Petty Cash Ledger Template For Small Business Owners Summary

Streamline your small business finances with a petty cash ledger template. Easily track daily expenses, manage funds, and maintain accurate records. Download a free template to simplify your accounting, improve cash flow, and reduce financial errors. Perfect for small business owners, this template helps you stay organized and in control of your petty cash transactions.

As a small business owner, managing your finances effectively is crucial for the success and growth of your company. One often overlooked aspect of financial management is the petty cash system. A petty cash ledger template can help you keep track of small expenses, ensuring that your business remains organized and financially stable. In this article, we will delve into the importance of a petty cash ledger template, its benefits, and provide a step-by-step guide on how to create and use one.

Why Use a Petty Cash Ledger Template?

A petty cash ledger template is a valuable tool for small business owners, enabling them to manage small expenses efficiently. It helps to ensure that all transactions are recorded, making it easier to track and reconcile petty cash transactions. By using a petty cash ledger template, you can:

- Keep track of small expenses, such as office supplies, travel expenses, and entertainment costs

- Ensure that all transactions are recorded and accounted for

- Reconcile petty cash transactions with your main accounting system

- Identify areas where costs can be reduced or optimized

- Maintain transparency and accountability within your organization

Benefits of Using a Petty Cash Ledger Template

Using a petty cash ledger template offers several benefits, including:

- Improved financial management: A petty cash ledger template helps you keep track of small expenses, ensuring that your financial records are accurate and up-to-date.

- Enhanced transparency: By recording all petty cash transactions, you can maintain transparency and accountability within your organization.

- Increased efficiency: A petty cash ledger template saves time and reduces the risk of errors, allowing you to focus on more critical tasks.

- Better decision-making: By analyzing your petty cash transactions, you can identify areas where costs can be reduced or optimized, making informed decisions about your business.

