Intro

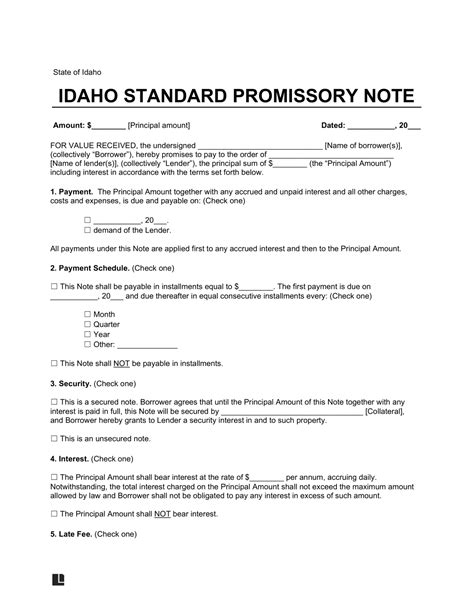

Learn the crucial components of a Promissory Note Template in Idaho. Discover the 5 essential elements to include for a legally binding agreement, covering loan terms, repayment schedules, and default clauses. Ensure your template is compliant with Idaho state laws and protect your interests with this comprehensive guide.

A promissory note is a crucial document that outlines the terms of a loan between two parties. In the state of Idaho, a promissory note template must include certain essential elements to ensure that the agreement is binding and enforceable. In this article, we will discuss the five essential elements that must be included in a promissory note template in Idaho.

What is a Promissory Note?

A promissory note is a written promise by one party (the borrower) to repay a loan to another party (the lender). The note outlines the terms of the loan, including the amount borrowed, interest rate, repayment terms, and any other conditions or requirements.

5 Essential Elements of a Promissory Note Template Idaho

The 5 Essential Elements of a Promissory Note Template Idaho

Here are the five essential elements that must be included in a promissory note template in Idaho:

1. Identification of the Parties

The promissory note must clearly identify the parties involved in the loan agreement, including the borrower and the lender. This includes their names, addresses, and contact information. This section is essential to ensure that the parties are aware of their obligations and responsibilities under the loan agreement.

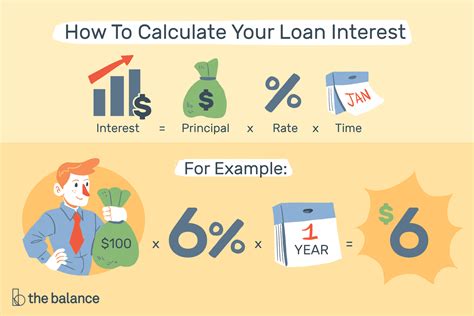

2. Loan Amount and Interest Rate

The promissory note must specify the loan amount and the interest rate charged on the loan. The interest rate must be clearly stated, and any conditions or requirements for interest rate changes must be outlined. This section is critical to ensure that the borrower understands the total cost of the loan and the lender's expectations for repayment.

3. Repayment Terms

The promissory note must outline the repayment terms of the loan, including the repayment schedule, payment amount, and any conditions or requirements for repayment. This section is essential to ensure that the borrower understands their obligations and responsibilities under the loan agreement.

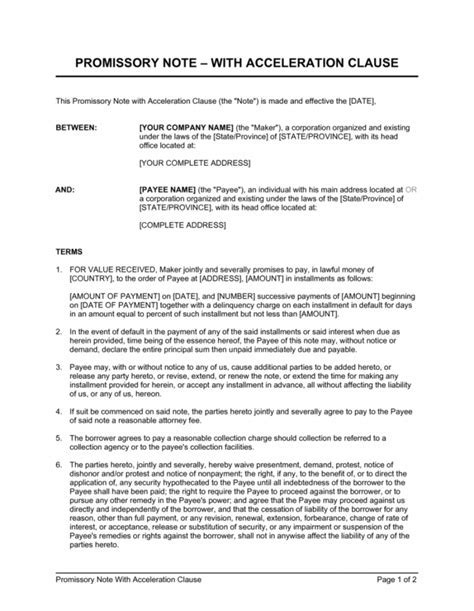

4. Default and Acceleration

The promissory note must specify the conditions under which the loan will be considered in default and the consequences of default. This includes any fees or charges associated with default and the lender's right to accelerate the loan. This section is critical to ensure that the borrower understands the risks associated with default and the lender's expectations for repayment.

5. Governing Law and Jurisdiction

The promissory note must specify the governing law and jurisdiction that will apply to the loan agreement. This includes the laws of the state of Idaho and the jurisdiction of the courts in Idaho. This section is essential to ensure that the parties understand the applicable laws and regulations that will govern the loan agreement.

