Excel Rolling Cash Flow Forecast Template Summary

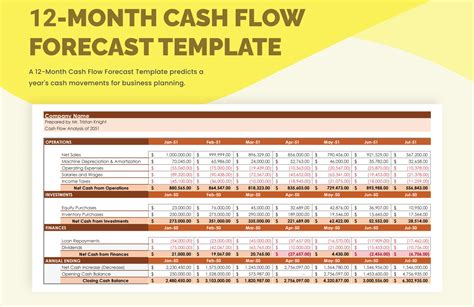

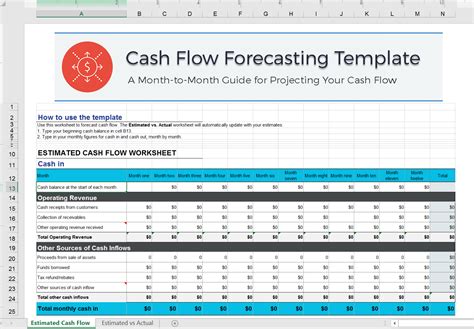

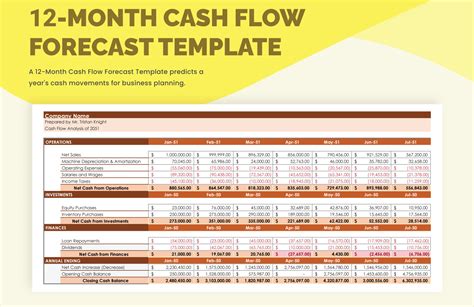

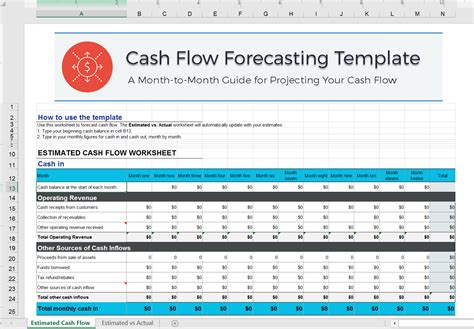

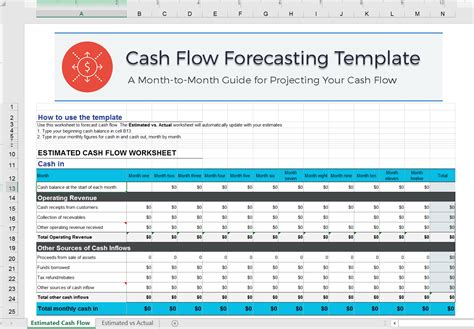

Streamline your financial planning with our expert-designed Excel Rolling Cash Flow Forecast Template. Easily predict and manage your businesss cash inflows and outflows over a 12-month period. This comprehensive template incorporates rolling forecasts, cash flow statements, and dashboard analysis, ensuring you stay on top of your companys financial health and make informed decisions.

Effective cash flow management is crucial for the success of any business. It allows companies to anticipate and prepare for potential cash shortfalls, make informed decisions about investments and funding, and ultimately drive growth and profitability. One powerful tool for achieving this is the rolling cash flow forecast template in Excel.

A rolling cash flow forecast is a dynamic financial model that projects a company's future cash inflows and outflows over a specified period, typically on a monthly or quarterly basis. This template is designed to help businesses anticipate and manage their cash flows more effectively by providing a clear picture of their financial position at any given time.

Benefits of Using a Rolling Cash Flow Forecast Template in Excel

There are several benefits to using a rolling cash flow forecast template in Excel:

- Improved Cash Flow Management: By accurately forecasting cash inflows and outflows, businesses can better manage their cash reserves, reduce the risk of cash shortfalls, and make more informed decisions about investments and funding.

- Enhanced Financial Visibility: The template provides a clear and transparent picture of a company's financial position, allowing managers to quickly identify areas for improvement and make data-driven decisions.

- Increased Flexibility: The rolling nature of the forecast allows businesses to easily update their projections as circumstances change, ensuring that their financial plans remain relevant and effective.

- Better Decision Making: By providing a comprehensive view of a company's financial situation, the template enables managers to make more informed decisions about resource allocation, investment, and funding.

Key Components of a Rolling Cash Flow Forecast Template in Excel

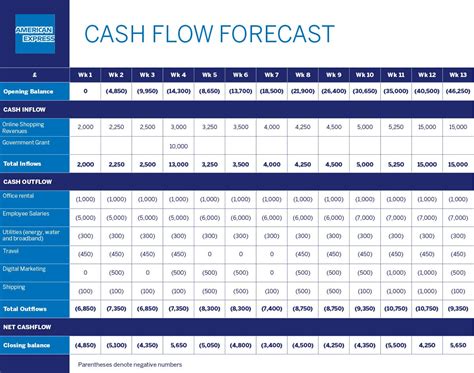

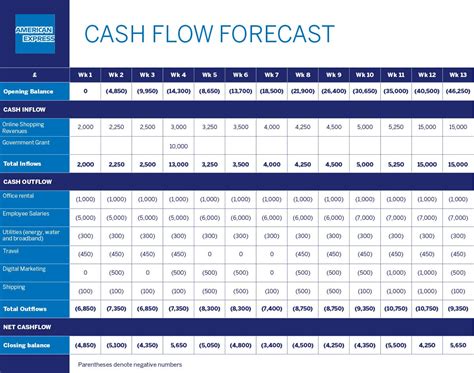

A typical rolling cash flow forecast template in Excel includes the following key components:

- Income Statement: A summary of projected income and expenses over the forecast period.

