Intro

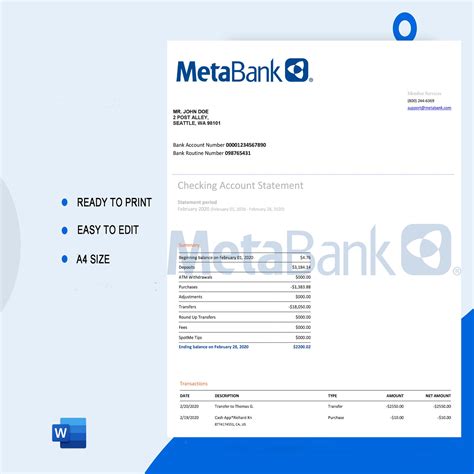

Discover how to streamline your financial record-keeping with the Metabank bank statement template. Learn 5 practical ways to utilize this template, from budgeting and expense tracking to financial reporting and auditing. Maximize your financial management with this essential tool, featuring customizable layouts and effortless data organization.

As a business owner or individual, managing your finances effectively is crucial for success. One essential tool for achieving this is a bank statement template. A well-structured template helps you keep track of your financial transactions, identify areas for improvement, and make informed decisions. In this article, we will explore five ways to use a MetaBank bank statement template to streamline your financial management.

Understanding MetaBank Bank Statement Template

A MetaBank bank statement template is a pre-designed document that helps you organize and analyze your financial transactions. It typically includes columns for date, description, debit, credit, and balance. This template can be customized to suit your specific needs, making it an essential tool for personal and business finance management.

Benefits of Using a MetaBank Bank Statement Template

Using a MetaBank bank statement template offers several benefits, including:

- Improved financial organization and tracking

- Enhanced budgeting and forecasting

- Simplified financial analysis and reporting

- Increased accuracy and reduced errors

- Customizable to meet specific business or personal needs

5 Ways to Use MetaBank Bank Statement Template

Here are five ways to use a MetaBank bank statement template to streamline your financial management:

1. Track Your Expenses

Use the template to track your expenses by categorizing your transactions into different columns. This will help you identify areas where you can cut back on unnecessary expenses and make adjustments to optimize your financial performance.

2. Monitor Your Cash Flow

Understanding Cash Flow

Cash flow is the lifeblood of any business or individual. It's essential to monitor your cash flow to ensure you have sufficient funds to meet your financial obligations. Use the MetaBank bank statement template to track your cash inflows and outflows, making it easier to manage your finances.

3. Create a Budget

Use the template to create a budget by categorizing your income and expenses. This will help you allocate your resources effectively, prioritize your spending, and achieve your financial goals.

4. Analyze Your Financial Performance

Financial Performance Analysis

Use the MetaBank bank statement template to analyze your financial performance by tracking your income, expenses, and cash flow. This will help you identify areas for improvement, make informed decisions, and optimize your financial performance.

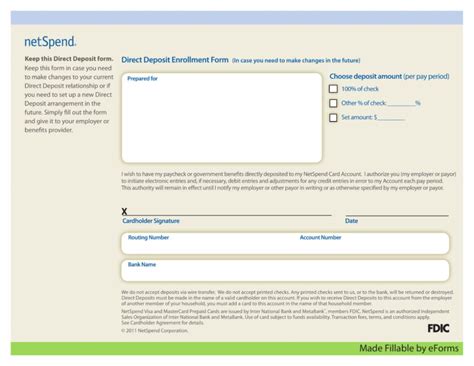

5. Prepare for Audits and Taxation

Use the template to prepare for audits and taxation by maintaining accurate and up-to-date financial records. This will help you comply with regulatory requirements, reduce the risk of errors, and ensure a smooth audit process.

Gallery of MetaBank Bank Statement Template

MetaBank Bank Statement Template Image Gallery

By using a MetaBank bank statement template, you can streamline your financial management, make informed decisions, and achieve your financial goals. Whether you're a business owner or individual, this template is an essential tool for tracking your expenses, monitoring your cash flow, creating a budget, analyzing your financial performance, and preparing for audits and taxation.