Intro

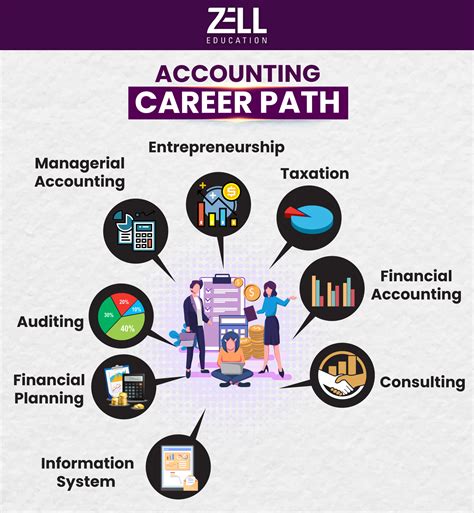

Master the fundamentals of accounting with our Debits and Credits Cheat Sheet. Learn the simple yet effective method to balance your books, understand asset, liability, and equity accounts, and navigate the accounting equation with ease. Get instant clarity on debits, credits, and the accounting cycle, and become a pro at financial record-keeping.

Accounting can be a daunting task, especially for those who are new to the field. One of the most fundamental concepts in accounting is the use of debits and credits. Understanding how to properly use debits and credits is essential for accurately recording financial transactions and preparing financial statements. In this article, we will provide a comprehensive guide to debits and credits, including a cheat sheet to help you easily navigate the world of accounting.

What are Debits and Credits?

In accounting, debits and credits are used to record changes in a company's financial position. A debit is an entry that increases an asset or expense account, while a credit is an entry that increases a liability or equity account. The key to understanding debits and credits is to remember that they are opposite sides of the same coin. When a debit is made to one account, a corresponding credit must be made to another account.

Debits and Credits: A Simple Example

Let's say a company purchases office supplies for $100. To record this transaction, the company would debit the Office Supplies Expense account for $100. At the same time, the company would credit the Cash account for $100. This is because the company has increased its office supplies expense and decreased its cash.

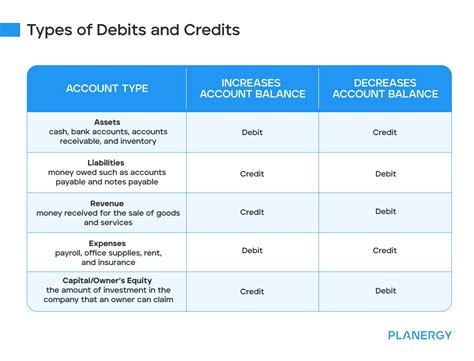

Debits and Credits Cheat Sheet

Here is a cheat sheet to help you easily navigate the world of debits and credits:

- Assets:

- Increase: Debit

- Decrease: Credit

- Liabilities:

- Increase: Credit

- Decrease: Debit

- Equity:

- Increase: Credit

- Decrease: Debit

- Revenues:

- Increase: Credit

- Decrease: Debit

- Expenses:

- Increase: Debit

- Decrease: Credit

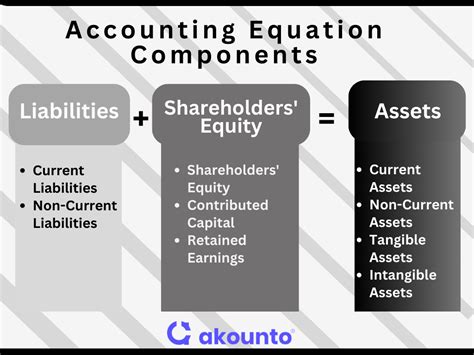

Understanding the Accounting Equation

The accounting equation is a fundamental concept in accounting that helps to explain the relationship between debits and credits. The accounting equation is:

Assets = Liabilities + Equity

This equation shows that a company's assets are equal to the sum of its liabilities and equity. When a company records a transaction, it must affect at least two accounts, one of which is an asset, liability, or equity account.

Using Debits and Credits to Record Transactions

Let's say a company purchases a piece of equipment for $10,000. To record this transaction, the company would debit the Equipment account for $10,000 and credit the Cash account for $10,000. This increases the company's equipment asset account and decreases its cash.

Common Debits and Credits Examples

Here are some common examples of debits and credits:

- Purchasing office supplies: Debit Office Supplies Expense, Credit Cash

- Paying rent: Debit Rent Expense, Credit Cash

- Purchasing equipment: Debit Equipment, Credit Cash

- Collecting cash from customers: Debit Cash, Credit Sales Revenue

- Issuing stock: Debit Cash, Credit Common Stock

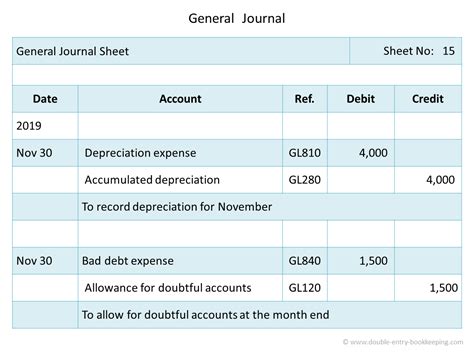

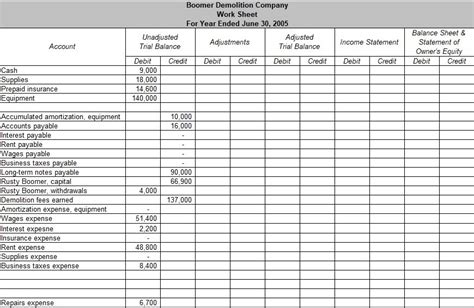

Using a Journal to Record Debits and Credits

A journal is a book of original entry that is used to record transactions. When a transaction is recorded, it is entered into the journal as a debit and credit. The journal is then used to post the transactions to the ledger accounts.

Posting Debits and Credits to the Ledger

After a transaction is recorded in the journal, it is posted to the ledger accounts. The ledger accounts are used to summarize the transactions and provide a balance for each account.

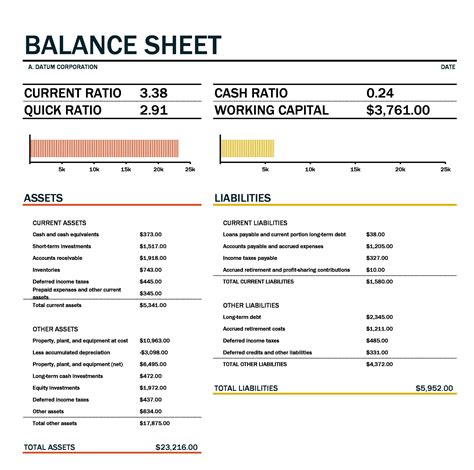

Debits and Credits in Financial Statements

Debits and credits are used to prepare financial statements, including the balance sheet and income statement. The balance sheet shows the company's assets, liabilities, and equity at a specific point in time, while the income statement shows the company's revenues and expenses over a specific period of time.

Conclusion

In conclusion, debits and credits are essential concepts in accounting that help to accurately record financial transactions and prepare financial statements. By understanding how to properly use debits and credits, you can ensure that your financial records are accurate and reliable. We hope this cheat sheet has been helpful in explaining the basics of debits and credits.

Accounting Image Gallery

We hope this article has been helpful in explaining the basics of debits and credits. If you have any questions or comments, please feel free to share them below.