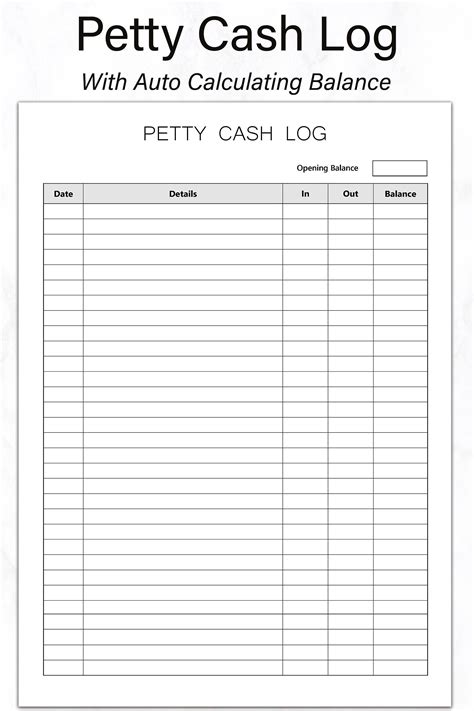

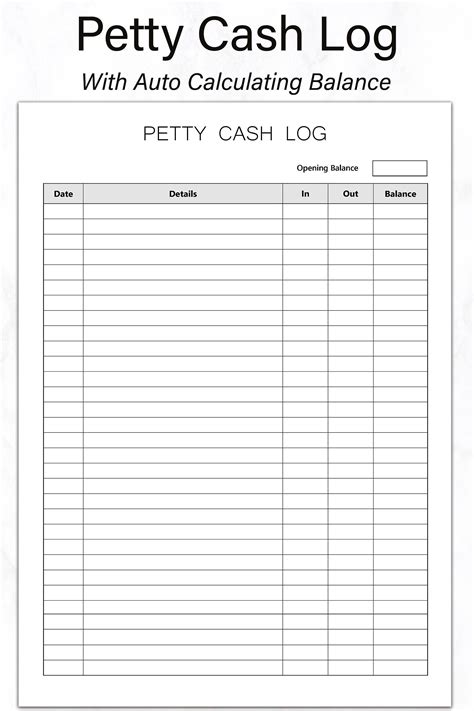

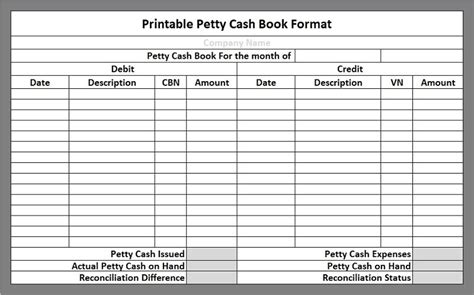

Creating a Petty Cash Ledger Template

Creating a petty cash ledger template is a straightforward process. Here's a step-by-step guide to help you get started:

- Determine the scope of your petty cash system: Identify the types of expenses that will be covered by your petty cash system, such as office supplies, travel expenses, and entertainment costs.

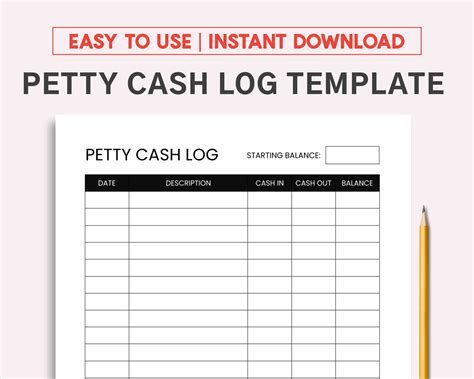

- Choose a format: Decide on the format of your petty cash ledger template, such as a spreadsheet or a paper-based system.

- Set up columns: Create columns for the date, description, amount, and running balance.

- Assign a petty cash custodian: Appoint a responsible individual to manage the petty cash system and ensure that all transactions are recorded.

- Establish a petty cash fund: Determine the amount of money that will be allocated to the petty cash fund and ensure that it is sufficient to cover small expenses.

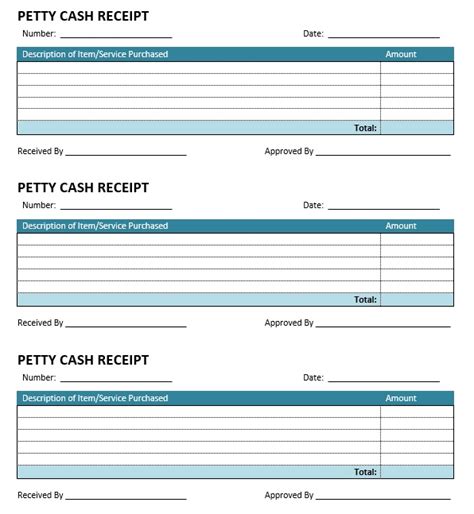

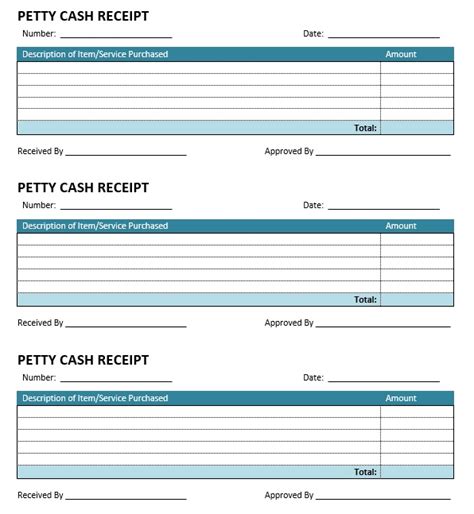

Using a Petty Cash Ledger Template

Using a petty cash ledger template is simple and straightforward. Here's a step-by-step guide to help you get started:

- Record transactions: Record each transaction in the petty cash ledger template, including the date, description, and amount.

- Update the running balance: Update the running balance column after each transaction to ensure that the balance is accurate.

