Discover 5 essential tips for State Farm life insurance, including policy options, coverage, and beneficiary management, to secure your loved ones financial future with term, whole, and universal life insurance plans.

Life insurance is an essential aspect of financial planning, providing a safety net for loved ones in the event of unexpected death. State Farm, one of the largest insurance companies in the United States, offers a range of life insurance products to suit various needs and budgets. When considering State Farm life insurance, it's crucial to understand the options available and how to make the most of your policy. In this article, we'll delve into the world of State Farm life insurance, exploring its benefits, types, and tips for maximizing your coverage.

State Farm life insurance offers numerous benefits, including financial protection for dependents, paying off outstanding debts, and covering funeral expenses. Moreover, life insurance can provide a sense of security and peace of mind, knowing that your loved ones will be taken care of even if you're no longer around. With State Farm, you can choose from various policy types, such as term life, whole life, and universal life insurance. Each type has its unique features, advantages, and disadvantages, which we'll discuss in detail later.

When selecting a State Farm life insurance policy, it's essential to consider your individual circumstances, financial goals, and priorities. You may want to consult with a licensed insurance agent to determine the best policy for your needs. Additionally, it's crucial to carefully review the policy terms, including the coverage amount, premium payments, and any exclusions or limitations. By doing so, you can ensure that you're getting the most out of your State Farm life insurance policy and protecting your loved ones' financial well-being.

Understanding State Farm Life Insurance Options

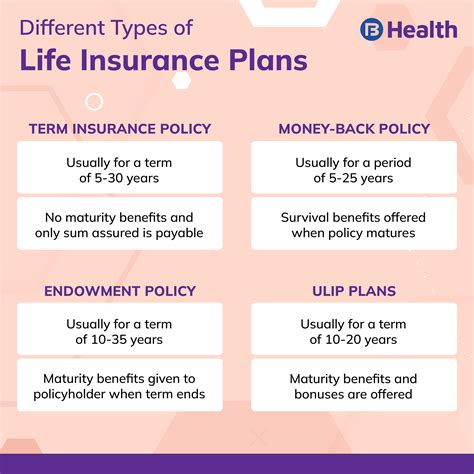

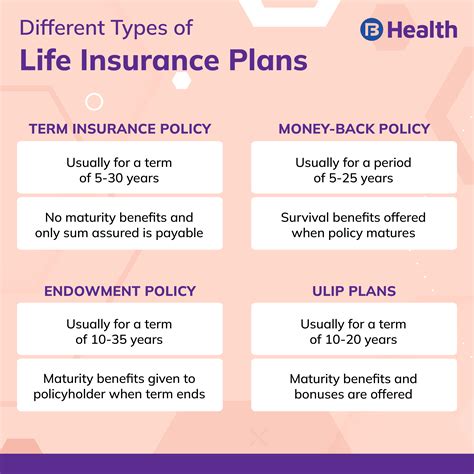

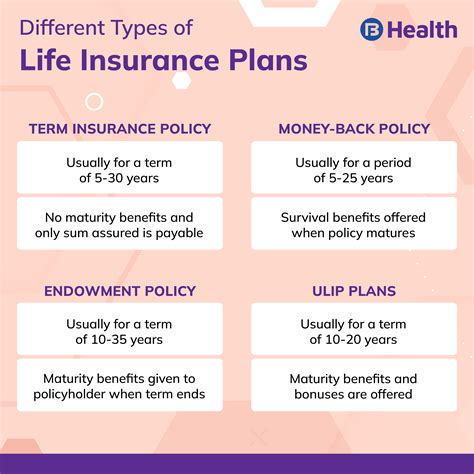

State Farm offers several life insurance options, each designed to cater to different needs and preferences. Term life insurance provides coverage for a specified period, usually 10, 20, or 30 years. This type of policy is often less expensive than permanent life insurance and can be an excellent choice for those on a budget. Whole life insurance, on the other hand, offers lifetime coverage and a cash value component that grows over time. Universal life insurance combines a death benefit with a savings component, allowing policyholders to adjust their premium payments and coverage amounts.

