Intro

Get instant access to 5 free UPS pay stub templates to streamline your payroll processing. Easily generate professional pay stubs with these customizable templates, perfect for employers and employees alike. Discover how to efficiently manage payroll records, calculate earnings, and ensure compliance with labor laws using these practical tools.

Receiving a pay stub is an essential part of being an employee. It serves as a record of the employee's earnings, deductions, and other relevant information. For employers, providing accurate and detailed pay stubs is crucial for maintaining transparency and trust with their employees. In this article, we will discuss the importance of pay stubs and provide five free UPS pay stub templates that employers can use.

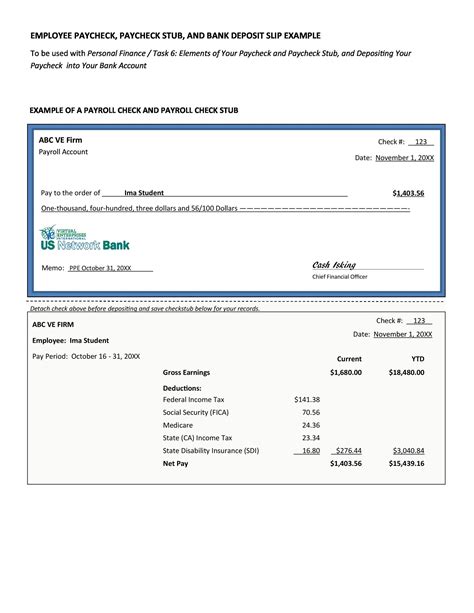

A pay stub, also known as a pay slip or paycheck stub, is a document that outlines the details of an employee's payment. It typically includes information such as the employee's name, pay period, gross pay, deductions, and net pay. Pay stubs are usually provided to employees along with their paycheck or direct deposit.

Why are Pay Stubs Important?

Pay stubs play a significant role in maintaining a smooth and transparent employer-employee relationship. Here are some reasons why pay stubs are important:

- Accuracy: Pay stubs help ensure that employees are paid accurately. By providing a detailed breakdown of earnings and deductions, employees can verify that their pay is correct.

- Transparency: Pay stubs promote transparency by showing employees exactly how their pay is calculated. This helps build trust between employers and employees.

- Record-keeping: Pay stubs serve as a record of an employee's earnings and deductions. This information can be useful for tax purposes, benefits, and other employment-related matters.

What Should be Included in a Pay Stub?

A pay stub should include the following essential information:

- Employee information: Employee name, address, and identification number

- Pay period: The dates covered by the pay period

- Gross pay: The total amount earned by the employee before deductions

- Deductions: A list of deductions, including taxes, benefits, and other withholdings

- Net pay: The employee's take-home pay after deductions

Tips for Creating a Pay Stub

When creating a pay stub, employers should keep the following tips in mind:

- Use a clear format: Use a clear and easy-to-read format to ensure that employees can understand their pay information.

- Include all necessary information: Make sure to include all the required information, such as employee name, pay period, gross pay, deductions, and net pay.

- Be accurate: Double-check the accuracy of the pay information to avoid errors.

