Managing debt can be a daunting task, but having a clear plan and the right tools can make all the difference. In this article, we will explore 7 ways to pay off debt using a Google Sheets template. Whether you're struggling with credit card debt, student loans, or personal loans, these strategies and template will help you take control of your finances and start building a debt-free future.

Understanding Your Debt

Before we dive into the 7 ways to pay off debt, it's essential to understand the type of debt you have and the interest rates associated with each debt. Make a list of all your debts, including the balance, interest rate, and minimum payment. This information will help you prioritize your debts and create a plan to tackle them.

Debt Snowball Method

The debt snowball method involves paying off your debts one by one, starting with the smallest balance first. This approach provides a psychological boost as you quickly eliminate smaller debts and see progress. To implement this method using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Payoff Order

Sort the table by balance, and focus on paying off the debt with the smallest balance first. Once you've paid off the first debt, use the money to attack the next debt on the list.

Debt Avalanche Method

The debt avalanche method involves paying off your debts one by one, starting with the debt with the highest interest rate. This approach saves you the most money in interest over time. To implement this method using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Payoff Order

Sort the table by interest rate, and focus on paying off the debt with the highest interest rate first. Once you've paid off the first debt, use the money to attack the next debt on the list.

Debt Consolidation

Debt consolidation involves combining multiple debts into one loan with a lower interest rate and a single monthly payment. This approach can simplify your finances and save you money on interest. To implement debt consolidation using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Consolidated Loan

Calculate the total balance and interest rate of the consolidated loan, and use the template to track your progress.

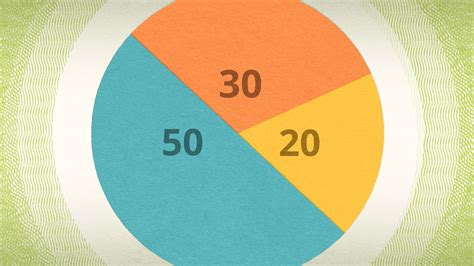

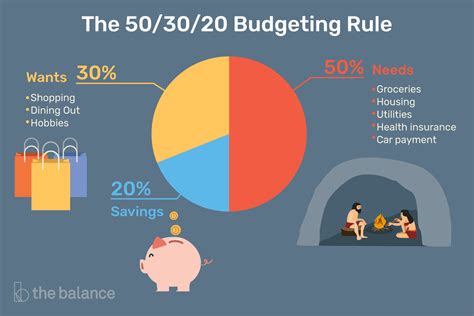

50/30/20 Rule

The 50/30/20 rule involves allocating 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. To implement this rule using a Google Sheets template, create a table with the following columns:

- Income

- Necessary Expenses

- Discretionary Spending

- Savings and Debt Repayment

Calculate the amount you can allocate towards debt repayment, and use the template to track your progress.

Snowflaking

Snowflaking involves making small, extra payments towards your debt whenever possible. This approach can help you pay off your debt faster and save money on interest. To implement snowflaking using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Extra Payment

Calculate the impact of making extra payments on your debt, and use the template to track your progress.

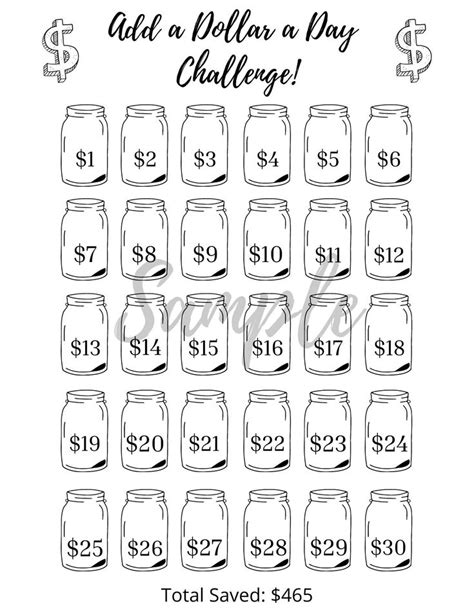

Dollar-a-Day Challenge

The dollar-a-day challenge involves paying an extra dollar towards your debt each day. This approach can help you pay off your debt faster and save money on interest. To implement the dollar-a-day challenge using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- Extra Payment

Calculate the impact of making an extra dollar payment each day on your debt, and use the template to track your progress.

Balance Transfer

A balance transfer involves transferring your debt to a credit card with a lower interest rate. This approach can save you money on interest and help you pay off your debt faster. To implement a balance transfer using a Google Sheets template, create a table with the following columns:

- Debt Name

- Balance

- Interest Rate

- Minimum Payment

- New Credit Card

Calculate the impact of transferring your debt to a new credit card, and use the template to track your progress.

Conclusion

Paying off debt requires discipline, patience, and the right tools. By using a Google Sheets template and implementing one of the 7 ways to pay off debt, you can take control of your finances and start building a debt-free future. Remember to track your progress, stay motivated, and celebrate your successes along the way.

Debt Repayment Strategies Image Gallery

We hope this article has provided you with valuable insights and strategies to pay off your debt. Share your favorite debt repayment method in the comments below, and don't forget to download the Google Sheets template to start tracking your progress today!