Intro

Generate accurate pay stubs for your waitressing staff with our easy-to-follow guide. Learn how to create a waitress pay stub template in 5 simple steps, including calculating tips, wages, and deductions. Master pay stub creation with our expert advice on payroll processing, employee compensation, and tax compliance.

Understanding the Importance of Accurate Payroll Records for Waitresses

As a restaurant owner or manager, it's crucial to maintain accurate and transparent payroll records for your waitstaff. A waitress pay stub template is an essential tool in achieving this goal. It ensures that your employees receive timely and accurate payments, while also helping you comply with labor laws and regulations. In this article, we'll guide you through the process of creating a waitress pay stub template in 5 easy steps.

Step 1: Gather Essential Information

To create a comprehensive pay stub template, you'll need to gather the following information:

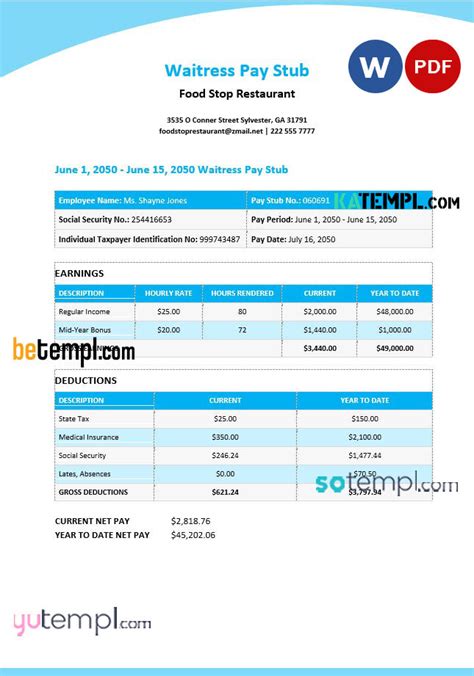

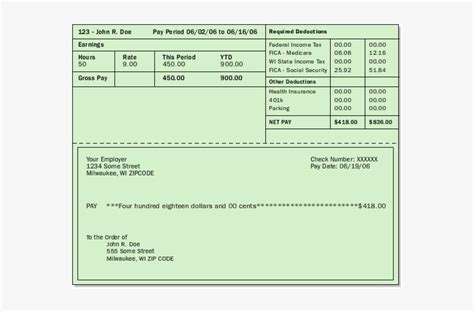

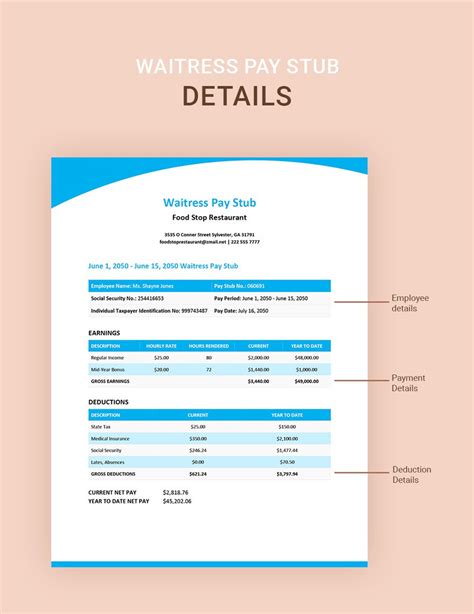

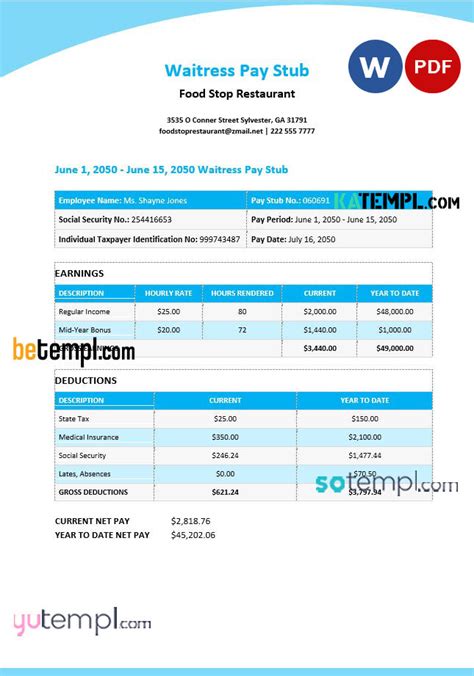

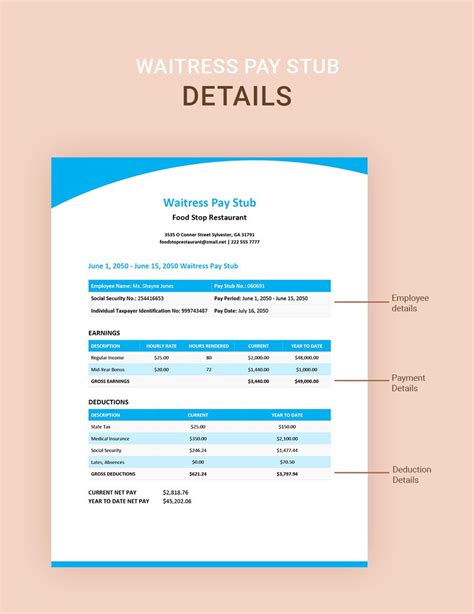

- Employee details: name, address, social security number, and employee ID

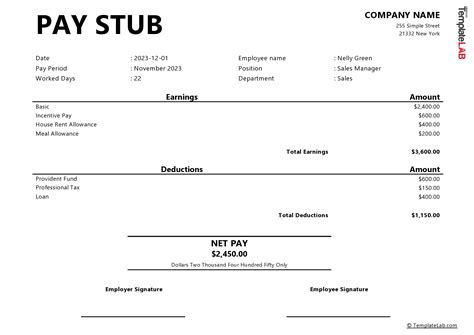

- Pay period and pay date

- Gross wages and net wages

- Deductions (federal, state, and local taxes, health insurance, etc.)

- Tips and gratuities

- Hours worked and hourly rate

What to Include in the Template

When creating your template, make sure to include the following essential elements:

- Employee identification

- Pay period and pay date

- Earnings and deductions

- Net pay

- Year-to-date (YTD) information

