Intro

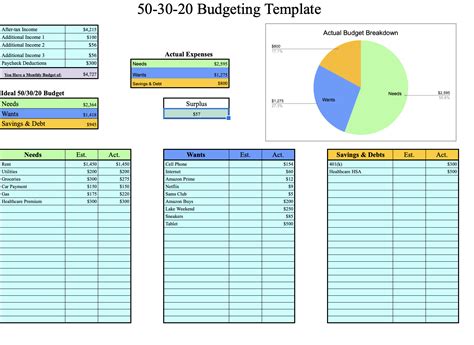

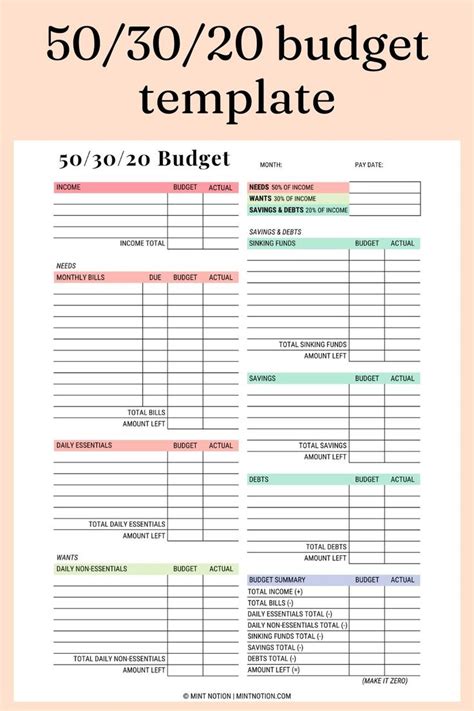

Master your finances with the 50/30/20 budget template. Learn how to allocate 50% of income towards necessities, 30% towards discretionary spending, and 20% towards saving and debt repayment. Boost financial stability and achieve goals with this simple, effective framework. Discover expert tips and get started with a free budget template.

The 50/30/20 budget template is a simple yet effective way to manage your finances and achieve financial stability. This template has been widely used and recommended by financial experts, and for good reason. In this article, we'll explore the benefits and workings of the 50/30/20 budget template, and provide a step-by-step guide on how to implement it in your financial planning.

The 50/30/20 budget template is based on the idea of allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. This template provides a clear and straightforward way to prioritize your expenses and make conscious financial decisions.

Benefits of the 50/30/20 Budget Template

The 50/30/20 budget template offers several benefits, including:

- Simplifies financial planning: The template provides a clear and easy-to-follow framework for managing your finances.

- Prioritizes necessary expenses: By allocating 50% of your income towards necessary expenses, you ensure that you're covering essential costs such as rent, utilities, and groceries.

- Encourages saving: The template sets aside 20% of your income for saving and debt repayment, helping you build a safety net and work towards long-term financial goals.

- Allows for flexibility: The 30% allocated for discretionary spending provides room for entertainment, hobbies, and travel, allowing you to enjoy your life while still being mindful of your finances.

Breaking Down the 50/30/20 Budget Template

To implement the 50/30/20 budget template, follow these steps:

- Calculate your net income: Start by calculating your take-home pay, which is your income after taxes.

- Allocate 50% towards necessary expenses: This includes essential costs such as:

- Rent or mortgage

- Utilities (electricity, water, gas, internet)

- Groceries

- Transportation (car loan or lease, insurance, gas)

- Minimum debt payments (credit cards, loans)

- Allocate 30% towards discretionary spending: This includes:

- Entertainment (dining out, movies, concerts)

- Hobbies

- Travel

- Personal expenses (gym membership, subscriptions)

- Allocate 20% towards saving and debt repayment: This includes:

- Emergency fund contributions

- Retirement savings

- Debt repayment (paying off high-interest loans or credit cards)

- Long-term savings goals (college fund, down payment on a house)

