Intro

Streamline payroll processing with our free Texas pay stub template. Designed for employers and employees, this template helps ensure compliance with Texas labor laws. Easily track earnings, deductions, and taxes. Download now and simplify payroll management with our customizable and printable template, perfect for small businesses and HR professionals.

Understanding the Importance of Pay Stub Templates in Texas

As an employer in Texas, it's essential to provide your employees with accurate and timely pay stubs. Pay stubs, also known as pay slips or paycheck stubs, are documents that detail an employee's earnings and deductions for a specific pay period. They serve as proof of income and are often required for various purposes, such as obtaining loans or renting an apartment. In this article, we'll explore the importance of pay stub templates in Texas and provide guidance on how to create and use them effectively.

Benefits of Using Pay Stub Templates

Using pay stub templates can benefit both employers and employees in several ways:

- Accuracy and Efficiency: Pay stub templates help ensure that all necessary information is included, reducing errors and saving time.

- Compliance with Texas Labor Laws: Pay stub templates can help employers comply with Texas labor laws, which require that employees receive accurate and timely pay stubs.

- Employee Confidence and Trust: Providing clear and detailed pay stubs can boost employee confidence and trust in their employer.

- Simplified Record-Keeping: Pay stub templates can help employers maintain accurate and organized records of employee earnings and deductions.

