6 Essentials Of A Secured Promissory Note In California Summary

Secure your investments with a solid promissory note in California. Discover the 6 essentials to include, such as borrower information, loan terms, and security interests. Ensure compliance with California laws and regulations. Protect your rights with a well-structured note that includes repayment terms, interest rates, and default consequences.

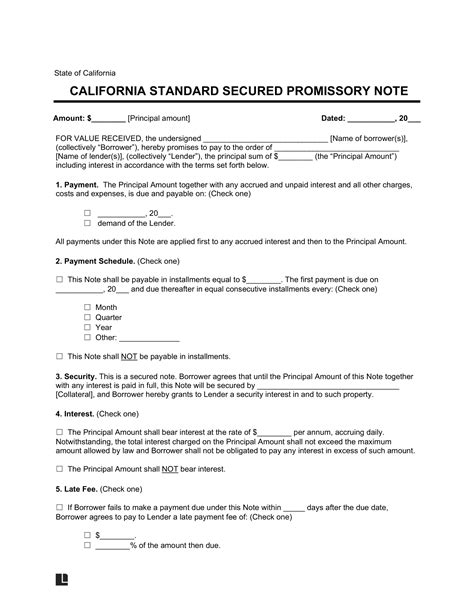

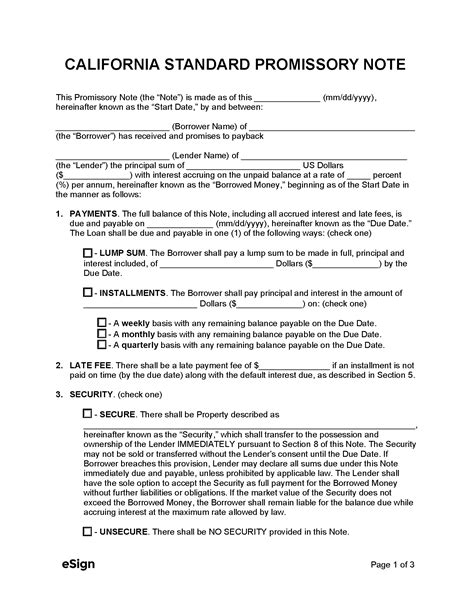

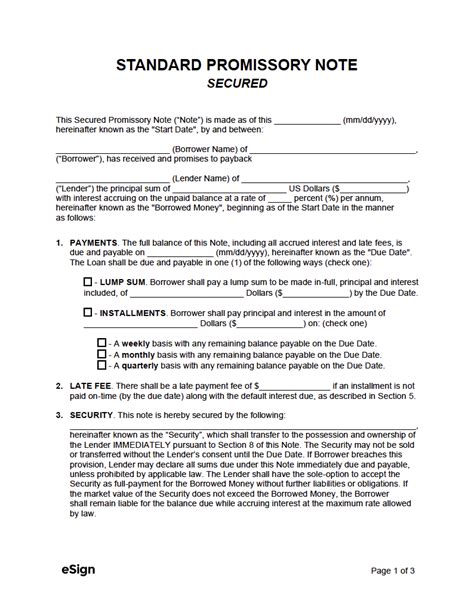

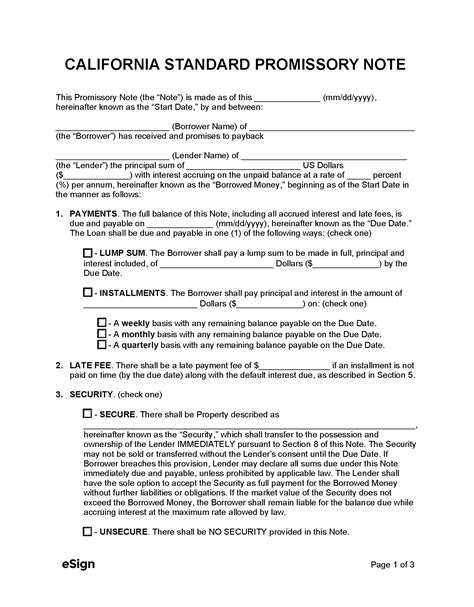

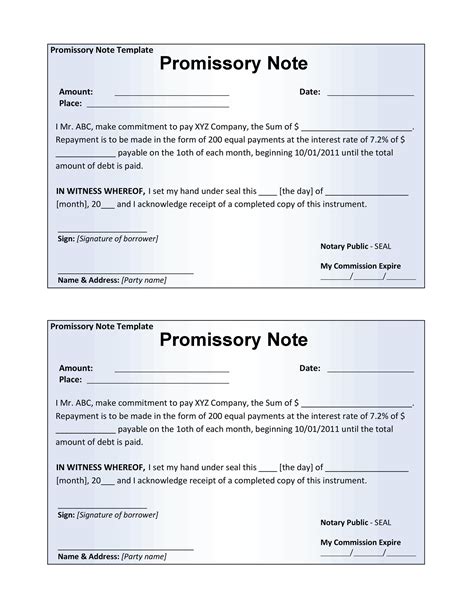

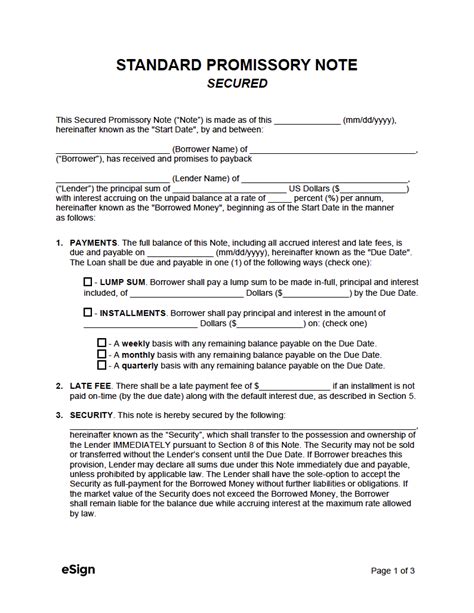

