Intro

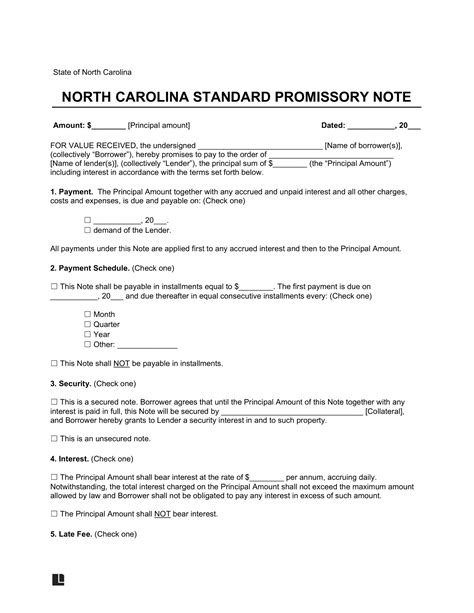

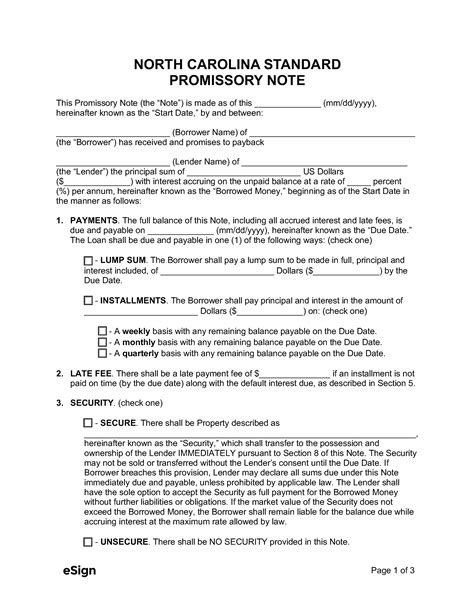

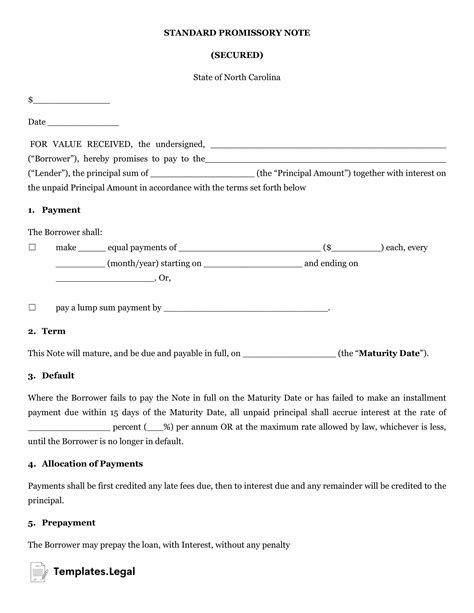

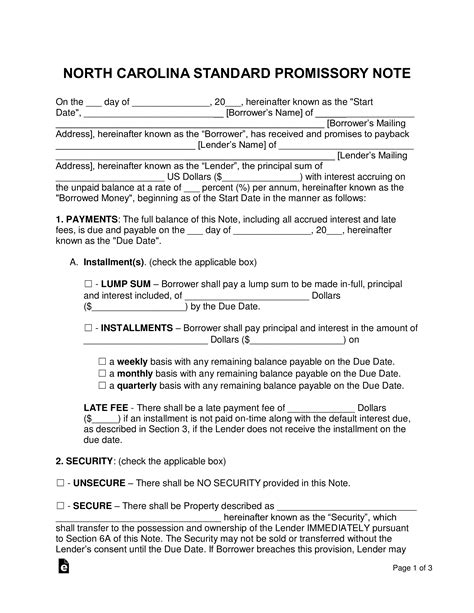

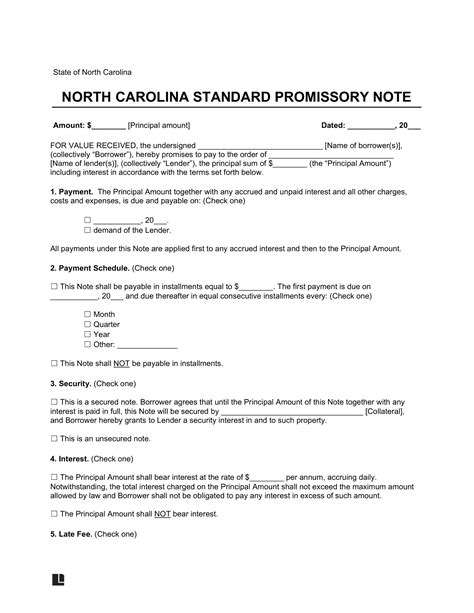

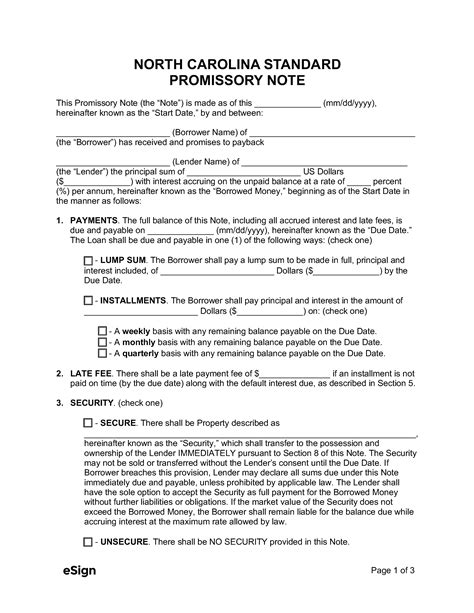

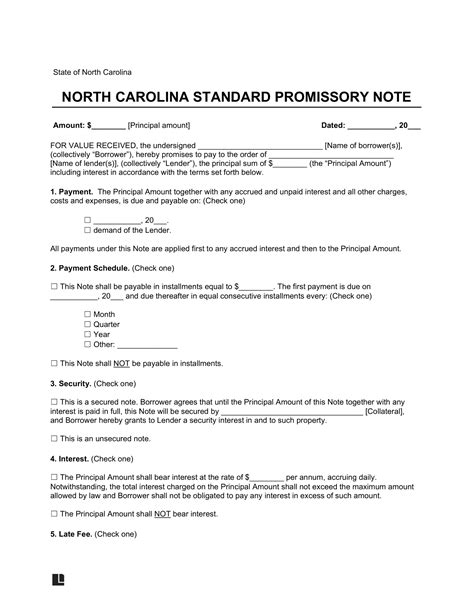

Secure your loans with a North Carolina Promissory Note Template. Easily create a binding agreement with our customizable template, ensuring loan repayment terms, interest rates, and payment schedules are clearly outlined. Download now and safeguard your financial interests with a legally enforceable promissory note in NC.

A promissory note is a crucial document in any lending or borrowing transaction, serving as a written promise to repay a debt. In North Carolina, having a comprehensive and well-structured promissory note template is essential for lenders and borrowers alike. This article will guide you through the process of creating a North Carolina promissory note template, highlighting the key elements, and providing valuable insights to ensure a smooth transaction.

Understanding the Importance of a Promissory Note in North Carolina

A promissory note is a legally binding agreement that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment terms, and default clauses. In North Carolina, a promissory note provides a clear understanding of the parties' obligations and responsibilities, protecting both the lender and borrower from potential disputes.

Key Components of a North Carolina Promissory Note Template

When creating a North Carolina promissory note template, it's essential to include the following key components:

- Parties involved: The names and addresses of the lender and borrower

- Loan amount: The principal amount borrowed

- Interest rate: The rate at which interest will be charged

- Repayment terms: The frequency and amount of payments

- Default clauses: The consequences of failing to make payments

- Governing law: The laws of North Carolina that will govern the agreement

Creating a Comprehensive North Carolina Promissory Note Template

To create a comprehensive North Carolina promissory note template, follow these steps:

- Define the parties involved: Clearly state the names and addresses of the lender and borrower.

- Specify the loan amount: Outline the principal amount borrowed and any applicable interest rates.

