Intro

Master your finances with the Tiffany Aliche Budget Template. Follow 5 simple steps to create a personalized budget that works for you. Learn how to track expenses, prioritize needs, and achieve financial stability. Say goodbye to debt and hello to savings with this expert-approved budgeting solution. Start your journey to financial freedom today!

In today's economy, managing finances effectively is crucial for achieving financial stability and security. One of the most effective ways to do this is by creating a budget that works for you, not against you. Tiffany Aliche, also known as "The Budgetnista," has helped thousands of people create budgets that have transformed their financial lives. In this article, we will explore the 5 simple steps to creating a Tiffany Aliche budget template that will help you take control of your finances.

Managing your finances can be overwhelming, especially when you're not sure where to start. You may feel like you're drowning in debt, or that you're not saving enough for the future. But the truth is, creating a budget is not as complicated as it seems. With the right tools and a little bit of knowledge, you can create a budget that will help you achieve your financial goals.

So, why is budgeting so important? Budgeting helps you prioritize your spending, make smart financial decisions, and achieve your long-term goals. By creating a budget, you'll be able to:

- Track your income and expenses

- Identify areas where you can cut back on unnecessary spending

- Make smart financial decisions that align with your goals

- Save for the future and achieve financial stability

Now, let's dive into the 5 simple steps to creating a Tiffany Aliche budget template.

