Calculating depreciation is an essential task for businesses and individuals who own assets that lose value over time. Microsoft Excel provides a straightforward way to calculate depreciation using various methods. In this article, we will guide you through the easy steps to calculate depreciation on Excel.

Understanding Depreciation

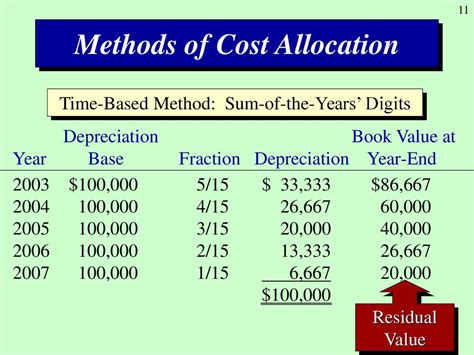

Depreciation is the decrease in value of an asset over its useful life. It's a non-cash expense that represents the reduction in the asset's value due to wear and tear, obsolescence, or other factors. Depreciation is calculated using various methods, including the Straight-Line Method, Declining Balance Method, and Units-of-Production Method.

Setting Up Your Excel Worksheet

Before calculating depreciation, set up your Excel worksheet with the necessary columns and headers. Create a table with the following columns:

| Asset | Cost | Useful Life | Residual Value | Depreciation Method |

|---|

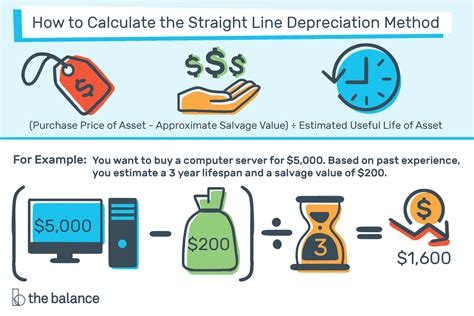

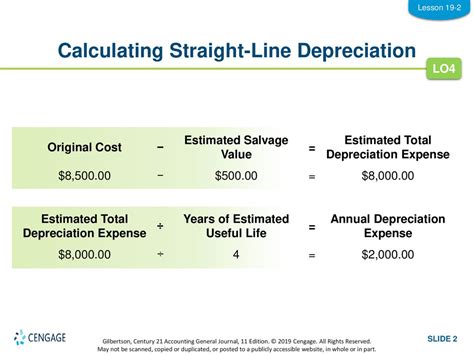

Calculating Depreciation Using the Straight-Line Method

The Straight-Line Method is the most common method of calculating depreciation. It assumes that the asset loses its value evenly over its useful life.

Step 1: Enter the Asset's Cost and Useful Life

Enter the asset's cost and useful life in the respective columns.

| Asset | Cost | Useful Life | Residual Value | Depreciation Method |

|---|---|---|---|---|

| Computer | 1000 | 5 | 0 | Straight-Line |

Step 2: Calculate the Annual Depreciation

Use the following formula to calculate the annual depreciation:

= (Cost - Residual Value) / Useful Life

In this example, the annual depreciation would be:

= (1000 - 0) / 5 = 200

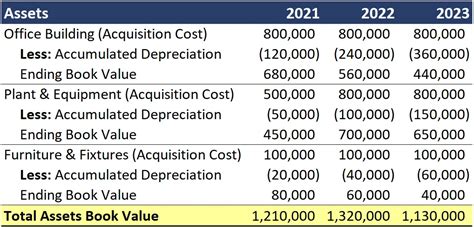

Step 3: Calculate the Accumulated Depreciation

Use the following formula to calculate the accumulated depreciation:

= Annual Depreciation x Number of Years

Assuming the asset has been in use for 3 years, the accumulated depreciation would be:

= 200 x 3 = 600

Step 4: Calculate the Book Value

Use the following formula to calculate the book value:

= Cost - Accumulated Depreciation

In this example, the book value would be:

= 1000 - 600 = 400

Calculating Depreciation Using the Declining Balance Method

The Declining Balance Method assumes that the asset loses its value at a faster rate in the early years of its useful life.

