Intro

Create a legally binding agreement with an Oklahoma Promissory Note Template. Learn the 5 essential details to include, such as loan terms, interest rates, and repayment schedules. Understand Oklahomas specific laws and regulations to ensure a secure and enforceable promissory note, perfect for lenders and borrowers alike.

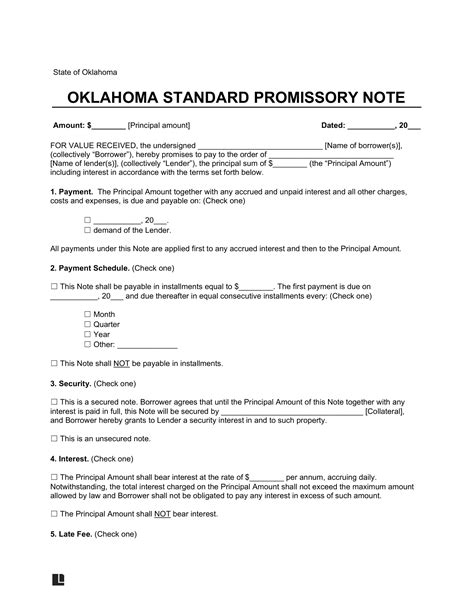

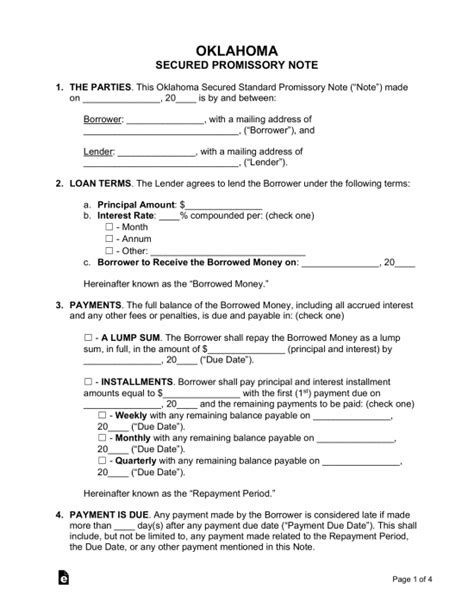

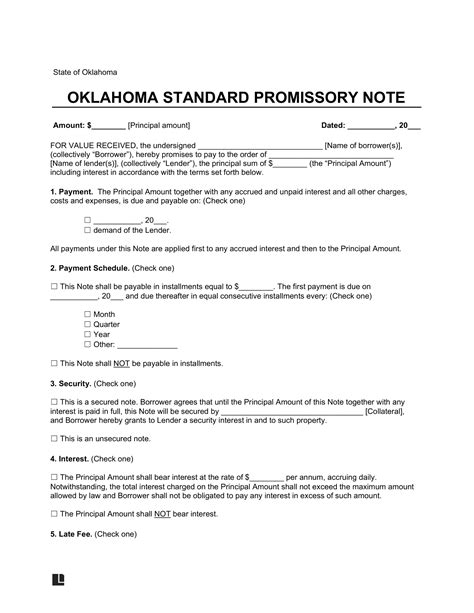

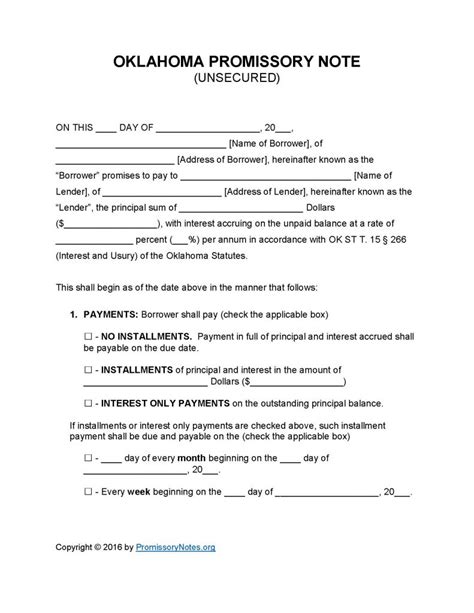

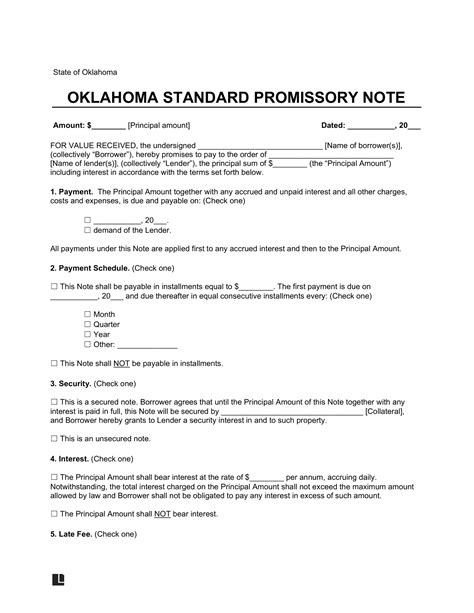

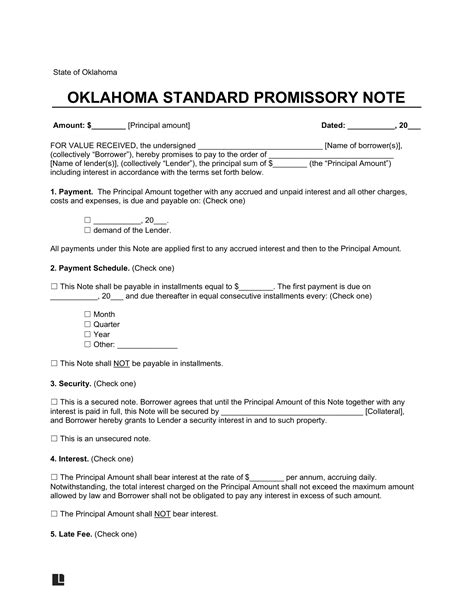

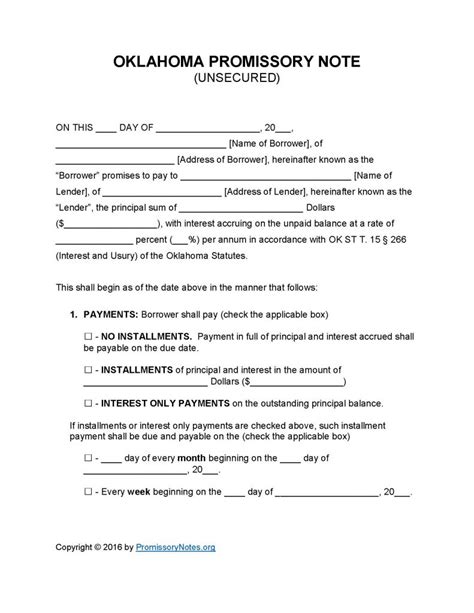

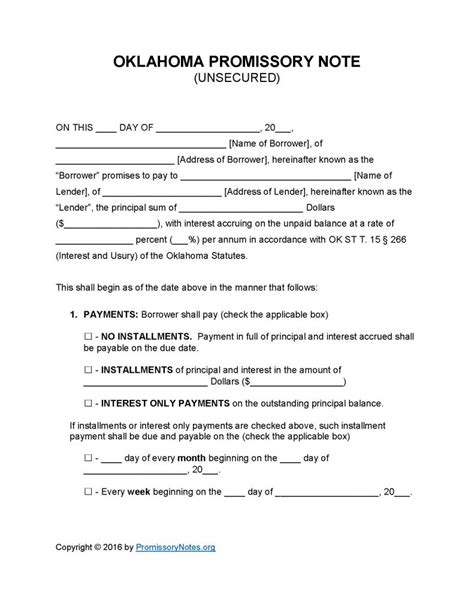

When it comes to lending or borrowing money in Oklahoma, having a clear and comprehensive agreement in place is essential to protect both parties' interests. One of the most commonly used documents for this purpose is an Oklahoma promissory note template. A promissory note is a written agreement that outlines the terms and conditions of a loan, including the amount borrowed, interest rate, repayment schedule, and any collateral or security required.

