Intro

Create a legally binding loan agreement with our free Standard Promissory Note Word Template download. This customizable template outlines repayment terms, interest rates, and borrower responsibilities, ensuring a clear understanding between lenders and borrowers. Download now and streamline your loan process with this essential financial document.

A Standard Promissory Note is a legally binding document that outlines the terms of a loan between two parties. It is a crucial document that ensures both parties understand their obligations and responsibilities. In this article, we will discuss the importance of a Standard Promissory Note, its components, and how to create one using a Word template.

What is a Standard Promissory Note?

A Standard Promissory Note is a written agreement between a borrower and a lender that outlines the terms of a loan. It is a promise by the borrower to repay the loan amount, along with interest and fees, to the lender. The note serves as a contract between the two parties and provides a clear understanding of the loan terms.

Importance of a Standard Promissory Note

A Standard Promissory Note is essential for several reasons:

- It provides a clear understanding of the loan terms, including the loan amount, interest rate, and repayment terms.

- It serves as a contract between the borrower and lender, ensuring both parties understand their obligations.

- It provides a record of the loan, which can be useful in case of disputes or disagreements.

- It helps to prevent misunderstandings and miscommunications between the borrower and lender.

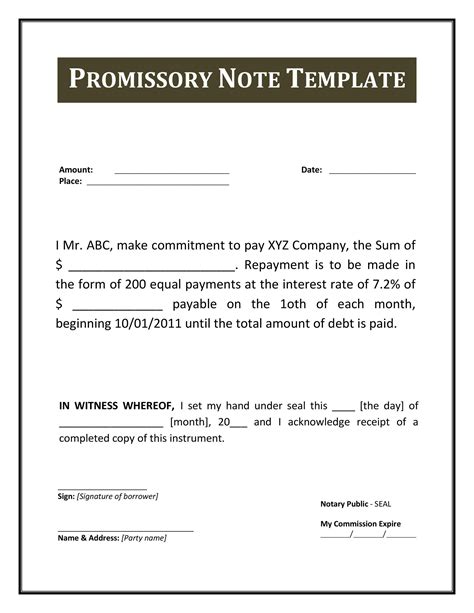

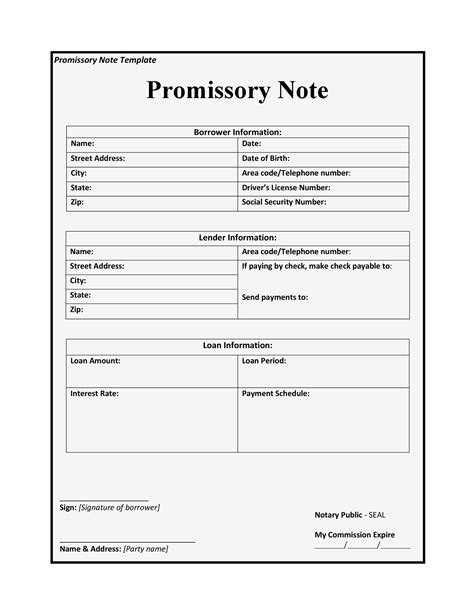

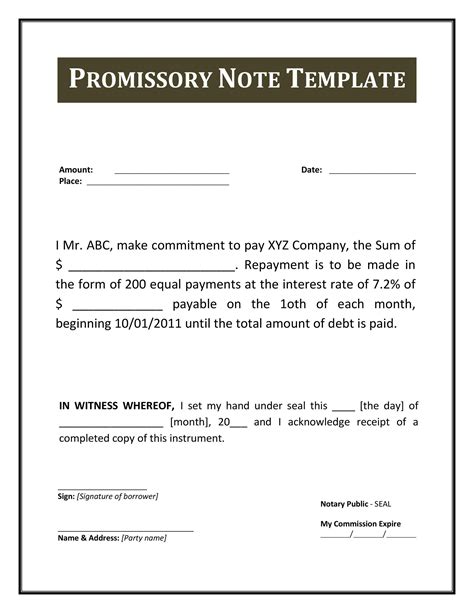

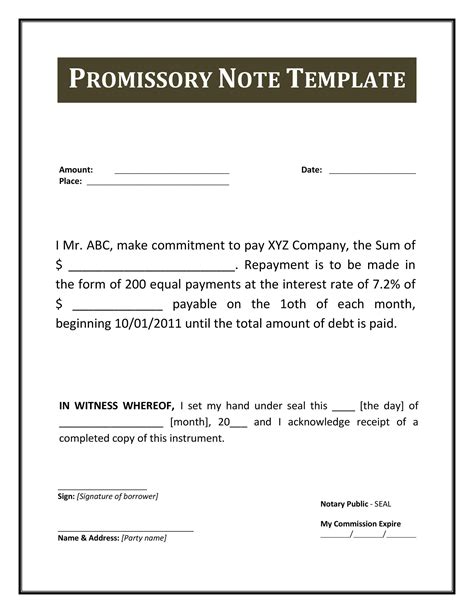

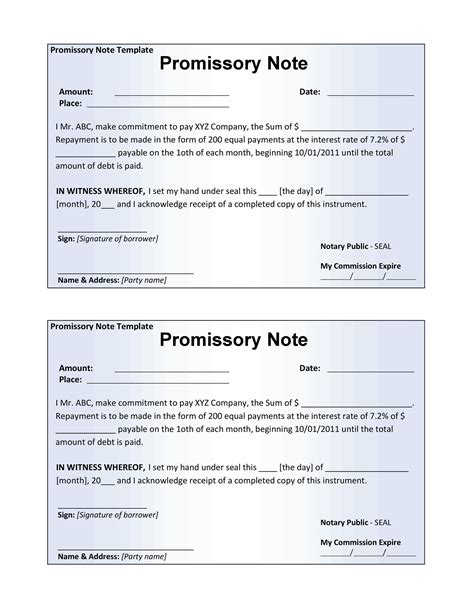

Components of a Standard Promissory Note

A Standard Promissory Note typically includes the following components:

- Loan Amount: The amount borrowed by the borrower.

- Interest Rate: The rate at which interest is charged on the loan amount.

- Repayment Terms: The terms of repayment, including the payment schedule and amount.

- Default Provisions: The consequences of default, including late fees and penalties.