Why Use a Promissory Note Template Idaho?

Using a promissory note template in Idaho can provide several benefits, including:

- Ensuring compliance with Idaho laws and regulations

- Providing a clear understanding of the loan agreement and the parties' obligations

- Reducing the risk of disputes and misunderstandings

- Protecting the lender's interests and ensuring repayment of the loan

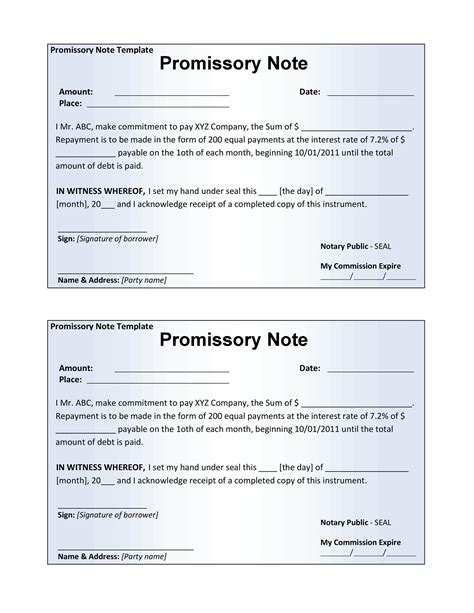

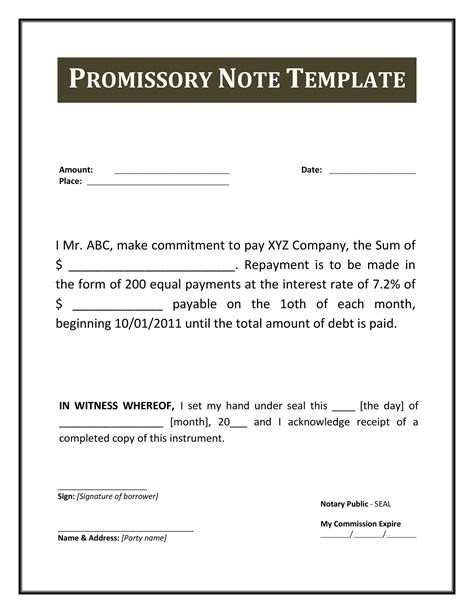

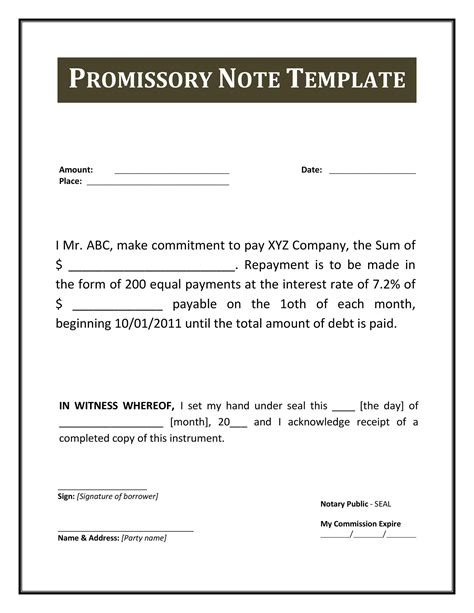

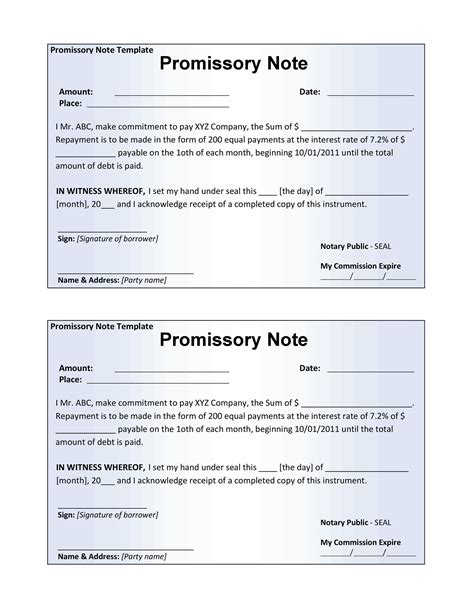

Gallery of Promissory Note Templates

Promissory Note Templates

By including these five essential elements in a promissory note template in Idaho, lenders can ensure that their loan agreements are binding, enforceable, and compliant with Idaho laws and regulations. Borrowers can also benefit from using a promissory note template, as it provides a clear understanding of their obligations and responsibilities under the loan agreement.