Intro

Discover Pentagon Federal online banking services, offering secure digital transactions, mobile banking, and account management with convenient bill pay and transfer options.

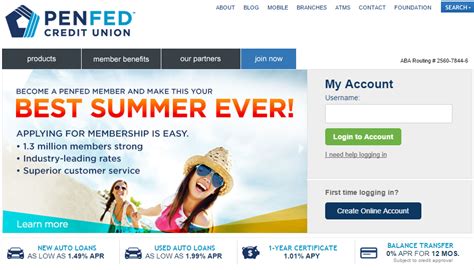

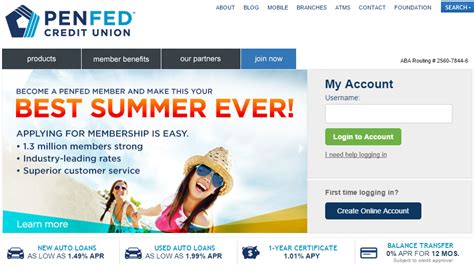

The world of online banking has revolutionized the way people manage their finances, and Pentagon Federal Credit Union, also known as PenFed, is at the forefront of this digital transformation. As one of the largest credit unions in the United States, PenFed offers a wide range of online banking services that cater to the diverse needs of its members. With a strong commitment to providing exceptional customer service, PenFed's online banking platform is designed to be user-friendly, secure, and convenient.

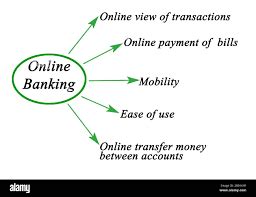

In today's fast-paced world, individuals and businesses alike require easy access to their financial information and the ability to conduct transactions from anywhere, at any time. PenFed's online banking services provide just that, allowing members to manage their accounts, pay bills, transfer funds, and apply for loans, all from the comfort of their own homes or on-the-go. The credit union's online platform is accessible 24/7, making it an ideal solution for those with busy schedules or limited mobility.

The importance of online banking cannot be overstated, as it offers numerous benefits, including increased convenience, improved financial management, and enhanced security. With PenFed's online banking services, members can monitor their account activity, set up account alerts, and receive notifications when suspicious transactions are detected. This level of control and visibility enables individuals to take a more proactive approach to managing their finances, making informed decisions, and avoiding potential pitfalls.

Introduction to PenFed Online Banking

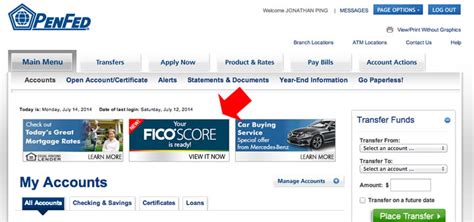

PenFed's online banking platform is designed to be intuitive and easy to navigate, even for those who are not tech-savvy. The credit union's website and mobile app provide a seamless user experience, allowing members to access their accounts, view statements, and conduct transactions with ease. The platform is also optimized for mobile devices, ensuring that members can manage their finances on-the-go, without compromising on security or functionality.

Key Features of PenFed Online Banking

Some of the key features of PenFed's online banking services include: * Online account management: Members can view their account balances, transaction history, and statements online. * Bill pay: PenFed's online banking platform allows members to pay bills electronically, setting up one-time or recurring payments. * Fund transfers: Members can transfer funds between their PenFed accounts or to external accounts. * Loan applications: PenFed's online banking platform enables members to apply for loans, including personal loans, mortgages, and credit cards. * Account alerts: Members can set up account alerts to notify them of suspicious transactions, low account balances, or other important events.Security Measures

Security is a top priority for PenFed, and the credit union has implemented robust measures to protect its members' sensitive information. These measures include:

- Encryption: PenFed's online banking platform uses advanced encryption technology to protect data transmission.

- Firewall protection: The credit union's systems are protected by firewalls, which prevent unauthorized access.

- Multi-factor authentication: Members are required to use multi-factor authentication, which adds an extra layer of security to the login process.

- Regular security updates: PenFed's systems are regularly updated with the latest security patches and software updates.

Benefits of PenFed Online Banking

The benefits of PenFed's online banking services are numerous, including: * Convenience: Members can access their accounts and conduct transactions from anywhere, at any time. * Time-saving: Online banking saves members time, as they can avoid visiting branches or waiting in line. * Cost-effective: Online banking reduces the need for paper statements, checks, and other banking materials. * Environmentally friendly: By reducing paper usage, online banking is a more environmentally friendly option.Mobile Banking

PenFed's mobile banking app is a convenient and secure way for members to manage their finances on-the-go. The app is available for both iOS and Android devices and provides a range of features, including:

- Account management: Members can view their account balances, transaction history, and statements.

- Bill pay: Members can pay bills electronically using the mobile app.

- Fund transfers: Members can transfer funds between their PenFed accounts or to external accounts.

- Deposit checks: Members can deposit checks remotely using the mobile app.

Mobile Banking Security

PenFed's mobile banking app is designed with security in mind, featuring: * Encryption: The app uses advanced encryption technology to protect data transmission. * Secure login: Members are required to use a secure login, which includes a username and password. * Biometric authentication: The app offers biometric authentication, including facial recognition and fingerprint scanning.Online Bill Pay

PenFed's online bill pay service allows members to pay bills electronically, setting up one-time or recurring payments. The service is convenient, secure, and easy to use, providing members with a range of benefits, including:

- Convenience: Members can pay bills from anywhere, at any time.

- Time-saving: Online bill pay saves members time, as they can avoid writing checks or visiting payment centers.

- Cost-effective: Online bill pay reduces the need for paper checks, stamps, and other banking materials.

Online Bill Pay Features

Some of the key features of PenFed's online bill pay service include: * Electronic payments: Members can make electronic payments to thousands of billers. * Payment scheduling: Members can schedule payments in advance, ensuring that bills are paid on time. * Payment tracking: Members can track their payments, receiving notifications when payments are processed.Account Management

PenFed's online banking platform provides members with a range of account management tools, including:

- Account statements: Members can view their account statements online, reducing the need for paper statements.

- Transaction history: Members can view their transaction history, including deposits, withdrawals, and transfers.

- Account alerts: Members can set up account alerts, notifying them of suspicious transactions, low account balances, or other important events.

Account Management Benefits

The benefits of PenFed's account management tools include: * Convenience: Members can access their account information from anywhere, at any time. * Time-saving: Online account management saves members time, as they can avoid visiting branches or waiting in line. * Cost-effective: Online account management reduces the need for paper statements, checks, and other banking materials.Pentagon Federal Online Banking Image Gallery

In conclusion, PenFed's online banking services provide members with a convenient, secure, and user-friendly way to manage their finances. With a range of features, including online account management, mobile banking, and online bill pay, members can take control of their financial lives, making informed decisions and avoiding potential pitfalls. Whether you're a busy professional, a student, or a retiree, PenFed's online banking services are designed to meet your unique needs, providing you with the flexibility and freedom to manage your finances on your own terms. So why not take the first step today and experience the benefits of PenFed's online banking services for yourself? Share your thoughts and experiences with online banking in the comments below, and don't forget to share this article with your friends and family who may be interested in learning more about the benefits of online banking.