Term Life Insurance

Term life insurance is a popular choice among State Farm policyholders. It provides coverage for a specified period, and if you die during that term, the insurance company pays out the death benefit to your beneficiaries. Term life insurance is generally less expensive than permanent life insurance, making it an attractive option for those on a tight budget. However, it's essential to note that term life insurance does not accumulate a cash value, and the coverage ends when the term expires.Whole Life Insurance

Whole life insurance, also known as permanent life insurance, offers lifetime coverage and a cash value component. The cash value grows over time, and policyholders can borrow against it or use it to pay premiums. Whole life insurance is often more expensive than term life insurance, but it provides a guaranteed death benefit and a guaranteed cash value accumulation. State Farm whole life insurance policies also offer a dividend payment, which can increase the policy's cash value and death benefit.Universal Life Insurance

Universal life insurance combines a death benefit with a savings component, allowing policyholders to adjust their premium payments and coverage amounts. This type of policy offers flexibility and potentially higher earnings on the savings component. However, universal life insurance can be more complex and expensive than term life insurance, and the cash value may fluctuate based on the performance of the underlying investments.5 Tips for Choosing the Right State Farm Life Insurance Policy

When selecting a State Farm life insurance policy, it's crucial to consider your individual circumstances, financial goals, and priorities. Here are five tips to help you choose the right policy:

- Determine your coverage needs: Calculate how much life insurance coverage you need based on your income, debts, and dependents. Consider factors such as funeral expenses, outstanding debts, and ongoing living expenses.

- Choose the right policy type: Decide which type of policy suits your needs, whether it's term life, whole life, or universal life insurance. Consider factors such as budget, financial goals, and risk tolerance.

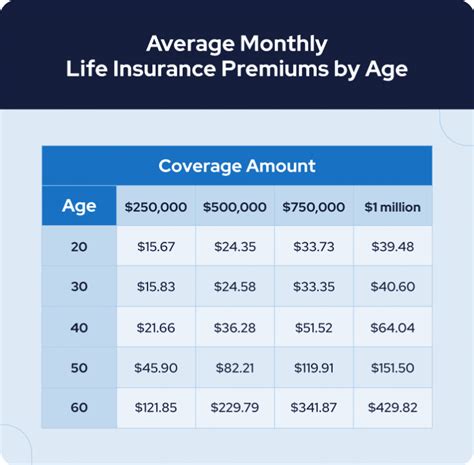

- Consider your budget: Determine how much you can afford to pay in premiums each month. State Farm offers various payment options, including monthly, quarterly, and annual payments.

- Review policy riders and endorsements: Policy riders and endorsements can enhance your coverage and provide additional benefits. Examples include waiver of premium, accidental death benefit, and long-term care riders.

- Consult with a licensed insurance agent: A licensed insurance agent can help you navigate the complex world of life insurance and choose the best policy for your needs. They can also provide guidance on policy riders, endorsements, and other options.

Maximizing Your State Farm Life Insurance Coverage

To maximize your State Farm life insurance coverage, consider the following strategies:

- Increase your coverage amount: If your income or expenses increase, you may need to adjust your coverage amount to ensure your loved ones are adequately protected.

- Add policy riders and endorsements: Policy riders and endorsements can provide additional benefits and enhance your coverage.

- Pay premiums annually: Paying premiums annually can help you save money on administrative fees and ensure you never miss a payment.

- Review and update your policy: Regularly review your policy to ensure it still meets your needs and update it as necessary.

Policy Riders and Endorsements

Policy riders and endorsements can enhance your coverage and provide additional benefits. Examples include:- Waiver of premium: This rider waives premium payments if you become disabled or critically ill.

- Accidental death benefit: This rider provides an additional death benefit if you die in an accident.

- Long-term care rider: This rider provides a portion of the death benefit to pay for long-term care expenses.

State Farm Life Insurance FAQs

Here are some frequently asked questions about State Farm life insurance:

- What is the difference between term life and whole life insurance?: Term life insurance provides coverage for a specified period, while whole life insurance offers lifetime coverage and a cash value component.

- Can I change my policy type?: Yes, you can change your policy type, but it may require a new application and underwriting process.

- How do I file a claim?: You can file a claim by contacting State Farm directly or through your licensed insurance agent.

State Farm Life Insurance Image Gallery

In conclusion, State Farm life insurance offers a range of options to suit various needs and budgets. By understanding the different policy types, considering your individual circumstances, and maximizing your coverage, you can ensure that your loved ones are protected and financially secure. Remember to review and update your policy regularly to ensure it still meets your needs. If you have any questions or concerns, don't hesitate to reach out to a licensed insurance agent or State Farm directly. Share your thoughts and experiences with State Farm life insurance in the comments below, and don't forget to share this article with friends and family who may benefit from this information.