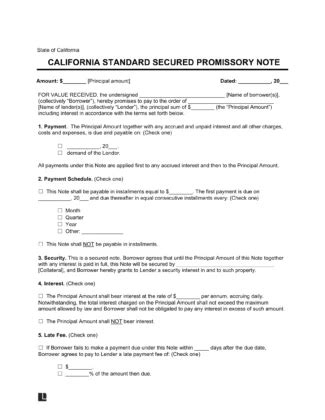

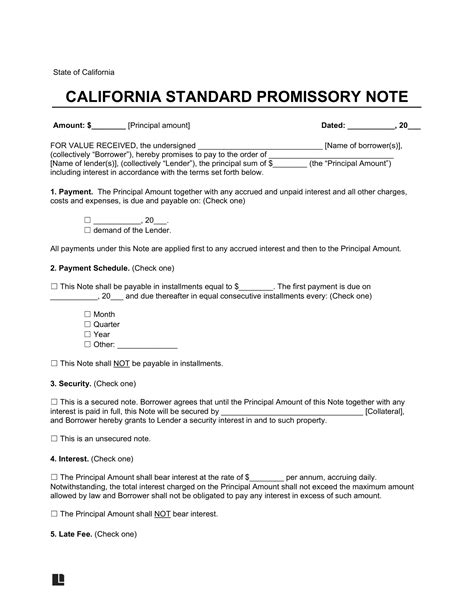

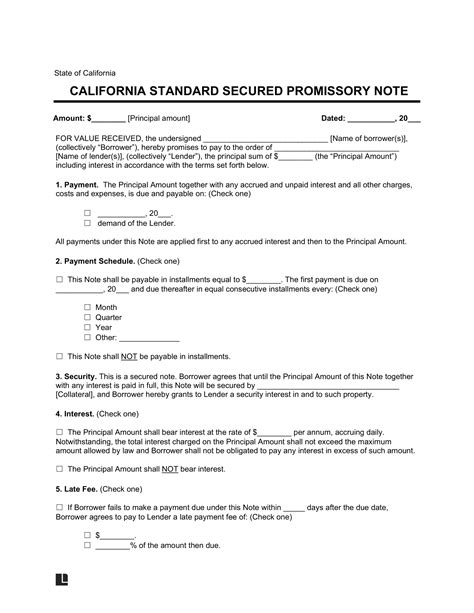

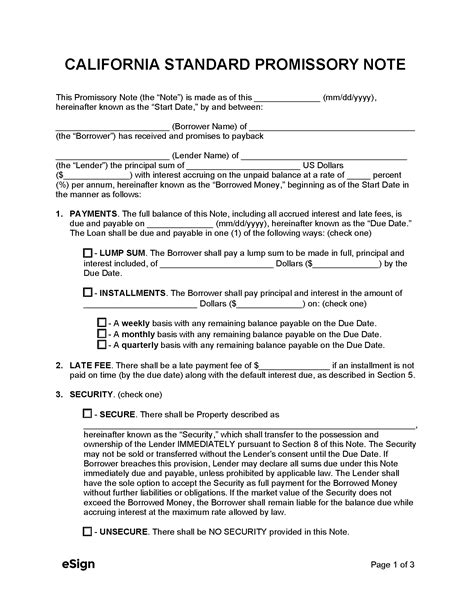

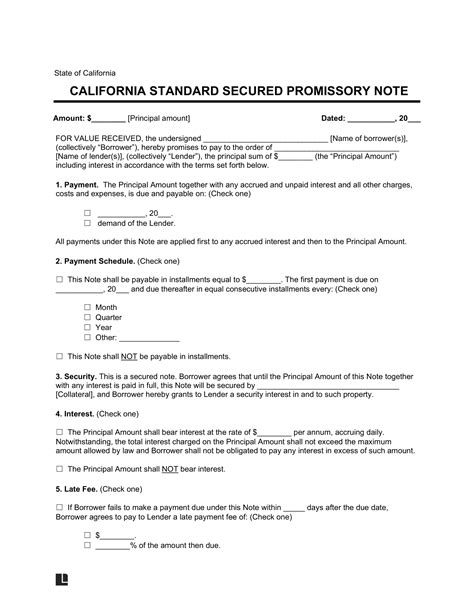

In California, a promissory note is a written agreement where one party, the borrower, promises to pay a sum of money to another party, the lender. When secured by collateral, the lender has an added layer of protection in case the borrower defaults on the loan. A secured promissory note in California is a valuable instrument for lenders, but it must be drafted with specific essentials to ensure its validity and enforceability.

