Master Navy Federal debt management with 5 expert tips, covering credit score optimization, debt consolidation, and budgeting strategies to achieve financial freedom and reduce debt burdens effectively.

Debt can be overwhelming, affecting not just your financial stability but also your mental health and relationships. Managing debt effectively is crucial for achieving long-term financial goals, such as buying a home, retirement, or ensuring your family's financial security. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers a variety of tools and resources to help its members navigate the complexities of debt management. Here, we'll explore five Navy Federal debt tips that can help you take control of your finances and move towards a debt-free future.

The importance of addressing debt cannot be overstated. High-interest debt, in particular, can quickly spiral out of control, making it difficult to pay more than the minimum payments each month. This can lead to a situation where you're paying a significant amount of money in interest over time without making much progress on the principal amount. Furthermore, debt can limit your financial flexibility, making it challenging to save for emergencies, invest in your future, or enjoy the fruits of your labor. By adopting effective debt management strategies, you can break free from the cycle of debt and start building wealth.

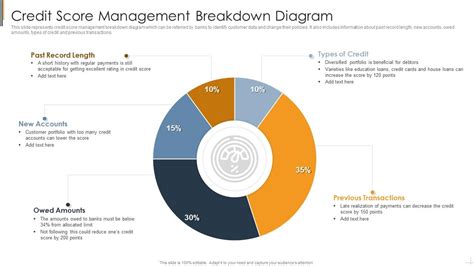

Understanding the nature of your debt is the first step towards managing it. This includes knowing the balance, interest rate, and minimum payment for each of your debts. With this information, you can prioritize your debts, focusing on paying off high-interest debts first while making minimum payments on others. Navy Federal Credit Union provides its members with access to financial advisors and online tools that can help in assessing their debt situation and creating a personalized plan to tackle it. Whether you're dealing with credit card debt, personal loans, or mortgages, having a clear understanding of your financial obligations is key to developing an effective debt management strategy.

Assessing Your Debt Situation

Assessing your debt situation involves more than just listing your debts. It requires understanding the terms of each debt, including the interest rate, repayment period, and any fees associated with it. This information is crucial for determining which debts to prioritize. For instance, debts with higher interest rates typically should be paid off first, as they cost more in the long run. Navy Federal's financial tools and experts can guide you through this process, helping you make informed decisions about your debt.

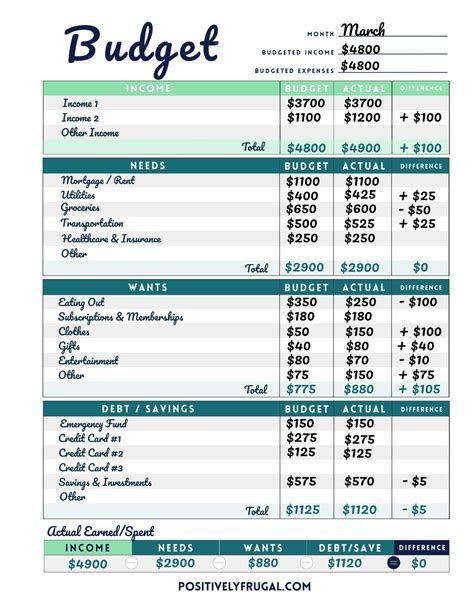

Creating a Budget

Creating a budget is a fundamental step in managing debt. It involves tracking your income and expenses to understand where your money is going and identifying areas where you can cut back. By allocating more funds towards debt repayment, you can pay off your debts faster. Navy Federal offers budgeting tools and workshops that can help you create a budget that works for you, not against you. Remember, budgeting is not about depriving yourself of things you enjoy but about making conscious financial decisions that align with your goals.

Consolidating Debt

Debt consolidation involves combining multiple debts into one loan with a lower interest rate and a single monthly payment. This can simplify your finances and potentially save you money on interest. Navy Federal Credit Union offers personal loans and balance transfer credit cards that can be used for debt consolidation. However, it's essential to carefully consider the terms of any consolidation loan or credit card to ensure it aligns with your financial goals and doesn't lead to further debt accumulation.

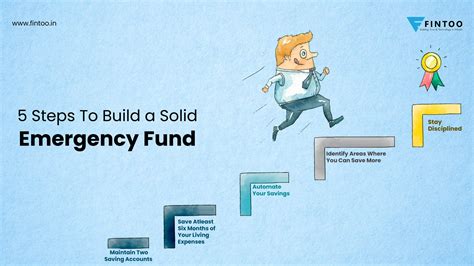

Building an Emergency Fund

Having an emergency fund in place is crucial for preventing debt. When unexpected expenses arise, such as car repairs or medical bills, having a cushion of savings can help you cover these costs without going into debt. Navy Federal encourages its members to build an emergency fund that can cover at least three to six months of living expenses. This fund not only provides peace of mind but also ensures that you're prepared for life's unexpected events, reducing the likelihood of accumulating more debt.

Avoiding New Debt

Finally, avoiding new debt while you're working to pay off existing debts is vital. This means being cautious with credit card usage and avoiding new loans unless absolutely necessary. Navy Federal Credit Union offers financial education resources that can help you understand the implications of debt and make smarter financial decisions. By avoiding new debt, you can focus on paying off your existing debts and moving closer to your goal of becoming debt-free.

Gallery of Debt Management Strategies

Debt Management Image Gallery

In conclusion, managing debt effectively requires a combination of understanding your debt situation, creating a budget, consolidating debt when necessary, building an emergency fund, and avoiding new debt. By following these strategies and leveraging the resources available through Navy Federal Credit Union, you can take significant steps towards achieving financial freedom. Remember, becoming debt-free is a journey that requires patience, discipline, and the right guidance. Share your thoughts on debt management and your experiences with Navy Federal's resources in the comments below. If you found this information helpful, consider sharing it with someone who might benefit from these tips. Together, we can work towards a future where financial stability and freedom are within reach for everyone.