Intro

Learn how to accurately complete a printable 2290 form with our step-by-step guide. Discover the top 5 ways to fill out the form, including calculating heavy vehicle use tax, reporting suspended vehicles, and more. Get expert tips on 2290 filing, HVUT, and IRS requirements to avoid costly errors and penalties.

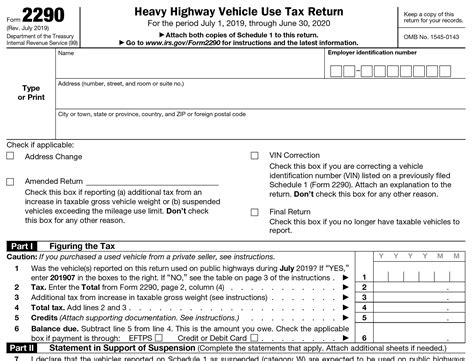

Filling out a printable 2290 form can be a daunting task, especially for those who are new to the process. The 2290 form is a required document for businesses that operate heavy highway motor vehicles, and it's essential to complete it accurately to avoid any penalties or delays. In this article, we'll guide you through five ways to fill out a printable 2290 form, making it easier for you to navigate the process.

What is a 2290 Form?

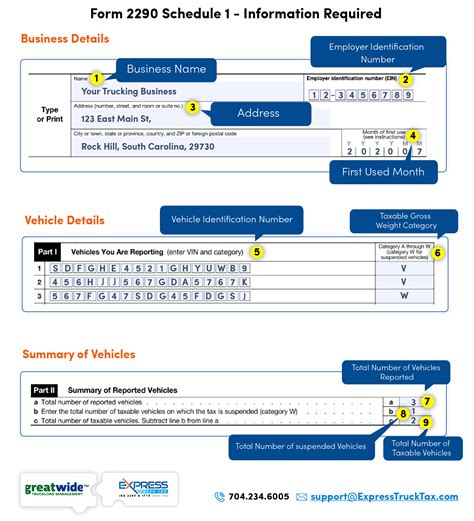

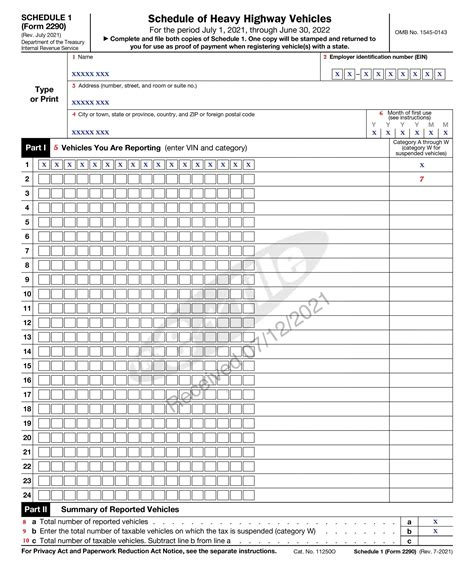

Before we dive into the ways to fill out a printable 2290 form, let's first understand what it is. The 2290 form, also known as the Heavy Highway Vehicle Use Tax Return, is a form used by the Internal Revenue Service (IRS) to collect taxes from businesses that operate heavy highway motor vehicles. The form is used to report and pay the heavy highway vehicle use tax (HVUT), which is a federal tax imposed on vehicles with a gross weight of 55,000 pounds or more.

Who Needs to File a 2290 Form?

Not all businesses need to file a 2290 form. The form is required for businesses that operate heavy highway motor vehicles, including:

- Trucks with a gross weight of 55,000 pounds or more

- Trailers with a gross weight of 55,000 pounds or more

- Semitrailers with a gross weight of 55,000 pounds or more

- Tractors with a gross weight of 55,000 pounds or more

5 Ways to Fill Out a Printable 2290 Form

Now that we've covered the basics of the 2290 form, let's move on to the five ways to fill out a printable 2290 form.

1. Manual Filing

One way to fill out a printable 2290 form is to do it manually. You can download the form from the IRS website or obtain a copy from your local IRS office. Once you have the form, you can fill it out by hand, making sure to follow the instructions carefully. This method can be time-consuming and prone to errors, but it's a good option if you only need to file one or two forms.

2. Online Filing

Another way to fill out a printable 2290 form is to file online. The IRS offers an electronic filing system that allows you to fill out and submit the form online. This method is faster and more convenient than manual filing, and it reduces the risk of errors. You can file online through the IRS website or through a third-party provider.

3. Tax Professional Filing

If you're not comfortable filling out the form yourself, you can hire a tax professional to do it for you. A tax professional can help you navigate the complex tax laws and ensure that your form is filled out accurately. This method is more expensive than manual or online filing, but it provides peace of mind knowing that your form is being handled by a professional.

4. Software Filing

You can also use software to fill out a printable 2290 form. There are many software programs available that can help you prepare and file your 2290 form. These programs can guide you through the filing process, perform calculations, and even submit the form electronically. Some popular software programs for filing the 2290 form include TurboTax and H&R Block.

