Intro

The Accounting Standards Codification (ASC) 842, also known as the "lease accounting standard," has brought about significant changes in the way companies account for leases. One of the most crucial aspects of implementing ASC 842 is accurately calculating lease obligations. In this article, we will provide a comprehensive guide on using an ASC 842 lease calculation template to simplify the process.

Importance of Accurate Lease Calculations

Accurate lease calculations are crucial for companies to ensure compliance with ASC 842. The standard requires lessees to recognize lease assets and liabilities on their balance sheets, which can significantly impact financial statements. Inaccurate calculations can lead to errors in financial reporting, potentially resulting in regulatory issues and damage to a company's reputation.

Benefits of Using an ASC 842 Lease Calculation Template

An ASC 842 lease calculation template can help companies streamline the lease calculation process, reducing the risk of errors and improving efficiency. Some benefits of using a template include:

- Simplified calculations: A template can help companies navigate the complex calculations required by ASC 842, ensuring accuracy and reducing the risk of errors.

- Time savings: By automating calculations, companies can save time and resources, allowing them to focus on other critical tasks.

- Improved compliance: A template can help companies ensure compliance with ASC 842, reducing the risk of regulatory issues and errors in financial reporting.

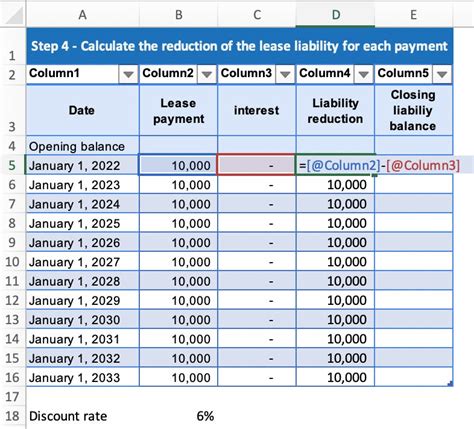

Understanding the ASC 842 Lease Calculation Template

An ASC 842 lease calculation template typically includes the following components:

- Lease Identification: Identifying the lease type (e.g., finance lease, operating lease) and determining the lease term.

- Lease Classification: Classifying the lease as a finance lease or operating lease based on the lease terms and conditions.

- Lease Payments: Calculating the total lease payments, including fixed payments, variable payments, and any in-substance fixed payments.

- Discount Rate: Determining the discount rate used to calculate the present value of lease payments.

- Present Value of Lease Payments: Calculating the present value of lease payments using the discount rate and lease term.

