Intro

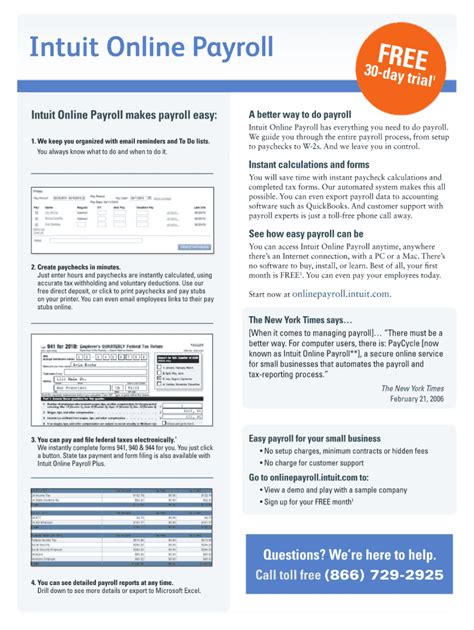

Streamline payroll processing with our 5 customizable QuickBooks pay stub templates. Easily create professional pay stubs with our free downloadable templates, featuring essential fields for employee details, pay rates, deductions, and more. Simplify payroll management and ensure compliance with our adaptable templates, perfect for small businesses and accountants.

Creating pay stubs for your employees can be a tedious task, but with the right tools, it can be a breeze. QuickBooks is a popular accounting software that helps small businesses manage their finances, including payroll. However, finding the perfect pay stub template can be challenging. In this article, we will explore five QuickBooks pay stub templates that you can use to create professional-looking pay stubs for your employees.

Why Use Pay Stub Templates?

Before we dive into the templates, let's discuss why using pay stub templates is important. Pay stubs are an essential part of employee compensation, and they provide a clear breakdown of an employee's earnings and deductions. By using a pay stub template, you can ensure that your pay stubs are accurate, consistent, and comply with state and federal regulations.

Benefits of Using QuickBooks Pay Stub Templates

QuickBooks offers a range of pay stub templates that can help you streamline your payroll process. Here are some benefits of using QuickBooks pay stub templates:

- Time-saving: QuickBooks pay stub templates can save you time and effort by automating the pay stub creation process.

- Accuracy: QuickBooks pay stub templates ensure that your pay stubs are accurate and comply with state and federal regulations.

- Customization: QuickBooks pay stub templates can be customized to fit your business needs and branding.

- Professional-looking: QuickBooks pay stub templates can help you create professional-looking pay stubs that reflect positively on your business.

5 QuickBooks Pay Stub Templates

Here are five QuickBooks pay stub templates that you can use to create professional-looking pay stubs for your employees:

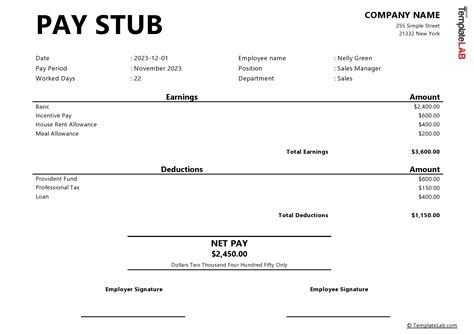

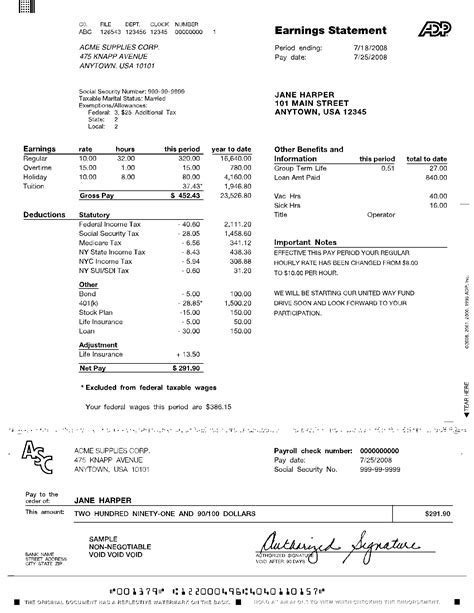

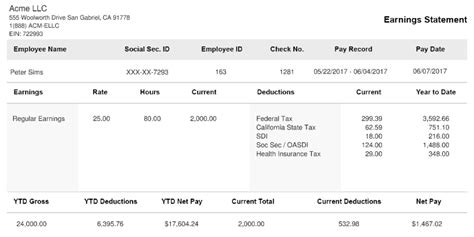

Template 1: Basic Pay Stub Template

The basic pay stub template is a simple and straightforward template that provides a clear breakdown of an employee's earnings and deductions. This template is ideal for small businesses that want to create a basic pay stub that meets state and federal regulations.

