Discover 5 ways to estimate taxes on your paycheck, including withholding, deductions, and exemptions, to avoid underpayment penalties and optimize tax refunds with accurate tax estimation and planning strategies.

The importance of understanding tax estimates cannot be overstated, especially when it comes to managing one's paycheck. Taxes can significantly impact the amount of money you take home, and having a clear understanding of how taxes are estimated and applied can help you make more informed financial decisions. Whether you're a seasoned employee or just starting your career, knowing how to estimate taxes on your paycheck can help you avoid surprises and plan your finances more effectively.

Taxes are a crucial part of our financial landscape, and understanding how they work is essential for anyone looking to manage their money wisely. From income tax to payroll tax, there are various types of taxes that can affect your paycheck, and knowing how to estimate them can help you budget more accurately. In this article, we'll delve into the world of tax estimates and explore five ways to estimate taxes on your paycheck, providing you with the knowledge and tools you need to take control of your financial situation.

The process of estimating taxes can seem daunting, but it's actually quite straightforward once you understand the basics. By considering factors such as your income level, filing status, and deductions, you can get a fairly accurate estimate of how much you'll owe in taxes. This information can then be used to adjust your withholding, ensuring that you're not overpaying or underpaying your taxes throughout the year. With the right approach, you can minimize the risk of owing a large amount of money when you file your tax return and maximize your refund.

Understanding Tax Estimates

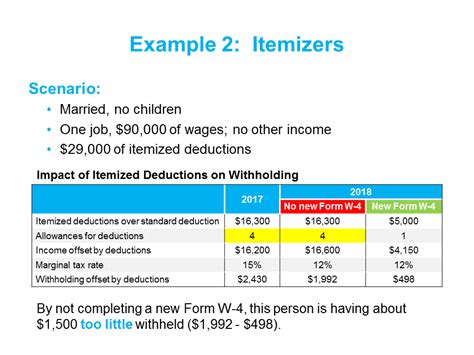

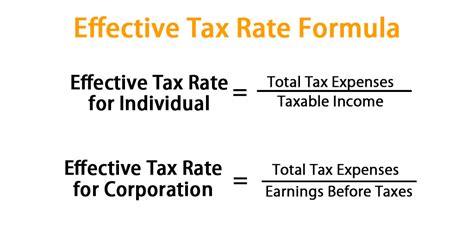

To estimate taxes on your paycheck, you need to understand how taxes are calculated. Taxes are typically withheld from your paycheck based on your income level, filing status, and the number of allowances you claim. The more allowances you claim, the less tax will be withheld from your paycheck. However, if you claim too many allowances, you may end up owing a large amount of money when you file your tax return. On the other hand, if you claim too few allowances, you may end up overpaying your taxes throughout the year.

Factors Affecting Tax Estimates

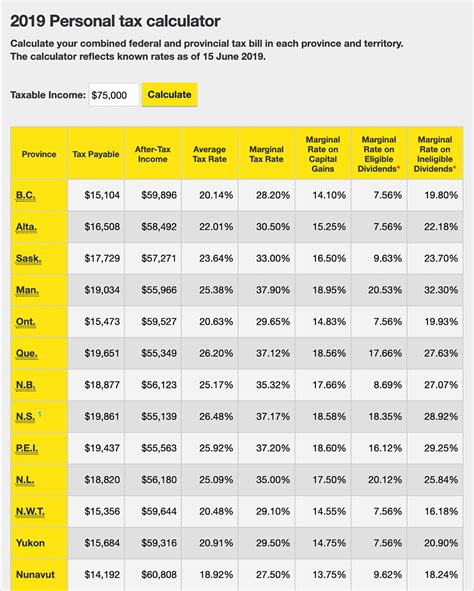

Several factors can affect your tax estimates, including your income level, filing status, and deductions. Your income level is the most significant factor, as it determines how much you'll owe in taxes. Your filing status, whether single, married, or head of household, can also impact your tax estimates. Additionally, deductions such as charitable donations, mortgage interest, and medical expenses can reduce your taxable income and lower your tax liability.5 Ways to Estimate Taxes on Your Paycheck

Now that we've covered the basics of tax estimates, let's explore five ways to estimate taxes on your paycheck. These methods can help you get a more accurate estimate of your tax liability and make informed decisions about your finances.

- Use the IRS Tax Withholding Estimator: The IRS offers a tax withholding estimator tool on its website that can help you estimate your tax liability. This tool takes into account your income, filing status, and deductions to provide an estimate of how much you'll owe in taxes.

- Consult a Tax Professional: A tax professional can help you estimate your tax liability and provide guidance on how to minimize your tax burden. They can also help you navigate the tax code and ensure you're taking advantage of all the deductions and credits you're eligible for.

