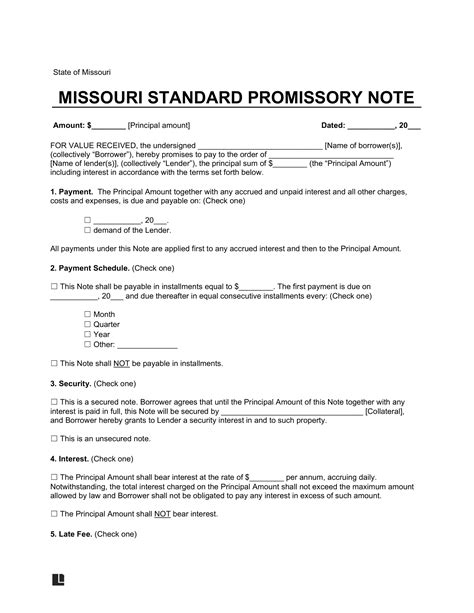

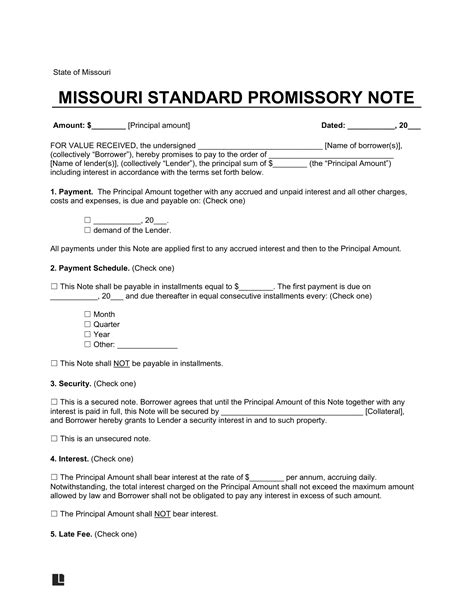

7 Essential Elements Of A Missouri Promissory Note Template Summary

Secure your loan agreements with a comprehensive Missouri promissory note template. Learn the 7 essential elements to include, such as loan terms, interest rates, and repayment schedules. Ensure enforceability and protect your interests with a well-structured template. Discover the must-haves for a legally binding note, including payment obligations and default clauses.

As a business owner or lender in Missouri, creating a promissory note template is a crucial step in formalizing loan agreements. A promissory note serves as a binding contract between the lender and borrower, outlining the terms and conditions of the loan. In this article, we will explore the 7 essential elements of a Missouri promissory note template, ensuring you have a comprehensive understanding of what to include.

Understanding the Importance of a Promissory Note

A promissory note is a written promise to pay a specified amount of money to the lender, typically with interest and repayment terms. It is a crucial document that protects both parties in the event of a dispute or default. Without a promissory note, lenders may struggle to recover their investment, while borrowers may face unclear expectations.

7 Essential Elements of a Missouri Promissory Note Template

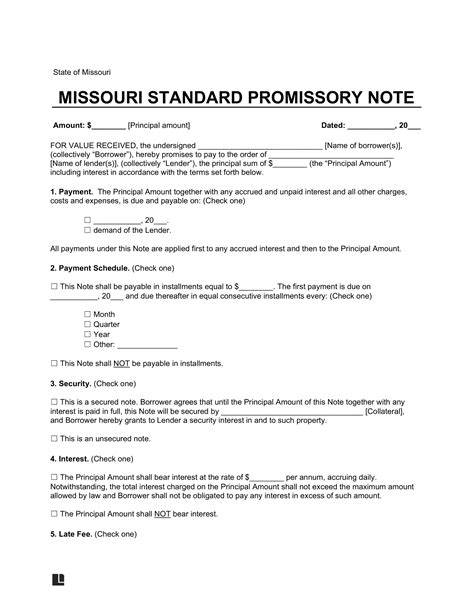

When creating a Missouri promissory note template, it is essential to include the following 7 elements:

