Intro

Unlock the power of data-driven real estate investing with 6 essential proforma templates. Master real estate financial analysis, model scenarios, and optimize returns. Dive into templates for cash flow projections, rental income, and property valuation, and discover the secrets to accurate forecasting and informed investment decisions.

Real estate investing can be a lucrative venture, but it requires careful planning and analysis to ensure success. One of the most critical tools in a real estate investor's arsenal is the proforma template. A proforma template is a financial model that helps investors estimate the potential income and expenses of a real estate investment. In this article, we will explore six essential real estate proforma templates that every investor should know.

What is a Proforma Template?

A proforma template is a financial model that provides a detailed breakdown of a real estate investment's potential income and expenses. It is used to estimate the cash flow, net operating income, and return on investment (ROI) of a property. Proforma templates are essential for investors, lenders, and property managers to evaluate the viability of a real estate investment.

Why Use Proforma Templates?

Proforma templates offer several benefits to real estate investors. They help investors:

- Evaluate the potential return on investment (ROI) of a property

- Estimate the cash flow and net operating income of a property

- Identify potential risks and opportunities associated with a property

- Compare different investment options

- Create a comprehensive financial plan for a real estate investment

6 Essential Real Estate Proforma Templates

Here are six essential real estate proforma templates that every investor should know:

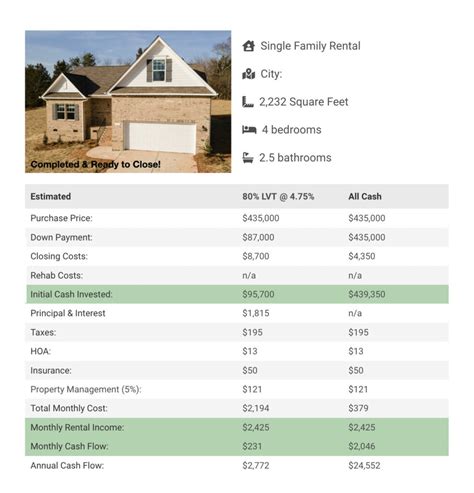

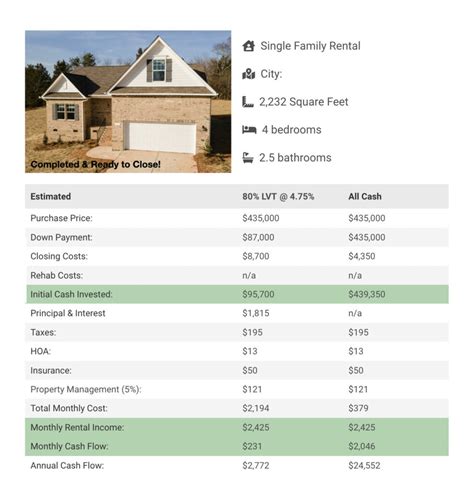

1. Residential Rental Property Proforma Template

This template is used to evaluate the potential income and expenses of a residential rental property. It includes sections for:

- Rental income

- Operating expenses (e.g., property taxes, insurance, maintenance)

- Debt service (e.g., mortgage payments)

- Net operating income (NOI)

- Cash flow

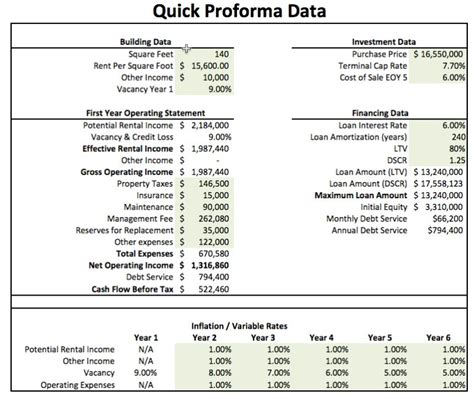

2. Commercial Property Proforma Template

This template is used to evaluate the potential income and expenses of a commercial property. It includes sections for:

- Rental income

- Operating expenses (e.g., property taxes, insurance, maintenance)

- Debt service (e.g., mortgage payments)

- Net operating income (NOI)

- Cash flow

- Additional sections for commercial-specific expenses (e.g., common area maintenance, property management fees)

3. Apartment Building Proforma Template

This template is used to evaluate the potential income and expenses of an apartment building. It includes sections for:

- Rental income

- Operating expenses (e.g., property taxes, insurance, maintenance)

- Debt service (e.g., mortgage payments)

- Net operating income (NOI)

- Cash flow

- Additional sections for apartment-specific expenses (e.g., utilities, amenities)

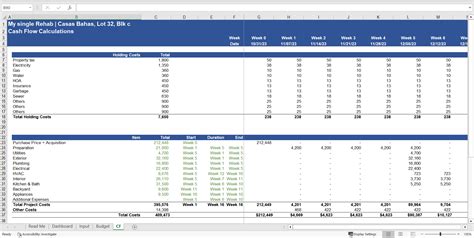

4. Fix-and-Flip Proforma Template

This template is used to evaluate the potential income and expenses of a fix-and-flip project. It includes sections for:

- Acquisition costs (e.g., purchase price, closing costs)

- Renovation costs (e.g., construction expenses, permits)

- Selling costs (e.g., real estate agent fees, closing costs)

- Potential profit

- Cash flow

5. Wholesale Real Estate Proforma Template

This template is used to evaluate the potential income and expenses of a wholesale real estate deal. It includes sections for:

- Acquisition costs (e.g., purchase price, closing costs)

- Assignment fees (e.g., fees paid to the seller)

- Selling costs (e.g., real estate agent fees, closing costs)

- Potential profit

- Cash flow

6. Real Estate Development Proforma Template

This template is used to evaluate the potential income and expenses of a real estate development project. It includes sections for:

- Land acquisition costs (e.g., purchase price, closing costs)

- Construction costs (e.g., building expenses, permits)

- Financing costs (e.g., interest, debt service)

- Potential revenue (e.g., sales, rentals)

- Net operating income (NOI)

- Cash flow

Tips for Using Proforma Templates

When using proforma templates, keep the following tips in mind:

- Use conservative estimates for income and expenses

- Consider multiple scenarios (e.g., best-case, worst-case, most likely)

- Update the template regularly to reflect changes in the market or property

- Use the template to compare different investment options

- Seek professional advice (e.g., accountant, attorney) to ensure accuracy and completeness

Gallery of Real Estate Proforma Templates

Real Estate Proforma Templates Gallery

Conclusion

In conclusion, proforma templates are essential tools for real estate investors. They help investors evaluate the potential income and expenses of a property, identify potential risks and opportunities, and create a comprehensive financial plan. By using the six essential real estate proforma templates outlined in this article, investors can make informed decisions and increase their chances of success in the real estate market.