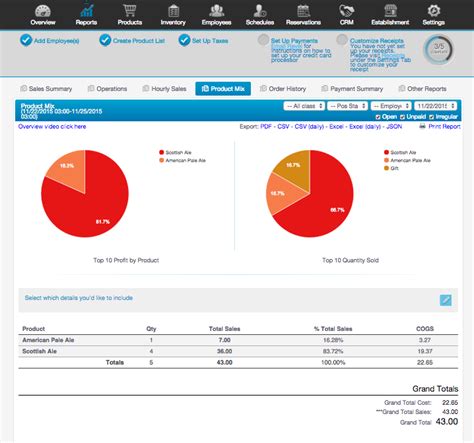

Effective financial management is crucial for any business, and QuickBooks Online (QBO) provides a range of tools to help you stay on top of your finances. One of the most powerful features of QBO is its reporting capabilities, which enable you to generate detailed insights into your business's financial performance. In this article, we'll explore three essential QBO management report templates that can help you make informed decisions and drive business growth.

Benefits of Using QBO Management Report Templates

QBO management report templates offer a range of benefits, including:

- Improved financial visibility: QBO reports provide a clear and accurate picture of your business's financial performance, enabling you to identify areas for improvement and make informed decisions.

- Increased efficiency: QBO reports can be automated, saving you time and reducing the risk of human error.

- Enhanced decision-making: QBO reports provide detailed insights into your business's financial performance, enabling you to make data-driven decisions that drive growth and profitability.

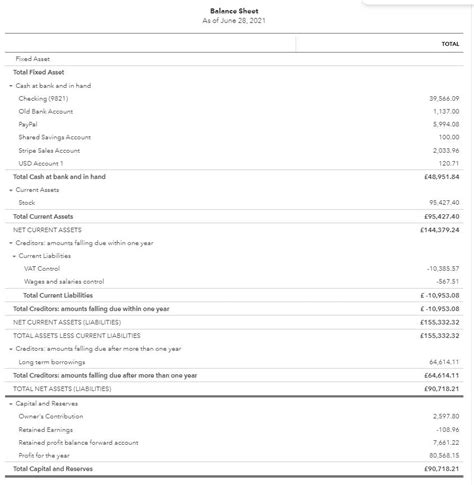

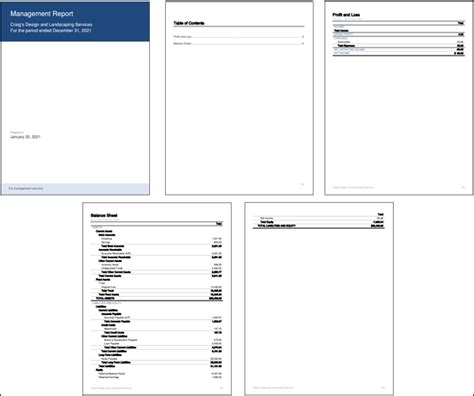

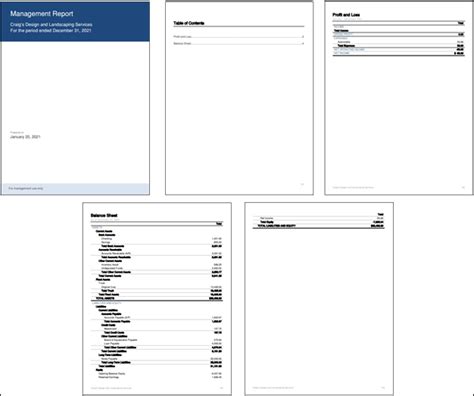

1. Balance Sheet Report Template

A balance sheet report template is a fundamental report that provides a snapshot of your business's financial position at a specific point in time. This report includes:

- Assets: Cash, accounts receivable, inventory, and other assets.

- Liabilities: Accounts payable, loans, and other liabilities.

- Equity: Share capital, retained earnings, and other equity.

To create a balance sheet report template in QBO, follow these steps:

- Log in to your QBO account and navigate to the Reports tab.

- Click on Balance Sheet and select the Report period.

- Customize the report as needed, using the Filters and Columns options.

- Click Run Report to generate the balance sheet report.

