Intro

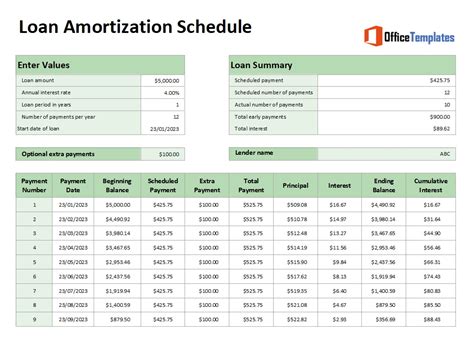

Create a personalized loan repayment plan with our free loan amortization schedule template featuring a customizable grace period. Easily track payments, interest, and principal balances. Ideal for borrowers and lenders, this template ensures transparency and helps manage debt. Download now and simplify your loan management process.

Creating a loan amortization schedule with a grace period can be a complex task, but with the right tools and knowledge, it can be made easier. In this article, we will discuss the importance of a loan amortization schedule, how to create one with a grace period, and provide a free template to get you started.

Understanding Loan Amortization Schedules

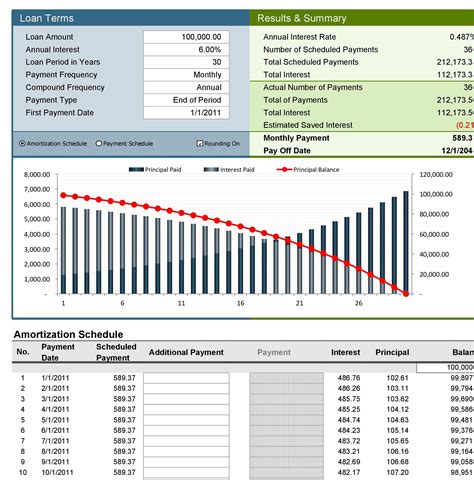

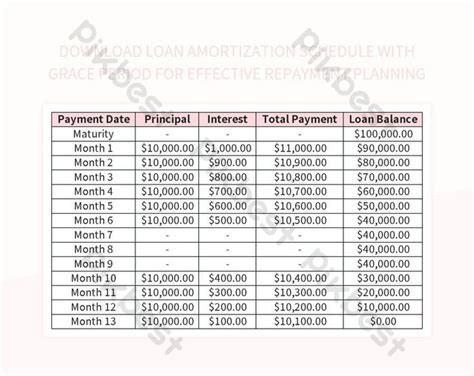

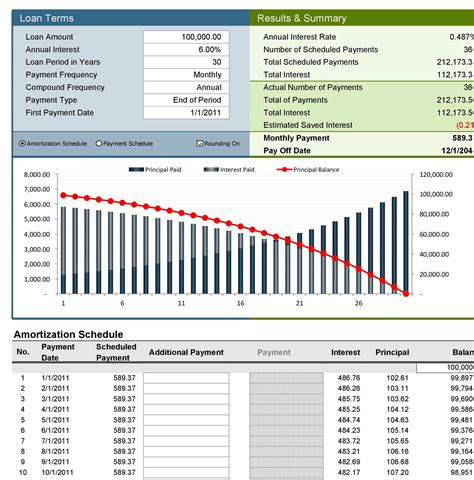

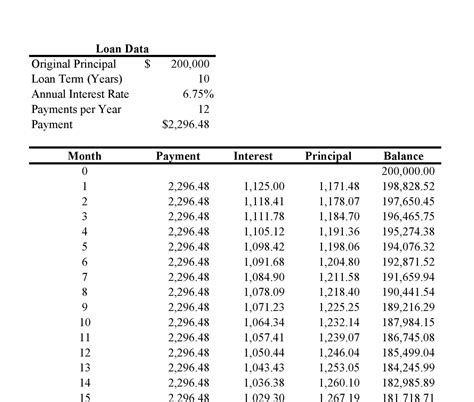

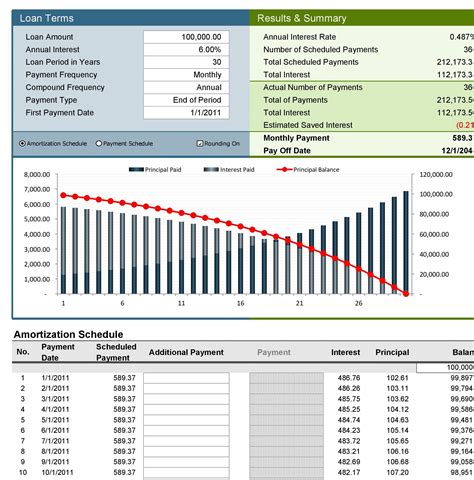

A loan amortization schedule is a table that shows the periodic payments on a loan, including the amount of each payment, the interest paid, and the principal balance remaining. It helps borrowers and lenders understand the loan repayment process and make informed decisions. A well-structured amortization schedule can also help identify potential problems, such as missed payments or increased interest rates.

The Importance of a Grace Period

A grace period is a provision in a loan agreement that allows the borrower to delay payment for a specified period without incurring late fees or penalties. It can be beneficial for borrowers who may need extra time to make a payment due to unforeseen circumstances. A loan amortization schedule with a grace period takes into account the delayed payments and adjusts the schedule accordingly.

Creating a Loan Amortization Schedule with a Grace Period

To create a loan amortization schedule with a grace period, you will need to gather the following information:

- Loan amount

- Interest rate

- Loan term

- Payment frequency

- Grace period

Once you have this information, you can use a spreadsheet or a specialized software to create the schedule. Here are the general steps:

- Determine the loan amount, interest rate, and loan term.

