Intro

Master the art of technical analysis with these 10 essential chart patterns for traders. Learn to identify and interpret trends, reversals, and continuations using patterns like Head and Shoulders, Triangles, and Wedges. Improve your trading skills and increase profits with this comprehensive guide to chart pattern recognition and analysis.

As a trader, being able to recognize and interpret chart patterns is a crucial skill that can help you make informed investment decisions and maximize your profits. Chart patterns are graphical representations of a security's price action over time, and they can provide valuable insights into the market's sentiment and potential future price movements. In this article, we will explore 10 essential chart patterns that every trader should know.

What are Chart Patterns?

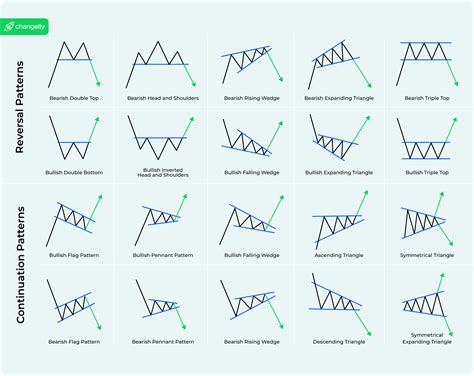

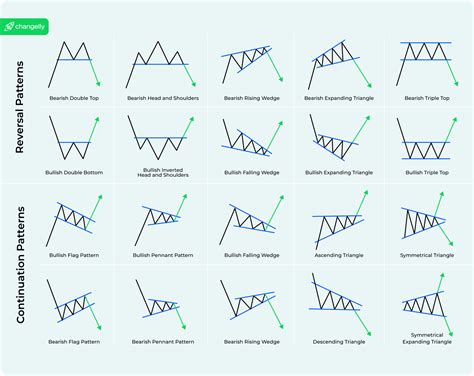

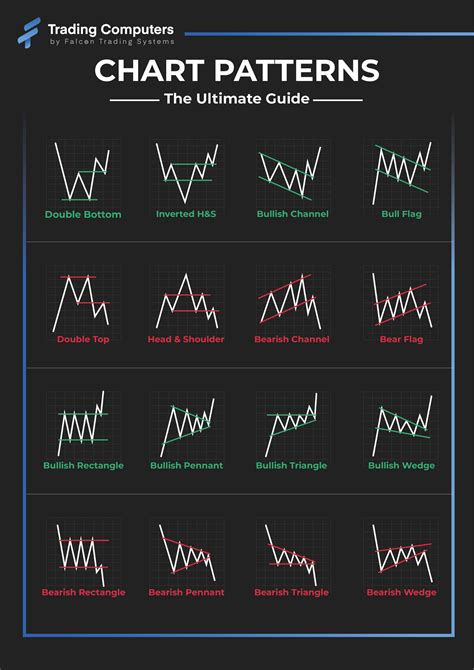

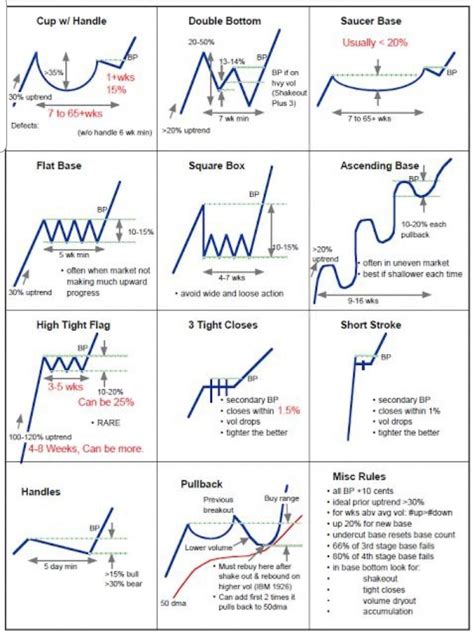

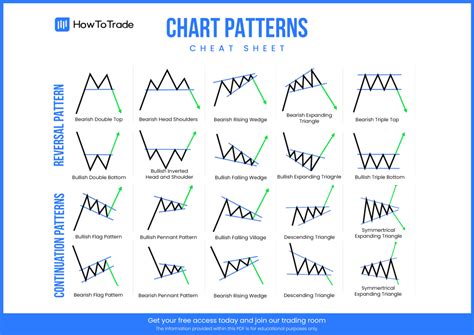

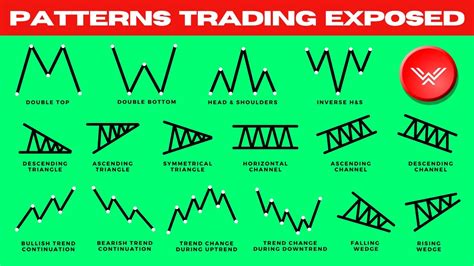

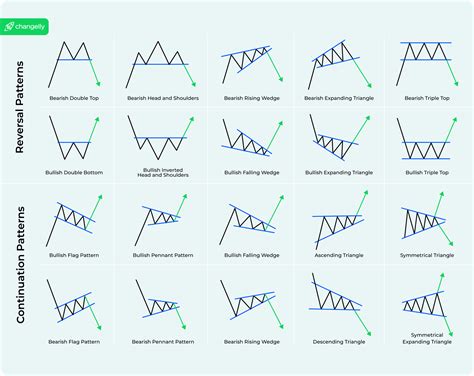

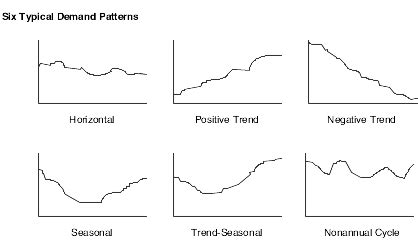

Chart patterns are specific shapes or formations that appear on a price chart, and they can be used to predict future price movements. These patterns are created by the price action of a security over time, and they can be used to identify trends, reversals, and other market phenomena. Chart patterns can be classified into two main categories: continuation patterns and reversal patterns.

