Managing your business's finances effectively is crucial for success, and a key part of that is tracking your profit and loss (P&L) statement. A P&L statement, also known as an income statement, summarizes your company's revenues and expenses over a specific period of time, usually a month, quarter, or year. This statement provides valuable insights into your business's financial performance, helping you make informed decisions.

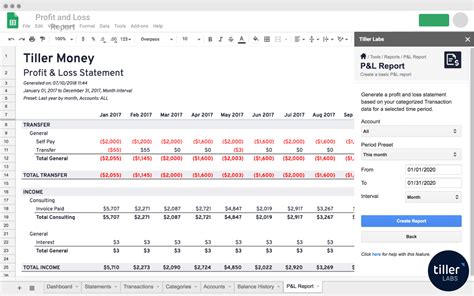

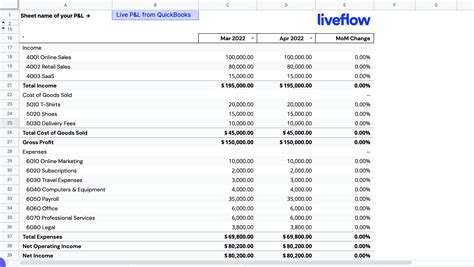

One of the most accessible and versatile tools for creating a P&L template is Google Sheets. Google Sheets offers a free, web-based spreadsheet program that allows real-time collaboration and automatic saving, making it an ideal choice for businesses of all sizes. Here, we'll guide you through creating a basic profit and loss template in Google Sheets.

Why Use a Profit and Loss Template in Google Sheets?

Using a P&L template in Google Sheets offers several advantages:

- Accessibility: Google Sheets is free and accessible from anywhere with an internet connection, making it easy to share with team members or accountants.

- Collaboration: Multiple users can edit the spreadsheet simultaneously, reducing errors and increasing productivity.

- Automatic Savings: Changes are saved automatically, ensuring you never lose your work.

- Flexibility: Google Sheets allows for easy formatting and customization of your P&L template to suit your business's specific needs.

How to Create a Basic Profit and Loss Template in Google Sheets

Creating a basic P&L template involves setting up sections for revenues, cost of goods sold, operating expenses, and calculating net income. Here's a step-by-step guide:

-

Set Up Your Template:

- Go to Google Drive and click on "New" > "Google Sheets" to create a new spreadsheet.

- Name your spreadsheet, e.g., "Profit and Loss Statement."

-

Revenue Section:

- Label the first column as "Revenues" and list your revenue streams (e.g., Sales, Services, Interest Income) in the rows below.

- In the next column, enter the corresponding amounts for each revenue stream.

-

Cost of Goods Sold (COGS) Section:

- Below the revenues section, label the next section as "Cost of Goods Sold."

- List your direct costs associated with producing or purchasing your products or services.

- Calculate the total COGS.

-

Gross Profit Calculation:

- Create a row to calculate the Gross Profit by subtracting the total COGS from the total revenues.

-

Operating Expenses Section:

- List all your operating expenses (salaries, rent, utilities, etc.) below the gross profit line.

- Calculate the total operating expenses.

-

Operating Income Calculation:

- Calculate the operating income by subtracting the total operating expenses from the gross profit.

-

Non-Operating Items:

- Include sections for non-operating income and expenses (interest income, taxes, etc.).

-

Net Income Calculation:

- Finally, calculate the net income by adding non-operating income and subtracting non-operating expenses from the operating income.

