Intro

Navigate Sea Harbor insurance claims with ease. Learn claim filing, processing, and settlement tips, including policy coverage, damage assessment, and dispute resolution, to maximize your insurance payout and minimize hassle.

The process of filing insurance claims can be overwhelming, especially when dealing with unexpected events such as accidents, natural disasters, or other unforeseen circumstances. Sea Harbor Insurance is a reputable provider that offers a range of insurance products to help individuals and businesses protect themselves against various risks. However, navigating the claims process can be daunting, which is why having a comprehensive guide is essential. In this article, we will delve into the world of Sea Harbor Insurance claims, providing you with a detailed guide on how to file a claim, what to expect, and tips for a smooth experience.

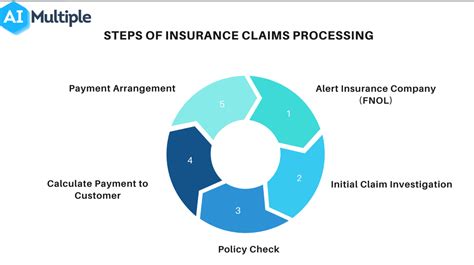

The importance of understanding the claims process cannot be overstated. When you purchase an insurance policy, you expect that the provider will be there to support you in times of need. However, the reality is that insurance companies are businesses, and their primary goal is to minimize payouts. This is why it is crucial to be well-informed and prepared when filing a claim. By knowing your rights, the requirements, and the steps involved, you can ensure that you receive the compensation you deserve. Whether you are a seasoned policyholder or new to the world of insurance, this guide will provide you with the knowledge and confidence to navigate the Sea Harbor Insurance claims process with ease.

Filing an insurance claim can be a complex and time-consuming process, but it doesn't have to be. With the right guidance, you can avoid common pitfalls and ensure that your claim is processed efficiently. In the following sections, we will explore the different aspects of the Sea Harbor Insurance claims process, including the types of claims, the required documentation, and the steps to follow. We will also provide you with practical tips and advice on how to prepare for the claims process, how to communicate with the insurance company, and how to negotiate a fair settlement. By the end of this article, you will be well-equipped to handle any insurance claim that comes your way.

Understanding Sea Harbor Insurance Claims

Types of Sea Harbor Insurance Claims

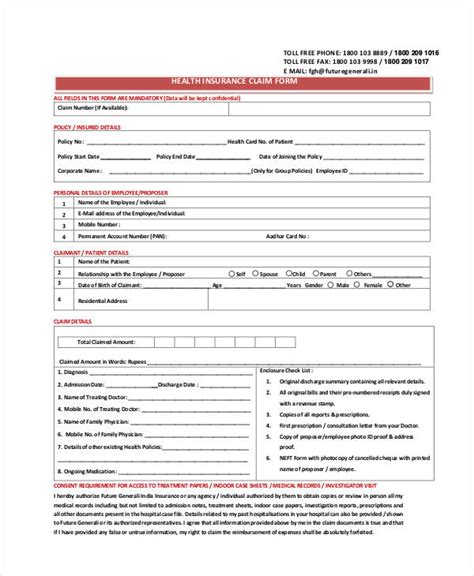

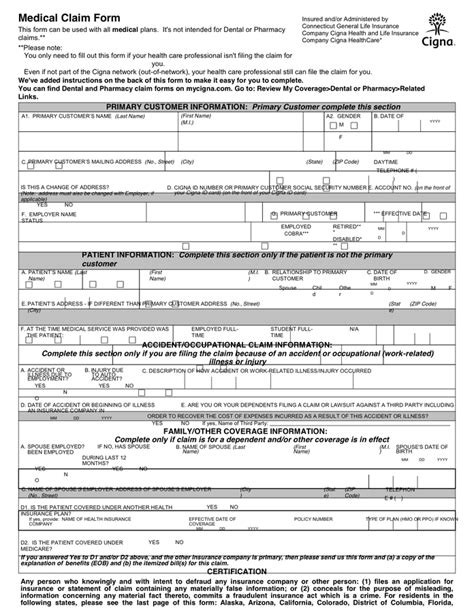

The types of claims that Sea Harbor Insurance offers can be broadly categorized into two main groups: property damage claims and liability claims. Property damage claims involve damage to your property, such as your home or vehicle, while liability claims involve injuries or damages to others. Within these two categories, there are several sub-types of claims, including: * Auto insurance claims: These claims involve damage to your vehicle, injuries to yourself or others, or damage to other people's property. * Home insurance claims: These claims involve damage to your home, theft, or loss of personal property. * Business insurance claims: These claims involve damage to your business property, injuries to employees or customers, or loss of business income. * Workers' compensation claims: These claims involve injuries or illnesses sustained by employees in the course of their work.Filing a Sea Harbor Insurance Claim

Tips for Filing a Sea Harbor Insurance Claim

To ensure that your claim is processed efficiently, it is essential to follow these tips: * Keep detailed records: Keep a record of all correspondence with the insurance company, including dates, times, and details of conversations. * Provide thorough documentation: Make sure you provide all the necessary documentation to support your claim. * Be patient: The claims process can take time, so be patient and don't rush the process. * Seek professional help: If you are unsure about any aspect of the claims process, consider seeking help from a professional, such as a lawyer or a public adjuster.Sea Harbor Insurance Claims Process

Sea Harbor Insurance Claims Department

The Sea Harbor Insurance claims department is responsible for handling all claims-related inquiries and issues. The department is staffed by experienced claims adjusters who are trained to handle a wide range of claims. If you have any questions or concerns about the claims process, you can contact the claims department directly.Sea Harbor Insurance Claims FAQs

Sea Harbor Insurance Claims Contact Information

If you have any questions or concerns about the claims process, you can contact Sea Harbor Insurance directly. Here is their contact information: * Phone: 1-800-SEA-HARBOR * Email: [claims@seaharborinsurance.com](mailto:claims@seaharborinsurance.com) * Address: 123 Main Street, Anytown, USA 12345Sea Harbor Insurance Claims Image Gallery

In conclusion, filing a Sea Harbor Insurance claim can be a complex and time-consuming process, but with the right guidance, you can navigate it with ease. By understanding the different types of claims, the required documentation, and the steps to follow, you can ensure that your claim is processed efficiently. Remember to keep detailed records, provide thorough documentation, and be patient throughout the process. If you have any questions or concerns, don't hesitate to contact Sea Harbor Insurance directly. With their experienced claims adjusters and comprehensive claims process, you can trust that your claim will be handled professionally and efficiently. We hope this guide has been helpful in providing you with the knowledge and confidence to navigate the Sea Harbor Insurance claims process. If you have any further questions or would like to share your experiences, please don't hesitate to comment below.