Intro

Streamline your small business finances with our free Excel invoice tracker template. Easily manage invoices, track payments, and stay on top of outstanding balances. Download our customizable template to simplify your accounting process and improve cash flow. Perfect for freelancers, entrepreneurs, and small business owners.

Managing finances effectively is crucial for the success of any small business. One essential tool to help with this is an invoice tracker, which enables you to keep tabs on the invoices you've sent to clients, including their status and payment due dates. For small businesses, using an Excel invoice tracker template can be an efficient way to streamline your financial management without incurring additional costs for specialized software.

Benefits of Using an Invoice Tracker Template in Excel

Using an Excel invoice tracker template can offer several benefits for small businesses, including enhanced financial organization, improved cash flow management, and reduced administrative burdens.

Enhanced Financial Organization

An Excel invoice tracker template allows you to centralize your invoicing information in one place. This makes it easier to track the status of your invoices, identify any payment delays, and follow up with clients more efficiently.

Improved Cash Flow Management

By keeping track of when payments are due, you can better manage your cash flow. This involves planning for incoming payments, anticipating potential delays, and making informed decisions about your business's financial operations.

Reduced Administrative Burdens

Automating your invoicing process with an Excel template can save time and reduce the administrative effort required to manage invoices manually. This allows you to focus on other critical aspects of your business.

Key Features to Look for in an Invoice Tracker Template

When selecting an Excel invoice tracker template, consider the following key features to ensure it meets your business needs:

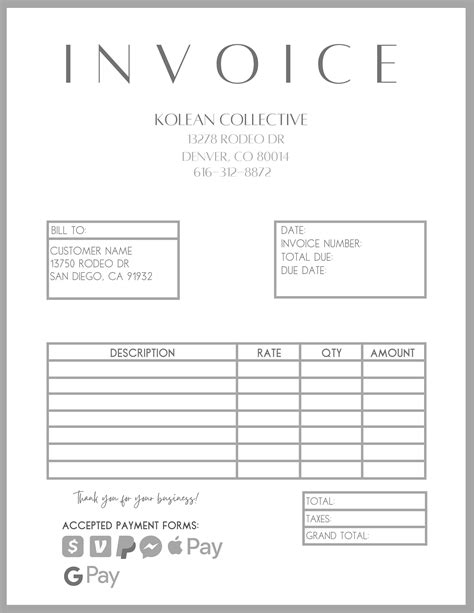

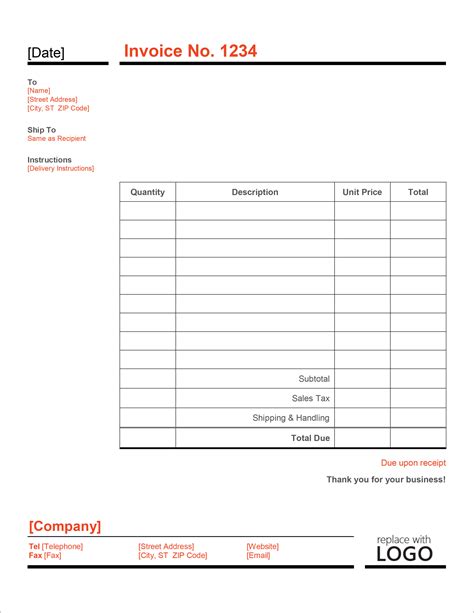

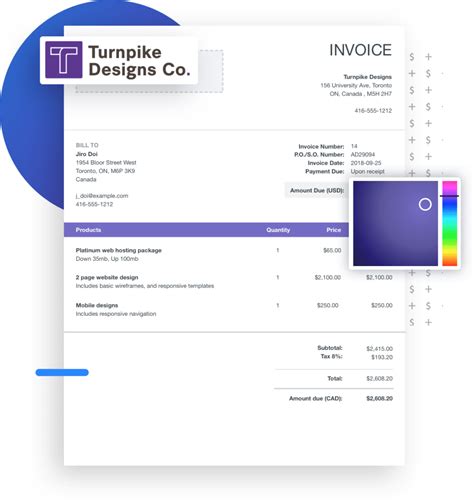

1. Customizable

Look for a template that is easy to customize according to your business's branding and invoicing needs. This should include the ability to add your company logo, adjust the layout, and include specific details such as payment terms and late fees.