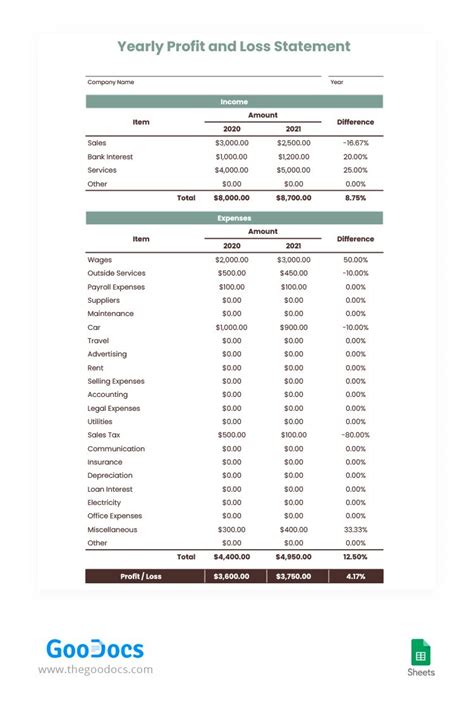

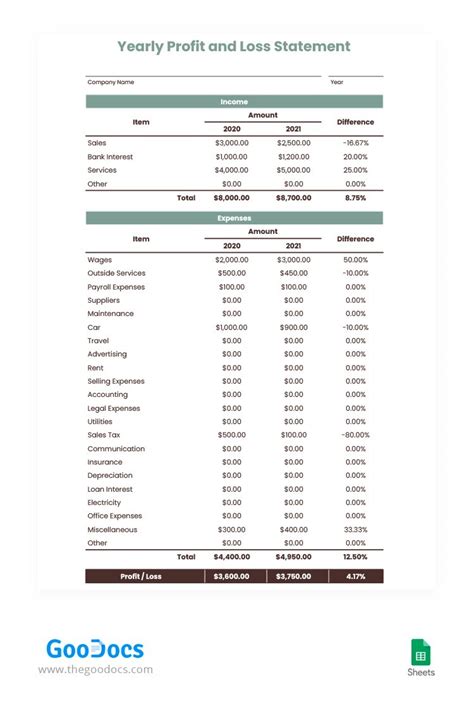

Example of a Basic P&L Template Layout:

| Category | Amount |

|---|---|

| Revenues | |

| Sales | $100,000 |

| Services | $20,000 |

| Interest Income | $5,000 |

| Total Revenues | $125,000 |

| Cost of Goods Sold | |

| Direct Materials | $30,000 |

| Direct Labor | $20,000 |

| Total COGS | $50,000 |

| Gross Profit | $75,000 |

| Operating Expenses | |

| Salaries | $20,000 |

| Rent | $10,000 |

| Total Operating Expenses | $30,000 |

| Operating Income | $45,000 |

| Non-Operating Items | |

| Interest Expense | -$5,000 |

| Taxes | -$10,000 |

| Net Income | $30,000 |

Tips for Customizing Your Profit and Loss Template

- Use Conditional Formatting: Highlight cells that exceed certain thresholds or contain errors to quickly identify areas needing attention.

- Automate Calculations: Use Google Sheets formulas to automatically calculate totals and percentages, reducing manual errors.

- Create Drop-Down Lists: For categories like expense types or departments, use drop-down lists to ensure consistency and ease of entry.

- Track Monthly or Quarterly Performance: Use separate sheets for each period to compare performance over time.

FAQs

-

Q: Can I use a profit and loss template for personal finance tracking?

- A: Yes, while this guide focuses on business use, you can adapt the template for personal finance tracking by categorizing your income and expenses similarly.

-

Q: How often should I update my P&L statement?

- A: It's recommended to update your P&L statement monthly to closely monitor your business's financial health and make timely adjustments.

-

Q: Can I share my P&L template with my accountant or financial advisor?

- A: Yes, Google Sheets allows you to share your spreadsheet with others, making it easy to collaborate with financial professionals.