Step 2: Choose a Template Format

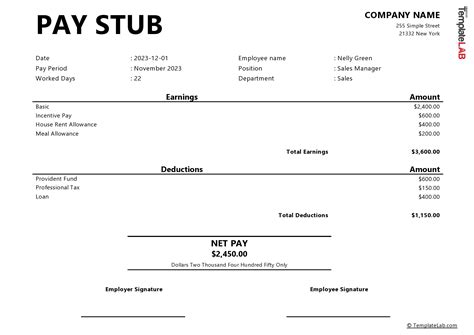

You can create a pay stub template using various software tools, such as Microsoft Word, Excel, or Google Docs. Choose a format that is easy to use and customize. If you're not comfortable creating a template from scratch, you can download pre-designed templates online.

Benefits of Using a Template

Using a template offers several benefits, including:

- Time-saving: A template saves you time and effort in creating pay stubs from scratch.

- Consistency: A template ensures consistency in the format and layout of your pay stubs.

- Accuracy: A template reduces errors and ensures accuracy in calculating wages and deductions.

Step 3: Customize the Template

Customize your template to suit your restaurant's specific needs. Include your company logo, address, and contact information. You can also add additional fields or sections to accommodate specific deductions or benefits.

Adding Additional Fields

Consider adding the following fields to your template:

- Overtime pay

- Bonuses or commissions

- Garnishments or wage levies

- Benefit deductions (e.g., health insurance, 401(k))

Step 4: Test and Refine the Template

Test your template with sample data to ensure accuracy and completeness. Refine the template as needed to address any errors or inconsistencies.

Tips for Refining the Template

- Use a clear and concise format

- Ensure accuracy in calculations and deductions

- Include space for signatures or electronic approval

Step 5: Implement the Template

Once you've refined your template, implement it in your payroll process. Train your staff on using the template, and ensure that it's easily accessible and secure.

