State Farm is one of the largest insurance companies in the United States, offering a wide range of insurance products and financial services to its customers. Alma, Arkansas, is a small city with a strong sense of community, and State Farm has a significant presence in the area. If you're a resident of Alma, AR, and you're looking for ways to save on your insurance premiums, here are five ways to do so with State Farm.

Bundle Your Policies

One of the easiest ways to save with State Farm is to bundle your policies. If you have multiple insurance policies, such as auto, home, and life insurance, you can bundle them together and receive a discount. This is because State Farm offers a multi-policy discount to customers who have multiple policies with the company. By bundling your policies, you can save up to 17% on your premiums.

How to Bundle Your Policies

Bundling your policies with State Farm is a straightforward process. Here's what you need to do:

- Contact your State Farm agent and let them know that you want to bundle your policies.

- Provide your agent with information about your current policies, including the type of policy, coverage limits, and premium amounts.

- Your agent will help you determine which policies can be bundled together and how much you can save.

- Once you've decided which policies to bundle, your agent will help you complete the necessary paperwork and update your policies.

Benefits of Bundling

Bundling your policies with State Farm offers several benefits, including:

- Discounted premiums: By bundling your policies, you can save up to 17% on your premiums.

- Simplified billing: When you bundle your policies, you'll receive a single bill for all of your policies, making it easier to keep track of your payments.

- Increased convenience: Bundling your policies can make it easier to manage your insurance coverage, as you'll only need to deal with one insurance company.

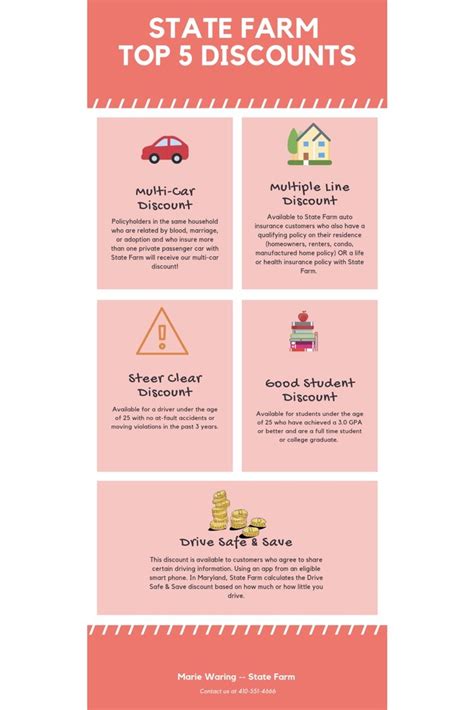

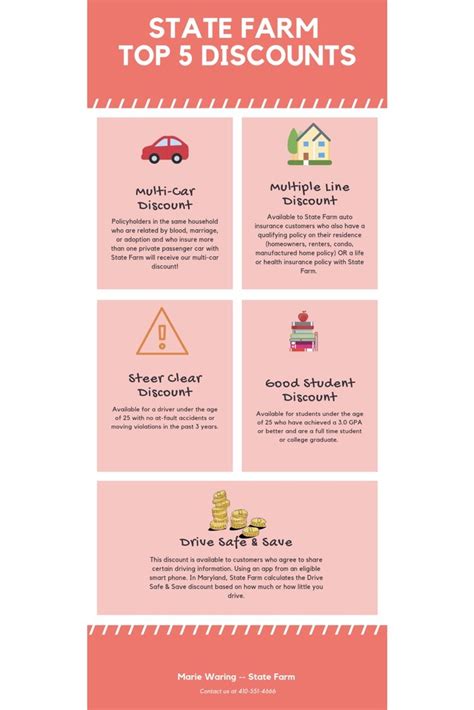

Take Advantage of Discounts

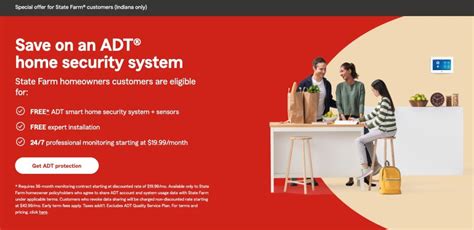

State Farm offers a wide range of discounts to its customers, including discounts for good grades, defensive driving courses, and anti-theft devices. By taking advantage of these discounts, you can save money on your insurance premiums.

