Intro

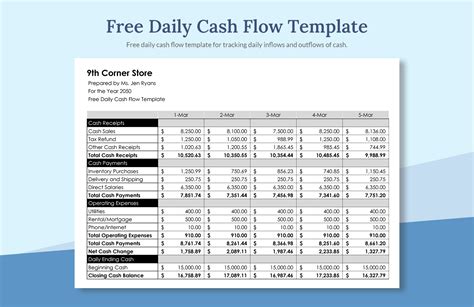

Maximize profitability with our free Uca Cash Flow Template Excel, designed specifically for small business owners. Streamline financial management, predict income, and make informed decisions. Improve cash flow forecasting, reduce financial stress, and boost growth with our easy-to-use Excel template. Download now and start optimizing your businesss financial performance.

Effective cash flow management is crucial for the success and survival of small businesses. It enables entrepreneurs to make informed decisions, manage finances efficiently, and ensure the company's liquidity. One tool that can help small business owners achieve this is the Uniform Cash Flow (UCA) template in Excel.

In this article, we will explore the UCA cash flow template in Excel, its importance for small businesses, and provide a comprehensive guide on how to use it effectively.

Understanding Cash Flow Management

Cash flow management involves tracking the inflows and outflows of cash and cash equivalents in a business. It helps entrepreneurs identify potential cash flow problems, make informed decisions, and ensure the company's liquidity. Effective cash flow management enables businesses to:

- Manage working capital efficiently

- Make informed decisions about investments and funding

- Identify potential cash flow problems and develop strategies to mitigate them

- Improve relationships with suppliers and customers

- Enhance the overall financial health of the business

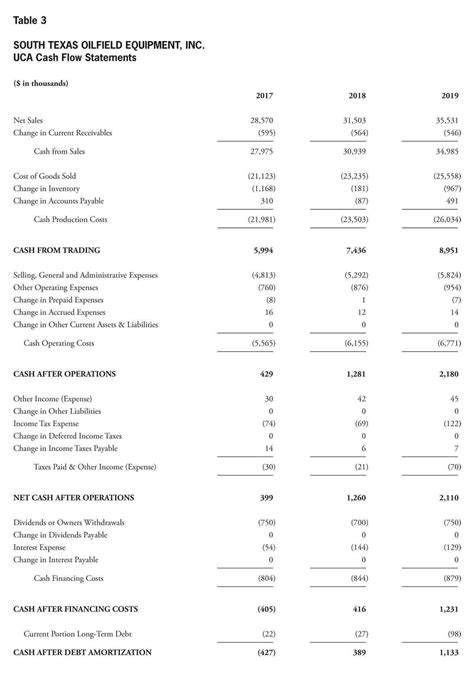

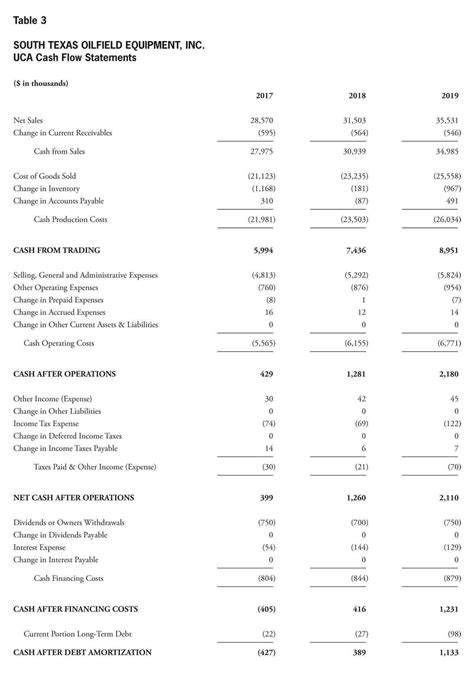

The Importance of UCA Cash Flow Template

The UCA cash flow template is a standardized tool that helps small business owners manage their cash flows effectively. It provides a comprehensive framework for tracking cash inflows and outflows, making it easier to identify potential cash flow problems and develop strategies to mitigate them.

The UCA cash flow template is particularly useful for small businesses because it:

- Provides a clear and concise picture of the company's cash flows

- Enables entrepreneurs to identify areas for improvement and develop strategies to optimize cash flows

- Helps businesses make informed decisions about investments and funding

- Enhances the overall financial health of the business

How to Use the UCA Cash Flow Template in Excel

Using the UCA cash flow template in Excel is relatively straightforward. Here's a step-by-step guide to help you get started:

- Download the template: You can download the UCA cash flow template from various online sources or create your own using Excel.

- Set up the template: Set up the template by entering your business's financial data, including cash inflows and outflows.

- Track cash inflows: Track your business's cash inflows, including sales, accounts receivable, and other sources of income.

- Track cash outflows: Track your business's cash outflows, including accounts payable, salaries, and other expenses.

- Analyze cash flows: Analyze your business's cash flows to identify potential problems and develop strategies to mitigate them.