Best Practices for Implementing the Template

- Store the template in a secure location

- Limit access to authorized personnel

- Regularly review and update the template to ensure compliance with labor laws and regulations

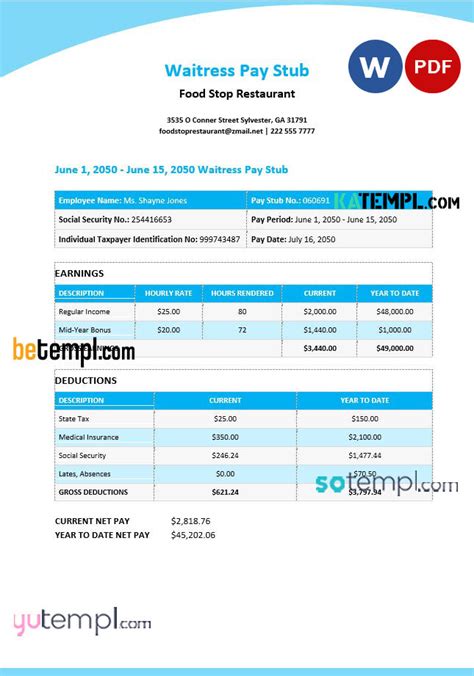

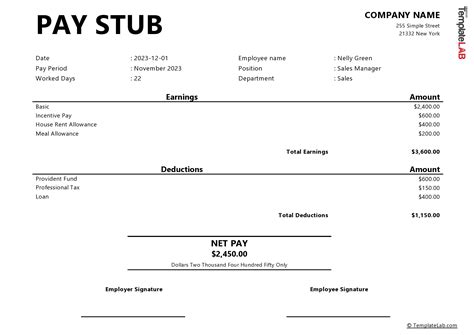

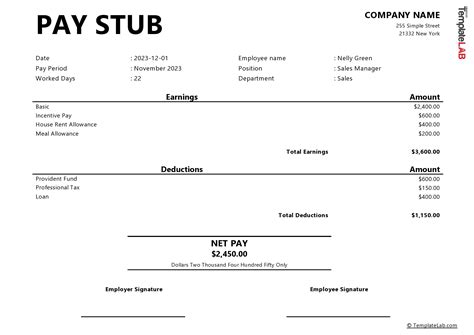

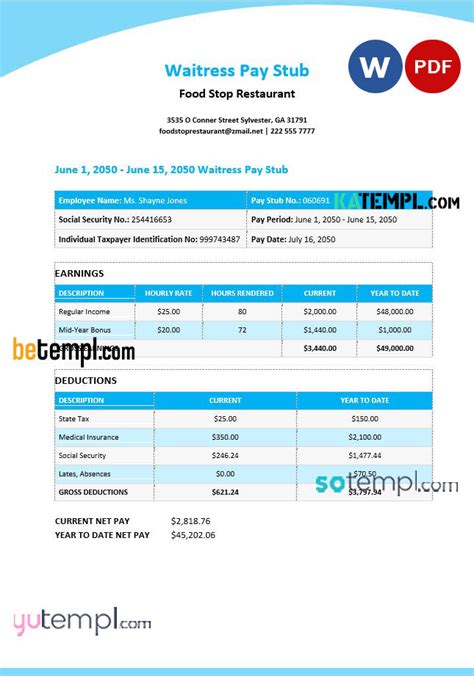

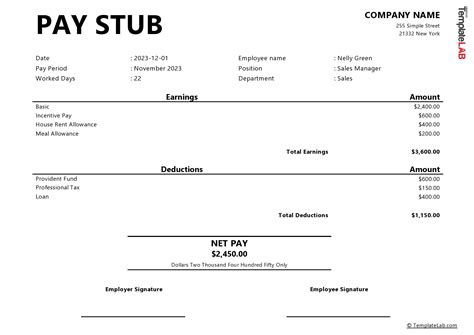

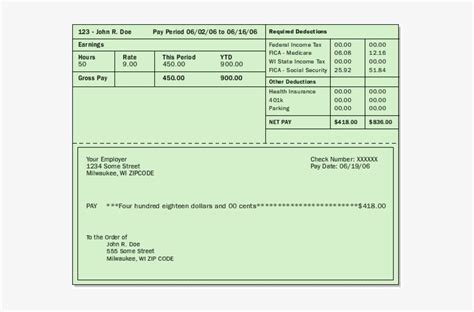

Waitress Pay Stub Template Gallery

We hope this article has provided you with a comprehensive guide to creating a waitress pay stub template in 5 easy steps. By following these steps, you can ensure accurate and transparent payroll records for your waitstaff, while also complying with labor laws and regulations. If you have any questions or need further assistance, please don't hesitate to comment below or share your thoughts with us.