- Calculate the monthly payment using a loan amortization formula or a financial calculator.

- Create a table with columns for payment date, payment amount, interest paid, principal paid, and outstanding balance.

- Enter the payment dates and amounts, taking into account the grace period.

- Calculate the interest paid and principal paid for each payment.

- Update the outstanding balance after each payment.

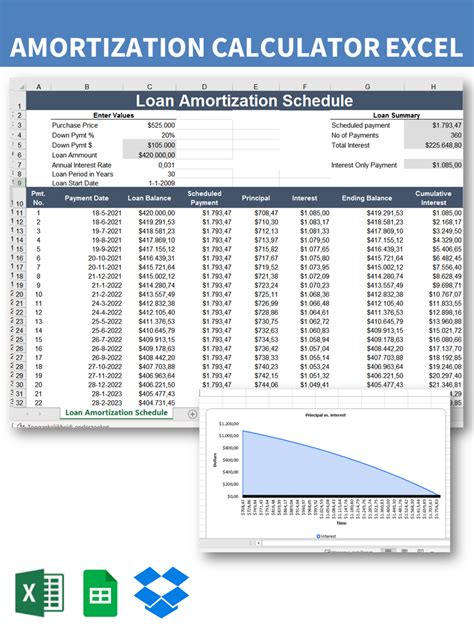

Free Loan Amortization Schedule Template

To make it easier for you to create a loan amortization schedule with a grace period, we are providing a free template. You can download the template below and customize it to fit your needs.

[Insert template download link]

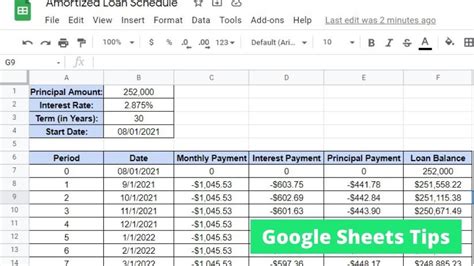

How to Use the Template

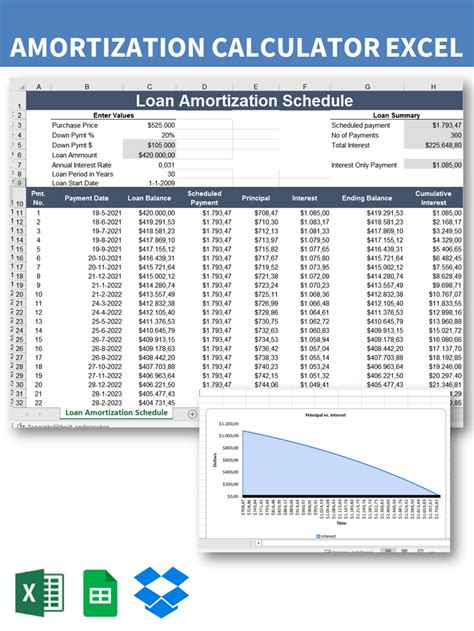

Using the template is straightforward. Simply enter the loan amount, interest rate, loan term, payment frequency, and grace period, and the template will calculate the monthly payments and create a schedule.

- Enter the loan amount in cell B2.

- Enter the interest rate in cell B3.

- Enter the loan term in cell B4.

- Enter the payment frequency in cell B5.

- Enter the grace period in cell B6.

- The template will calculate the monthly payment and create a schedule.

Benefits of Using a Loan Amortization Schedule with a Grace Period

Using a loan amortization schedule with a grace period can have several benefits, including:

- Improved financial planning: A loan amortization schedule helps you understand the loan repayment process and make informed decisions.

- Reduced stress: A grace period can provide peace of mind in case of unexpected financial difficulties.

- Better loan management: A loan amortization schedule with a grace period helps you manage your loan effectively and avoid missed payments.

Common Mistakes to Avoid When Creating a Loan Amortization Schedule

When creating a loan amortization schedule with a grace period, there are several common mistakes to avoid:

- Incorrect interest rate: Make sure to enter the correct interest rate to avoid incorrect calculations.

- Inaccurate loan term: Ensure that the loan term is accurate to avoid incorrect calculations.

- Ignoring the grace period: Make sure to take into account the grace period when creating the schedule.

Tips for Customizing the Template

To customize the template to fit your needs, follow these tips:

- Adjust the interest rate: If the interest rate changes, adjust the rate in the template.

- Change the loan term: If the loan term changes, update the template accordingly.

- Add or remove payments: If you need to add or remove payments, update the schedule accordingly.

Conclusion

Creating a loan amortization schedule with a grace period can be a complex task, but with the right tools and knowledge, it can be made easier. By using a free template and following the tips outlined in this article, you can create a schedule that meets your needs and helps you manage your loan effectively.

Gallery of Loan Amortization Schedule Templates

Loan Amortization Schedule Templates

FAQ

- Q: What is a loan amortization schedule? A: A loan amortization schedule is a table that shows the periodic payments on a loan, including the amount of each payment, the interest paid, and the principal balance remaining.

- Q: What is a grace period? A: A grace period is a provision in a loan agreement that allows the borrower to delay payment for a specified period without incurring late fees or penalties.

- Q: How do I create a loan amortization schedule with a grace period? A: You can create a loan amortization schedule with a grace period using a spreadsheet or specialized software. Enter the loan amount, interest rate, loan term, payment frequency, and grace period, and the template will calculate the monthly payments and create a schedule.