Intro

Create a personalized plan to pay off student loans with our expert guide to using a Student Loan Payoff Calculator in Excel. Learn how to calculate loan interest, track payments, and optimize your debt repayment strategy to achieve financial freedom faster. Say goodbye to debt stress and hello to a brighter future.

Are you tired of feeling overwhelmed by your student loan debt? Do you dream of being debt-free and starting a new chapter in your life? With a student loan payoff calculator Excel template, you can take control of your finances and create a personalized plan to pay off your student loans.

In this article, we will explore the benefits of using a student loan payoff calculator Excel template, how to create one, and provide a step-by-step guide on how to use it to plan your debt freedom.

The Importance of Managing Student Loan Debt

Student loan debt is a significant burden for many individuals. According to the Federal Reserve, outstanding student loan debt in the United States has surpassed $1.7 trillion, making it the second-largest type of consumer debt after mortgages. The weight of student loan debt can affect not only your financial stability but also your mental health and overall well-being.

Managing student loan debt requires a strategic approach. By using a student loan payoff calculator Excel template, you can gain a deeper understanding of your debt, explore different repayment scenarios, and create a plan to pay off your loans efficiently.

Benefits of Using a Student Loan Payoff Calculator Excel Template

A student loan payoff calculator Excel template offers several benefits, including:

- Personalized planning: Create a tailored plan to pay off your student loans based on your individual financial situation.

- Scenarios analysis: Explore different repayment scenarios, such as increasing your monthly payments or consolidating your loans.

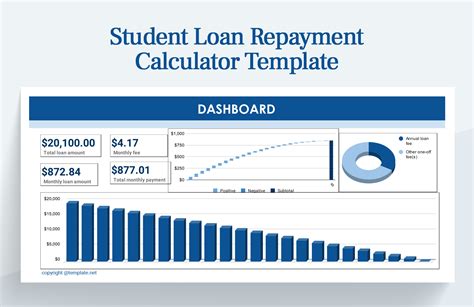

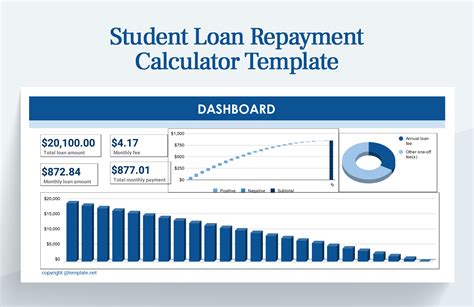

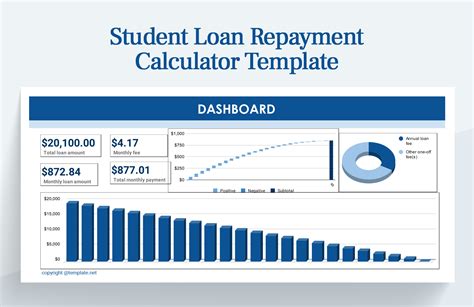

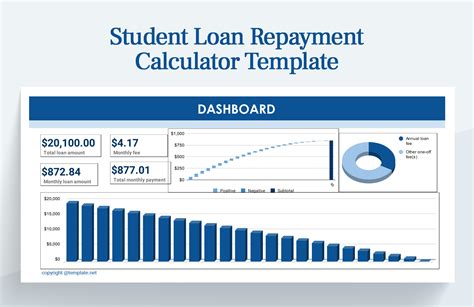

- Visualization: Use charts and graphs to visualize your debt repayment progress and make adjustments as needed.

- Flexibility: Update your template as your financial situation changes to ensure you're on track to meet your debt repayment goals.

