Intro

Discover how VA disability benefits impact food stamps income eligibility. Learn about the intersection of veterans benefits and SNAP (Supplemental Nutrition Assistance Program) eligibility, including income limits, deductions, and exemptions. Understand how to maximize your benefits and navigate the application process for veterans and their families.

As a veteran, navigating the complexities of government benefits can be overwhelming. Two essential benefits that can significantly impact a veteran's quality of life are VA Disability Benefits and Food Stamps. Understanding how these benefits interact and affect income eligibility is crucial for making informed decisions about your financial future.

VA Disability Benefits provide tax-free compensation to veterans who have suffered injuries or illnesses during their military service. These benefits are designed to offset the loss of income and quality of life resulting from a service-connected disability. However, the process of applying for and receiving VA Disability Benefits can be lengthy and complex.

On the other hand, Food Stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), provide essential financial assistance to low-income individuals and families, enabling them to purchase nutritious food. Eligibility for Food Stamps is typically based on household income, expenses, and resources.

In this article, we will delve into the intricacies of VA Disability Benefits and Food Stamps, focusing on income eligibility and how these benefits interact.

VA Disability Benefits: An Overview

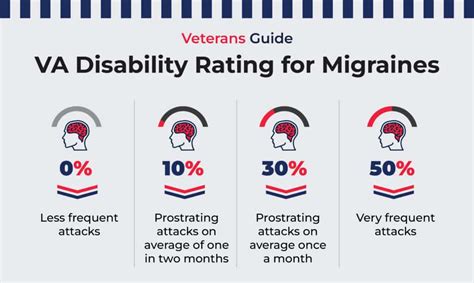

VA Disability Benefits are designed to compensate veterans for the loss of income and quality of life resulting from a service-connected disability. To be eligible, veterans must have a disability rating of at least 10% and meet specific service requirements.

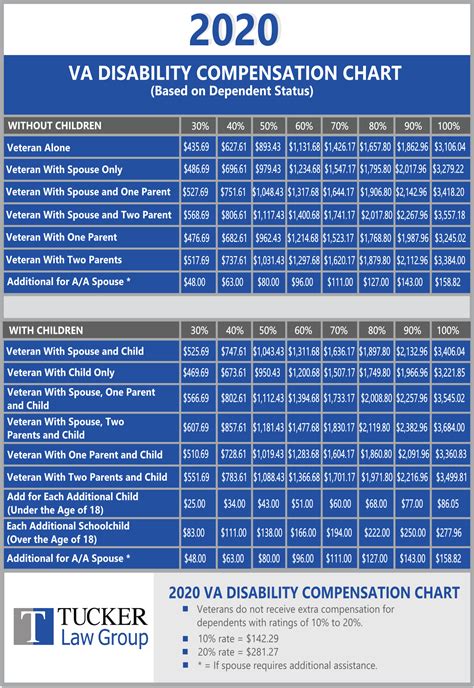

The VA uses a rating system to evaluate the severity of a disability, ranging from 0% to 100%. The rating determines the amount of monthly compensation, which can range from $152.64 for a 10% rating to $3,057.75 for a 100% rating.

Types of VA Disability Benefits

There are several types of VA Disability Benefits, including:

- Service Connection: Compensation for disabilities resulting from injuries or illnesses incurred during military service.

- Presumptive Service Connection: Compensation for disabilities presumed to be related to military service, such as Agent Orange exposure.

- Individual Unemployability (IU): Compensation for veterans unable to work due to a service-connected disability.

Food Stamps (SNAP) Income Eligibility

To be eligible for Food Stamps, applicants must meet specific income and resource requirements. The income limits vary depending on household size, expenses, and resources.

For a household of one, the gross income limit is $1,313 per month, while the net income limit is $990 per month. For a household of two, the gross income limit is $1,784 per month, and the net income limit is $1,335 per month.

Resources, such as cash, savings, and investments, are also considered when determining eligibility. Most households can have up to $2,250 in resources and still be eligible for Food Stamps.

How VA Disability Benefits Affect Food Stamps Eligibility

VA Disability Benefits are considered income when determining eligibility for Food Stamps. However, not all VA Disability Benefits are treated equally.

- Taxable VA Disability Benefits: Some VA Disability Benefits, such as Dependents' Educational Assistance, are taxable and considered income when determining Food Stamps eligibility.

- Non-Taxable VA Disability Benefits: Most VA Disability Benefits, including compensation for service-connected disabilities, are non-taxable and not considered income when determining Food Stamps eligibility.

Calculating Income for Food Stamps Eligibility

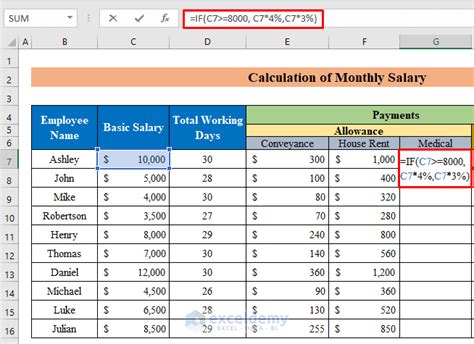

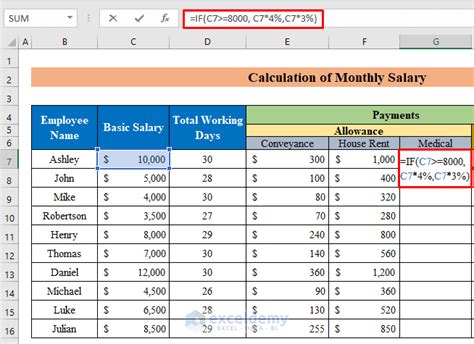

When calculating income for Food Stamps eligibility, the following steps are taken:

- Gross Income: Calculate the household's gross income, including VA Disability Benefits.

- Deductions: Apply deductions, such as housing costs, utilities, and medical expenses.

- Net Income: Calculate the household's net income by subtracting deductions from gross income.

Example: Calculating Income for Food Stamps Eligibility

Meet John, a veteran with a 50% disability rating, receiving $1,146.33 per month in VA Disability Benefits. John's household has a gross income of $2,500 per month. After applying deductions, John's net income is $1,800 per month.

Using the Food Stamps income limits, John's household is eligible for benefits, as their net income is below the limit for a household of two.

Conclusion: Navigating VA Disability Benefits and Food Stamps

Navigating the complexities of VA Disability Benefits and Food Stamps can be challenging. Understanding how these benefits interact and affect income eligibility is essential for making informed decisions about your financial future.

If you're a veteran receiving VA Disability Benefits and considering applying for Food Stamps, it's crucial to understand how your benefits will be affected. By calculating your income and resources, you can determine your eligibility for Food Stamps and make informed decisions about your financial well-being.

We encourage you to share your thoughts and experiences with VA Disability Benefits and Food Stamps in the comments below. Your feedback will help us better understand the challenges veterans face and provide more accurate information in the future.

Gallery of VA Disability Benefits and Food Stamps

VA Disability Benefits and Food Stamps Image Gallery