Intro

Streamline your freelance finances with our 5 customizable Excel templates for independent contractor pay stubs. Easily track payments, deductions, and benefits. Perfect for freelancers, consultants, and small business owners. Download and edit these free templates to simplify your invoicing and accounting, and stay organized with ease.

As an independent contractor, managing your finances and keeping track of your income is crucial. One essential tool for achieving this is a pay stub. A pay stub is a document that shows your earnings, deductions, and net pay for a specific period. In this article, we will explore five templates for independent contractor pay stubs in Excel.

Creating a pay stub template in Excel can help you streamline your financial management and make it easier to track your income. With these templates, you can easily generate pay stubs for each payment you receive from clients. Before we dive into the templates, let's discuss the importance of pay stubs for independent contractors.

Pay stubs are essential for independent contractors because they provide a clear record of your income and expenses. This record can be useful when filing taxes, applying for loans, or negotiating with clients. Moreover, pay stubs can help you identify areas where you can optimize your finances and make informed decisions about your business.

Now, let's explore the five templates for independent contractor pay stubs in Excel.

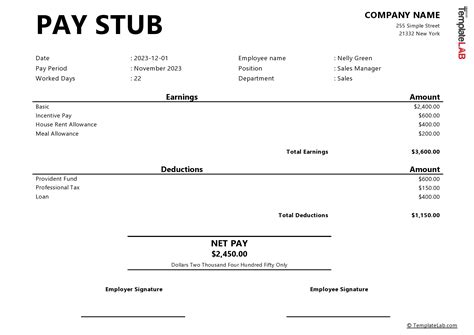

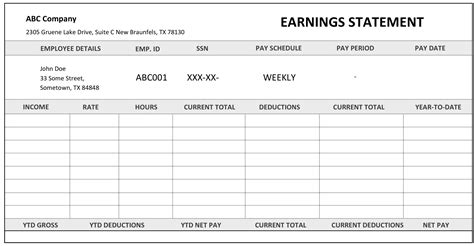

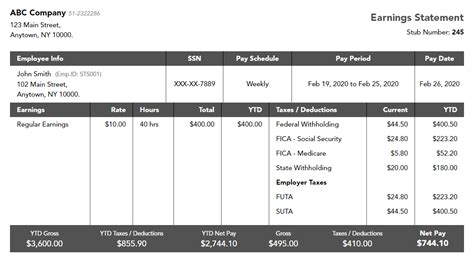

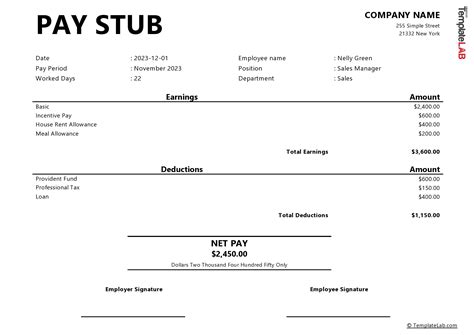

Template 1: Basic Pay Stub Template

This template is ideal for independent contractors who want a simple and straightforward pay stub. The template includes the following fields:

- Date

- Client name

- Payment amount

- Deductions (taxes, fees, etc.)

- Net pay

Basic Pay Stub Template

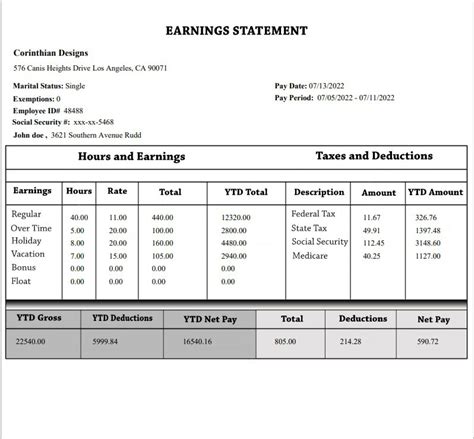

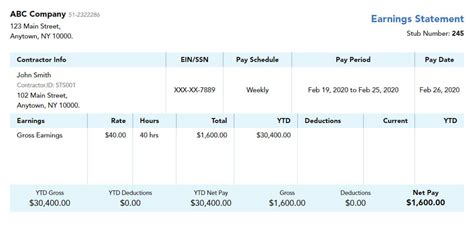

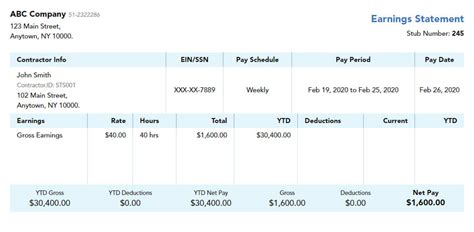

Template 2: Detailed Pay Stub Template

This template is suitable for independent contractors who want to track more detailed information about their payments. The template includes the following fields:

- Date

- Client name

- Payment amount

- Deductions (taxes, fees, etc.)

