Intro

Boost your Michigan paycheck with expert tips on payroll, taxes, and employee benefits, including wage laws and deductions, to maximize your take-home pay and navigate the states labor laws with confidence.

Understanding how your paycheck works is crucial for managing your finances effectively, especially in a state like Michigan where the cost of living can vary significantly from one city to another. Your paycheck is not just about the amount of money you take home but also about the deductions, taxes, and benefits that come with it. Whether you're a seasoned professional or just starting your career, navigating the intricacies of your paycheck can be overwhelming. However, with the right knowledge, you can make informed decisions about your financial future.

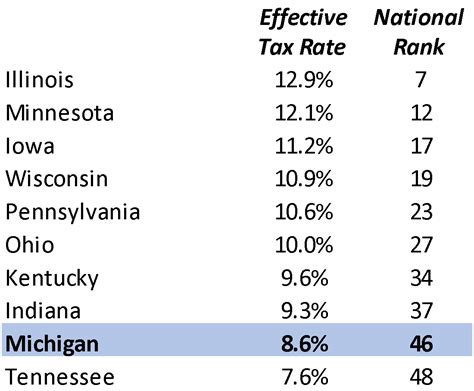

In Michigan, as in the rest of the United States, your paycheck is subject to federal and state taxes, along with other deductions such as health insurance, retirement savings, and potentially union dues, depending on your employment situation. The state of Michigan has a progressive income tax system, which means that the more you earn, the higher the tax rate on your income. This system is designed to ensure that those who have more contribute a bit more to the state's coffers. Understanding how these taxes and deductions work can help you better plan your budget and make the most out of your hard-earned money.

The importance of managing your paycheck wisely cannot be overstated. It's not just about making ends meet each month; it's also about planning for the future, whether that means saving for a down payment on a house, paying off debt, or building up your retirement fund. In Michigan, where the economy is diverse and includes significant sectors like manufacturing, agriculture, and technology, financial planning can look very different from one person to the next. Nonetheless, having a solid grasp of your paycheck and how it fits into your overall financial strategy is key to achieving your long-term goals.

Understanding Your Paycheck

To truly understand your paycheck, you need to delve into its components. This includes your gross income (the amount of money you earn before any deductions), net income (the amount of money you take home after deductions), federal and state taxes, social security taxes, health insurance premiums, and any retirement contributions you might be making. In Michigan, the state income tax rate is set at 4.25%, which is a flat rate applied to all taxable income. However, your overall tax burden will also depend on federal income taxes, which are progressive and based on your income level.

Breaking Down Deductions

Deductions are a critical part of your paycheck. They can include mandatory items like taxes and social security contributions, as well as voluntary deductions such as health insurance premiums, 401(k) contributions, and life insurance. Understanding each of these deductions can help you make informed decisions about how you allocate your income. For instance, contributing to a 401(k) can be an effective way to save for retirement, especially if your employer offers a match, which essentially means they contribute a certain amount to your retirement fund based on your contributions.

Michigan Tax Tips

When it comes to taxes in Michigan, there are several tips that can help you minimize your tax liability and maximize your refund. One of the most important things is to ensure you're taking advantage of all the deductions and credits you're eligible for. Michigan, like many states, offers specific tax credits for things like homestead property, earned income, and even contributions to certain college savings plans. Being aware of these opportunities can make a significant difference in your tax bill.

Utilizing Tax Credits

Tax credits are particularly valuable because they directly reduce the amount of tax you owe, dollar for dollar. In Michigan, the Homestead Property Tax Credit is a notable example. This credit is designed for homeowners and renters who meet certain income and residency requirements, helping to offset the cost of property taxes. Another significant credit is the Earned Income Tax Credit (EITC), a federal credit that Michigan also adopts, which is geared towards low-to-moderate-income working individuals and families. The EITC can provide a substantial refund, even if you don't owe taxes, making it a vital component of financial planning for eligible households.

Managing Your Finances

Effective financial management is about more than just understanding your paycheck; it's also about creating a budget, saving for emergencies, paying off debt, and planning for long-term goals like retirement and buying a home. In Michigan, where economic conditions can vary, having a solid financial foundation can provide peace of mind and flexibility, regardless of what the future holds.

Creating a Budget

A budget is your roadmap to financial stability. It helps you track your income and expenses, ensuring that you're living within your means and making progress towards your financial goals. When creating a budget, it's essential to be realistic and detailed, accounting for all your necessary expenses, savings, and debt payments. The 50/30/20 rule is a useful guideline: 50% of your income should go towards necessary expenses like rent, utilities, and groceries, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Financial Planning Tools

There are numerous financial planning tools available that can help you manage your finances more effectively. From budgeting apps like Mint and You Need a Budget (YNAB) to investment platforms and retirement savings calculators, technology can provide valuable insights and automation to simplify your financial life. In Michigan, where access to financial services can vary by location, leveraging digital tools can be especially beneficial.

Automating Savings

One of the most powerful financial planning tools is automation. By setting up automatic transfers from your checking account to your savings, investment, or retirement accounts, you can ensure that you're consistently saving and investing without having to think about it. This approach can help you build wealth over time, take advantage of compound interest, and make steady progress towards your long-term financial goals.

Conclusion and Next Steps

In conclusion, managing your paycheck and finances in Michigan requires a combination of understanding your income and deductions, leveraging tax tips and credits, creating a budget, and utilizing financial planning tools. By taking control of your financial situation, you can achieve stability, security, and ultimately, your long-term goals. Whether you're looking to buy a home, retire comfortably, or simply enjoy a more secure financial future, the principles outlined here can serve as a foundation for your journey.

Michigan Paycheck Gallery

We invite you to share your thoughts and experiences with managing your paycheck and finances in Michigan. Your insights can help others navigate their financial journeys. Consider sharing this article with friends, family, or colleagues who might benefit from understanding more about their paychecks and financial planning in Michigan. Together, we can work towards a more financially literate and secure community.