Intro

Unlock the secrets of calculating tax brackets with ease using Excel formulas. Discover a step-by-step guide to creating a tax bracket formula in Excel, covering marginal tax rates, taxable income, and deductions. Learn how to accurately calculate tax brackets and optimize your tax planning with this simple yet powerful Excel solution.

Understanding Tax Brackets: A Comprehensive Guide

Tax brackets can be a complex and intimidating topic, especially for those who are new to filing taxes. However, with the right tools and knowledge, navigating tax brackets can be made easy. In this article, we will explore the concept of tax brackets, how they work, and provide an Excel formula to help you calculate your tax liability.

What are Tax Brackets?

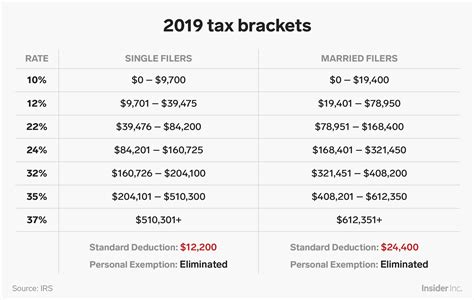

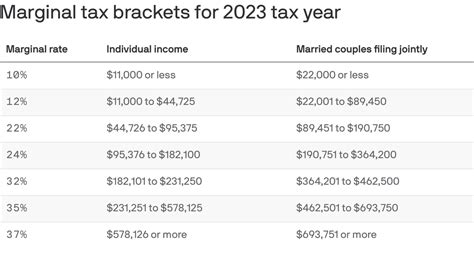

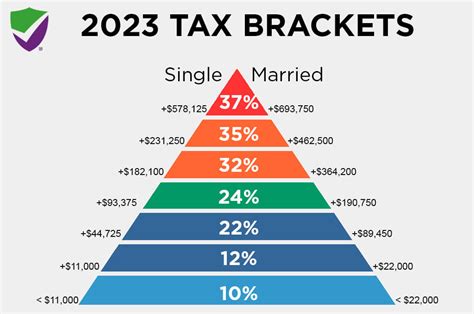

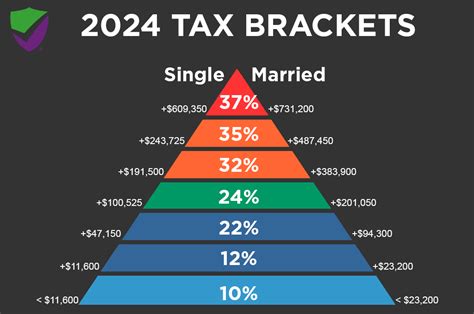

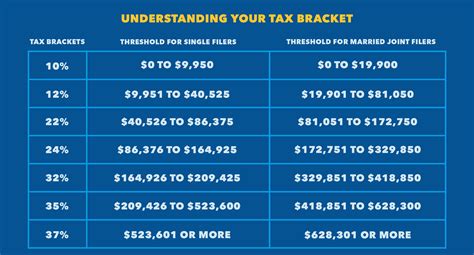

Tax brackets, also known as tax tables or tax schedules, are the ranges of income that are subject to different tax rates. The tax rates increase as the income increases, and the tax brackets are adjusted annually for inflation. In the United States, for example, there are seven tax brackets: 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

How Do Tax Brackets Work?