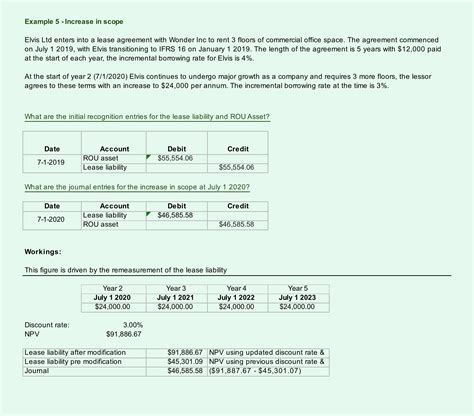

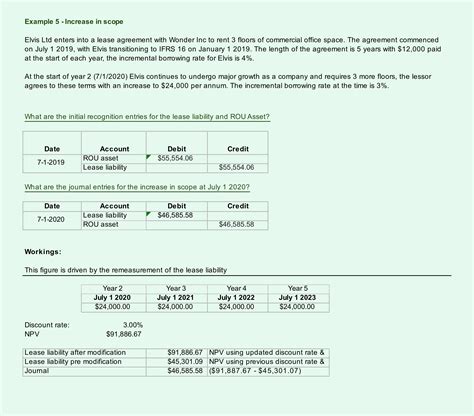

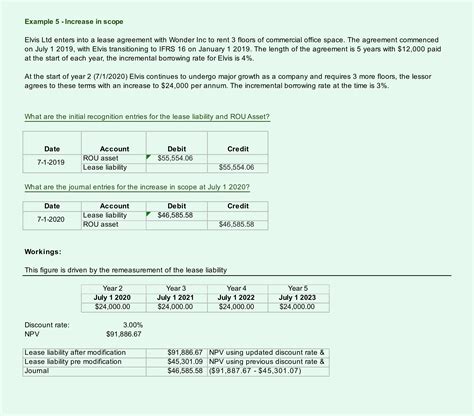

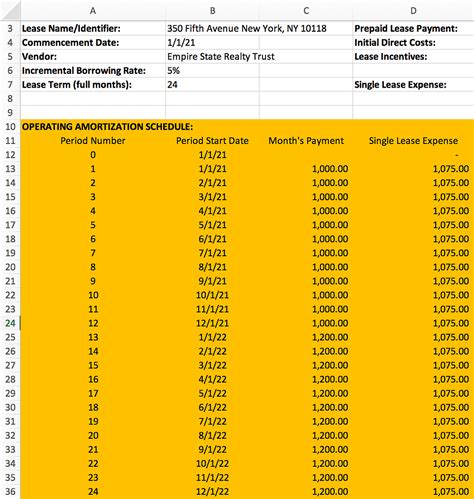

ASC 842 Lease Calculation Template Example

Here is an example of an ASC 842 lease calculation template:

| Lease Identification | |

|---|---|

| Lease Type | Finance Lease |

| Lease Term | 5 years |

| Lease Classification | |

|---|---|

| Lease Classification | Finance Lease |

| Lease Payments | |

|---|---|

| Fixed Payments | $10,000 per year |

| Variable Payments | $2,000 per year |

| In-Substance Fixed Payments | $1,000 per year |

| Total Lease Payments | $13,000 per year |

| Discount Rate | |

|---|---|

| Discount Rate | 6% |

| Present Value of Lease Payments | |

|---|---|

| Present Value of Lease Payments | $54,493.19 |

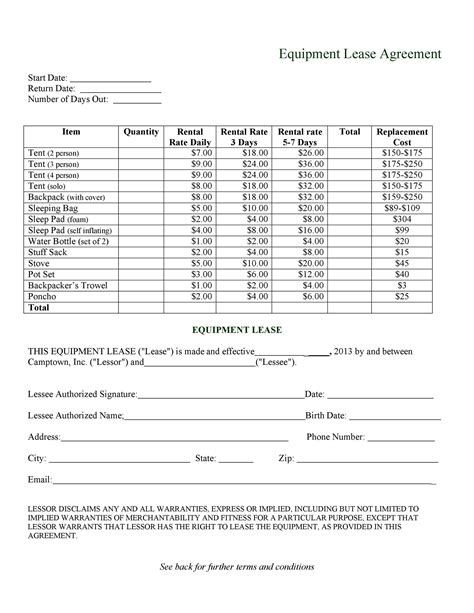

Gallery of ASC 842 Lease Calculation Templates

ASC 842 Lease Calculation Template Gallery

Best Practices for Using an ASC 842 Lease Calculation Template

To ensure accurate and efficient lease calculations, companies should follow these best practices when using an ASC 842 lease calculation template:

- Regularly Review and Update the Template: Regularly review and update the template to ensure it remains compliant with ASC 842 and reflects any changes in lease accounting rules.

- Use Accurate and Complete Data: Ensure that all data used in the template is accurate and complete, including lease terms, payments, and discount rates.

- Test the Template: Test the template with different scenarios to ensure it produces accurate results.

- Document the Template: Document the template, including assumptions, calculations, and results, to ensure transparency and compliance.

Conclusion

An ASC 842 lease calculation template can help companies simplify the lease calculation process, reducing errors and improving efficiency. By understanding the components of the template, using accurate and complete data, and following best practices, companies can ensure accurate and compliant lease calculations. We encourage you to share your experiences with using ASC 842 lease calculation templates in the comments below.

Share this article with your colleagues and friends to help them understand the importance of accurate lease calculations.