- Reconcile transactions: Reconcile petty cash transactions with your main accounting system on a regular basis to ensure that all transactions are accounted for.

- Analyze transactions: Analyze your petty cash transactions to identify areas where costs can be reduced or optimized.

- Maintain transparency: Ensure that all transactions are transparent and accountable, and that the petty cash ledger template is accessible to authorized personnel.

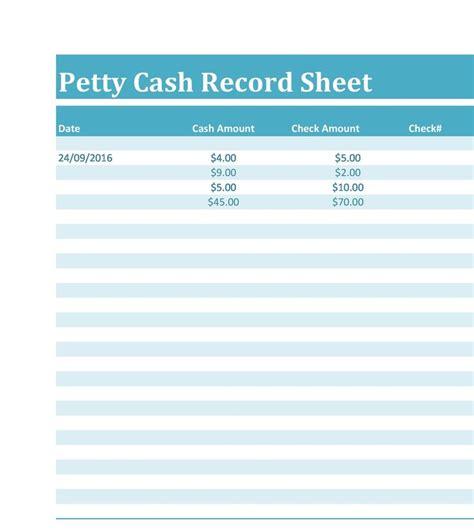

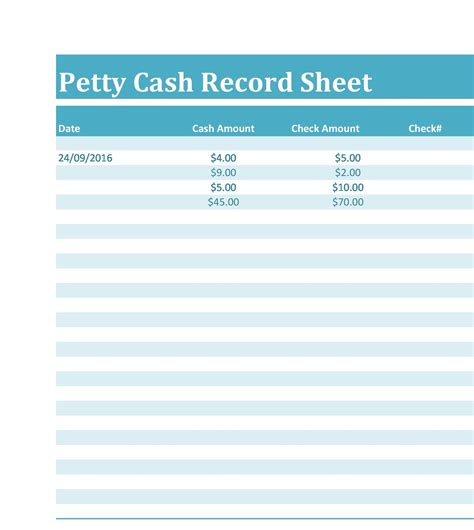

Petty Cash Ledger Template Example

Here's an example of a petty cash ledger template:

| Date | Description | Amount | Running Balance |

|---|---|---|---|

| 2023-02-01 | Office supplies | $50.00 | $100.00 |

| 2023-02-05 | Travel expenses | $200.00 | $300.00 |

| 2023-02-10 | Entertainment costs | $150.00 | $450.00 |

Best Practices for Using a Petty Cash Ledger Template

Here are some best practices for using a petty cash ledger template:

- Regularly review and reconcile petty cash transactions

- Ensure that all transactions are transparent and accountable

- Maintain a sufficient petty cash fund to cover small expenses

- Analyze petty cash transactions to identify areas where costs can be reduced or optimized

- Ensure that the petty cash ledger template is accessible to authorized personnel

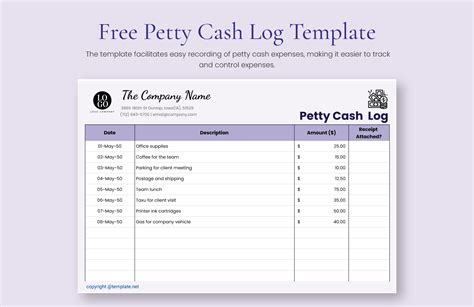

Petty Cash Ledger Template Image Gallery

In conclusion, a petty cash ledger template is an essential tool for small business owners, enabling them to manage small expenses efficiently. By following the steps outlined in this article, you can create and use a petty cash ledger template to improve your financial management, enhance transparency, and increase efficiency. Remember to regularly review and reconcile petty cash transactions, ensure that all transactions are transparent and accountable, and maintain a sufficient petty cash fund to cover small expenses.

We hope this article has been informative and helpful. If you have any questions or need further assistance, please don't hesitate to comment below. Share this article with your friends and colleagues to help them manage their petty cash systems effectively.