Types of Discounts Offered by State Farm

State Farm offers several types of discounts, including:

- Good student discount: If you're a student with good grades, you may be eligible for a discount on your auto insurance premiums.

- Defensive driving discount: If you complete a defensive driving course, you may be eligible for a discount on your auto insurance premiums.

- Anti-theft discount: If your vehicle is equipped with an anti-theft device, you may be eligible for a discount on your auto insurance premiums.

- Multi-vehicle discount: If you have multiple vehicles insured with State Farm, you may be eligible for a discount on your premiums.

How to Qualify for Discounts

To qualify for discounts with State Farm, you'll need to meet certain requirements. Here's what you need to do:

- Contact your State Farm agent and ask about the discounts that are available.

- Provide your agent with the necessary documentation, such as proof of good grades or completion of a defensive driving course.

- Your agent will help you determine which discounts you're eligible for and how much you can save.

Improve Your Credit Score

Your credit score can have a significant impact on your insurance premiums. By improving your credit score, you can save money on your insurance premiums.

How to Improve Your Credit Score

Improving your credit score requires time and effort, but it's worth it in the long run. Here are some tips to help you improve your credit score:

- Pay your bills on time: Payment history is a significant factor in determining your credit score, so make sure to pay your bills on time.

- Keep credit card balances low: High credit card balances can negatively impact your credit score, so try to keep your balances low.

- Monitor your credit report: Check your credit report regularly to ensure that it's accurate and up-to-date.

- Avoid applying for too much credit: Applying for too much credit can negatively impact your credit score, so only apply for credit when necessary.

Benefits of Improving Your Credit Score

Improving your credit score offers several benefits, including:

- Lower insurance premiums: By improving your credit score, you can save money on your insurance premiums.

- Lower interest rates: A good credit score can also help you qualify for lower interest rates on loans and credit cards.

- Increased financial flexibility: A good credit score can give you more financial flexibility and options.

Increase Your Deductible

Increasing your deductible can help you save money on your insurance premiums. However, it's essential to carefully consider the potential risks and benefits before making a decision.

How to Increase Your Deductible

Increasing your deductible is a straightforward process. Here's what you need to do:

- Contact your State Farm agent and let them know that you want to increase your deductible.

- Your agent will help you determine how much you can save by increasing your deductible.

- Once you've decided on a new deductible amount, your agent will help you update your policy.

Risks and Benefits of Increasing Your Deductible

Increasing your deductible offers both risks and benefits. Here are some things to consider:

- Lower premiums: Increasing your deductible can help you save money on your insurance premiums.

- Higher out-of-pocket costs: If you need to file a claim, you'll need to pay a higher deductible amount out-of-pocket.

- Potential for higher claims costs: If you need to file a claim, you may end up paying more in claims costs if you have a higher deductible.

Drop Unnecessary Coverage

Finally, dropping unnecessary coverage can help you save money on your insurance premiums. By carefully reviewing your policy and dropping coverage that you no longer need, you can save money on your premiums.

How to Drop Unnecessary Coverage

Dropping unnecessary coverage is a straightforward process. Here's what you need to do:

- Contact your State Farm agent and let them know that you want to review your policy.

- Your agent will help you determine which coverage options are unnecessary.

- Once you've decided which coverage options to drop, your agent will help you update your policy.

Benefits of Dropping Unnecessary Coverage

Dropping unnecessary coverage offers several benefits, including:

- Lower premiums: By dropping unnecessary coverage, you can save money on your insurance premiums.

- Simplified policy: Dropping unnecessary coverage can also help simplify your policy and make it easier to manage.

- Increased financial flexibility: By saving money on your insurance premiums, you can increase your financial flexibility and options.

In conclusion, there are several ways to save with State Farm in Alma, AR. By bundling your policies, taking advantage of discounts, improving your credit score, increasing your deductible, and dropping unnecessary coverage, you can save money on your insurance premiums and increase your financial flexibility. Contact your State Farm agent today to learn more about how you can save.

State Farm Discounts Image Gallery

If you have any questions or comments about this article, please feel free to share them below. We'd love to hear from you!