Intro

Discover competitive USAA VA loan rates, featuring flexible mortgage options, low APRs, and exclusive benefits for veterans, with insights on fixed-rate, adjustable-rate, and jumbo loans.

The world of mortgage lending can be complex, especially for those who are new to the process. One option that stands out for eligible borrowers is the USAA VA loan, which offers competitive rates and terms. For those who are serving or have served in the military, understanding the ins and outs of these loans can be crucial in making informed decisions about their financial future.

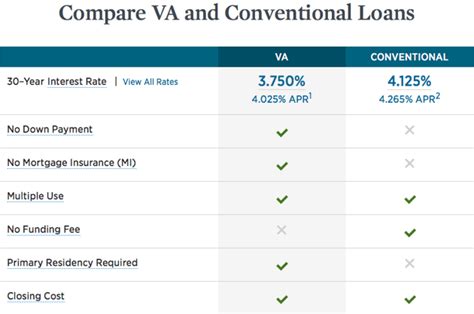

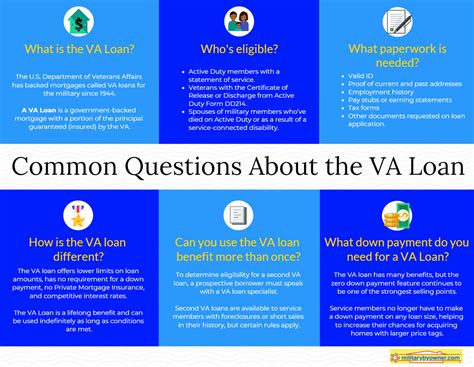

VA loans are backed by the Department of Veterans Affairs, which means they often come with more favorable terms than conventional loans. This includes lower interest rates, lower or no down payment requirements, and more lenient credit score requirements. USAA, a financial services company that exclusively serves military members and their families, offers VA loans with some of the most competitive rates and terms available.

For individuals looking to purchase, refinance, or improve a home, understanding the current USAA VA loan rates is essential. These rates can fluctuate based on a variety of factors, including the borrower's credit score, the loan term, and the current market conditions. As of the latest updates, USAA VA loan rates are among the lowest in the industry, making them an attractive option for those who qualify.

Understanding USAA VA Loan Rates

Understanding the specifics of USAA VA loan rates involves looking at several key factors. The interest rate on a VA loan can be fixed or adjustable, with fixed rates providing stability and predictable monthly payments, while adjustable rates may offer lower initial rates but with the risk of increases over time. USAA provides both types, allowing borrowers to choose the option that best fits their financial situation and goals.

Types of USAA VA Loans and Their Rates

USAA offers a variety of VA loan products, each designed to meet different needs. These include purchase loans for buying a new home, refinance loans for replacing an existing loan with a new one, often to secure a lower rate or tap into home equity, and cash-out refinance loans, which allow homeowners to borrow against their home's equity. The rates for these loans can vary, with factors such as the loan amount, property type, and borrower's creditworthiness playing significant roles.Benefits of USAA VA Loans

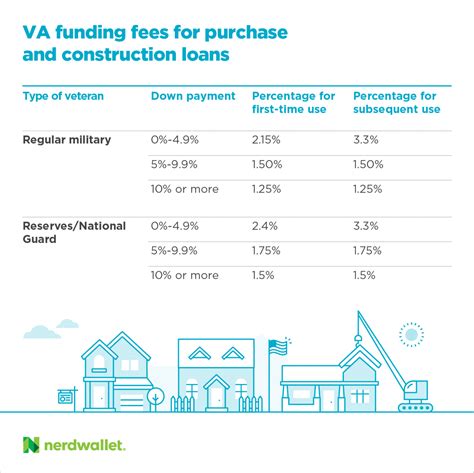

The benefits of choosing a USAA VA loan are numerous. One of the most significant advantages is the lack of a down payment requirement for loans up to a certain amount, which can be a huge savings for borrowers. Additionally, USAA VA loans do not require private mortgage insurance (PMI), which can lower monthly payments. The funding fee, which is typically required for VA loans, can be financed into the loan or paid upfront, and some borrowers may be exempt from this fee altogether.

How to Qualify for a USAA VA Loan

Qualifying for a USAA VA loan involves meeting certain eligibility requirements set by the Department of Veterans Affairs and USAA. These include being an active-duty service member, veteran, or surviving spouse, meeting specific service requirements, and having a valid Certificate of Eligibility (COE). USAA also considers credit score and income when determining eligibility and loan terms.Applying for a USAA VA Loan

The application process for a USAA VA loan is designed to be straightforward and efficient. It begins with pre-qualification, where borrowers can get an idea of how much they might qualify for. Next, they'll need to get pre-approved, which involves providing financial documents to USAA. After finding a home and having it appraised, the loan goes into underwriting, and if approved, the borrower can close on the loan.

Tips for Getting the Best USAA VA Loan Rate

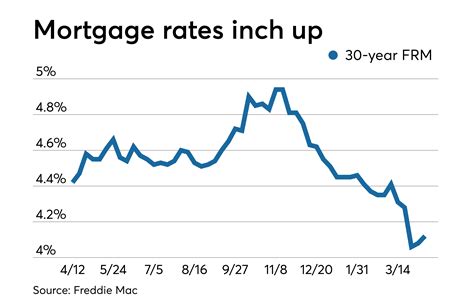

To secure the best possible rate on a USAA VA loan, borrowers should focus on improving their credit score, as higher scores can qualify for better rates. Shopping around and comparing rates from different lenders, even though USAA is a top choice for many, can also be beneficial. Additionally, considering the timing of the application, as rates can fluctuate, and being prepared to act quickly when rates are favorable can make a significant difference.USAA VA Loan Rates and Market Trends

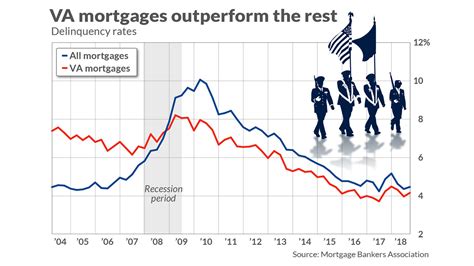

Market trends play a significant role in determining USAA VA loan rates. When the economy is strong, and inflation is a concern, interest rates may rise to combat it. Conversely, during economic downturns, rates may decrease to stimulate growth. Borrowers should stay informed about these trends and be prepared to lock in a rate when it's favorable.

Long-Term Implications of USAA VA Loan Rates

The long-term implications of USAA VA loan rates can be substantial. A lower rate can mean thousands of dollars in savings over the life of the loan. For this reason, borrowers should carefully consider their options and possibly consult with a financial advisor to determine the best strategy for their situation.Conclusion and Next Steps

In conclusion, USAA VA loan rates offer a compelling option for eligible borrowers, providing a path to homeownership with favorable terms. By understanding the current rates, the benefits of these loans, and how to qualify, individuals can make informed decisions about their financial future.

Final Considerations

Before making a decision, it's essential to weigh all the factors, including the potential risks and benefits, and to consider seeking professional advice. The world of mortgage lending is complex, and what works for one person may not work for another. By being informed and prepared, borrowers can navigate this process with confidence.USAA VA Loan Image Gallery

For those considering a USAA VA loan, the next step is to start the pre-qualification process and to reach out to USAA for more detailed information. By taking these steps, individuals can move closer to achieving their goal of homeownership, backed by the competitive rates and terms offered by USAA. We invite you to share your thoughts and experiences with USAA VA loans in the comments below and to share this article with anyone who might benefit from this information.