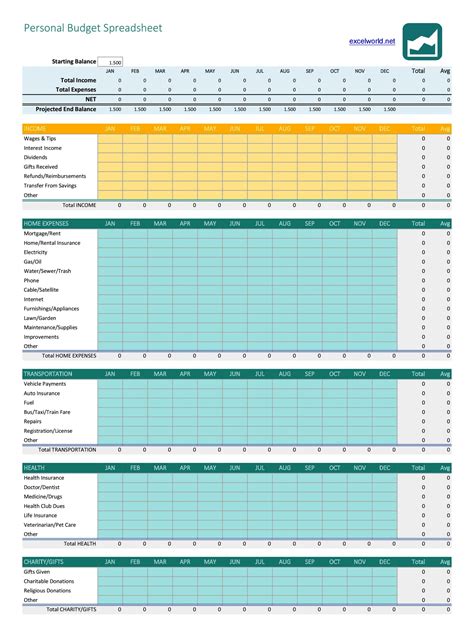

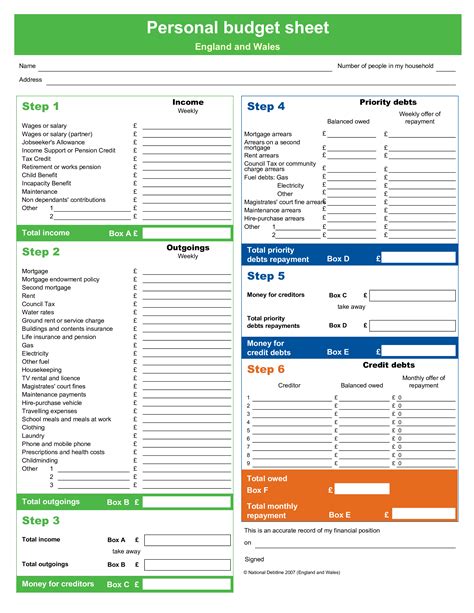

Step 1: Identify Your Income and Expenses

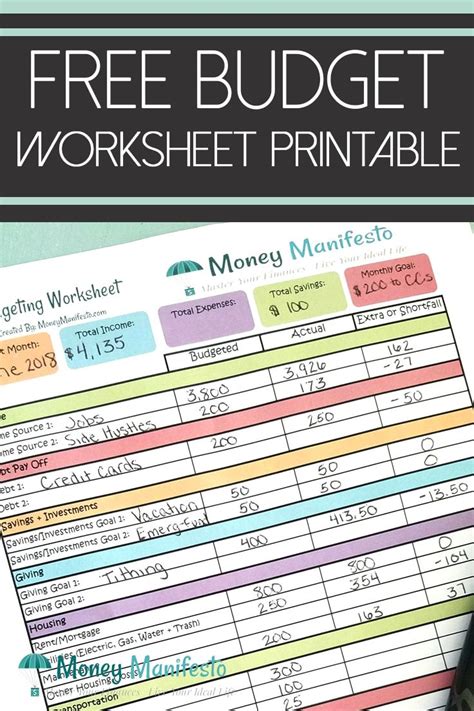

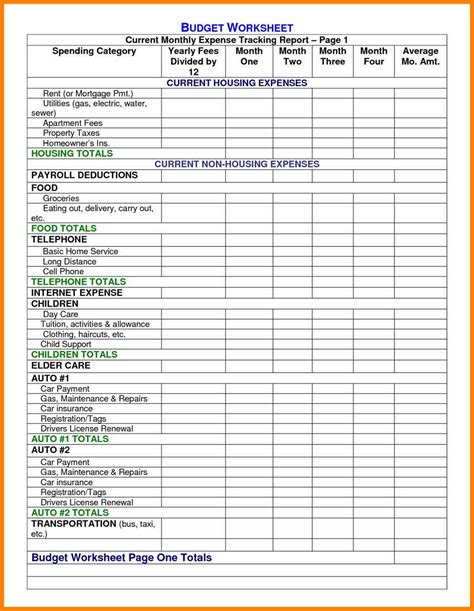

The first step in creating a budget is to identify your income and expenses. Start by gathering all of your financial documents, including pay stubs, bank statements, and bills. Then, calculate your total monthly income and list out all of your monthly expenses, including rent/mortgage, utilities, groceries, and entertainment.

It's essential to be honest and accurate when tracking your income and expenses. Make sure to include every single transaction, no matter how small it may seem. This will give you a clear picture of where your money is going and help you identify areas where you can cut back.

50/30/20 Rule

One of the most effective ways to allocate your income is by using the 50/30/20 rule. This rule suggests that 50% of your income should go towards necessary expenses, such as rent/mortgage, utilities, and groceries. 30% should go towards discretionary spending, such as entertainment and hobbies. And 20% should go towards saving and debt repayment.

By following this rule, you'll be able to prioritize your spending and make sure that you're saving enough for the future.

Step 2: Set Financial Goals

Once you have a clear picture of your income and expenses, it's time to set financial goals. What do you want to achieve with your budget? Do you want to save for a down payment on a house? Pay off debt? Build up your emergency fund?

Your financial goals should be specific, measurable, achievable, relevant, and time-bound (SMART). For example, "I want to save $1,000 for a down payment on a house within the next 6 months."

Having clear financial goals will help you stay motivated and focused on your budget. It will also give you a sense of direction and help you make smart financial decisions.

Short-Term vs. Long-Term Goals

When setting financial goals, it's essential to consider both short-term and long-term goals. Short-term goals are goals that you want to achieve within the next year or two. Examples of short-term goals include saving for a vacation, paying off credit card debt, or building up your emergency fund.

Long-term goals, on the other hand, are goals that you want to achieve within the next 5-10 years. Examples of long-term goals include saving for a down payment on a house, retirement, or a big purchase.

By setting both short-term and long-term goals, you'll be able to prioritize your spending and make smart financial decisions that align with your goals.

Step 3: Create a Budget Plan

Now that you have a clear picture of your income and expenses, and you've set financial goals, it's time to create a budget plan. A budget plan is a detailed outline of how you plan to allocate your income and expenses.