5 Free UPS Pay Stub Templates

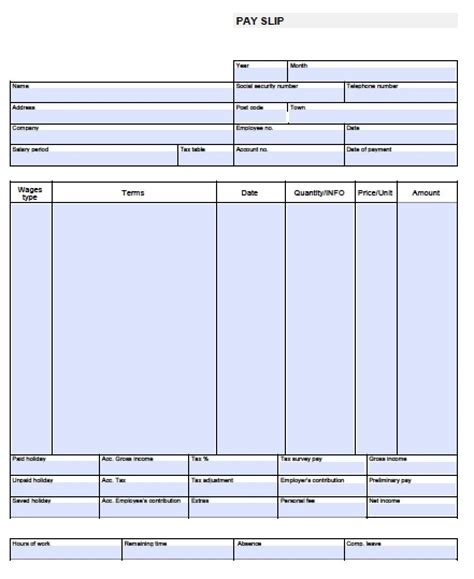

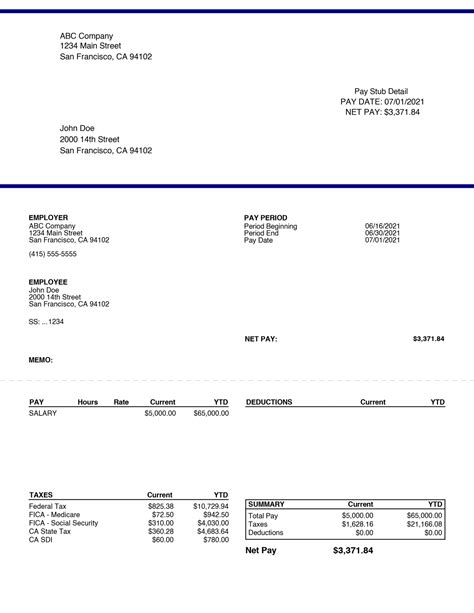

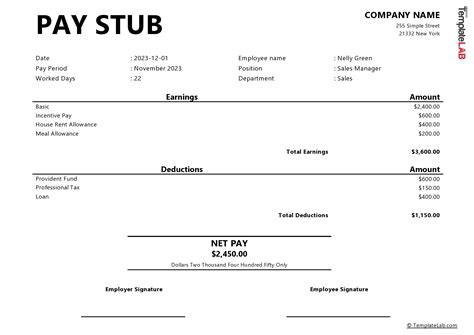

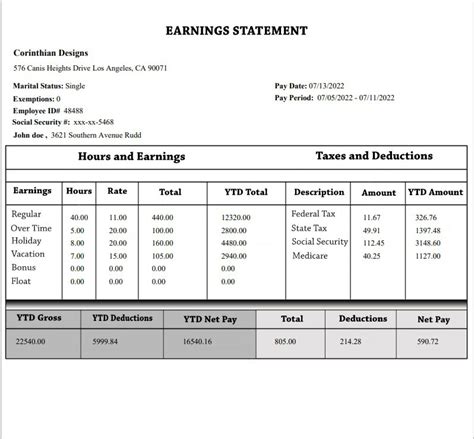

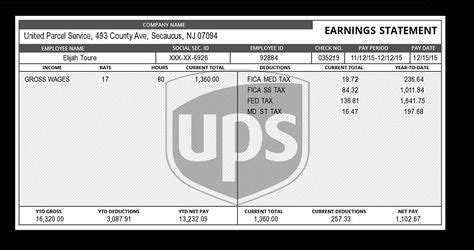

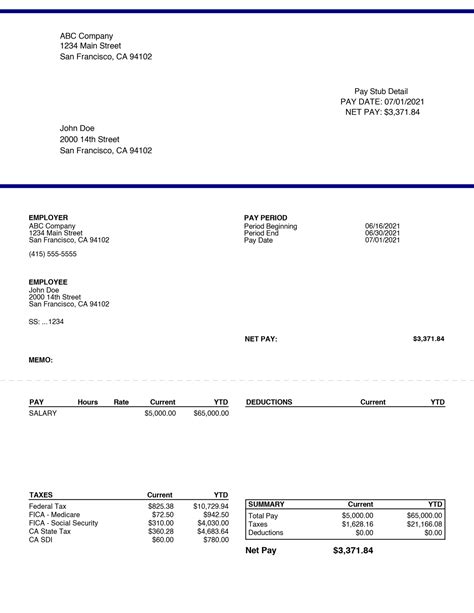

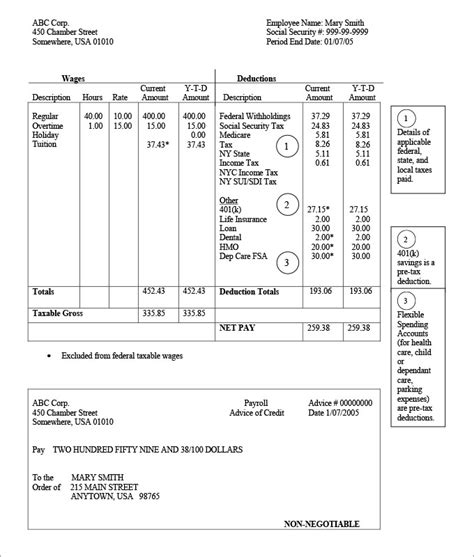

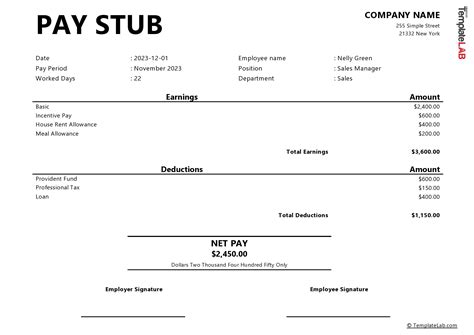

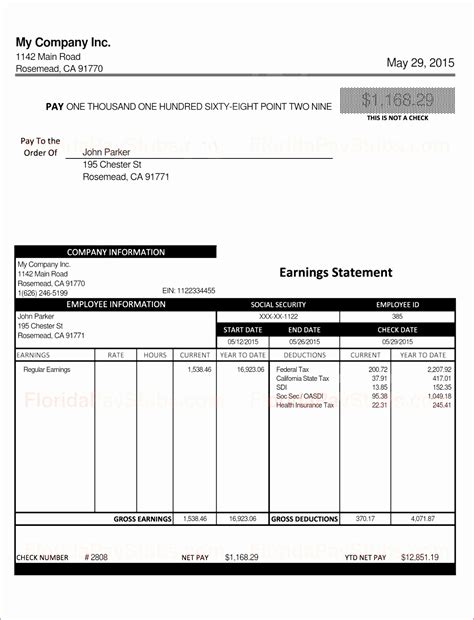

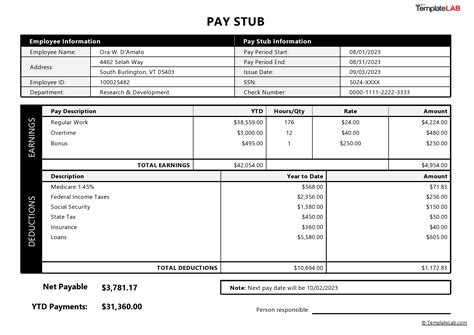

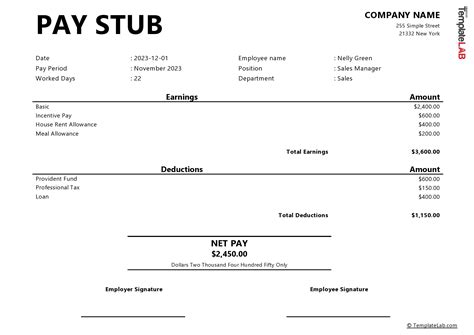

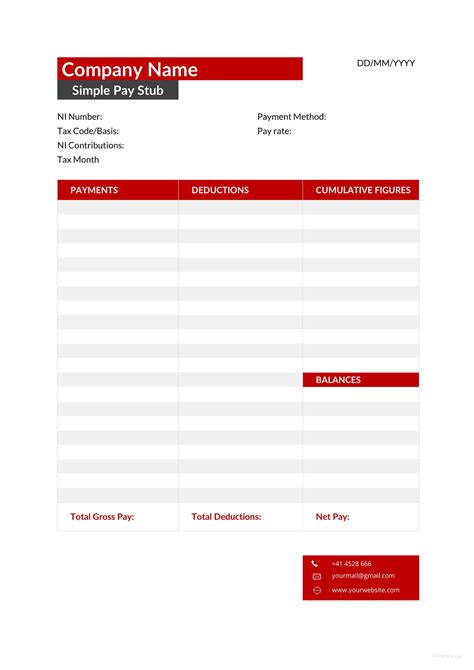

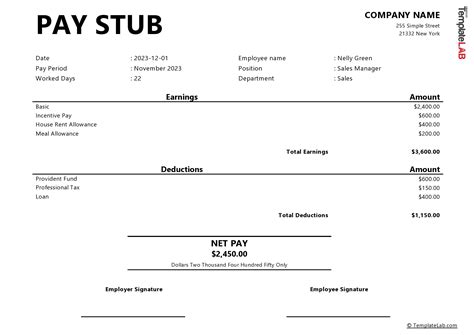

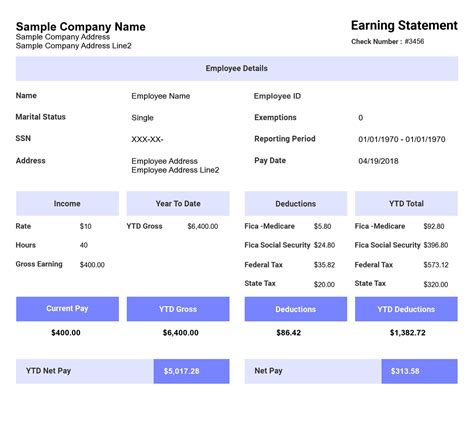

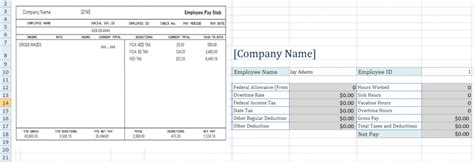

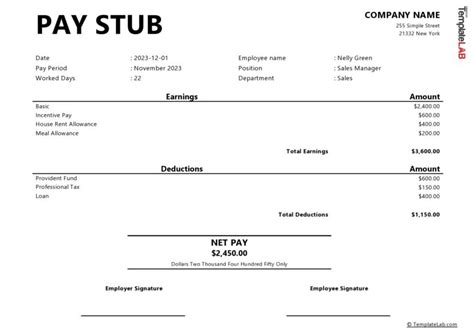

Here are five free UPS pay stub templates that employers can use:

- Basic Pay Stub Template: This template provides a simple and straightforward format for creating pay stubs.

- Detailed Pay Stub Template: This template includes more detailed information, such as a breakdown of deductions and benefits.

- UPS Pay Stub Template with Logo: This template includes a UPS logo and provides a more formal format for creating pay stubs.

- Pay Stub Template with Employee Information: This template includes a section for employee information, such as address and identification number.

- Pay Stub Template with Notes Section: This template includes a notes section where employers can include additional information or comments.

Conclusion

In conclusion, pay stubs are an essential part of the employer-employee relationship. By providing accurate and detailed pay stubs, employers can promote transparency and trust with their employees. The five free UPS pay stub templates provided in this article can help employers create professional and informative pay stubs.

Pay Stub Templates Image Gallery

We hope this article has provided valuable information and resources for creating pay stubs. If you have any questions or need further assistance, please don't hesitate to ask.