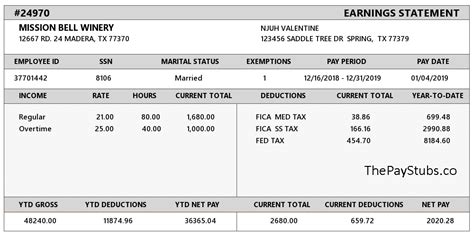

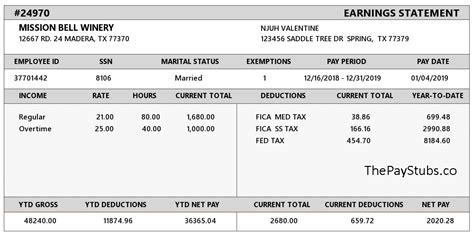

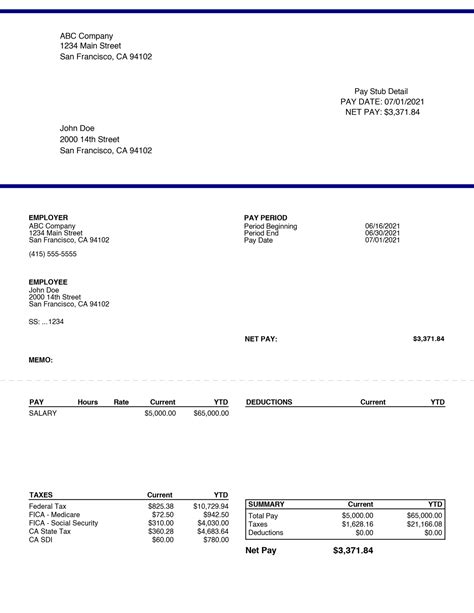

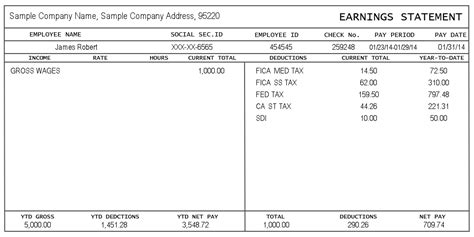

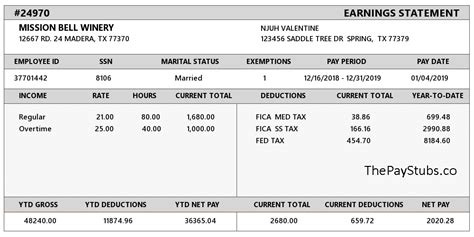

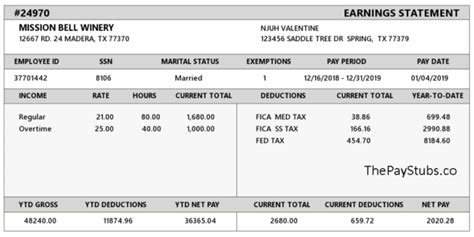

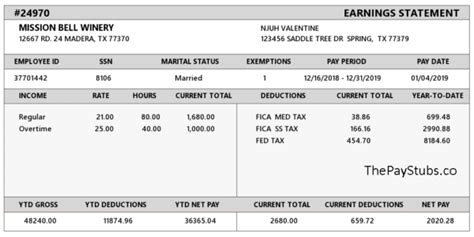

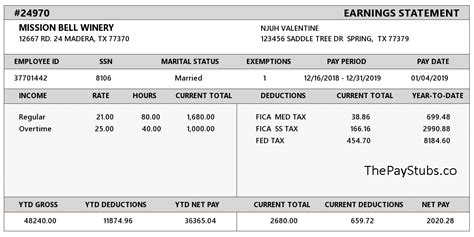

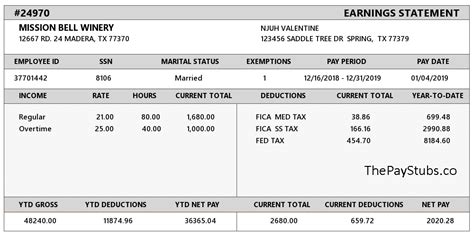

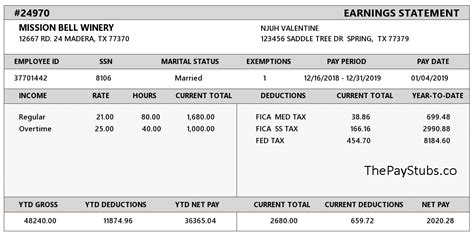

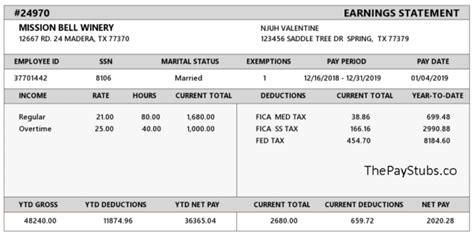

What to Include in a Texas Pay Stub Template

A Texas pay stub template should include the following essential information:

- Employee Information: Employee name, address, and social security number.

- Employer Information: Employer name, address, and tax identification number.

- Pay Period and Date: Pay period start and end dates, as well as the pay date.

- Gross Earnings: Total earnings before deductions.

- Deductions: List of deductions, including taxes, insurance, and other withholdings.

- Net Pay: Total take-home pay after deductions.

Creating a Texas Pay Stub Template

To create a Texas pay stub template, you can use a spreadsheet software like Microsoft Excel or Google Sheets. Here's a step-by-step guide:

- Set Up the Template: Create a new spreadsheet and set up the columns and rows to accommodate the necessary information.

- Add Employee and Employer Information: Include fields for employee and employer information, such as name, address, and social security number.

- Create Pay Period and Date Fields: Add fields for pay period start and end dates, as well as the pay date.

- Calculate Gross Earnings: Use formulas to calculate gross earnings based on hours worked and pay rate.

- List Deductions: Create a list of deductions, including taxes, insurance, and other withholdings.

- Calculate Net Pay: Use formulas to calculate net pay based on gross earnings and deductions.

Best Practices for Using Pay Stub Templates

To get the most out of pay stub templates, follow these best practices:

- Use a Standardized Template: Use a standardized template to ensure consistency and accuracy.

- Review and Update Regularly: Regularly review and update the template to ensure compliance with changing labor laws and regulations.

- Train Employees on Pay Stub Templates: Train employees on how to read and understand pay stubs, as well as how to report errors or discrepancies.

- Maintain Accurate Records: Maintain accurate and organized records of employee earnings and deductions.

Common Mistakes to Avoid When Using Pay Stub Templates

When using pay stub templates, avoid the following common mistakes:

- Inaccurate or Incomplete Information: Ensure that all necessary information is included and accurate.

- Failure to Update Template: Regularly update the template to ensure compliance with changing labor laws and regulations.

- Insufficient Training: Provide adequate training to employees on how to read and understand pay stubs.

Conclusion

Pay stub templates are an essential tool for employers and employees in Texas. By understanding the benefits and best practices of using pay stub templates, employers can ensure compliance with labor laws and provide accurate and timely pay stubs to their employees. Employees can also benefit from clear and detailed pay stubs, which can boost confidence and trust in their employer.

Gallery of Texas Pay Stub Template Examples

Texas Pay Stub Template Image Gallery