Step 1: Enter the Asset's Cost and Useful Life

Enter the asset's cost and useful life in the respective columns.

| Asset | Cost | Useful Life | Residual Value | Depreciation Method |

|---|---|---|---|---|

| Computer | 1000 | 5 | 0 | Declining Balance |

Step 2: Calculate the Annual Depreciation

Use the following formula to calculate the annual depreciation:

= (Cost - Accumulated Depreciation) x Declining Balance Rate

Assuming a declining balance rate of 20%, the annual depreciation for the first year would be:

= (1000 - 0) x 0.2 = 200

Step 3: Calculate the Accumulated Depreciation

Use the following formula to calculate the accumulated depreciation:

= Annual Depreciation + Accumulated Depreciation

In this example, the accumulated depreciation after the first year would be:

= 200 + 0 = 200

Step 4: Calculate the Book Value

Use the following formula to calculate the book value:

= Cost - Accumulated Depreciation

In this example, the book value after the first year would be:

= 1000 - 200 = 800

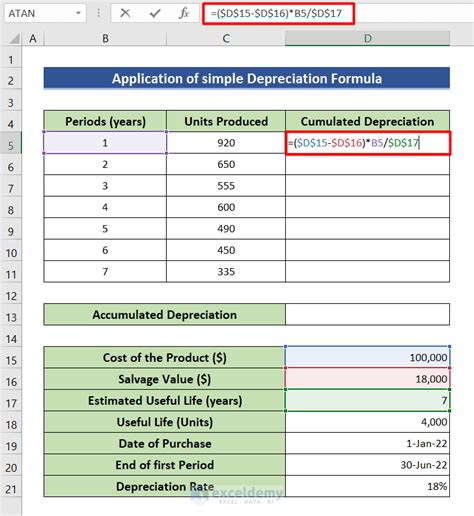

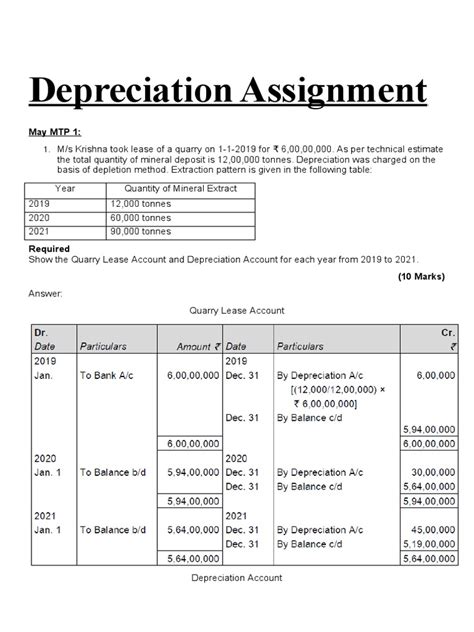

Calculating Depreciation Using the Units-of-Production Method

The Units-of-Production Method assumes that the asset loses its value based on the number of units produced.

Step 1: Enter the Asset's Cost and Total Units

Enter the asset's cost and total units in the respective columns.

| Asset | Cost | Total Units | Units Produced | Depreciation Method |

|---|---|---|---|---|

| Machine | 10000 | 10000 | 2000 | Units-of-Production |

Step 2: Calculate the Depreciation per Unit

Use the following formula to calculate the depreciation per unit:

= (Cost - Residual Value) / Total Units

In this example, the depreciation per unit would be:

= (10000 - 0) / 10000 = 1

Step 3: Calculate the Annual Depreciation

Use the following formula to calculate the annual depreciation:

= Depreciation per Unit x Units Produced

In this example, the annual depreciation for the first year would be:

= 1 x 2000 = 2000

Step 4: Calculate the Accumulated Depreciation

Use the following formula to calculate the accumulated depreciation:

= Annual Depreciation + Accumulated Depreciation

In this example, the accumulated depreciation after the first year would be:

= 2000 + 0 = 2000

Step 5: Calculate the Book Value

Use the following formula to calculate the book value:

= Cost - Accumulated Depreciation

In this example, the book value after the first year would be:

= 10000 - 2000 = 8000

Tips and Variations

- To calculate depreciation for multiple assets, create separate tables or worksheets for each asset.

- To calculate depreciation for a partial year, adjust the annual depreciation formula to reflect the number of months or days the asset was in use.

- To calculate depreciation using a custom method, create a custom formula or use a depreciation calculator.

Gallery of Depreciation Images

Depreciation Image Gallery

We hope this article has helped you understand how to calculate depreciation on Excel using various methods. Remember to adjust the formulas and calculations according to your specific needs and asset types. If you have any questions or need further clarification, please don't hesitate to comment below.