- Use Tax Software: Tax software such as TurboTax or H&R Block can help you estimate your tax liability and prepare your tax return. These programs ask you a series of questions about your income, filing status, and deductions, and then provide an estimate of your tax liability.

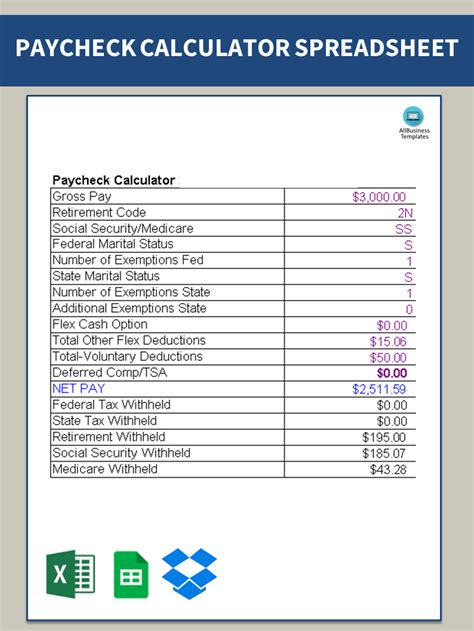

- Review Your Pay Stub: Your pay stub can provide valuable information about your tax withholding. By reviewing your pay stub, you can see how much tax is being withheld from your paycheck and adjust your withholding accordingly.

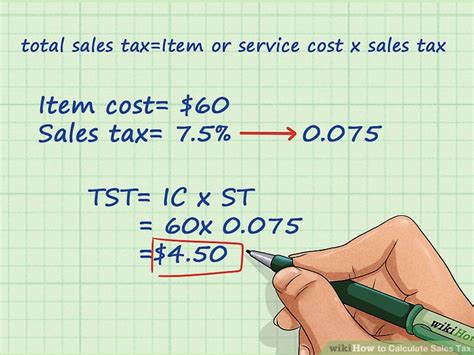

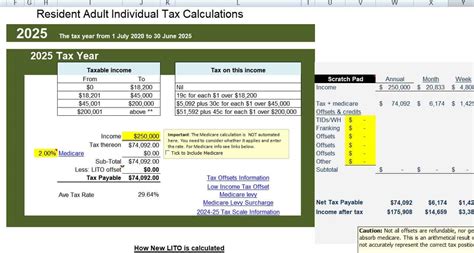

- Use a Tax Calculator: A tax calculator can help you estimate your tax liability based on your income, filing status, and deductions. These calculators are often available online and can provide a quick and easy way to estimate your tax liability.

Benefits of Estimating Taxes

Estimating taxes on your paycheck can provide several benefits, including avoiding surprises at tax time, minimizing the risk of owing a large amount of money, and maximizing your refund. By estimating your tax liability, you can adjust your withholding to ensure you're not overpaying or underpaying your taxes throughout the year. This can help you avoid penalties and interest, and ensure you're taking home the maximum amount of money possible.Common Tax Estimation Mistakes

When estimating taxes on your paycheck, it's essential to avoid common mistakes that can impact your tax liability. These mistakes include underestimating or overestimating your income, failing to account for deductions and credits, and neglecting to adjust your withholding throughout the year. By avoiding these mistakes, you can ensure you're getting an accurate estimate of your tax liability and making informed decisions about your finances.

Tax Estimation Tips

To get an accurate estimate of your tax liability, it's essential to follow some basic tips. These tips include keeping accurate records of your income and expenses, staying up-to-date on changes to the tax code, and consulting a tax professional if you're unsure about any aspect of the tax estimation process. By following these tips, you can ensure you're getting an accurate estimate of your tax liability and making informed decisions about your finances.Tax Estimation Tools and Resources

There are several tools and resources available to help you estimate taxes on your paycheck. These tools include tax software, tax calculators, and the IRS tax withholding estimator. By using these tools, you can get an accurate estimate of your tax liability and make informed decisions about your finances.

Tax Estimation Best Practices

To ensure you're getting an accurate estimate of your tax liability, it's essential to follow some best practices. These best practices include reviewing your pay stub regularly, adjusting your withholding throughout the year, and consulting a tax professional if you're unsure about any aspect of the tax estimation process. By following these best practices, you can ensure you're getting an accurate estimate of your tax liability and making informed decisions about your finances.Tax Estimate Paycheck Image Gallery

By following the tips and best practices outlined in this article, you can ensure you're getting an accurate estimate of your tax liability and making informed decisions about your finances. Remember to review your pay stub regularly, adjust your withholding throughout the year, and consult a tax professional if you're unsure about any aspect of the tax estimation process. With the right approach, you can minimize the risk of owing a large amount of money when you file your tax return and maximize your refund. We invite you to share your thoughts and experiences with tax estimates in the comments below, and encourage you to share this article with anyone who may benefit from this information.