Managing monthly bills can be a daunting task, especially when dealing with multiple payments, due dates, and varying amounts. Staying on top of your bills can help you avoid late fees, penalties, and negative impacts on your credit score. One effective way to organize your monthly bills is by using an Excel template. In this article, we will explore five ways to organize your monthly bills with an Excel template and provide you with practical examples and tips to get started.

Benefits of Using an Excel Template for Monthly Bills

Before we dive into the five ways to organize your monthly bills with an Excel template, let's explore the benefits of using a template:

- Simplifies bill tracking and management

- Reduces errors and missed payments

- Enhances budgeting and financial planning

- Increases productivity and saves time

- Provides a clear overview of your financial obligations

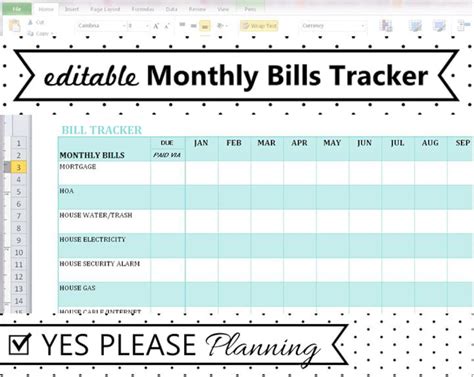

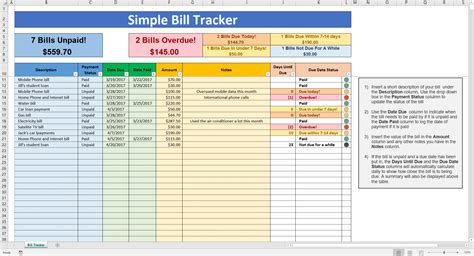

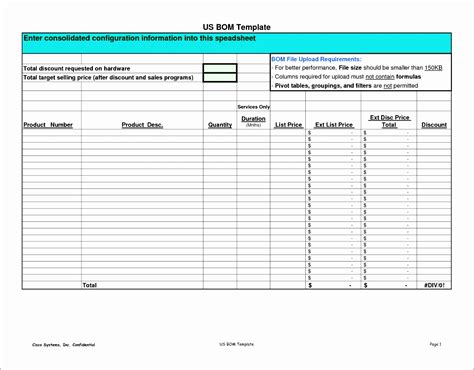

1. Create a Bill Tracking Table

To get started, create a bill tracking table in your Excel template. This table should include the following columns:

- Bill Name

- Due Date

- Amount

- Payment Status

- Payment Method

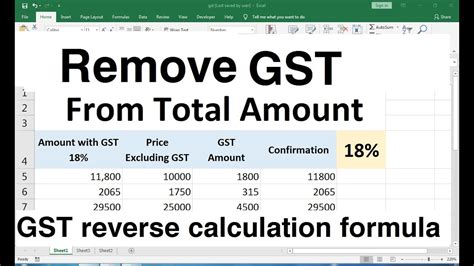

2. Use Formulas to Calculate Total Amounts

To make your bill tracking table more dynamic, use formulas to calculate the total amount due for each bill. For example, you can use the SUM function to calculate the total amount due for all bills.

- =SUM(B2:B10)

This formula will add up the amounts in cells B2 through B10, which correspond to the amounts due for each bill.

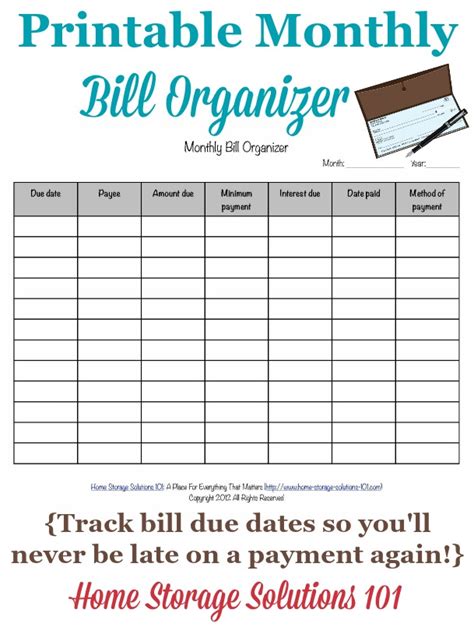

3. Create a Payment Schedule

To stay on top of your bill payments, create a payment schedule in your Excel template. This schedule should include the following columns:

