Intro

Master your MyPay statement with 5 expert tips, covering pay stub analysis, tax withholding, and benefits enrollment, to optimize your financial planning and paycheck management.

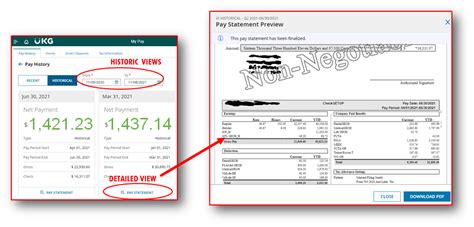

Understanding and managing your finances effectively is crucial in today's fast-paced world. One of the key documents that help you keep track of your financial transactions is your pay statement. For those who receive their pay through MyPay, a comprehensive online service, navigating and making the most out of your MyPay statement is essential. Here, we delve into the importance of these statements and how they can be utilized to your advantage.

MyPay statements are more than just a record of your income; they provide a detailed breakdown of your earnings, deductions, and benefits. This information is vital for budgeting, tax planning, and long-term financial planning. By understanding each component of your MyPay statement, you can make informed decisions about your financial health. Moreover, in an era where digital documentation is becoming the norm, having access to your pay information online offers convenience and ease of management.

The relevance of MyPay statements extends beyond personal finance management. They are also crucial for employers and HR departments, as they help in maintaining accurate payroll records, ensuring compliance with tax laws, and facilitating smooth employee relations. For individuals, particularly those in the military or government services, who rely on MyPay for their compensation, being adept at reading and interpreting these statements is not just beneficial but necessary.

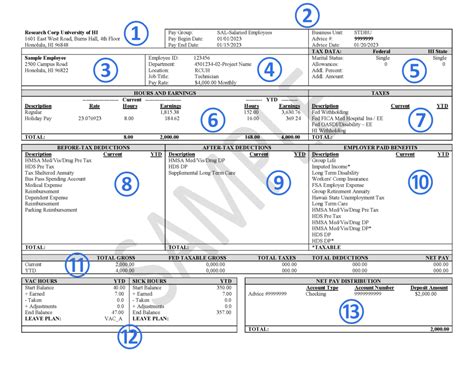

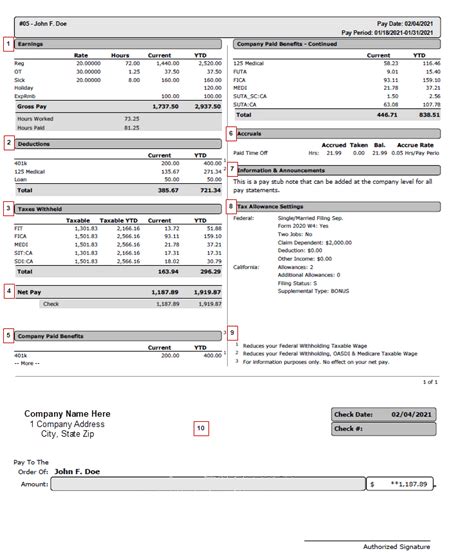

Understanding Your MyPay Statement

To make the most out of your MyPay statement, it's essential to understand its components. Typically, a MyPay statement includes your gross pay, net pay, deductions for taxes, insurance, and other benefits, along with any leave balances you might have. Each of these elements provides valuable insights into your financial situation and future projections. For instance, knowing your exact take-home pay helps in budgeting for expenses, while being aware of your tax deductions can assist in planning for tax season.

Breaking Down the Components

- Gross Pay: This is your total pay before any deductions. It includes your base salary, allowances, and any overtime or bonus payments.

- Net Pay: Often referred to as take-home pay, this is the amount you receive after all deductions have been made.

- Deductions: These can include federal, state, and local taxes, along with deductions for health insurance, retirement plans, and other benefits.

- Leave Balances: This section shows how much annual, sick, or other types of leave you have available.

Managing Your Finances with MyPay

Effective financial management involves not just earning a steady income but also ensuring that your money is working for you. With MyPay, you have the tools to track your income and deductions closely, making it easier to identify areas where you can cut back or save. For example, if you notice that a significant portion of your income is going towards taxes, you might consider consulting a tax advisor to explore options for reducing your tax liability.

Tips for Maximizing Your MyPay Benefits

- Regularly Review Your Statement: Keep an eye on your earnings and deductions to catch any discrepancies early.

- Plan Your Taxes: Use your MyPay statement to estimate your tax obligations and plan accordingly.

- Optimize Your Benefits: Ensure you're making the most of the benefits available to you, such as health insurance and retirement plans.

- Save and Invest: Allocate a portion of your net pay towards savings and investments to secure your financial future.

- Seek Professional Advice: If you're unsure about any aspect of your MyPay statement or financial planning, don't hesitate to seek advice from a financial advisor.

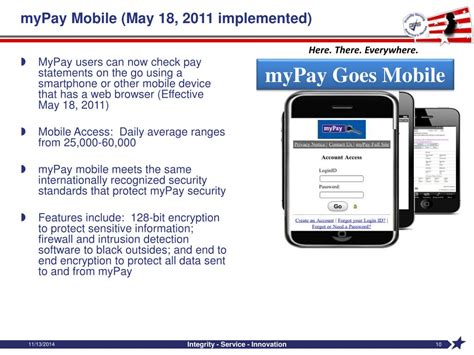

Security and Accessibility of MyPay

One of the significant advantages of MyPay is its emphasis on security and accessibility. The system is designed to protect your personal and financial information, ensuring that your data is safe from unauthorized access. Moreover, the online platform allows you to access your pay statements and manage your account from anywhere, at any time, providing unparalleled convenience.

Best Practices for Secure Access

- Use Strong Passwords: Ensure your login credentials are unique and difficult to guess.

- Keep Your Information Updated: Regularly review and update your personal and financial information to prevent any discrepancies.

- Be Cautious of Phishing Attempts: Never share your login details or respond to suspicious emails claiming to be from MyPay.

Future of MyPay and Financial Management

As technology continues to evolve, so does the landscape of financial management. MyPay and similar platforms are at the forefront of this evolution, offering users more streamlined, secure, and accessible ways to manage their finances. The future holds promise for even more integrated and personalized financial services, potentially including AI-driven financial planning tools and real-time budgeting apps.

Embracing Digital Financial Solutions

- Stay Informed: Keep up-to-date with the latest developments in digital finance.

- Explore New Tools: Be open to trying new financial management tools and apps.

- Provide Feedback: Share your experiences and suggestions with service providers to help shape the future of financial technology.

Gallery of MyPay Statement Tips

MyPay Statement Tips Image Gallery

Final Thoughts on MyPay Statements

In conclusion, mastering the art of managing your MyPay statement is a crucial step towards achieving financial stability and security. By understanding the intricacies of your pay, deductions, and benefits, you can make informed decisions that impact your current and future financial health. Whether you're a seasoned professional or just starting out, the tips and insights provided here aim to empower you with the knowledge needed to navigate the complex world of personal finance with confidence.

As you continue on your financial journey, remember the importance of staying informed, seeking advice when needed, and embracing the technological advancements that are shaping the future of finance. Share your thoughts and experiences with managing MyPay statements in the comments below, and consider sharing this article with others who might benefit from these valuable insights. Together, let's work towards a future where financial literacy and security are within everyone's reach.