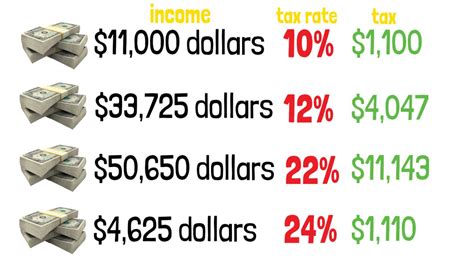

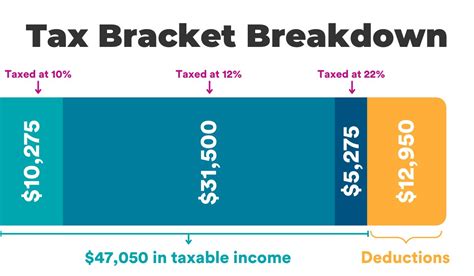

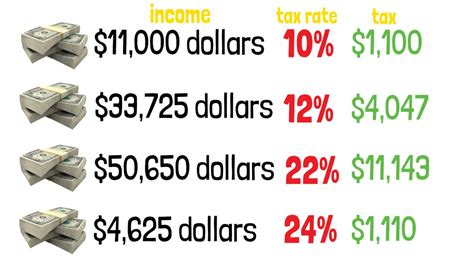

Tax brackets work by applying a specific tax rate to the income within each bracket. The tax rate increases as the income increases, but the taxpayer only pays the higher rate on the amount above the threshold. For example, if the tax brackets are 10% for income up to $10,000, 15% for income between $10,001 and $20,000, and 20% for income above $20,000, a taxpayer with an income of $25,000 would pay:

- 10% on the first $10,000 (=$1,000)

- 15% on the next $10,000 (=$1,500)

- 20% on the last $5,000 (=$1,000)

Total tax liability = $1,000 + $1,500 + $1,000 = $3,500

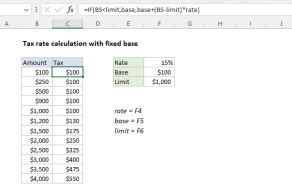

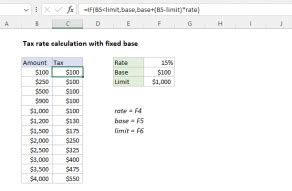

Excel Formula for Tax Brackets

To calculate your tax liability using Excel, you can use the following formula:

=SUMPRODUCT((A2>=Tax_Bracket_Lower_Limit)(A2<Tax_Bracket_Upper_Limit)(A2-Tax_Bracket_Lower_Limit)Tax_Rate)+IF(A2>=Tax_Bracket_Upper_Limit,Tax_Bracket_Upper_LimitTax_Rate,0)

Where:

- A2 is the cell containing the income

- Tax_Bracket_Lower_Limit is the cell containing the lower limit of the tax bracket

- Tax_Bracket_Upper_Limit is the cell containing the upper limit of the tax bracket

- Tax_Rate is the cell containing the tax rate

This formula calculates the tax liability by multiplying the income by the tax rate, and then applying the tax brackets.

Example:

Suppose we have the following tax brackets:

| Tax Bracket | Lower Limit | Upper Limit | Tax Rate |

|---|---|---|---|

| 10% | 0 | 10,000 | 0.10 |

| 15% | 10,001 | 20,000 | 0.15 |

| 20% | 20,001 | 0.20 |

We can enter the following data in Excel:

| Income | Tax Bracket Lower Limit | Tax Bracket Upper Limit | Tax Rate |

|---|---|---|---|

| 25,000 | 0 | 10,000 | 0.10 |

| 25,000 | 10,001 | 20,000 | 0.15 |

| 25,000 | 20,001 | 0.20 |

Using the formula above, we can calculate the tax liability as follows:

=SUMPRODUCT((25000>=0)(25000<10000)(25000-0)0.10)+IF(25000>=10000,100000.10,0)+SUMPRODUCT((25000>=10001)(25000<20000)(25000-10001)0.15)+IF(25000>=20000,200000.15,0)+SUMPRODUCT((25000>=20001)(25000>0)(25000-20001)*0.20)

The result is:

$3,500

This is the same result we obtained manually earlier.

Conclusion

Tax brackets can be complex, but with the right tools and knowledge, navigating them can be made easy. The Excel formula provided above can help you calculate your tax liability accurately. Remember to always consult with a tax professional or the IRS website for the most up-to-date information on tax brackets and rates.

Take Action:

Try using the Excel formula above to calculate your tax liability. Share your experience and any questions you may have in the comments below.

Tax Brackets Image Gallery