Basis points, or BPS, are a unit of measurement used to express the difference between two percentages or interest rates. One basis point is equivalent to 0.01% or 0.0001 in decimal form. Basis points are commonly used in finance, particularly in the calculation of interest rates, investment returns, and credit risk.

Using a basis points calculator in Excel can simplify complex financial calculations, making it an essential tool for financial analysts, investors, and researchers. Here are five ways to use a basis points calculator in Excel:

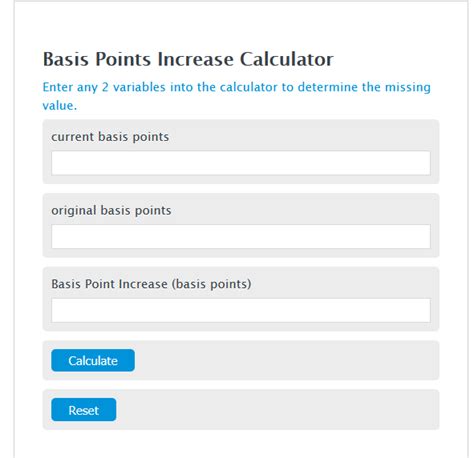

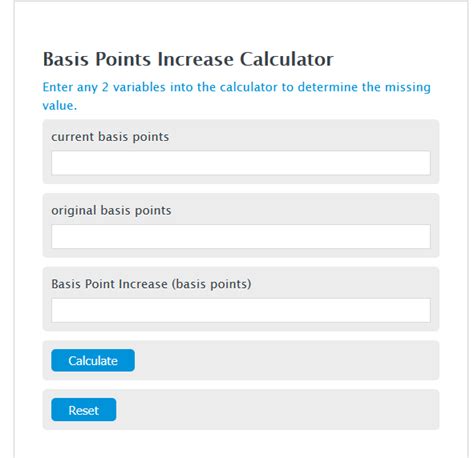

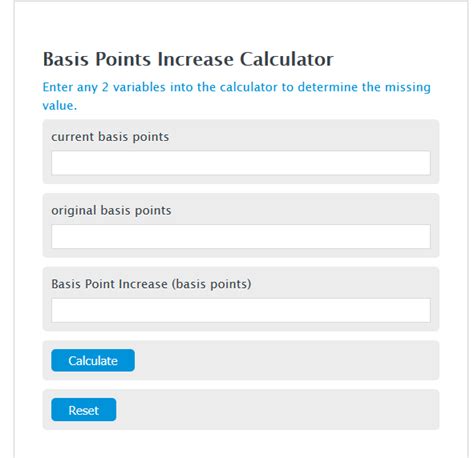

What is a Basis Points Calculator?

A basis points calculator is a mathematical formula or function used to calculate the difference between two percentages or interest rates in basis points. In Excel, you can use a simple formula to calculate basis points: (New Rate - Old Rate) x 100. However, this formula can be cumbersome to use, especially when dealing with large datasets.

A dedicated basis points calculator in Excel can simplify this process by providing a pre-built formula that takes into account the old and new rates, and returns the result in basis points.

Calculating Interest Rate Changes

One of the primary uses of a basis points calculator is to calculate the change in interest rates. For instance, suppose you want to calculate the change in interest rate on a loan from 5% to 5.5%. Using a basis points calculator, you can quickly determine that the change is 50 basis points (0.5% - 0.05% = 0.005 x 100 = 50 BPS).

To calculate interest rate changes in basis points, follow these steps:

- Enter the old interest rate in cell A1.

- Enter the new interest rate in cell B1.

- Use the formula

= (B1 - A1) x 100to calculate the change in basis points.

Example: Calculating Interest Rate Changes

| Old Interest Rate | New Interest Rate | Change in Basis Points |

|---|---|---|

| 5% | 5.5% | 50 BPS |

| 6% | 6.2% | 20 BPS |

| 4% | 4.1% | 10 BPS |

Calculating Investment Returns

Basis points can also be used to express investment returns. For instance, suppose you invested in a stock that returned 8% last year, and you want to calculate the return in basis points. Using a basis points calculator, you can determine that the return is 800 basis points (8% x 100 = 800 BPS).

To calculate investment returns in basis points, follow these steps:

- Enter the investment return as a percentage in cell A1.

- Use the formula

= A1 x 100to calculate the return in basis points.

Example: Calculating Investment Returns

| Investment Return | Return in Basis Points |

|---|---|

| 8% | 800 BPS |

| 5% | 500 BPS |

| 12% | 1200 BPS |

Calculating Credit Risk

Basis points can also be used to express credit risk. For instance, suppose you are evaluating the creditworthiness of a borrower and want to calculate the credit spread in basis points. Using a basis points calculator, you can determine the credit spread and make a more informed decision.

To calculate credit risk in basis points, follow these steps:

- Enter the credit spread as a percentage in cell A1.

- Use the formula

= A1 x 100to calculate the credit spread in basis points.

Example: Calculating Credit Risk

| Credit Spread | Credit Spread in Basis Points |

|---|---|

| 2% | 200 BPS |

| 1.5% | 150 BPS |

| 3% | 300 BPS |

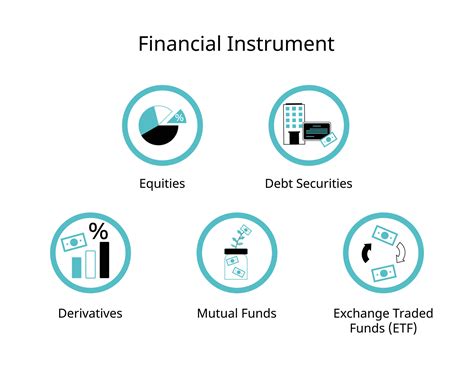

Comparison of Financial Instruments

Basis points can be used to compare the performance of different financial instruments, such as bonds, stocks, and mutual funds. By expressing the returns of each instrument in basis points, you can make a more informed decision about which instrument to invest in.

To compare financial instruments in basis points, follow these steps:

- Enter the returns of each instrument as a percentage in cells A1, B1, and C1.

- Use the formula

= A1 x 100,= B1 x 100, and= C1 x 100to calculate the returns in basis points.

Example: Comparison of Financial Instruments

| Instrument | Return | Return in Basis Points |

|---|---|---|

| Bond | 4% | 400 BPS |

| Stock | 8% | 800 BPS |

| Mutual Fund | 6% | 600 BPS |

Portfolio Optimization

Basis points can be used to optimize portfolios by expressing the returns of each asset in basis points. By identifying the assets with the highest returns in basis points, you can rebalance your portfolio to maximize returns.

To optimize a portfolio in basis points, follow these steps:

- Enter the returns of each asset as a percentage in cells A1, B1, and C1.

- Use the formula

= A1 x 100,= B1 x 100, and= C1 x 100to calculate the returns in basis points. - Identify the assets with the highest returns in basis points and rebalance the portfolio accordingly.

Example: Portfolio Optimization

| Asset | Return | Return in Basis Points |

|---|---|---|

| Stock A | 10% | 1000 BPS |

| Stock B | 8% | 800 BPS |

| Bond | 4% | 400 BPS |

Basis Points Calculator Gallery

In conclusion, a basis points calculator in Excel is a powerful tool for financial analysts, investors, and researchers. By using this calculator, you can simplify complex financial calculations, make more informed decisions, and optimize portfolios. Whether you are calculating interest rate changes, investment returns, credit risk, or comparing financial instruments, a basis points calculator can help you achieve your goals.

We hope this article has provided you with a comprehensive understanding of how to use a basis points calculator in Excel. If you have any questions or need further clarification, please don't hesitate to ask.