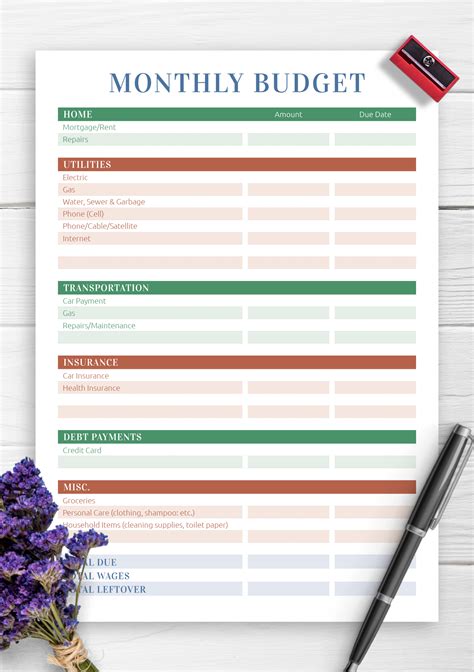

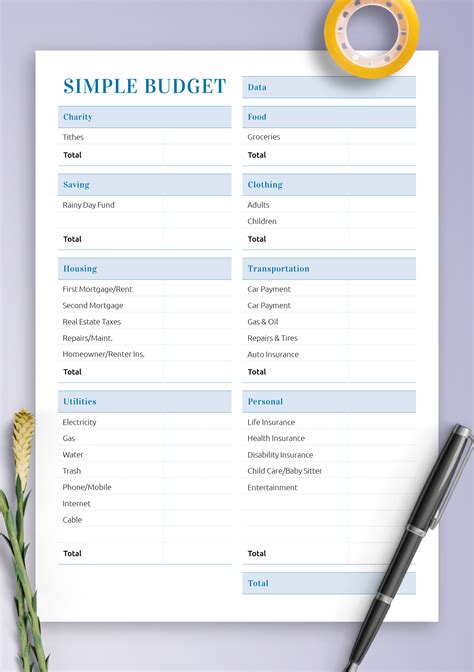

Start by categorizing your expenses into needs, wants, and savings. Then, allocate your income accordingly. Make sure to include a category for emergency fund contributions and debt repayment.

Your budget plan should be realistic and achievable. It should also be flexible, allowing you to make adjustments as needed.

Budgeting Apps

There are many budgeting apps available that can help you create and track your budget. Some popular options include Mint, You Need a Budget (YNAB), and Personal Capital.

These apps can help you track your income and expenses, set financial goals, and receive alerts and reminders to help you stay on track.

Step 4: Track Your Spending

Once you have a budget plan in place, it's essential to track your spending. This will help you stay on track and make sure that you're not overspending.

Start by tracking every single transaction, no matter how small it may seem. You can use a budgeting app, spreadsheet, or even just a notebook to track your spending.

Make sure to review your spending regularly, making adjustments as needed. This will help you stay on track and achieve your financial goals.

Accountability Partner

Having an accountability partner can be a great way to stay on track with your budget. This can be a friend, family member, or even a financial advisor.

Your accountability partner can help you stay motivated and focused on your budget. They can also provide support and guidance when you need it.

Step 5: Review and Revise

Finally, it's essential to review and revise your budget regularly. This will help you stay on track and make sure that you're achieving your financial goals.

Start by reviewing your budget every few months, making adjustments as needed. This will help you stay on track and achieve your financial goals.

Budgeting Is a Journey

Budgeting is a journey, not a destination. It takes time, effort, and patience to create a budget that works for you.

Don't be too hard on yourself if you slip up. Instead, learn from your mistakes and make adjustments as needed.

By following these 5 simple steps, you'll be able to create a Tiffany Aliche budget template that will help you take control of your finances and achieve your financial goals.

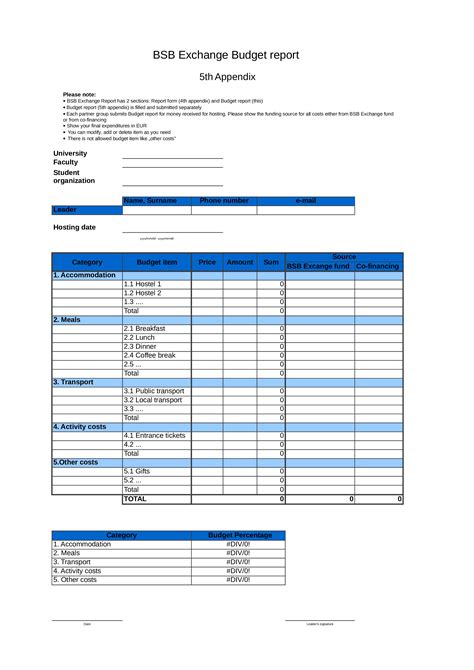

Printable Budget Templates Image Gallery

We hope this article has provided you with the tools and knowledge you need to create a Tiffany Aliche budget template that will help you take control of your finances and achieve your financial goals. Remember, budgeting is a journey, not a destination. It takes time, effort, and patience to create a budget that works for you. But with the right tools and a little bit of knowledge, you can achieve financial stability and security. So, what are you waiting for? Start creating your budget today and take the first step towards financial freedom!