Creating a conscious spending plan is an essential step in taking control of your finances and achieving your financial goals. Ramit Sethi, a renowned personal finance expert, has developed a 6-step template to help you create a conscious spending plan that works for you. In this article, we will walk you through each step of the template and provide you with practical examples and tips to make the most of it.

Understanding the Importance of Conscious Spending

Before we dive into the 6-step template, it's essential to understand the importance of conscious spending. Conscious spending is about being mindful of your spending habits and making intentional financial decisions that align with your values and goals. It's not about depriving yourself of things you enjoy, but about making sure that your spending is aligned with what's truly important to you.

Ramit's 6-Step Template

Ramit's 6-step template is designed to help you create a conscious spending plan that works for you. Here are the six steps:

Step 1: Identify Your Financial Goals

The first step in creating a conscious spending plan is to identify your financial goals. What do you want to achieve? Do you want to save for a down payment on a house? Pay off debt? Build up your emergency fund? Write down your goals and make sure they are specific, measurable, and achievable.

Example: "I want to save $10,000 for a down payment on a house within the next 12 months."

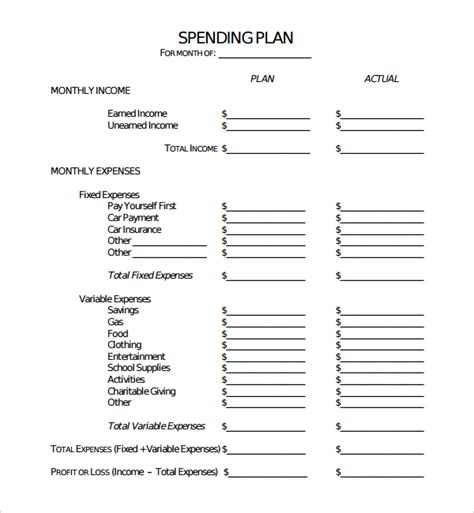

Step 2: Track Your Expenses

The second step is to track your expenses. For one month, write down every single transaction you make, including small purchases like coffee or snacks. This will help you identify areas where you can cut back and allocate your money more efficiently.

Example: Use a budgeting app like Mint or Personal Capital to track your expenses.

Step 3: Categorize Your Expenses

The third step is to categorize your expenses. Divide your expenses into categories like housing, transportation, food, entertainment, and savings. This will help you see where your money is going and make adjustments accordingly.

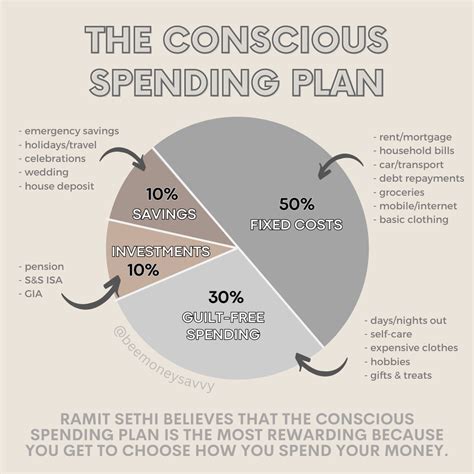

Example: Use the 50/30/20 rule as a guideline: 50% of your income should go towards necessary expenses like housing and utilities, 30% towards discretionary spending, and 20% towards saving and debt repayment.

Step 4: Set Budget Targets

The fourth step is to set budget targets. Based on your income and expenses, set realistic targets for each category. Make sure to prioritize your financial goals and allocate your money accordingly.

Example: "I will allocate $500 towards saving for my down payment each month."

Step 5: Automate Your Savings

The fifth step is to automate your savings. Set up automatic transfers from your checking account to your savings or investment accounts. This will ensure that you save consistently and make progress towards your financial goals.

Example: Set up a monthly automatic transfer of $500 from your checking account to your savings account.

Step 6: Review and Adjust

The final step is to review and adjust your conscious spending plan regularly. Check in with yourself every few months to see if you're on track to meet your financial goals. Make adjustments as needed to stay on track.

Example: Review your budget every three months and make adjustments to your spending categories or savings targets as needed.

Gallery of Conscious Spending Plans

Conscious Spending Plan Image Gallery

By following Ramit's 6-step template, you can create a conscious spending plan that helps you achieve your financial goals. Remember to review and adjust your plan regularly to stay on track. With a conscious spending plan in place, you'll be able to make intentional financial decisions that align with your values and goals.

We'd love to hear from you! Have you created a conscious spending plan? What tips and strategies have worked for you? Share your thoughts in the comments below.