Template Features:

- Employee name and address

- Pay period and pay date

- Gross earnings and net earnings

- Federal and state taxes

- Other deductions (e.g., health insurance, 401(k))

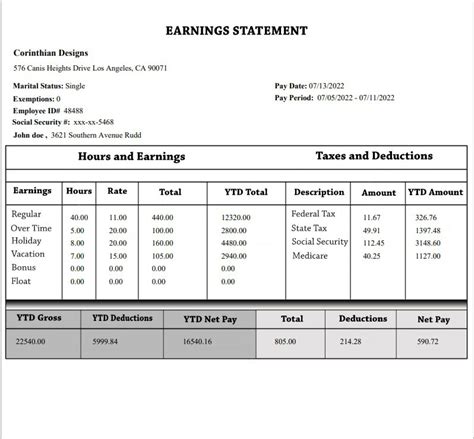

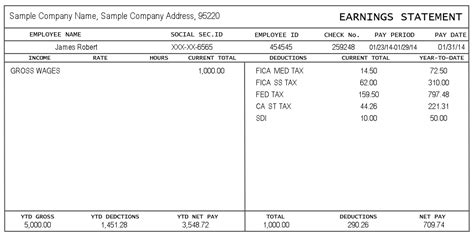

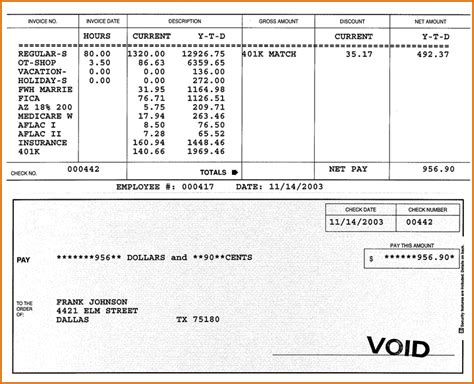

Template 2: Detailed Pay Stub Template

The detailed pay stub template provides a comprehensive breakdown of an employee's earnings and deductions. This template is ideal for businesses that want to provide their employees with a detailed understanding of their compensation.

Template Features:

- Employee name and address

- Pay period and pay date

- Gross earnings and net earnings

- Federal and state taxes

- Other deductions (e.g., health insurance, 401(k))

- Breakdown of earnings by pay type (e.g., regular, overtime)

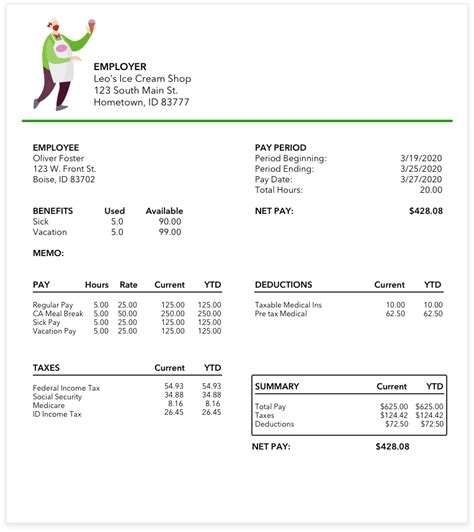

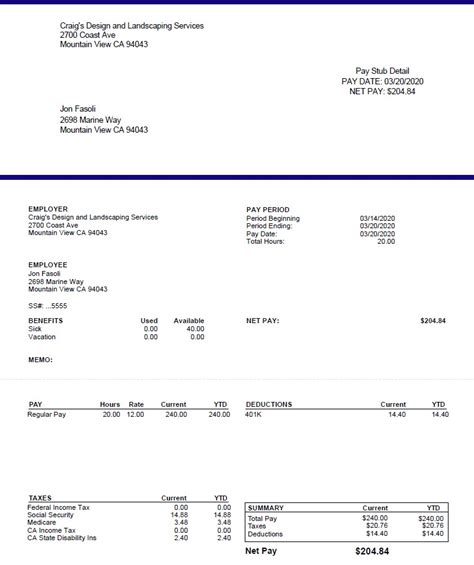

Template 3: Hourly Pay Stub Template

The hourly pay stub template is designed for businesses that pay their employees on an hourly basis. This template provides a clear breakdown of an employee's hourly earnings and deductions.

Template Features:

- Employee name and address

- Pay period and pay date

- Hourly earnings and total hours worked

- Federal and state taxes

- Other deductions (e.g., health insurance, 401(k))

