Effective employee management is crucial for any business, and a significant part of this process involves managing pay stubs. A pay stub, also known as a pay slip or paycheck stub, is a document that outlines an employee's payment details, including their salary, deductions, and taxes. Having a well-organized and easily accessible pay stub system can save time and reduce errors. In this article, we will discuss the importance of pay stubs, the benefits of using a Paycor pay stub template, and how to create an effective pay stub system.

Understanding the Importance of Pay Stubs

Pay stubs are a vital part of employee management, providing employees with a clear and transparent record of their earnings and deductions. They help employees understand their take-home pay, taxes, and benefits, and enable them to track their income and expenses. Additionally, pay stubs are essential for tax purposes, as they provide a record of an employee's income and tax deductions.

Benefits of Using a Pay Stub Template

Using a pay stub template can simplify the process of creating and managing pay stubs. A well-designed template can help reduce errors, save time, and improve the overall efficiency of the payroll process. Here are some benefits of using a Paycor pay stub template:

- Streamlined payroll process: A pay stub template can help automate the payroll process, reducing the time and effort required to create and distribute pay stubs.

- Improved accuracy: A template can help minimize errors, ensuring that pay stubs are accurate and complete.

- Enhanced transparency: A pay stub template can provide employees with a clear and transparent record of their earnings and deductions.

- Compliance with regulations: A template can help ensure compliance with relevant laws and regulations, such as tax laws and labor laws.

Creating an Effective Pay Stub System with Paycor

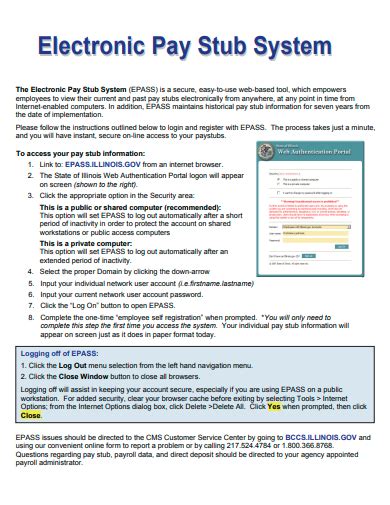

Paycor is a cloud-based HR and payroll software that provides a range of tools and features to help businesses manage their payroll and HR processes. Here are some steps to create an effective pay stub system with Paycor:

- Set up your payroll account: Create a payroll account with Paycor and set up your company's payroll information, including employee data, pay rates, and tax information.

- Customize your pay stub template: Use Paycor's pay stub template to create a customized template that meets your company's needs. You can add your company's logo, adjust the layout, and include relevant information.

- Automate payroll processing: Use Paycor's automation features to streamline the payroll process, including calculating pay, deductions, and taxes.

- Distribute pay stubs: Use Paycor's distribution features to send pay stubs to employees, either electronically or by mail.

Best Practices for Managing Pay Stubs

Here are some best practices for managing pay stubs:

- Keep accurate records: Ensure that pay stubs are accurate and complete, and that they are stored securely and in compliance with relevant laws and regulations.

- Provide transparent information: Provide employees with clear and transparent information about their earnings and deductions.

- Use automation: Use automation features to streamline the payroll process and reduce errors.

- Comply with regulations: Ensure compliance with relevant laws and regulations, such as tax laws and labor laws.

