Intro

Unlock the secrets of the 15K: Discover the benefits and investment insights of this tax-advantaged retirement savings plan. Learn how to maximize your savings, reduce taxes, and secure your financial future. Get expert advice on 15K investment strategies, contribution limits, and withdrawal rules to make informed decisions.

In the world of finance, numerous savings plans and investment vehicles exist to help individuals achieve their long-term financial goals. One such option that has garnered significant attention in recent years is the 15k plan. But what exactly is a 15k plan, and how does it work? In this article, we will delve into the benefits and investment insights of the 15k plan, exploring its mechanics, advantages, and potential drawbacks.

What is a 15k Plan?

A 15k plan is a type of savings plan that allows individuals to set aside a fixed amount of money each month, typically $1,500, towards a specific financial goal. This plan is designed to help people build wealth over time, providing a disciplined approach to saving and investing. The 15k plan can be tailored to suit various financial objectives, such as retirement, down payment on a house, or funding a child's education.

Benefits of the 15k Plan

So, why should you consider a 15k plan? Here are some benefits that make it an attractive option:

- Disciplined savings: The 15k plan encourages individuals to save a fixed amount regularly, helping to develop a savings habit and reducing the likelihood of frivolous spending.

- Long-term growth: By investing a significant amount each month, individuals can benefit from the power of compound interest, potentially leading to substantial wealth accumulation over time.

- Flexibility: The 15k plan can be customized to fit various financial goals and risk tolerance levels, making it an adaptable option for different investors.

- Low risk: Compared to other investment vehicles, the 15k plan is generally considered a low-risk option, as it involves saving and investing a fixed amount each month.

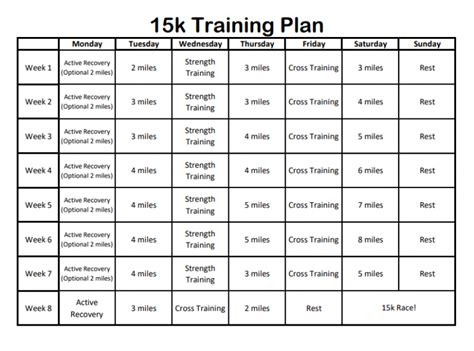

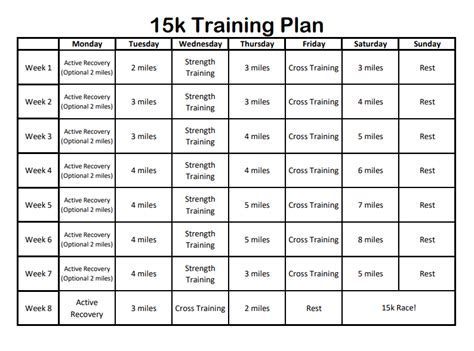

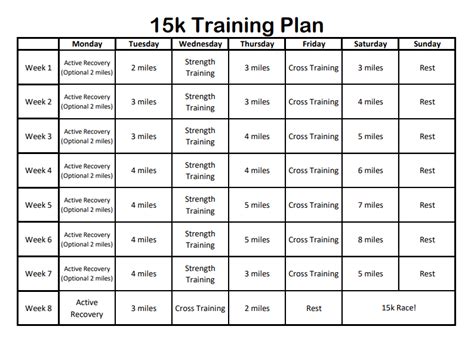

How Does the 15k Plan Work?

The 15k plan operates on a straightforward principle: set aside a fixed amount each month, and invest it in a diversified portfolio. Here's a breakdown of the process:

- Determine your financial goal: Identify what you want to achieve with your 15k plan, whether it's retirement, a down payment, or education expenses.

- Choose your investment portfolio: Select a diversified investment portfolio that aligns with your risk tolerance and financial goals.

- Set up automatic transfers: Arrange for automatic monthly transfers of $1,500 from your checking account to your investment portfolio.

- Monitor and adjust: Periodically review your investment portfolio and rebalance it as needed to ensure it remains aligned with your financial objectives.

Investment Insights for the 15k Plan

When it comes to investing your 15k plan contributions, it's essential to consider the following insights:

- Diversification: Spread your investments across various asset classes, such as stocks, bonds, and real estate, to minimize risk and maximize returns.

- Low-cost index funds: Opt for low-cost index funds, which offer broad diversification and tend to be less expensive than actively managed funds.

- Tax efficiency: Consider the tax implications of your investments and aim to minimize tax liabilities.

- Regular portfolio rebalancing: Periodically review and rebalance your investment portfolio to ensure it remains aligned with your financial objectives.

Common Challenges and Considerations

While the 15k plan offers numerous benefits, it's essential to be aware of potential challenges and considerations:

- Inflation risk: Inflation can erode the purchasing power of your savings over time, reducing the value of your investments.

- Market volatility: Market fluctuations can impact the value of your investments, potentially leading to losses.

- Liquidity constraints: The 15k plan involves setting aside a fixed amount each month, which may limit your liquidity and ability to access funds in case of an emergency.

- Fees and expenses: Be mindful of fees and expenses associated with your investment portfolio, as they can eat into your returns.

Alternatives to the 15k Plan

If the 15k plan doesn't suit your financial goals or risk tolerance, consider the following alternatives:

- 401(k) or employer-sponsored retirement plans: Contribute to tax-advantaged retirement plans, such as a 401(k) or employer-sponsored plan, to save for retirement.

- High-yield savings accounts: Open a high-yield savings account to earn interest on your savings while maintaining liquidity.

- Robo-advisors: Utilize robo-advisors, which offer automated investment management and diversified portfolios at a lower cost.

Conclusion

In conclusion, the 15k plan offers a disciplined approach to saving and investing, providing a range of benefits, including long-term growth, flexibility, and low risk. By understanding the mechanics of the 15k plan and considering investment insights, individuals can make informed decisions about their financial goals. While challenges and considerations exist, the 15k plan can be a valuable tool for building wealth over time.

Take the next step: Share your thoughts on the 15k plan in the comments below. Have you considered implementing a 15k plan, or do you have alternative savings strategies in place? Share your experiences and insights with our community!

Gallery of 15k Plan-Related Images

15k Plan Image Gallery