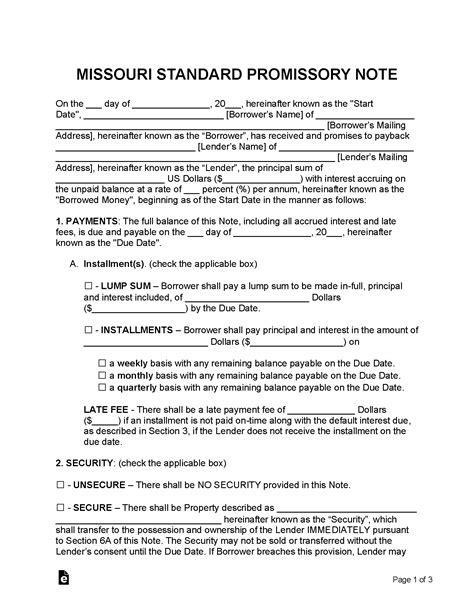

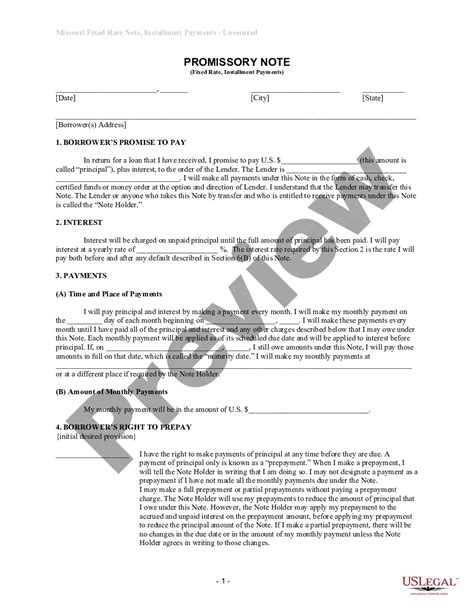

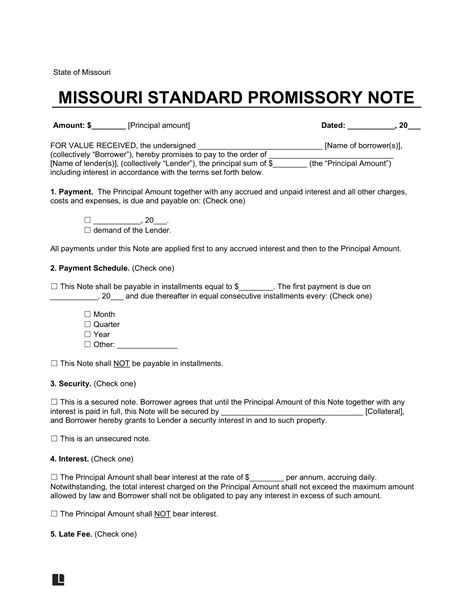

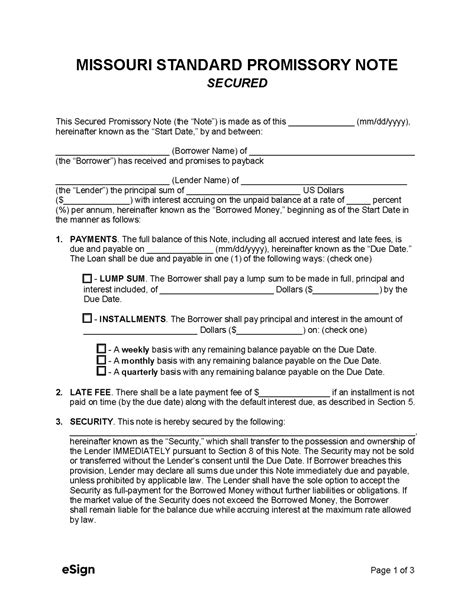

1. Parties Involved

The promissory note should clearly identify the parties involved, including the lender (also known as the payee) and the borrower (also known as the maker). Include the full names, addresses, and contact information for both parties.