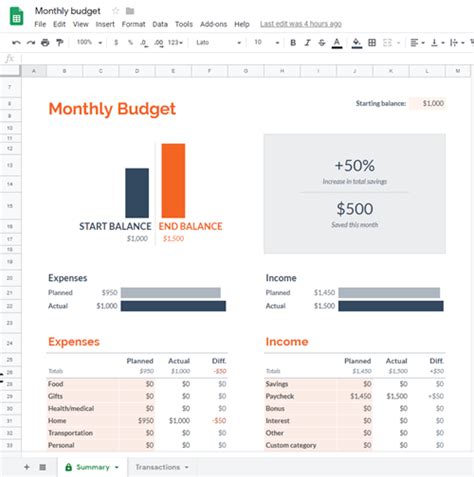

Example of the 50/30/20 Budget Template in Action

Let's say you have a net income of $4,000 per month. Here's how you could allocate your income using the 50/30/20 budget template:

- Necessary expenses (50%): $2,000

- Rent: $1,500

- Utilities: $100

- Groceries: $300

- Transportation: $100

- Discretionary spending (30%): $1,200

- Entertainment: $500

- Hobbies: $200

- Travel: $500

- Saving and debt repayment (20%): $800

- Emergency fund: $400

- Retirement savings: $200

- Debt repayment: $200

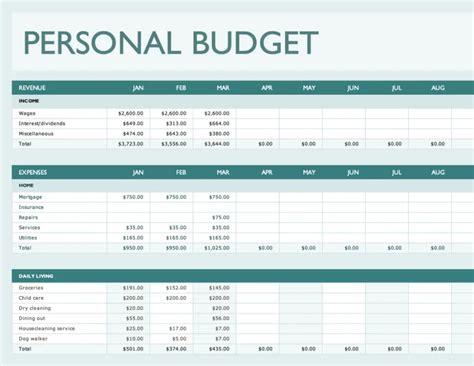

Tips for Implementing the 50/30/20 Budget Template

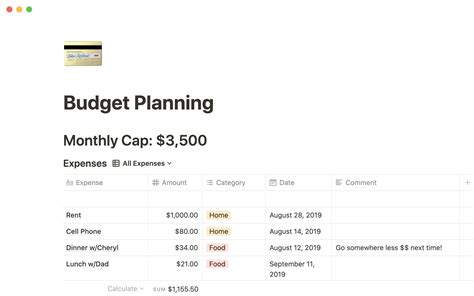

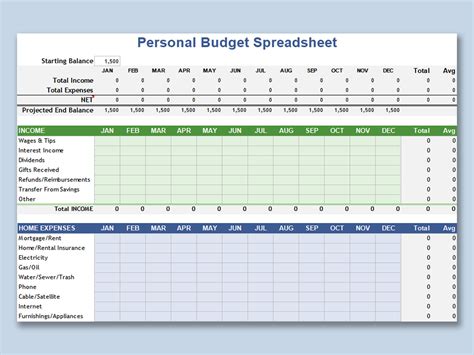

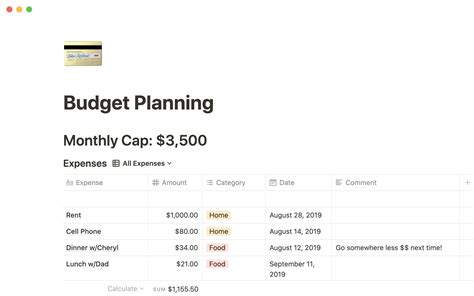

- Track your expenses: Use a budgeting app or spreadsheet to track your expenses and stay on top of your finances.

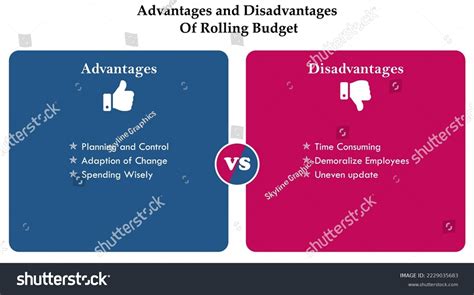

- Be flexible: The 50/30/20 budget template is a guideline, not a hard and fast rule. Be willing to adjust your allocations as needed.

