods.

Gallery of Payback Period Calculation Methods

Payback Period Calculation Methods Image Gallery

In conclusion, calculating payback in Excel can be accomplished in various ways, depending on the complexity of the project and the desired level of accuracy. By using one of the five methods outlined in this article, you can easily calculate payback periods and make informed decisions about your investments. Remember to always consider the assumptions and limitations of each method and to use the one that best fits your needs.