Intro

Revolutionize insurance claims with cutting-edge technologies. Discover 5 innovative ways advanced claims technologies transform the industry, streamlining processes, enhancing customer experience, and reducing costs. Learn how AI, automation, and data analytics optimize claims handling, improve accuracy, and foster faster settlements, making insurance more efficient and customer-centric.

The insurance industry has undergone significant transformations in recent years, driven by advancements in technology. One of the key areas where technology has made a substantial impact is in the claims process. Advanced claims technologies have revolutionized the way insurance companies handle claims, making the process faster, more efficient, and more customer-centric. In this article, we will explore five ways advanced claims technologies are transforming the insurance industry.

Improved Efficiency and Accuracy

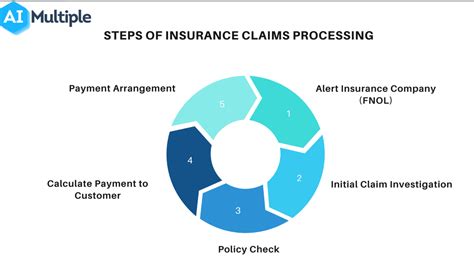

Advanced claims technologies have significantly improved the efficiency and accuracy of the claims process. Automation and artificial intelligence (AI) are being used to streamline claims processing, reducing the time and effort required to settle claims. For instance, AI-powered chatbots can help policyholders report claims and provide basic information, freeing up adjusters to focus on more complex tasks. Additionally, advanced data analytics can help identify potential fraud and detect anomalies in claims data, reducing the risk of errors and mispayments.

Benefits of Improved Efficiency and Accuracy

• Reduced claims processing time • Improved accuracy and reduced errors • Enhanced customer experience • Increased efficiency and productivity for adjusters • Reduced risk of fraud and mispayments

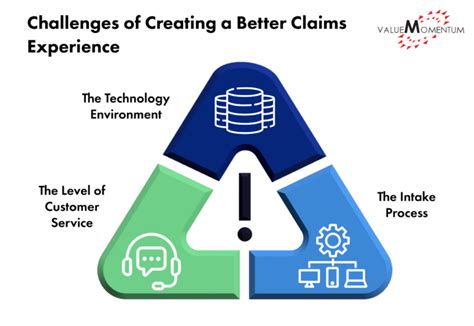

Enhanced Customer Experience

Advanced claims technologies are also transforming the customer experience. Mobile apps and online portals allow policyholders to report claims and track the status of their claims in real-time. This provides a higher level of transparency and communication, keeping customers informed and engaged throughout the claims process. Moreover, AI-powered chatbots can provide 24/7 support, answering frequently asked questions and helping policyholders navigate the claims process.

Benefits of Enhanced Customer Experience

• Increased transparency and communication • Improved customer satisfaction and loyalty • Enhanced customer engagement and retention • Reduced complaints and negative reviews • Increased positive word-of-mouth and referrals

Increased Use of Data Analytics

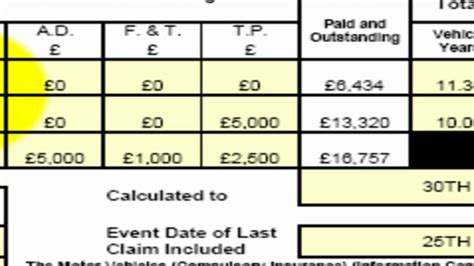

Advanced claims technologies are also enabling the increased use of data analytics in the claims process. Advanced data analytics can help insurance companies identify trends and patterns in claims data, providing valuable insights into areas such as claims frequency, severity, and causes. This information can be used to improve risk management, underwriting, and pricing, as well as to identify opportunities for cost savings and process improvements.

Benefits of Increased Use of Data Analytics

• Improved risk management and underwriting • Enhanced pricing and rating accuracy • Increased cost savings and process improvements • Better decision-making and strategic planning • Improved regulatory compliance and reporting

Increased Adoption of Emerging Technologies

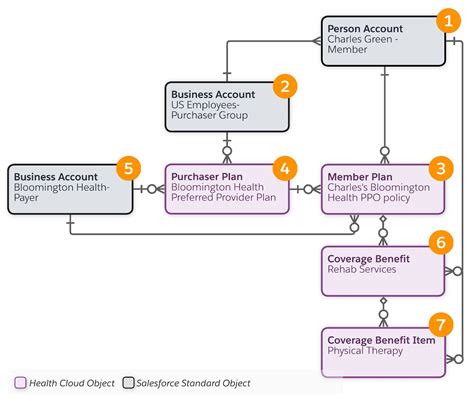

Advanced claims technologies are also driving the adoption of emerging technologies such as blockchain, Internet of Things (IoT), and drones. For instance, blockchain can be used to create secure and transparent claims records, while IoT devices can provide real-time data on risk factors and claims events. Drones can be used to assess damage and inspect properties, reducing the need for physical inspections and improving the accuracy of claims assessments.

Benefits of Increased Adoption of Emerging Technologies

• Improved claims accuracy and transparency • Increased efficiency and productivity • Enhanced customer experience and engagement • Reduced risk and improved regulatory compliance • Increased innovation and competitiveness

Changing Role of Adjusters and Claims Professionals

Finally, advanced claims technologies are changing the role of adjusters and claims professionals. As automation and AI take over routine and administrative tasks, adjusters and claims professionals will need to focus on higher-value tasks such as complex claims handling, customer engagement, and data analysis. This requires a new set of skills and competencies, including data analytics, communication, and customer service.

Benefits of Changing Role of Adjusters and Claims Professionals

• Increased focus on high-value tasks and activities • Improved customer engagement and experience • Enhanced data analysis and insights • Increased efficiency and productivity • Improved career development and opportunities

Gallery of Claims Technology Images:

Claims Technology Image Gallery

In conclusion, advanced claims technologies are transforming the insurance industry in numerous ways. From improved efficiency and accuracy to enhanced customer experience and increased use of data analytics, these technologies are revolutionizing the claims process. As the industry continues to evolve, it is essential for insurance companies to stay ahead of the curve and adopt these emerging technologies to remain competitive and provide the best possible experience for their customers.