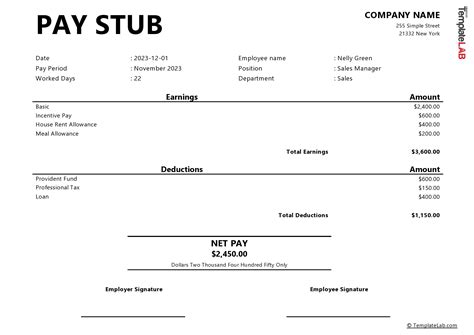

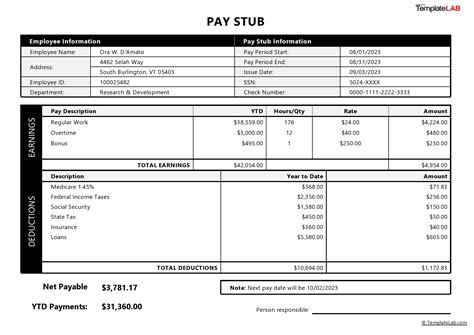

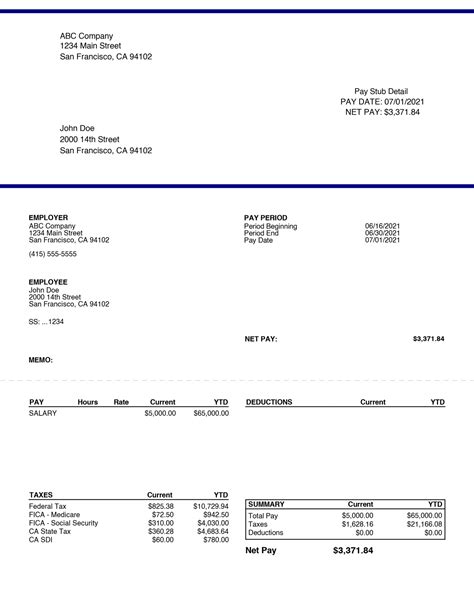

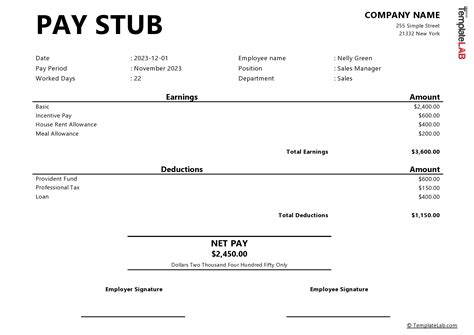

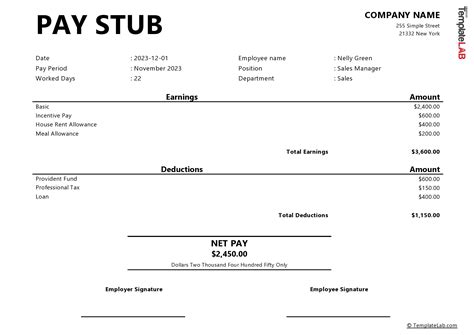

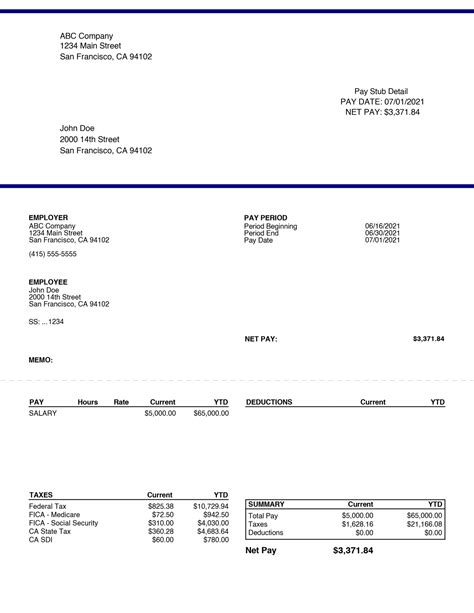

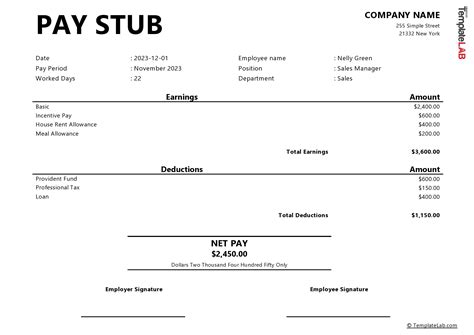

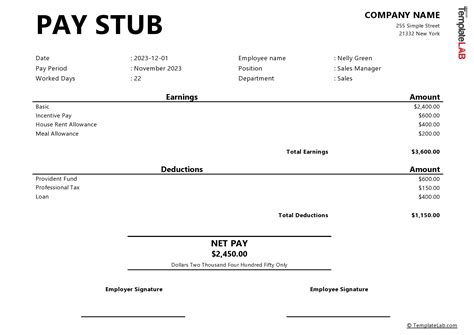

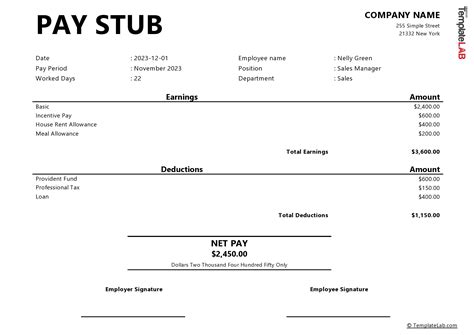

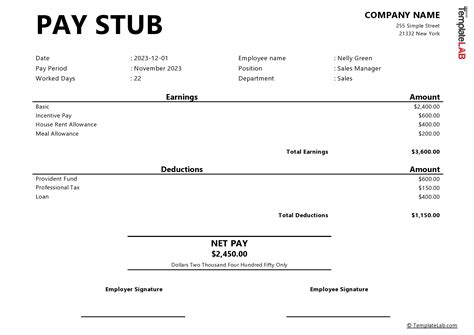

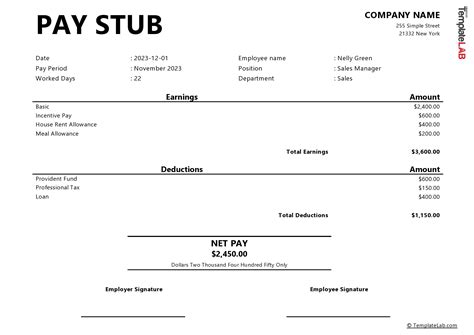

Gallery of Pay Stub Templates

Pay Stub Template Gallery

Conclusion

In conclusion, a Paycor pay stub template can simplify the process of creating and managing pay stubs, reducing errors and improving the overall efficiency of the payroll process. By following the steps outlined in this article, businesses can create an effective pay stub system that provides employees with clear and transparent information about their earnings and deductions. Additionally, by using automation features and complying with relevant laws and regulations, businesses can ensure a streamlined and accurate payroll process.

We hope this article has provided valuable insights into the importance of pay stubs and the benefits of using a Paycor pay stub template. If you have any questions or comments, please feel free to share them below.