5. E-File Through a Provider

Finally, you can also e-file your 2290 form through a provider. There are many providers that offer e-filing services for the 2290 form, including FileYourTaxes.com and 2290Tax.com. These providers can help you prepare and file your form electronically, and they often offer additional services such as audit support and tax consulting.

Benefits of Filing a 2290 Form Electronically

Filing a 2290 form electronically has several benefits, including:

- Faster processing time: Electronic filing is faster than manual filing, and you can receive your Schedule 1 in minutes.

- Reduced errors: Electronic filing reduces the risk of errors, as the software can perform calculations and check for accuracy.

- Increased security: Electronic filing is more secure than manual filing, as your information is encrypted and protected.

- Environmentally friendly: Electronic filing is more environmentally friendly than manual filing, as it reduces the need for paper and ink.

Common Mistakes to Avoid When Filing a 2290 Form

When filing a 2290 form, there are several common mistakes to avoid, including:

- Incorrect vehicle identification number (VIN)

- Incorrect gross weight

- Incorrect tax year

- Incorrect payment information

- Failure to sign the form

Conclusion

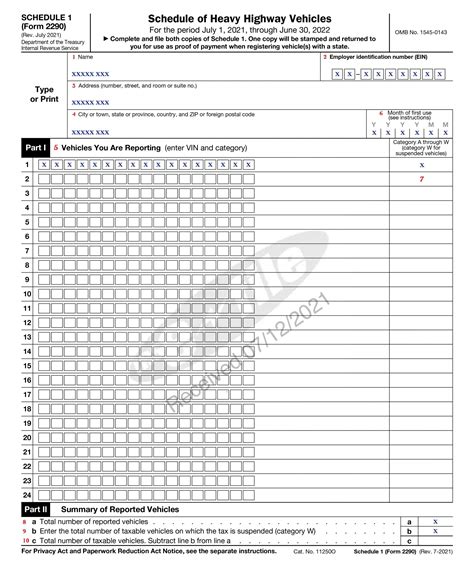

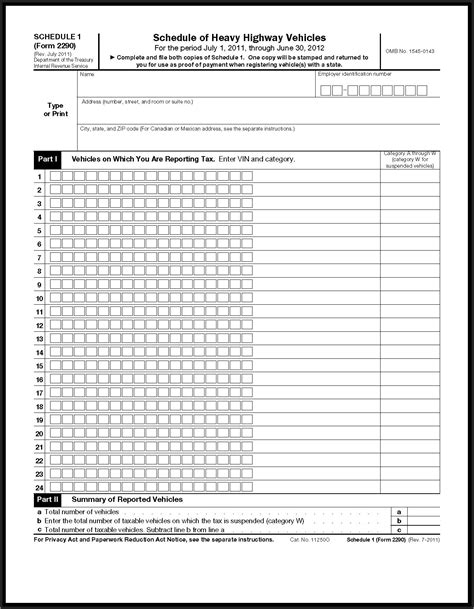

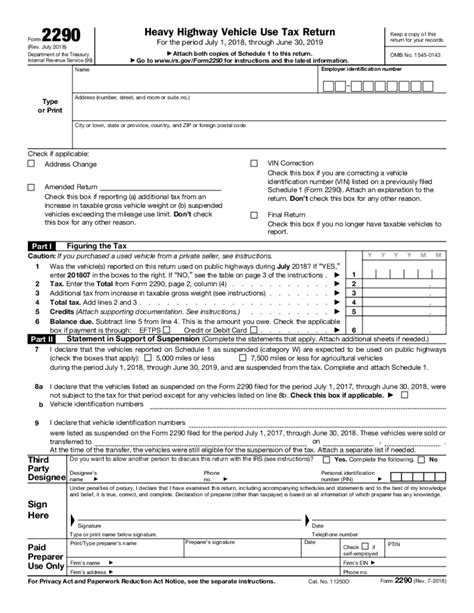

Filling out a printable 2290 form can be a daunting task, but it doesn't have to be. By following the five ways to fill out a printable 2290 form outlined in this article, you can ensure that your form is filled out accurately and submitted on time. Remember to avoid common mistakes and take advantage of the benefits of electronic filing.Gallery of 2290 Form-Related Images

2290 Form Image Gallery

Frequently Asked Questions

Q: What is the deadline for filing the 2290 form? A: The deadline for filing the 2290 form is August 31st of each year.

Q: Can I file the 2290 form electronically? A: Yes, you can file the 2290 form electronically through the IRS website or through a third-party provider.

Q: What is the penalty for not filing the 2290 form? A: The penalty for not filing the 2290 form can range from $500 to $5,000, depending on the circumstances.

Q: Can I file an amended 2290 form? A: Yes, you can file an amended 2290 form if you need to make changes to your original return.

Q: How do I get a copy of my 2290 form? A: You can obtain a copy of your 2290 form by contacting the IRS or by logging into your online account.

We hope this article has been helpful in guiding you through the process of filling out a printable 2290 form. If you have any further questions or concerns, please don't hesitate to reach out to us.