- Prioritize needs over wants: Be honest with yourself about what you need versus what you want. Prioritize essential expenses over discretionary spending.

- Automate your savings: Set up automatic transfers to your savings and investment accounts to make saving easier and less prone to being neglected.

Common Challenges and Solutions

- Challenge: I don't have enough income to cover my necessary expenses. Solution: Consider reducing discretionary spending or exploring ways to increase your income, such as taking on a side job or asking for a raise.

- Challenge: I'm struggling to save 20% of my income. Solution: Start small by setting aside 10% or 5% of your income and gradually increase the amount over time.

Conclusion

The 50/30/20 budget template is a simple and effective way to manage your finances and achieve financial stability. By allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment, you can create a balanced and sustainable financial plan. Remember to track your expenses, be flexible, and prioritize needs over wants. With the 50/30/20 budget template, you'll be on your way to financial freedom in no time.

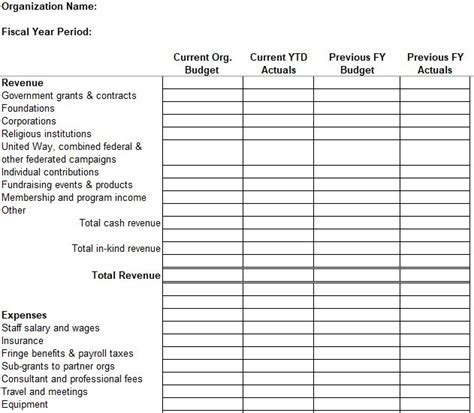

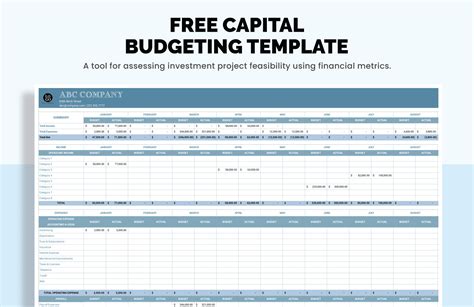

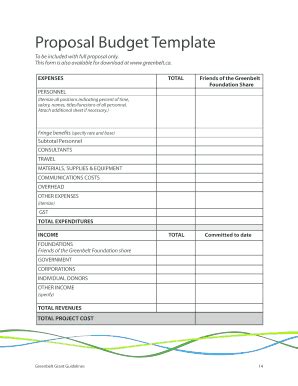

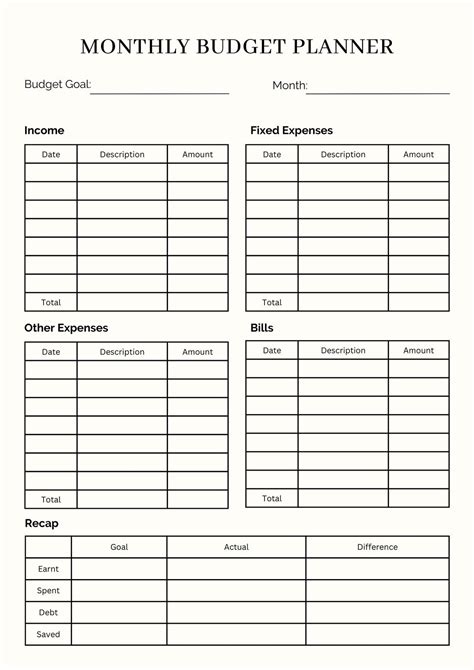

50/30/20 Budget Template Image Gallery

We hope this article has helped you understand the 50/30/20 budget template and how to implement it in your financial planning. Remember to track your expenses, be flexible, and prioritize needs over wants. With the 50/30/20 budget template, you'll be on your way to financial freedom in no time. Share your thoughts and experiences with the 50/30/20 budget template in the comments below!