- Net pay

- Hours worked

- Rate per hour

- Expenses (materials, travel, etc.)

Detailed Pay Stub Template

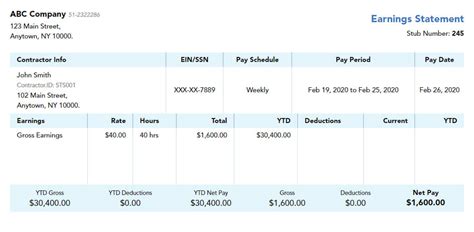

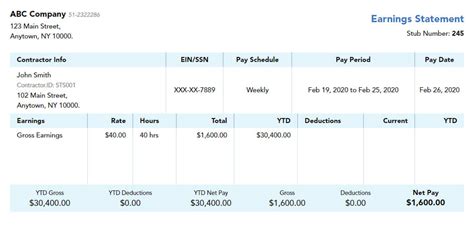

Template 3: Pay Stub Template with Invoicing

This template is designed for independent contractors who want to generate invoices and pay stubs simultaneously. The template includes the following fields:

- Date

- Client name

- Payment amount

- Deductions (taxes, fees, etc.)

- Net pay

- Invoice number

- Invoice date

- Payment terms

Pay Stub Template with Invoicing

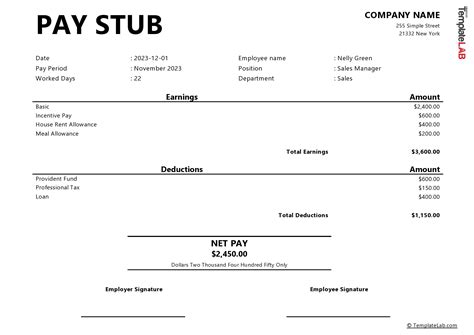

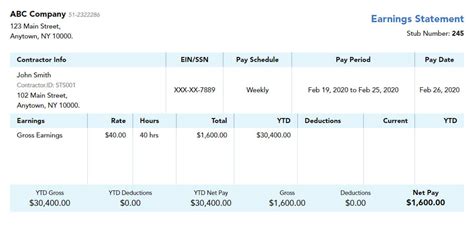

Template 4: Pay Stub Template with Taxes

This template is suitable for independent contractors who want to track their tax deductions and payments. The template includes the following fields:

- Date

- Client name

- Payment amount

- Deductions (taxes, fees, etc.)

- Net pay

- Tax rate

- Tax amount

- Total tax paid

Pay Stub Template with Taxes

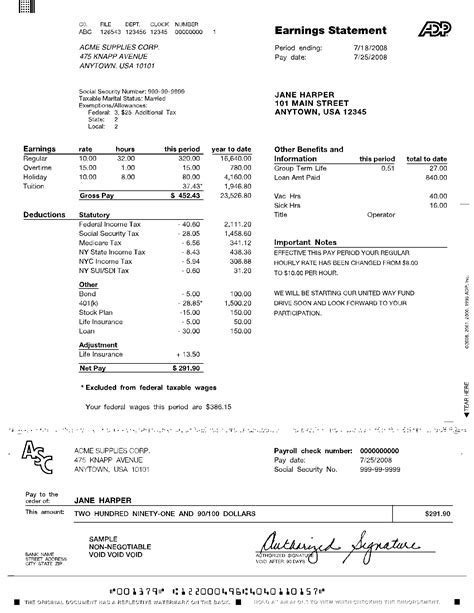

Template 5: Pay Stub Template with Benefits

This template is designed for independent contractors who offer benefits to their employees or want to track their own benefits. The template includes the following fields:

- Date

- Client name

- Payment amount

- Deductions (taxes, fees, etc.)

- Net pay

- Benefits (health insurance, retirement plan, etc.)

- Benefit amount

Pay Stub Template with Benefits

In conclusion, these five templates for independent contractor pay stubs in Excel can help you streamline your financial management and make it easier to track your income. Whether you need a basic or detailed template, there's an option for you. By using these templates, you can create professional-looking pay stubs that will help you stay organized and focused on your business.

Independent Contractor Pay Stub Templates Gallery

Independent Contractor Pay Stub Templates Gallery

Feel free to share your thoughts and suggestions on independent contractor pay stub templates in the comments section below. If you have any questions or need further assistance, please don't hesitate to ask.