In this article, we will explore the five essential details that should be included in an Oklahoma promissory note template to ensure that it is comprehensive, effective, and legally binding.

1. Borrower and Lender Information

The first essential detail to include in an Oklahoma promissory note template is the borrower and lender information. This should include the names, addresses, and contact information of both parties. It's also important to specify the borrower's and lender's capacities, such as whether they are acting as individuals or on behalf of a business or organization.

Including this information helps to establish the identities of the parties involved and provides a clear understanding of their roles and responsibilities.

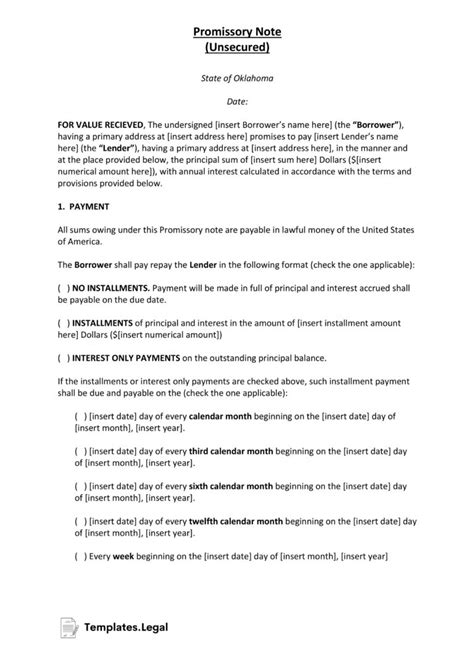

2. Loan Amount and Interest Rate

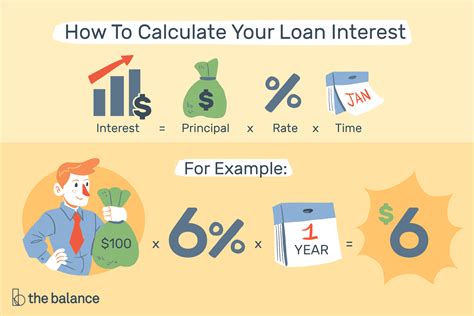

The second essential detail to include in an Oklahoma promissory note template is the loan amount and interest rate. This should specify the total amount borrowed, the interest rate applicable, and the frequency of interest accrual.