- Balance Sheet: A snapshot of the company's projected assets, liabilities, and equity at the end of each forecast period.

- Cash Flow Statement: A detailed breakdown of projected cash inflows and outflows over the forecast period.

- Assumptions: A list of assumptions used to create the forecast, including revenue growth rates, expense ratios, and funding requirements.

- Rolling Forecast: A dynamic table that updates automatically as new data is entered, providing a rolling view of the company's projected cash flows over the forecast period.

How to Create a Rolling Cash Flow Forecast Template in Excel

Creating a rolling cash flow forecast template in Excel is a relatively straightforward process. Here are the basic steps:

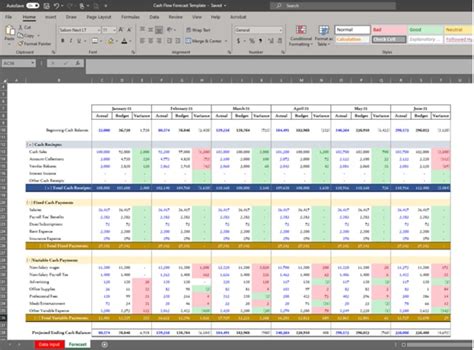

- Set up the template structure: Create a new Excel workbook and set up a basic template structure, including separate sheets for the income statement, balance sheet, cash flow statement, assumptions, and rolling forecast.

- Enter historical data: Enter historical financial data into the template, including income statement, balance sheet, and cash flow statement data.

- Define assumptions: Define the assumptions used to create the forecast, including revenue growth rates, expense ratios, and funding requirements.

- Create the rolling forecast: Create a dynamic table that updates automatically as new data is entered, providing a rolling view of the company's projected cash flows over the forecast period.

- Format and review: Format the template to make it easy to read and understand, and review the forecast to ensure that it is accurate and realistic.

Best Practices for Using a Rolling Cash Flow Forecast Template in Excel

Here are some best practices for using a rolling cash flow forecast template in Excel:

- Regularly update the forecast: Regularly update the forecast to reflect changes in the business and ensure that the financial plans remain relevant and effective.

- Use realistic assumptions: Use realistic assumptions when creating the forecast, and avoid making overly optimistic or pessimistic projections.

- Monitor cash flows closely: Monitor cash flows closely and adjust the forecast as necessary to ensure that the company remains on track to meet its financial goals.

- Use the template to drive decision making: Use the template to drive decision making, and ensure that all stakeholders are aligned with the company's financial goals and objectives.

Common Mistakes to Avoid When Using a Rolling Cash Flow Forecast Template in Excel

Here are some common mistakes to avoid when using a rolling cash flow forecast template in Excel:

- Using overly complex templates: Avoid using overly complex templates that are difficult to understand and maintain.

- Failing to regularly update the forecast: Failing to regularly update the forecast can lead to inaccurate projections and poor decision making.

- Using unrealistic assumptions: Using unrealistic assumptions can lead to inaccurate projections and poor decision making.

- Not monitoring cash flows closely: Not monitoring cash flows closely can lead to cash shortfalls and other financial problems.

Conclusion

A rolling cash flow forecast template in Excel is a powerful tool for managing cash flows and driving business success. By following best practices and avoiding common mistakes, businesses can use this template to create accurate and realistic financial projections, make informed decisions, and achieve their financial goals.

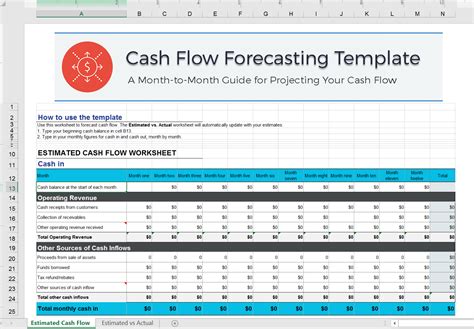

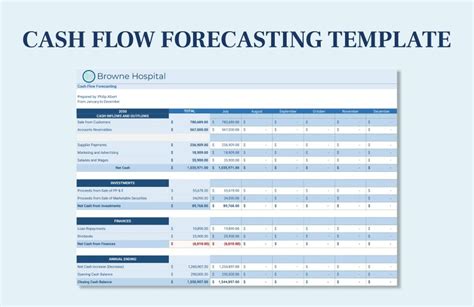

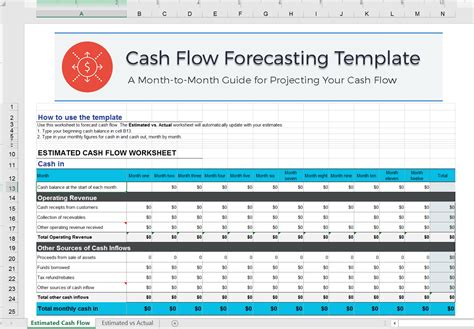

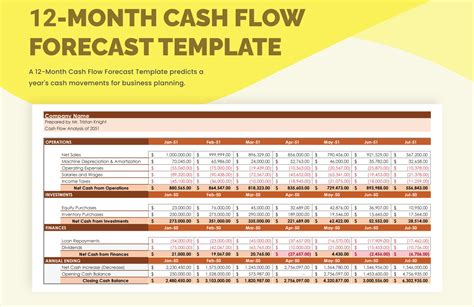

Excel Rolling Cash Flow Forecast Template Image Gallery