To create a legally binding secured promissory note in California, the following six essentials must be included:

1. Clear Identification of Parties

A secured promissory note must clearly identify the borrower and the lender. This includes their names, addresses, and contact information. In California, the lender can be an individual, a business, or an entity, while the borrower can be an individual or a business.

It is essential to accurately identify the parties involved to avoid confusion or disputes in the future.

Example:

"Borrower: John Doe, 123 Main Street, Anytown, CA 12345 Lender: Jane Smith, 456 Elm Street, Anytown, CA 12345"

2. Description of Loan Terms

The secured promissory note must clearly outline the loan terms, including:

- The principal amount borrowed

- The interest rate

- The repayment schedule

- The maturity date

- Any fees or charges associated with the loan

In California, the loan terms must comply with state and federal regulations.

Example:

"Loan Amount: $100,000 Interest Rate: 6% per annum Repayment Schedule: Monthly payments of $1,000 for 120 months Maturity Date: 5 years from the date of execution Fees: $500 origination fee"

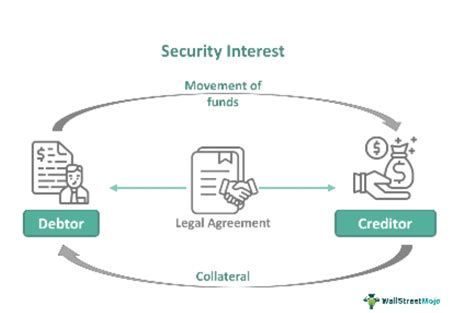

3. Security Interest

A secured promissory note must describe the collateral that secures the loan. This includes:

- A description of the collateral

- The location of the collateral

- The value of the collateral

In California, the security interest must be perfected by filing a UCC-1 financing statement with the Secretary of State.

Example:

"Collateral: 2020 Toyota Camry, Vehicle Identification Number (VIN) #1234567890, located at 123 Main Street, Anytown, CA 12345 Value: $20,000"

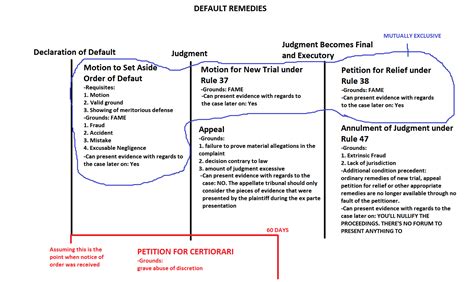

4. Default and Remedies

A secured promissory note must outline the consequences of default, including:

- The events that constitute default

- The remedies available to the lender in case of default

- The process for accelerating the loan

In California, the lender must comply with state and federal regulations when enforcing default remedies.

Example:

"Default: Failure to make 3 consecutive payments Remedies: Acceleration of loan, foreclosure, and repossession Acceleration: Upon default, the entire principal balance becomes due and payable"

5. Governing Law

A secured promissory note must specify the governing law that applies to the agreement. In California, the note should specify that California law governs the agreement.

This ensures that any disputes or issues related to the note are resolved under California law.

Example:

"Governing Law: This note shall be governed by and construed in accordance with the laws of the State of California"

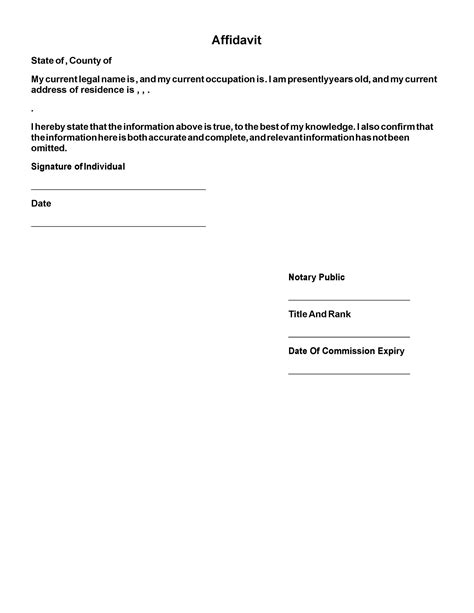

6. Signatures and Acknowledgments

A secured promissory note must be signed by the borrower and acknowledged by a notary public. In California, the notary public must verify the identity of the borrower and witness their signature.

This ensures that the note is binding and enforceable.

Example:

"Borrower's Signature: _____________________________ Notary Public Acknowledgment: _____________________________"

By including these six essentials, a secured promissory note in California can provide a lender with added protection and security in case the borrower defaults on the loan.

Secured Promissory Note in California Image Gallery

We encourage you to comment below with any questions or concerns you may have regarding secured promissory notes in California.