2. Automatic Calculations

An ideal template should have automatic calculations for totals, taxes, and discounts. This will save you time and reduce errors when generating invoices.

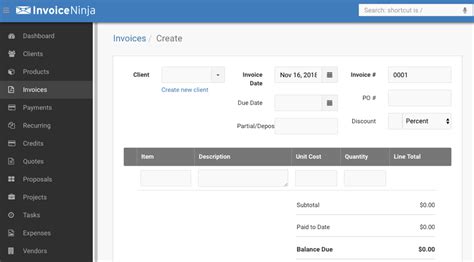

3. Invoice Status Tracking

The template should allow you to track the status of each invoice, such as 'sent', 'paid', or 'overdue'. This feature helps in managing follow-ups and maintaining a clear overview of your outstanding invoices.

4. Payment Due Date Tracking

Ensure the template includes a feature to track payment due dates. This is crucial for managing your cash flow and sending timely reminders to clients.

5. Reporting and Analytics

Opt for a template that provides basic reporting and analytics. This could include summaries of outstanding invoices, payment history, and other financial insights that can help you make informed business decisions.

Steps to Create Your Own Invoice Tracker Template in Excel

If you prefer to create your own template from scratch, here are the basic steps to follow:

-

Open Excel and Create a New Spreadsheet: Start by opening Excel and creating a new workbook. Give your workbook a relevant name, such as 'Invoice Tracker'.

-

Set Up Your Template Structure: Design your template structure. Typically, this includes columns for invoice number, client name, invoice date, due date, amount, and status.

-

Add Automatic Calculations: Use Excel formulas to automate calculations for totals, taxes, and discounts. For example, you can use the

SUMfunction to calculate the total amount due. -

Format Your Template: Customize the appearance of your template by adding your company logo, adjusting the layout, and selecting appropriate fonts and colors.

-

Test Your Template: Before using your template for actual invoicing, test it with sample data to ensure everything works as expected.

Free Excel Invoice Tracker Template for Small Business

If you're looking for a straightforward solution without the need to create your own template, you can find many free Excel invoice tracker templates online. These templates are designed to cater to the needs of small businesses and can be downloaded and used immediately.

Customizing Your Free Template

Once you've downloaded a free Excel invoice tracker template, you'll likely need to customize it to fit your business's specific needs. Here are some tips for customization:

- Add Your Company Logo: Insert your company logo into the template to personalize it.

- Adjust the Layout: Modify the layout to fit your invoicing requirements. This might involve adding or removing columns.

- Include Payment Terms: Ensure the template includes your payment terms, such as the payment methods you accept and any late fees.

Implementing Your Invoice Tracker Template

After customizing your template, it's time to implement it in your business operations. Here are a few tips for effective implementation:

1. Train Your Staff

If you have employees who will be using the template, make sure they understand how to use it correctly. Provide training on how to generate invoices, track payments, and update the status of invoices.

2. Integrate with Your Accounting System

Consider integrating your invoice tracker template with your accounting system. This can help ensure consistency in your financial records and make it easier to manage your finances.

3. Regularly Review and Update

Regularly review your invoice tracker template to ensure it continues to meet your business needs. Update the template as necessary to reflect changes in your invoicing processes or financial management strategies.

Free Excel Invoice Tracker Templates for Small Business Image Gallery

Conclusion

Utilizing an Excel invoice tracker template can be a simple yet effective way for small businesses to manage their invoicing and financial tracking. Whether you choose to download a free template or create your own, this tool can help streamline your business operations, reduce administrative burdens, and improve your cash flow management. By following the tips outlined above, you can implement an efficient invoicing system that supports the growth and success of your business.

Feel free to share your experiences or ask questions about using Excel invoice tracker templates in the comments section below!