- Establish repayment terms: Define the frequency and amount of payments, including the payment schedule and any late fees.

- Include default clauses: Specify the consequences of failing to make payments, such as acceleration of the loan or collection costs.

- Governing law: State that the laws of North Carolina will govern the agreement.

Benefits of Using a North Carolina Promissory Note Template

Using a North Carolina promissory note template offers several benefits, including:

- Clear understanding of obligations: A comprehensive template ensures that both parties understand their responsibilities and obligations.

- Protection from disputes: A well-structured template can help prevent disputes by outlining the terms and conditions of the loan.

- Compliance with North Carolina laws: A template that adheres to North Carolina laws and regulations ensures that the agreement is enforceable.

Common Mistakes to Avoid When Creating a North Carolina Promissory Note Template

When creating a North Carolina promissory note template, avoid the following common mistakes:

- Ambiguous language: Ensure that the template uses clear and concise language to avoid confusion.

- Inadequate information: Include all necessary information, such as the loan amount, interest rate, and repayment terms.

- Non-compliance with North Carolina laws: Ensure that the template adheres to North Carolina laws and regulations.

Best Practices for Using a North Carolina Promissory Note Template

To ensure a smooth transaction, follow these best practices when using a North Carolina promissory note template:

- Carefully review the template: Ensure that the template meets your specific needs and complies with North Carolina laws.

- Seek professional advice: Consult with an attorney or financial advisor to ensure that the template is comprehensive and accurate.

- Keep records: Keep accurate records of the loan, including payments and any communication with the borrower.

Gallery of North Carolina Promissory Note Templates

North Carolina Promissory Note Templates

In conclusion, a comprehensive North Carolina promissory note template is essential for lenders and borrowers to ensure a smooth transaction. By following the guidelines outlined in this article and avoiding common mistakes, you can create a well-structured template that protects your interests and complies with North Carolina laws.