- Bill Name

- Due Date

- Payment Date

- Payment Amount

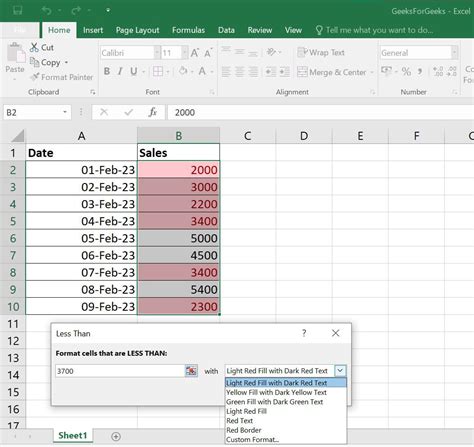

4. Use Conditional Formatting to Highlight Overdue Bills

To quickly identify overdue bills, use conditional formatting in your Excel template. For example, you can use a formula to highlight cells in the Due Date column that are less than or equal to the current date.

- =TODAY()>=A2

This formula will highlight cells in the Due Date column that are overdue.

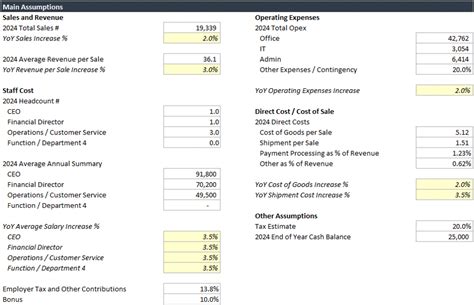

5. Create a Budgeting Section

Finally, create a budgeting section in your Excel template to track your income and expenses. This section should include the following columns:

- Income

- Fixed Expenses

- Variable Expenses

- Total Expenses

By following these five ways to organize your monthly bills with an Excel template, you can simplify your bill tracking and management, reduce errors and missed payments, and enhance your budgeting and financial planning.

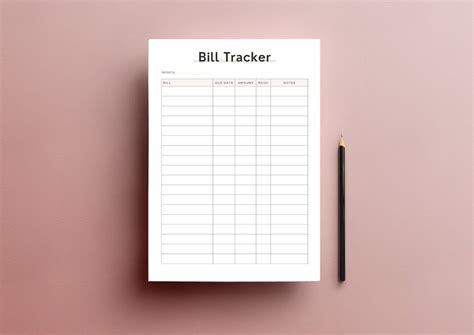

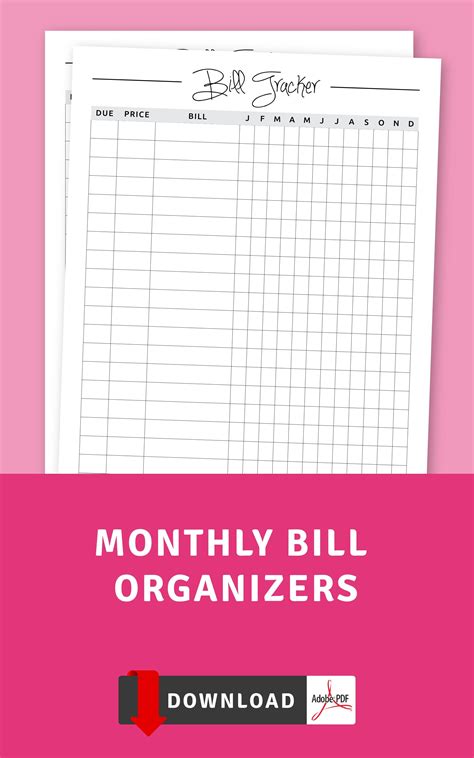

Gallery of Monthly Bill Organization

By implementing these strategies and using an Excel template, you can take control of your monthly bills and improve your financial management. Share your thoughts on how you manage your monthly bills in the comments section below.