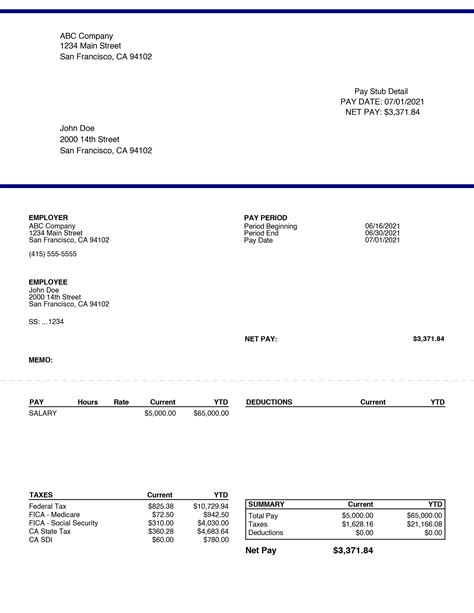

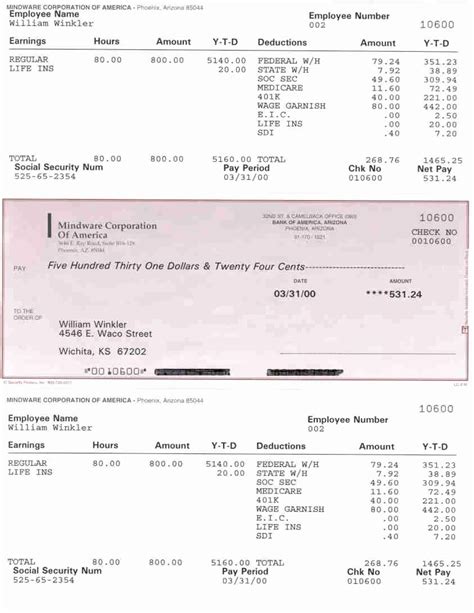

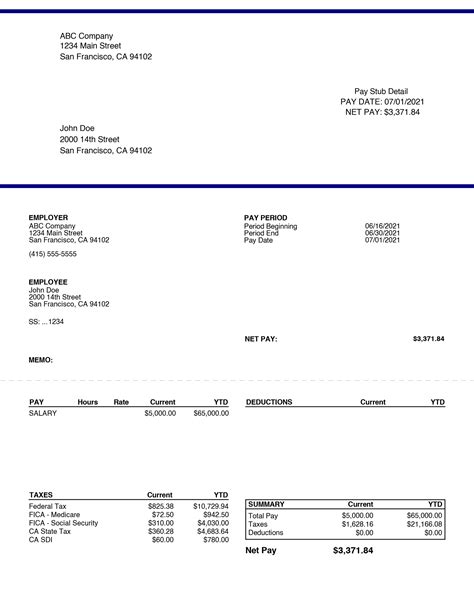

Template 4: Salary Pay Stub Template

The salary pay stub template is designed for businesses that pay their employees a salary. This template provides a clear breakdown of an employee's salary and deductions.

Template Features:

- Employee name and address

- Pay period and pay date

- Salary earnings and net earnings

- Federal and state taxes

- Other deductions (e.g., health insurance, 401(k))

Template 5: Pay Stub Template with Benefits

The pay stub template with benefits is designed for businesses that offer their employees benefits such as health insurance, 401(k), and paid time off. This template provides a clear breakdown of an employee's benefits and deductions.

Template Features:

- Employee name and address

- Pay period and pay date

- Gross earnings and net earnings

- Federal and state taxes

- Other deductions (e.g., health insurance, 401(k))

- Breakdown of benefits (e.g., health insurance, paid time off)

Conclusion

Creating pay stubs can be a challenging task, but with the right template, it can be a breeze. QuickBooks offers a range of pay stub templates that can help you streamline your payroll process and create professional-looking pay stubs for your employees. Whether you're a small business or a large corporation, there's a QuickBooks pay stub template that's right for you.

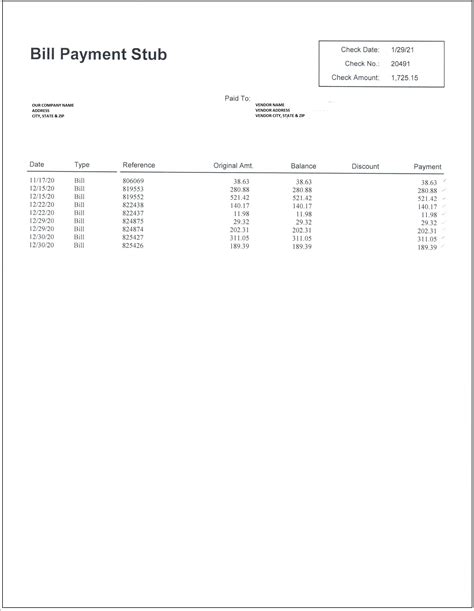

Gallery of QuickBooks Pay Stub Templates

QuickBooks Pay Stub Templates Gallery

FAQs

Q: What is a pay stub template? A: A pay stub template is a pre-designed document that provides a clear breakdown of an employee's earnings and deductions.

Q: Why use a pay stub template? A: Using a pay stub template can save you time and effort, ensure accuracy, and provide a professional-looking pay stub.

Q: Can I customize a pay stub template? A: Yes, you can customize a pay stub template to fit your business needs and branding.

Q: What information should be included on a pay stub? A: A pay stub should include employee name and address, pay period and pay date, gross earnings and net earnings, federal and state taxes, and other deductions.

Q: Can I use a pay stub template for hourly employees? A: Yes, there are pay stub templates designed specifically for hourly employees.

Share Your Thoughts

We hope this article has provided you with valuable insights into QuickBooks pay stub templates. If you have any questions or comments, please share them below. We'd love to hear from you!