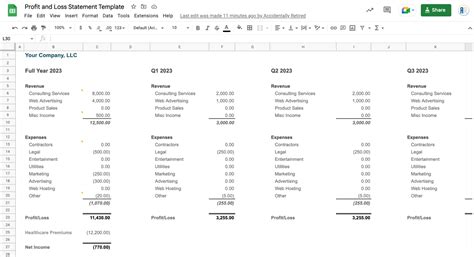

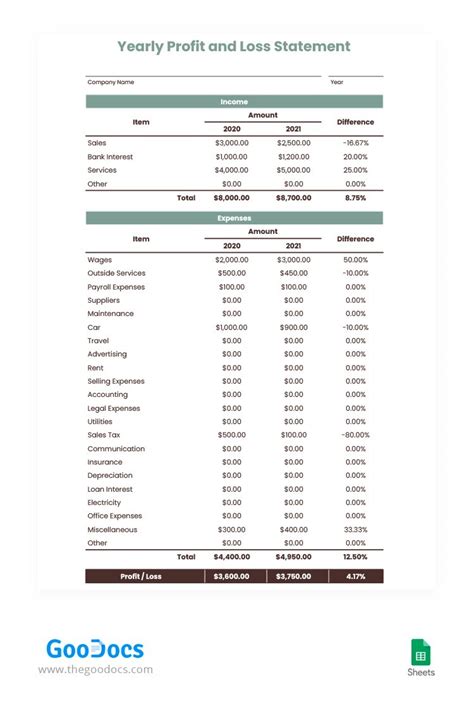

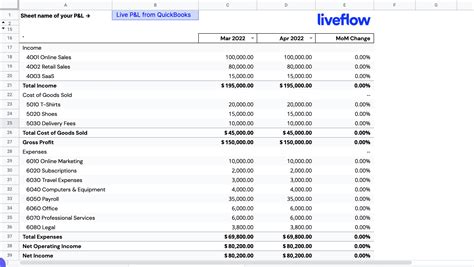

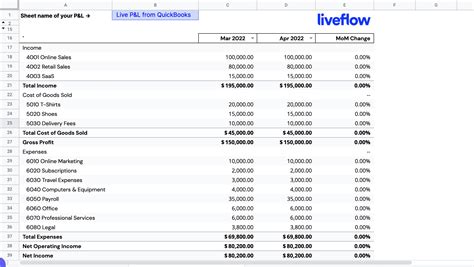

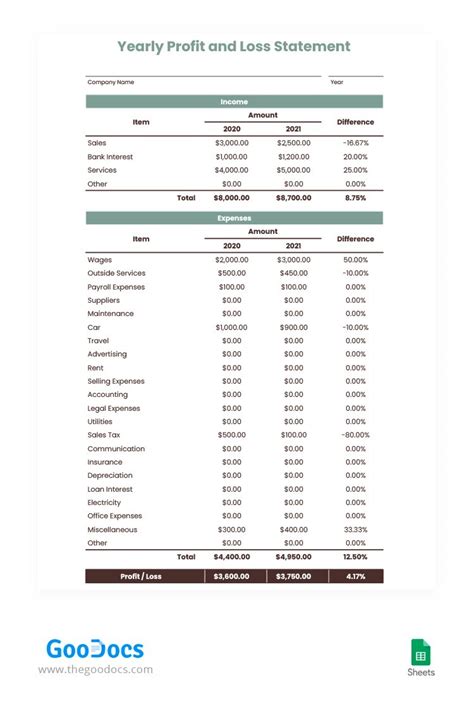

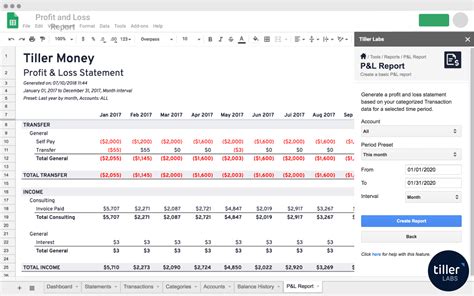

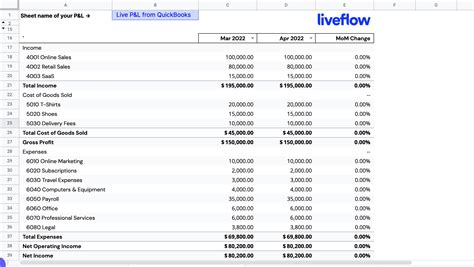

Profit and Loss Template Google Sheets Image Gallery

By following these steps and tips, you can create a comprehensive profit and loss template in Google Sheets that helps you efficiently track your business's financial performance. Remember, the key to benefiting from a P&L statement is regular updates and analysis, allowing you to make informed decisions to drive your business forward.