Benefits of Using the UCA Cash Flow Template

Using the UCA cash flow template provides numerous benefits for small business owners, including:

- Improved cash flow management: The template provides a comprehensive framework for tracking cash inflows and outflows, making it easier to identify potential cash flow problems.

- Enhanced financial decision-making: The template enables entrepreneurs to make informed decisions about investments and funding.

- Increased transparency: The template provides a clear and concise picture of the company's cash flows, making it easier to identify areas for improvement.

Common Mistakes to Avoid

When using the UCA cash flow template, there are several common mistakes to avoid, including:

- Inaccurate data entry: Ensure that all financial data is entered accurately and consistently.

- Failure to track cash flows regularly: Regularly track cash flows to identify potential problems and develop strategies to mitigate them.

- Ignoring cash flow projections: Use cash flow projections to identify potential problems and develop strategies to mitigate them.

Best Practices for Using the UCA Cash Flow Template

To get the most out of the UCA cash flow template, follow these best practices:

- Use the template regularly: Regularly use the template to track cash flows and identify potential problems.

- Analyze cash flows regularly: Analyze cash flows regularly to identify areas for improvement and develop strategies to optimize cash flows.

- Use cash flow projections: Use cash flow projections to identify potential problems and develop strategies to mitigate them.

Conclusion

Effective cash flow management is crucial for the success and survival of small businesses. The UCA cash flow template in Excel provides a comprehensive framework for tracking cash inflows and outflows, making it easier to identify potential cash flow problems and develop strategies to mitigate them. By following the best practices outlined in this article, small business owners can use the UCA cash flow template to improve their cash flow management, enhance financial decision-making, and increase transparency.

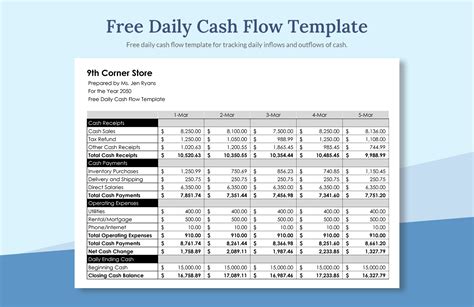

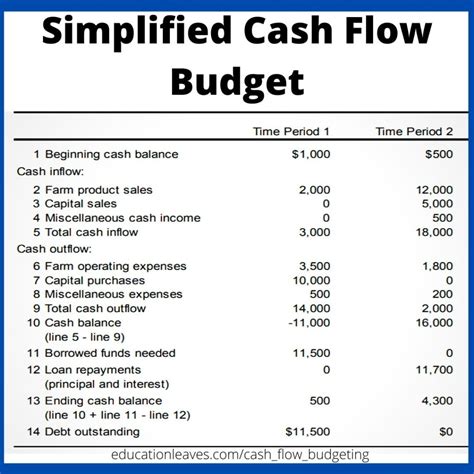

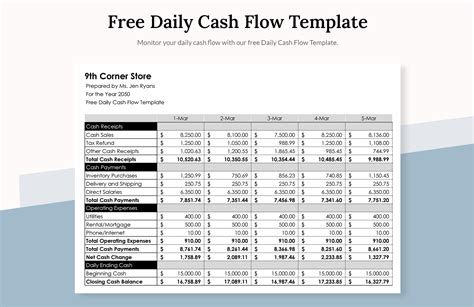

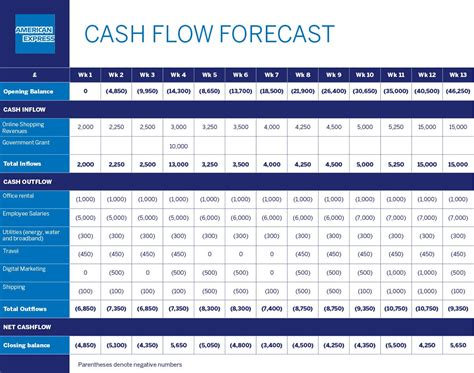

Gallery of UCA Cash Flow Template

UCA Cash Flow Template Gallery

Frequently Asked Questions

Q: What is the UCA cash flow template? A: The UCA cash flow template is a standardized tool that helps small business owners manage their cash flows effectively.

Q: How do I use the UCA cash flow template? A: To use the UCA cash flow template, simply download the template, set it up, track cash inflows and outflows, and analyze cash flows regularly.

Q: What are the benefits of using the UCA cash flow template? A: The benefits of using the UCA cash flow template include improved cash flow management, enhanced financial decision-making, and increased transparency.

Q: What are some common mistakes to avoid when using the UCA cash flow template? A: Common mistakes to avoid include inaccurate data entry, failure to track cash flows regularly, and ignoring cash flow projections.

Q: How can I get the most out of the UCA cash flow template? A: To get the most out of the UCA cash flow template, use it regularly, analyze cash flows regularly, and use cash flow projections.