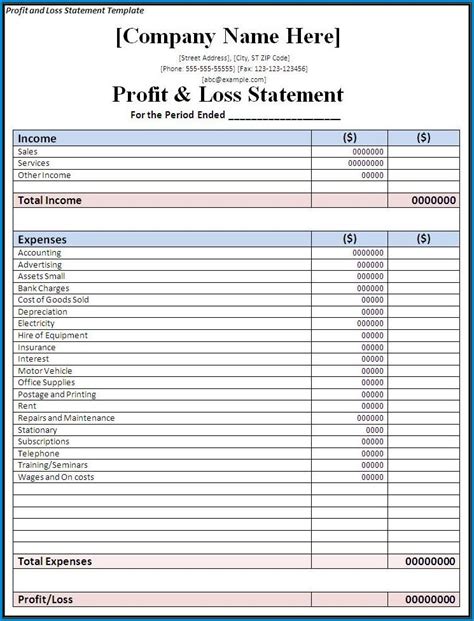

2. Profit and Loss Report Template

A profit and loss report template is a critical report that provides a detailed analysis of your business's revenue and expenses over a specific period. This report includes:

- Revenue: Sales, services, and other revenue streams.

- Cost of Goods Sold: Direct costs associated with producing and selling your products or services.

- Gross Profit: The difference between revenue and cost of goods sold.

- Operating Expenses: Salaries, rent, utilities, and other operating expenses.

- Net Profit: The difference between gross profit and operating expenses.

To create a profit and loss report template in QBO, follow these steps:

- Log in to your QBO account and navigate to the Reports tab.

- Click on Profit and Loss and select the Report period.

- Customize the report as needed, using the Filters and Columns options.

- Click Run Report to generate the profit and loss report.

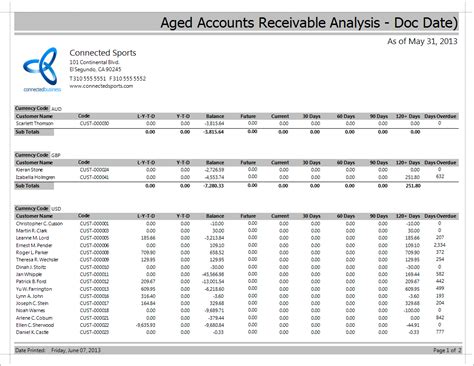

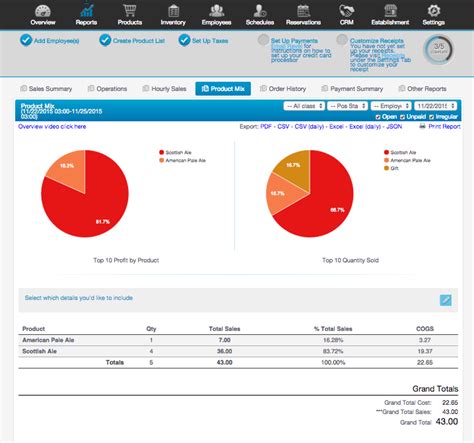

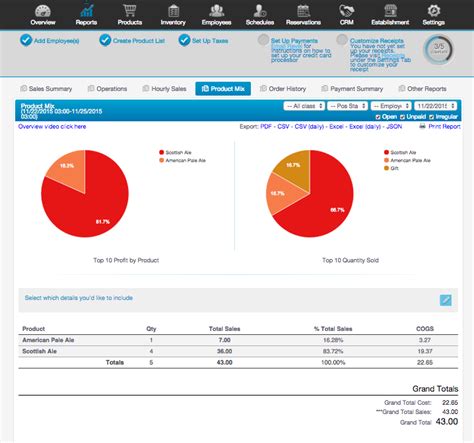

3. Accounts Receivable Aging Report Template

An accounts receivable aging report template is a vital report that provides a detailed analysis of your business's outstanding invoices and payments. This report includes:

- Invoice Date: The date the invoice was issued.

- Invoice Number: The unique identifier for each invoice.

- Customer: The name of the customer who owes the payment.

- Due Date: The date the payment is due.

- Amount: The amount of the payment due.

To create an accounts receivable aging report template in QBO, follow these steps:

- Log in to your QBO account and navigate to the Reports tab.

- Click on Accounts Receivable Aging and select the Report period.

- Customize the report as needed, using the Filters and Columns options.

- Click Run Report to generate the accounts receivable aging report.

Gallery of QBO Management Report Templates

QBO Management Report Templates

By using these three essential QBO management report templates, you can gain a deeper understanding of your business's financial performance and make informed decisions to drive growth and profitability. Remember to customize the reports to suit your business needs and regularly review them to stay on top of your finances.

We hope this article has been informative and helpful in your financial management journey. If you have any questions or need further assistance, please don't hesitate to comment below.