The interest rate can be fixed or variable, and the loan amount can be a single sum or a series of advances. It's also important to specify the payment terms, including the repayment schedule and any late payment fees.

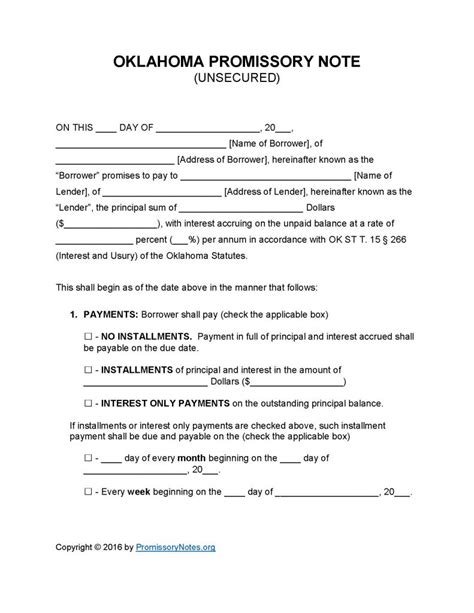

3. Repayment Terms

The third essential detail to include in an Oklahoma promissory note template is the repayment terms. This should specify the repayment schedule, including the frequency and amount of payments, as well as the final payment date.

The repayment terms can be tailored to suit the needs of both parties, including installment payments, balloon payments, or lump sum payments.

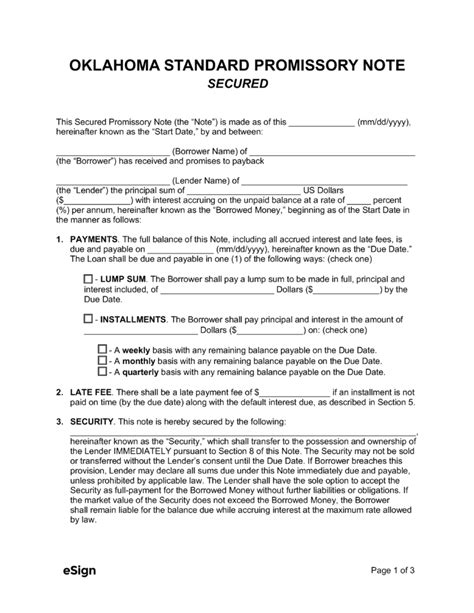

4. Collateral or Security

The fourth essential detail to include in an Oklahoma promissory note template is collateral or security. This should specify any assets or property that the borrower has pledged as collateral to secure the loan.

Collateral can include real estate, vehicles, equipment, or other assets. By including this information, the lender can protect their interests in the event of default.

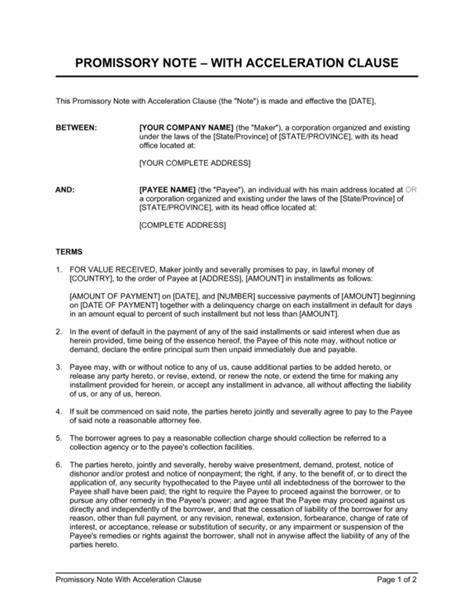

5. Default and Acceleration

The fifth essential detail to include in an Oklahoma promissory note template is default and acceleration. This should specify the circumstances under which the loan can be declared in default, such as late payments or failure to comply with the terms and conditions.

In the event of default, the lender can accelerate the loan, requiring the borrower to repay the entire amount immediately. This clause helps to protect the lender's interests and ensures that the borrower takes their obligations seriously.

Oklahoma Promissory Note Template Image Gallery

In conclusion, an Oklahoma promissory note template is a vital document for lenders and borrowers to establish a clear and comprehensive agreement. By including the five essential details outlined above, both parties can protect their interests and ensure that the loan is repaid according to the agreed terms. Remember to always consult with a lawyer or financial advisor before signing any loan agreement.

We hope this article has provided valuable insights into the importance of an Oklahoma promissory note template. If you have any questions or comments, please feel free to share them below.