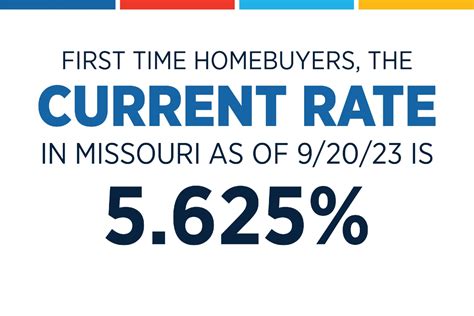

2. Loan Amount and Interest Rate

Specify the total amount borrowed (principal) and the interest rate charged on the loan. The interest rate should be expressed as a percentage and may be fixed or variable. Missouri law governs the maximum interest rates that can be charged on loans.

3. Repayment Terms

Outline the repayment terms, including the frequency of payments (e.g., monthly, quarterly), the payment amount, and the total number of payments. Specify the due date for each payment and the late payment fee (if applicable).

4. Collateral (If Applicable)

If the loan is secured by collateral (e.g., property, vehicle), describe the collateral in detail, including its value and any conditions related to its use.

5. Default and Acceleration

Specify the circumstances under which the borrower will be considered in default (e.g., late payment, failure to pay). Outline the consequences of default, including acceleration of the loan (i.e., the entire balance becomes due immediately).

6. Governing Law and Jurisdiction

Indicate that the promissory note will be governed by and construed in accordance with the laws of the State of Missouri. Specify the jurisdiction for any disputes arising from the note.

7. Signatures and Acknowledgments

Both parties must sign and date the promissory note to acknowledge their agreement to its terms. Include space for signatures and any additional acknowledgments (e.g., notarization).

By including these 7 essential elements, you can create a comprehensive and enforceable Missouri promissory note template that protects both lenders and borrowers.

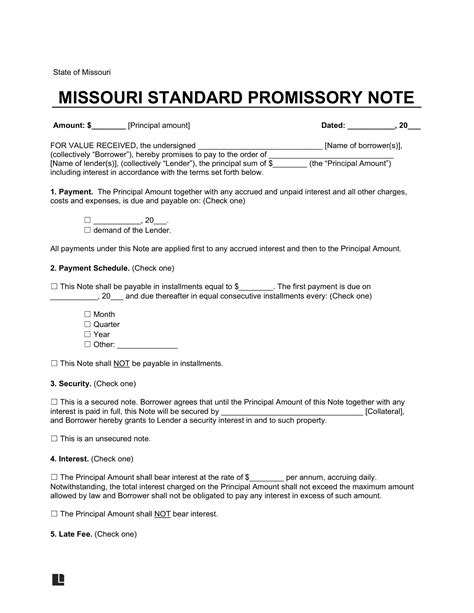

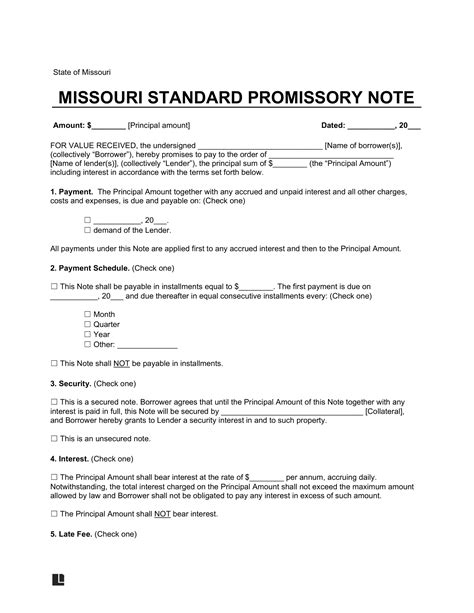

Gallery of Missouri Promissory Note Templates

Missouri Promissory Note Template Gallery

We hope this comprehensive guide has helped you understand the essential elements of a Missouri promissory note template. If you have any further questions or need assistance creating a template, please don't hesitate to reach out.