Intro

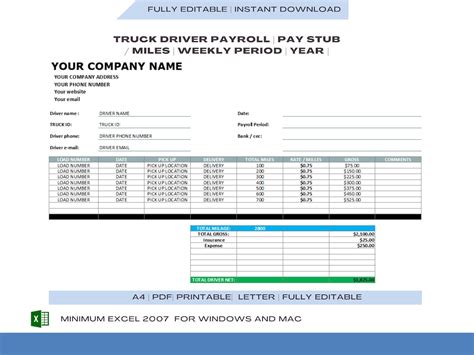

Optimize your trucking business with essential pay stub template guidelines. Learn how to create accurate and compliant pay stubs with our expert advice, covering deductions, benefits, and driver compensation. Ensure seamless payroll processing with our 5 must-know guidelines for trucking pay stub templates.

As a trucking company owner or manager, ensuring that your drivers receive accurate and timely pay stubs is crucial for their financial well-being and your company's compliance with labor laws. A well-designed trucking pay stub template can help you achieve this goal. In this article, we will discuss the five essential guidelines to follow when creating a trucking pay stub template.

Importance of Accurate Pay Stubs for Truckers

For truckers, receiving accurate pay stubs is vital for managing their finances, tracking their earnings, and ensuring they are being paid correctly. Inaccurate or missing pay stubs can lead to frustration, mistrust, and even legal issues. As a trucking company, providing accurate pay stubs demonstrates your commitment to transparency, fairness, and compliance with labor laws.

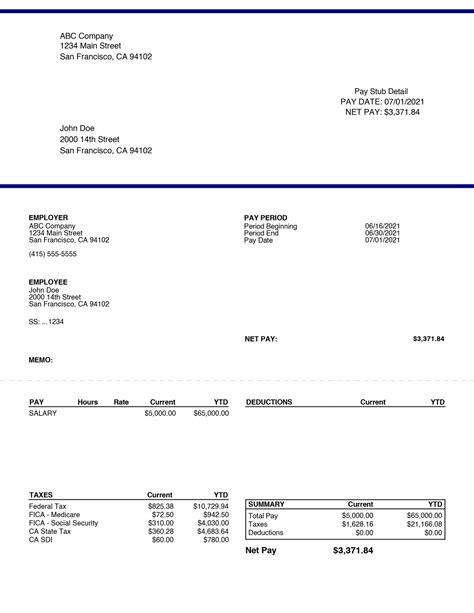

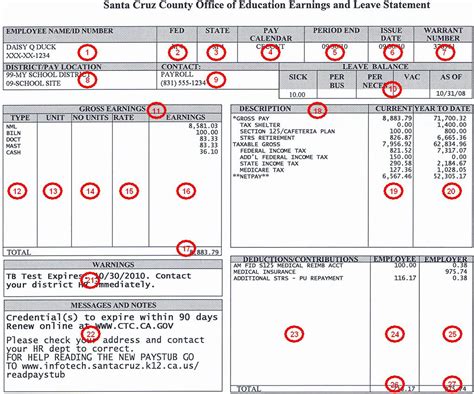

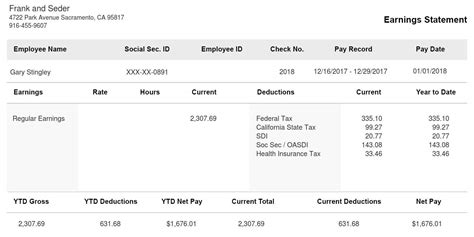

Guideline 1: Include Essential Pay Stub Information

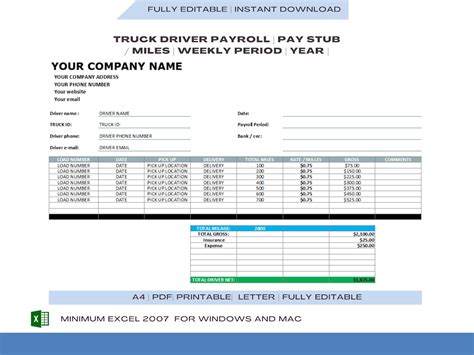

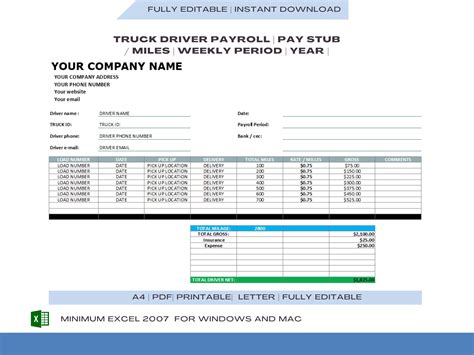

A trucking pay stub template should include the following essential information:

- Driver's name and identification number

- Pay period dates

- Gross earnings (including hourly, mileage, and load-based pay)

- Deductions (taxes, benefits, etc.)

- Net pay (take-home pay)

- Year-to-date (YTD) earnings

Additional Information to Consider

- Overtime pay and hours worked

- Bonuses or incentives

- Reimbursements for expenses (fuel, maintenance, etc.)

- Benefits (health, dental, vision, etc.)

Guideline 2: Comply with Labor Laws and Regulations

As a trucking company, you must comply with federal and state labor laws, including:

- Fair Labor Standards Act (FLSA)

- Federal Motor Carrier Safety Administration (FMCSA) regulations

- State-specific labor laws and regulations

Ensure your pay stub template meets these requirements by:

- Providing accurate and detailed information about pay and deductions

- Including required notices and disclosures (e.g., workers' compensation)

- Complying with electronic pay stub delivery regulations (if applicable)

Guideline 3: Ensure Clarity and Readability

A clear and readable pay stub template is essential for drivers to understand their pay and deductions. Consider the following:

- Use a clean and simple layout

- Use clear and concise language

- Avoid using jargon or technical terms

- Use headings and subheadings to organize information

Guideline 4: Include Space for Notes and Comments

Providing space for notes and comments on the pay stub template allows drivers to communicate with your accounting or HR team about any pay discrepancies or concerns. This can help:

- Resolve pay issues promptly

- Improve communication between drivers and staff

- Reduce errors and misunderstandings

Guideline 5: Review and Update Regularly

Regularly reviewing and updating your trucking pay stub template ensures compliance with changing labor laws and regulations. Consider:

- Reviewing your template annually or bi-annually

- Updating your template to reflect changes in labor laws or regulations

- Soliciting feedback from drivers and staff to improve the template

By following these five essential guidelines, you can create a trucking pay stub template that is accurate, clear, and compliant with labor laws. This will help you maintain a positive relationship with your drivers, reduce errors and misunderstandings, and ensure compliance with regulatory requirements.

Trucking Pay Stub Template Gallery

We hope this article has provided you with valuable insights into creating an effective trucking pay stub template. Remember to prioritize accuracy, clarity, and compliance with labor laws and regulations. If you have any questions or need further guidance, please leave a comment below.