Intro

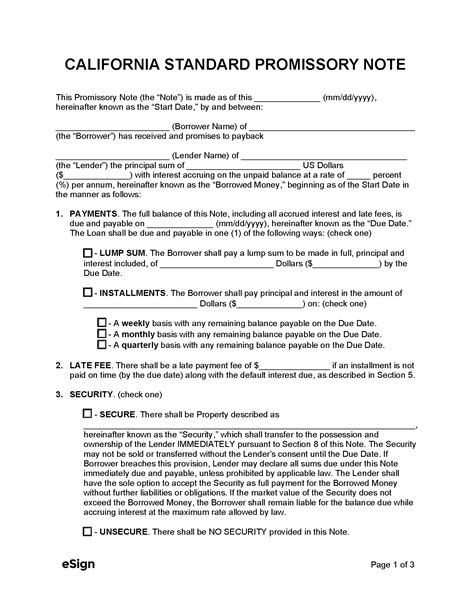

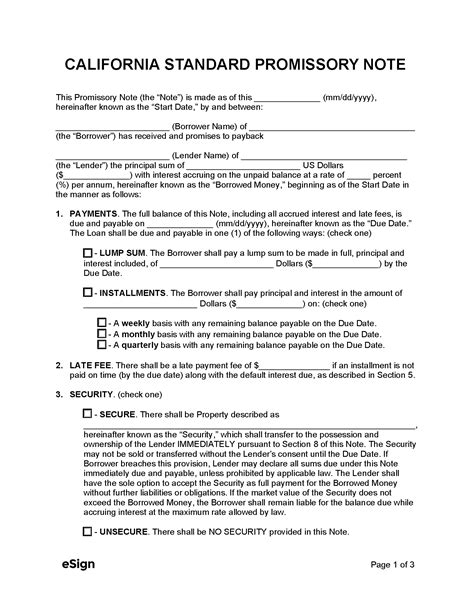

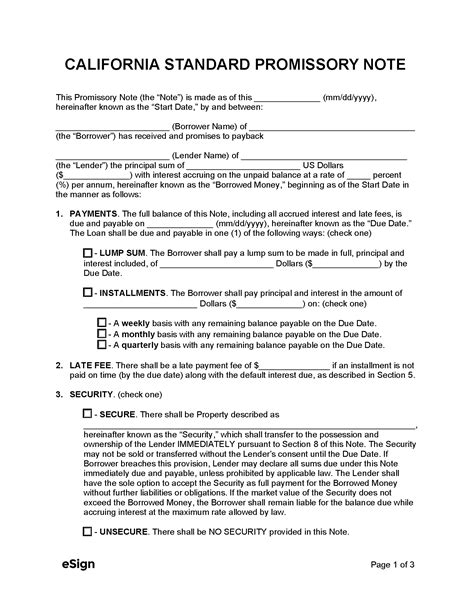

When it comes to lending or borrowing money in California, a promissory note is a crucial document that outlines the terms of the loan. A promissory note is a written agreement between two parties, where one party (the borrower) promises to pay a sum of money to the other party (the lender) according to a specified schedule. In California, a promissory note must contain certain essential elements to be considered valid. In this article, we will explore the five essential elements of a promissory note in California.

What is a Promissory Note?

A promissory note is a type of contract that outlines the terms of a loan. It is a written agreement between two parties, where one party promises to pay a sum of money to the other party according to a specified schedule. A promissory note typically includes the amount borrowed, the interest rate, the repayment terms, and the due date.

Essential Elements of a Promissory Note in California

For a promissory note to be considered valid in California, it must contain the following essential elements:

1. Identification of the Parties

The promissory note must identify the parties involved in the loan transaction. This includes the name and address of the borrower and the lender. In California, the promissory note must also include the borrower's social security number or individual taxpayer identification number.

2. Amount and Terms of the Loan

The promissory note must specify the amount borrowed and the terms of the loan. This includes the interest rate, the repayment terms, and the due date. In California, the promissory note must also specify whether the loan is secured or unsecured.

3. Promise to Pay

The promissory note must include a promise to pay the loan amount, including any interest and fees. The promise to pay must be unconditional and must specify the method of payment.

4. Date and Signatures

The promissory note must be dated and signed by both the borrower and the lender. In California, the promissory note must also be notarized.

5. Governing Law

The promissory note must specify the governing law that applies to the loan transaction. In California, the promissory note must specify that the loan transaction is governed by California law.

In conclusion, a promissory note is a crucial document that outlines the terms of a loan in California. To be considered valid, a promissory note must contain the five essential elements outlined above. These elements include identification of the parties, amount and terms of the loan, promise to pay, date and signatures, and governing law.

Gallery of Promissory Note California

Promissory Note California Image Gallery

We hope this article has provided you with a comprehensive understanding of the essential elements of a promissory note in California. If you have any questions or comments, please feel free to share them below.