Creating a Student Loan Payoff Calculator Excel Template

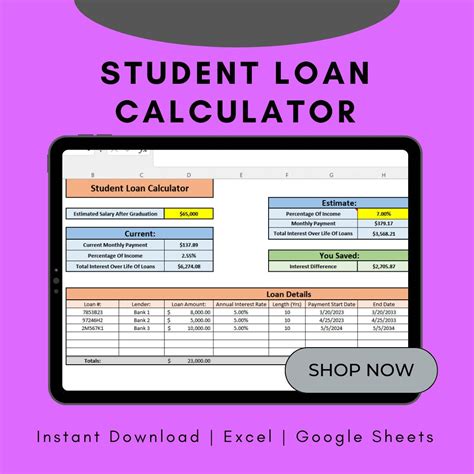

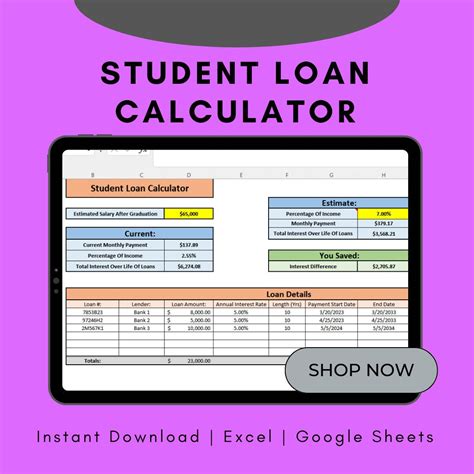

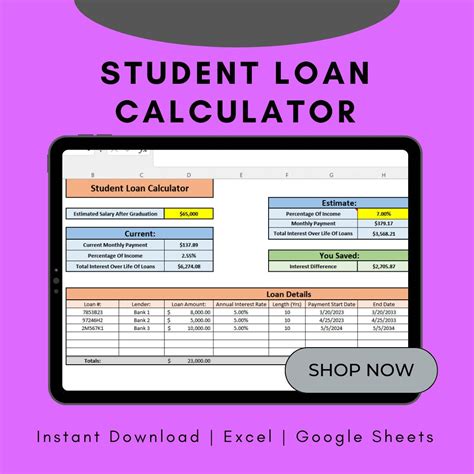

To create a student loan payoff calculator Excel template, you'll need to set up a spreadsheet with the following components:

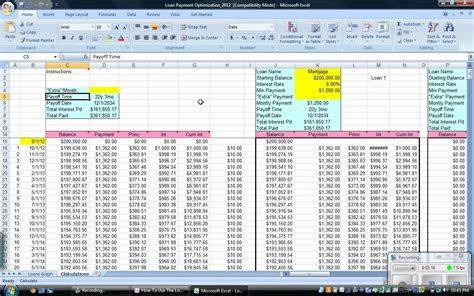

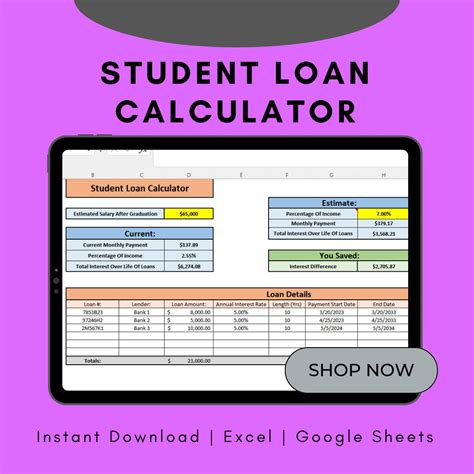

- Loan information: List your student loans, including the loan amount, interest rate, and minimum monthly payment.

- Repayment options: Set up different repayment scenarios, such as increasing your monthly payment or consolidating your loans.

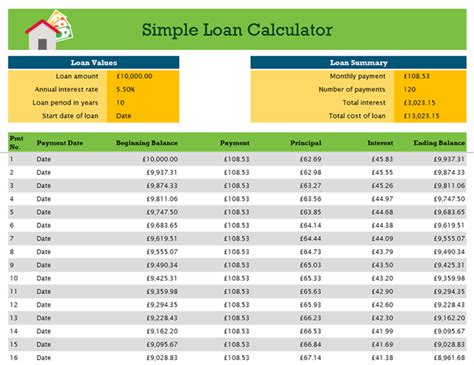

- Calculator: Use formulas to calculate the total interest paid, payoff period, and monthly payments for each scenario.

- Visualization: Use charts and graphs to visualize your debt repayment progress.

Here's a step-by-step guide to creating a basic student loan payoff calculator Excel template:

- Open a new Excel spreadsheet and set up a table to list your student loans, including the loan amount, interest rate, and minimum monthly payment.

- Set up a separate table to list different repayment scenarios, such as increasing your monthly payment or consolidating your loans.

- Use formulas to calculate the total interest paid, payoff period, and monthly payments for each scenario.

- Create charts and graphs to visualize your debt repayment progress.

Using the Student Loan Payoff Calculator Excel Template

Once you've created your student loan payoff calculator Excel template, it's time to use it to plan your debt freedom. Here's a step-by-step guide:

- Input your loan information: Enter your student loan details, including the loan amount, interest rate, and minimum monthly payment.

- Select a repayment scenario: Choose a repayment scenario, such as increasing your monthly payment or consolidating your loans.

- Review the results: Use the calculator to determine the total interest paid, payoff period, and monthly payments for the selected scenario.

- Adjust and refine: Refine your plan by adjusting the repayment scenario and recalculating the results.

- Track your progress: Use the template to track your debt repayment progress and make adjustments as needed.

Tips and Strategies for Paying Off Student Loans

In addition to using a student loan payoff calculator Excel template, here are some tips and strategies for paying off your student loans:

- Increase your income: Consider taking on a side hustle or asking for a raise to increase your income and put more towards your loans.

- Decrease expenses: Cut back on unnecessary expenses and allocate the saved funds towards your loans.

- Consolidate your loans: Consolidating your loans may simplify your payments and potentially lower your interest rate.

- Pay more than the minimum: Paying more than the minimum monthly payment can help you pay off your loans faster and save on interest.

Conclusion

Paying off student loans requires a strategic approach. By using a student loan payoff calculator Excel template, you can create a personalized plan to pay off your loans efficiently. Remember to track your progress, adjust your plan as needed, and stay committed to achieving debt freedom.

Share Your Thoughts

Have you used a student loan payoff calculator Excel template to plan your debt freedom? Share your experiences and tips in the comments below.

Student Loan Payoff Calculator Excel Template Gallery

Student Loan Payoff Calculator Excel Template Gallery