- Governing Law: The law that governs the agreement.

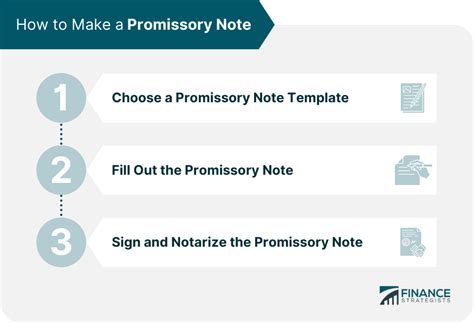

Creating a Standard Promissory Note using a Word Template

Creating a Standard Promissory Note using a Word template is a straightforward process. Here are the steps to follow:

- Download a Standard Promissory Note Word template from a reliable source.

- Open the template in Microsoft Word.

- Fill in the required information, including the loan amount, interest rate, and repayment terms.

- Review the document carefully to ensure accuracy and completeness.

- Sign and date the document.

Benefits of using a Standard Promissory Note Word Template

Using a Standard Promissory Note Word template offers several benefits, including:

- Convenience: The template provides a pre-formatted document that saves time and effort.

- Accuracy: The template ensures accuracy and completeness, reducing the risk of errors.

- Professionalism: The template provides a professional-looking document that enhances credibility.

- Customization: The template can be customized to suit specific needs and requirements.

Free Download of Standard Promissory Note Word Template

You can download a free Standard Promissory Note Word template from various online sources. Here are a few options:

- Microsoft Office Online: Microsoft offers a range of free templates, including a Standard Promissory Note template.

- Template.net: Template.net offers a variety of free templates, including a Standard Promissory Note template.

- ** Vertex42**: Vertex42 offers a range of free templates, including a Standard Promissory Note template.

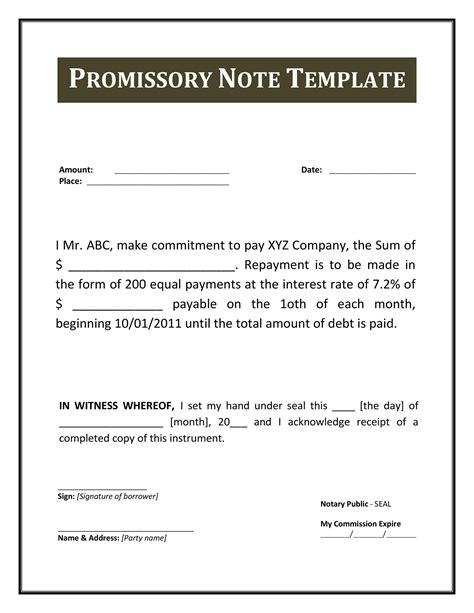

Gallery of Standard Promissory Note Templates

Standard Promissory Note Templates

In conclusion, a Standard Promissory Note is a vital document that ensures both parties understand their obligations and responsibilities. Creating a Standard Promissory Note using a Word template is a straightforward process that offers several benefits, including convenience, accuracy, professionalism, and customization. By downloading a free Standard Promissory Note Word template, you can create a professional-looking document that enhances credibility.