Continuation Patterns

Continuation patterns are chart patterns that indicate the continuation of a trend. These patterns suggest that the price will continue to move in the same direction as the previous trend.

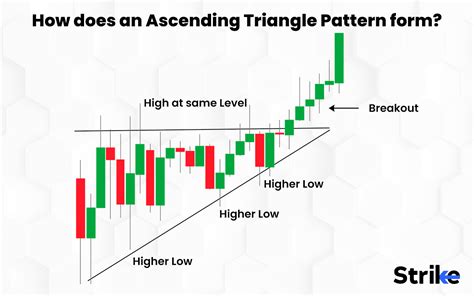

1. Ascending Triangle

An ascending triangle is a continuation pattern that forms when a security's price is consolidating in a narrow range, with higher lows and a flat upper trendline. This pattern is a bullish sign, and it suggests that the price will eventually break out to the upside.

2. Descending Triangle

A descending triangle is a continuation pattern that forms when a security's price is consolidating in a narrow range, with lower highs and a flat lower trendline. This pattern is a bearish sign, and it suggests that the price will eventually break out to the downside.

Reversal Patterns

Reversal patterns are chart patterns that indicate a change in the direction of a trend. These patterns suggest that the price will reverse and move in the opposite direction of the previous trend.

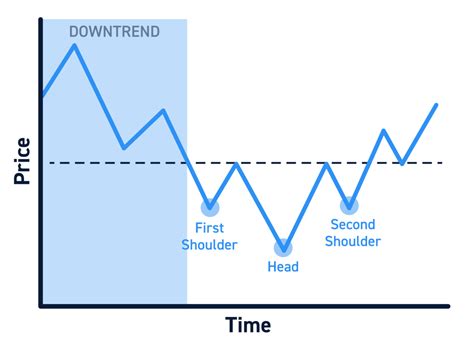

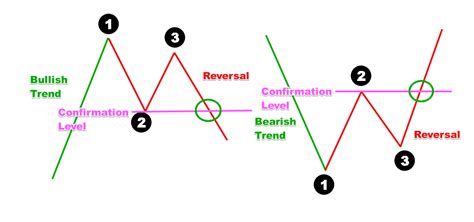

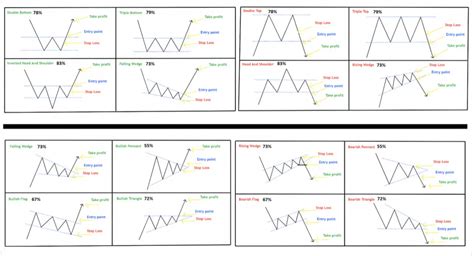

3. Head and Shoulders

A head and shoulders pattern is a reversal pattern that forms when a security's price is making a series of highs and lows, with the middle high being the highest point (the head) and the two outer highs being lower than the head (the shoulders). This pattern is a bearish sign, and it suggests that the price will eventually break out to the downside.

4. Inverse Head and Shoulders

An inverse head and shoulders pattern is a reversal pattern that forms when a security's price is making a series of lows and highs, with the middle low being the lowest point (the head) and the two outer lows being higher than the head (the shoulders). This pattern is a bullish sign, and it suggests that the price will eventually break out to the upside.

5. Double Top

A double top is a reversal pattern that forms when a security's price is making two consecutive highs at the same level, with a low in between the two highs. This pattern is a bearish sign, and it suggests that the price will eventually break out to the downside.

6. Double Bottom

A double bottom is a reversal pattern that forms when a security's price is making two consecutive lows at the same level, with a high in between the two lows. This pattern is a bullish sign, and it suggests that the price will eventually break out to the upside.

7. Triangles

Triangles are chart patterns that form when a security's price is consolidating in a narrow range, with converging trendlines. There are three types of triangles: symmetrical triangles, ascending triangles, and descending triangles.

8. Wedges

Wedges are chart patterns that form when a security's price is consolidating in a narrow range, with converging trendlines that are either rising or falling. There are two types of wedges: rising wedges and falling wedges.

9. Flags

Flags are chart patterns that form when a security's price is consolidating in a narrow range, with a flat or slightly rising trendline. This pattern is a continuation sign, and it suggests that the price will eventually break out to the upside.

10. Pennants

Pennants are chart patterns that form when a security's price is consolidating in a narrow range, with a triangular shape. This pattern is a continuation sign, and it suggests that the price will eventually break out to the upside.

Chart Patterns Image Gallery

In conclusion, chart patterns are a valuable tool for traders to predict future price movements and make informed investment decisions. By recognizing and interpreting these patterns, traders can gain a competitive edge in the markets and increase their chances of success.